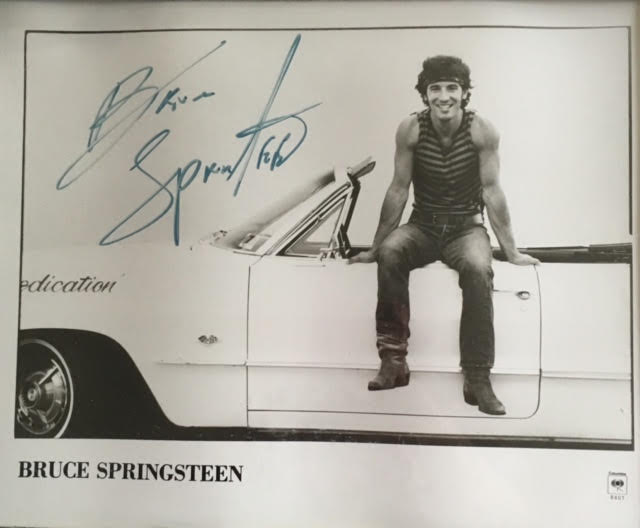

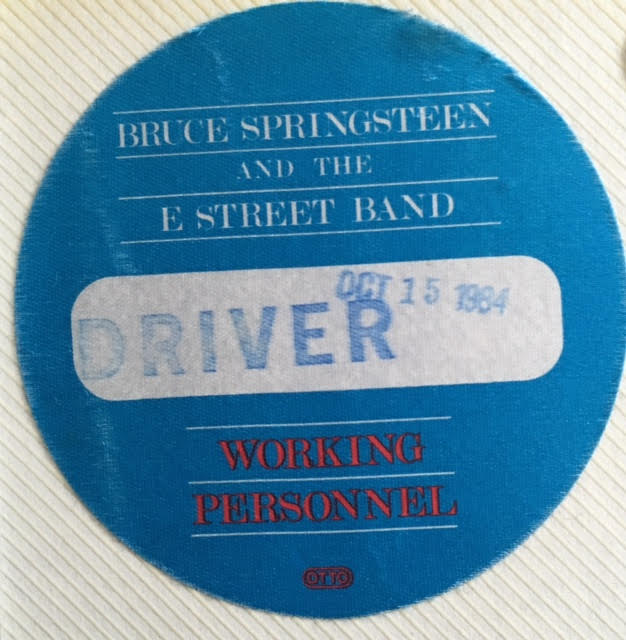

After two years of rigorous bodybuilding, a jacked Bruce Springsteen, arrived in Vancouver in fighting form for his October 15th, 1984 Born in the U.S.A. concert date. Traveling in the van with The Boss to the Four Seasons, was Steven Van Zandt (Silvio from The Sopranos), and his future wife, Patti Scialfa, and a couple of the other E Street-ers.

Bruce sat behind me, and eventually picked up a microphone normally used for site-seeing tours. "Welcome to Vancouver! We are heading down..." He leaned towards the side of my seat and asked me in a whisper, what street we were on? I whispered back, Granville Street. "Granville Street! This lovely area is called.." Asking me again: "Shaughnessy! Towering over Vancouver, you can see ... Grouse Mountain." He kept the band laughing all the way to the hotel. It turns out I was the straight man in this street comedy duo. This was not your typical airport transfer.

Traveling in a separate van, accompanied only by his assistant, was the late great saxophonist, Clarence Clemmons. I spent the majority of the rest of the visit taking care of "The Big Man" as he was called. He was warm, relaxed, funny, talkative, and definitely the biggest thing about him was his heart. He loved Alaska King Crab, and I picked him up one from Kamei Sushi on Thurlow, every night he was in town.

Judging on the way he used to wail on the sax, I always assumed he would be more boisterous. He saved all that for the stage. Pre concert he would be back stage knocking off dozens of reps on an abdominal board. The Boss's new physique may have been an inspiration to him, however, it appeared the King Crabs were winning that battle.

Among the celebrities back stage waiting to visit the band post concert was a very shy Daryl Hannah and her new boyfriend, Jackson Browne. Browne and The Boss remain friends to this day and celebrated Bruce's 66th birthday on stage last September.

I was fortunate enough to catch The Boss and almost the entire E Street band in 2008. Clarence passed away three years later.

Dow 20,000, Gold, Oil and Base Metals

The Dow was within 184 points of a breakout. And anyone who thinks that it failed once again to penetrate the 18,351 intraday high, I would argue that it's a long way from the Black Friday low of 15370. It's now up over 17%.

The gold bulls may feel frustrated by yet another smackdown this week, after another valiant attack at 1260 plus. I say better here than 1050. Those who called for oil to drop to $26 again are flirting with being almost 70% wrong. The base metals looked great last week, and even zinc was pushing toward 0.90, for the first time in a while. $TV Trevali up 160% intraday from November? Very little to complain about.

https://ceo.ca/index.html?c58550283144

Then there is lithium and the juniors. Here is a shocker: 22 of the BeckDex 50 (plus) were at 52 Week intraday highs last week:

KOR MAG PE SBB WML SSP PGM IDM GPH SXR WPQ NFR EAM GSH KES HPL JEM GGS CXO CCY NEV NXE

Ok...NOW someone slap me.

Talking our Books

$CXO Colorado Resources was a popular subject last week here at CEO.CA. The stock opened up modestly Monday at 0.175, and trended up all week until the halt early Thursday morning. Doubling their land position in the Golden Triangle caused the stock to almost double from Friday (April 15) intraday low of 0.155, to last Fridays intraday high of 0.295. This one is going higher.

$LIX profit taking was balanced by position building in Giustra's 3 other winners. $CCY, $GGS and $SSP all saw intraday highs last week. The treasuries are getting fatter and as anticipated, the trickle down momentum, is building a solid following.

Several people mentioned to me that they were going to average down, average up or buy $LIX for the first time last week. Go ahead and guess where it's headed. I made my prediction clear last week.

Robert McLeod's $IDM Mining closed at a 52 week high of 0.125 on Friday. He has a lot of friends at CEO.CA, and it shows. Peter Koven's article in the Financial Post on how Robert is taking advantage of crowdfunding helped as well.

The BergDex

If everyone is a genius during a junior bull market, then Robert Hirschberg is a cross between Einstein and Stephen Hawking.

I was observing $XMG MGX Minerals climbing the charts last week. $XMG opened the week at 0.115 and hit a intraday high of .23 on both Thursday and Friday on 5.2 million shares. It all made sense when reading this news release:

MGX MINERALS ANNOUNCES $500,000 STRATEGIC PRIVATE PLACEMENT FOR ALBERTA LITHIUM

Closing of the private placement is conditional upon satisfactory due diligence of MGX by the investors and compliance with all regulatory requirements. The principle investors are Dr. K. Sethu Raman, Robert Hirschberg and Sam Sahota.o

This is how the rest of the BergDex performed for the week, starting with his 3 Globe and Mail picks from March 4th:

- $LIX

March 03: 0.85

April 22: 2.21

Up 160%

- $PGM

March 03: 0.24

April 22: 0.48

Up 100%

- $NGZ

March 03: 0.045

April 22: 0.14

Up 211%

That's an impressive 157% average in 7 weeks to the entire Globe and Mail subscriber base.

Check out the returns on Robert's other picks from his tweet on March 24th:

$BOL Up 60%, $CAP Up 25%, $EAM Up 59%, $GSH Up 53%, $NFR Up 94%, $NX 114%, SXR -25%, $WML Up 100% WPQ Up 73%

https://mobile.twitter.com/r_hirschberg/status/713018047846490112?p=v

That's a 51.4% gain on average. $XMG was up 83% for the week, and is now part of the BergDex. At least we know who Dr 7/ 11 is now. (11 discoveries and 7 in production)

$HPL Horizon Petroleum

My first post on HPL was at 0.015 on July 16. HPL hit an intraday high of 0.08 on Friday, before closing at 0.06. This one has the potential to be the best performer on the BeckDex 50 going forward. Betting on the jockeys? Read on:

- Horizon will buy Iskander Energy for 55,373,072 shares to create a new International Oil and Gas Company

- Senior management of $CNE Canacol (Market Cap $605 Million) run HPL (David Winter and Charlie Gamba)

- Iskander chairman, Kent Jespersen, is also chairman of $VII Seven Generations (Market Cap $6.2 Billion), and was former Chairman of North American Oil Sands

- Statoil bought North American Oil Sands for $2 Bil in 2007

- Michael Florence (former president of Sherfam, parent company of Apotex) joins the new board. He represents Canada's 5th richest man according to Forbes (Bernard Sherman: $5.4 Bil), and may have a substantial stake in the new company (Horizon becomes Scion)

- 29 analysts from North and South America, and Europe cover $CNE and $VII

Canacol (CNE) ANALYST COVERAGE (12)

http://www.canacolenergy.com/s/analyst-coverage.asp

Seven Generations (VII) Analyst Coverage (17)

https://www.7genergy.com/investors/analyst-coverage

Horizon Petroleum Announces Recapitalization Transaction to Create a New International Oil & Gas Company

Iskander Board of Directors

http://www.iskanderenergy.com/about-us/board-of-directors

Bernard Sherman in Forbes

http://www.forbes.com/profile/bernard-barry-sherman/

July 16 post

https://ceo.ca/index.html?8c98bea9c784

November 9 post

https://ceo.ca/index.html?7da4d0f5fc53

The BeckDex 50

The List:

$LIX $SBB $IDM $NXE $PTM $SKE $JEM $HPL $IDI $CCY $MCC $BOL $EAM $CAP $GSH $NFR $NGZ $NX $PGM $SXR $UWE $WML $WPQ $MRZ $KLS $BUS $CT $NXO $BAR $CIN $CT $DMA $GRG $ICG $MAG $WKM $RLG $RST $JEM $BAY $WLF $MSD $LAG $GPH $NEV $IN $TV $BTH $GLH $KRN $PE $KOR $SSP $RMX $XGM

- If a shell had a change of business, only the opening price low is used.

- Two-year lows are used (majority bottomed in 2105)

The list is broken down into 3 categories: Under .25, Under .50, and Over .50

UNDER .25:

- $CXO Colorado Resources

Year High 0.295 (New)

Year Low 0.05

Last 0.27

Up 5300% (New)

- $GGS Golden Secret Ventures

Year High 0.55 (New)

Year Low 0.02

Last 0.51

Up 2450% (New)

- $RLG West Red Lake Gold Mines

Year High 0.21

Year Low 0.01

Last 0.125

Up 1150%

- $JEM Jagercor Energy

Year High 0.08 (New)

Year Low 0.01

Last 0.08

Up 700% (New)

- $NGZ NRG Metals

Year High 0.175

Year Low 0.02

Last 0.14

Up 600%

- $NX Noka Resources

Year High 0.26

Year Low 0.025

Last 0.15

Up 500%

- $HPL Horizon Petroleum

Year High 0.08 (New)

Year Low 0.01

Last 0.06

Up 500%

- $HRT Harte Gold

Year High 0.345

Year Low 0.045

Last 0.23.5

Up 422%

- $CAP Castle Peak

Year High 0.035

Year Low 0.005

Last 0.025

Up 400%

- $MCC Magor Corporation

Year High 0.315

Year Low 0.015

Last 0.075

Up 400%

- $KES Kessulrun Resources

Year High 0.11 (New)

Year Low 0.02

Last 0.10

Up 400%

- $GSH Golden Share Mining

Year High 0.15 (New)

Year Low 0.03

Last 0.145

Up 383% (New)

- $RST Rosita Mining

Year High 0.10

Year Low 0.01

Last 0.045

Up 350%

- $EAM East Africa Metals

Year High 0.145 (New)

Year Low 0.03

Last 0.135

Up 350%

- $DMA DiaMedica

Year High 0.25

2014 Low 0.035

Last 0.155

Up 342%

- $NFR Northern Freegold

Year High 0.20 (New)

Year Low 0.04

Last 0.155

Up 288%

- $WPQ WPC Resources

Year High 0.12 (New)

Year Low 0.025

Last 0.095

Up 280%

- $RMX Rubicon Minerals

Year High 1.485

Year Low 0.015

Last 0.055

Up 266%

- $MSD Moseda Technologies

Year High 0.365

Year Low 0.065

Last 0.225

Up 246%

- $WKM West Kirkland Mining

Year High 0.135 (New)

Year Low 0.035

Last 0.105

Up 200%

- $SXR SGX Resources

Year High 0.05 (New)

Year Low 0.005

Last 0.015

Up 200%

- $IDI Indico Resources

Year High 0.16

Year Low 0.02

Last 0.06

Up 200%

- $PRS.H Prism Resources

Year High 0.11

Year Low 0.04

Last 0.11

Up 175%

- $BOL Bold Ventures

Year High 0.05

Year Low 0.015

Last 0.04

Up 167%

- $XMG MGX Minerals

Year High 0.70

Year Low 0.08

Last 0.21

Up 163%

- $WLF Wolfden Resources

Year High 0.21

2014 Low 0.045

Last 0.11

Up 144%

- $GPH Graphite One Resources

Year High 0.16 (New)

Year Low 0.065

Last 0.145

Up 123% (New

- $IDM IDM Mining

Year High 0.125 (New)

Year Low 0.065

Last 0.125 (New)

Up 92% (New)

- $LAG Laguna Blends

Year High 0.40

Year Low 0.08

Last 0.11

Up 38%

- $SKE Skeena Resources

Year High 0.125

Year Low 0.055

Last 0.075

Up 36%

- $IN InMed Pharmaceuticals

Year High 0.405

Year Low 0.10

Last 0.125

Up 25%

- $MRS

Year High 0.275

Year Low 0.05

Last 0.055

Up 10%

UNDER .50:

- $PGM Pure Gold Mining

Year High 0.55 (New)

Year Low 0.07

Last 0.48 (New)

Up 586%

- $CCY Catalyst Copper

Year High 0.56 (New)

Year Low 0.10

Last 0.495

Up 395%

- $SSP Sandspring Resources

Year High 0.485 (New)

Year Low 0.11

Last 0.44 (New)

Up 300% (New)

- $BAY Aston Bay Holdings

Year High 0.32

Year Low 0.08

Last 0.285

Up 256%

- $NEV Nevada Sunrise Gold

Year High 0.38

Year Low 0.125

Last 0.285

Up 128%

- $GLH Golden Leaf Holdings

Year High 1.40

Year Low 0.355 (New)

Last 0.375

Up 6%

OVER .50:

- $WML Wealth Minerals

Year High 0.71 (New)

2014 Low 0.03

Last 0.54

Up 1700%

- $LIX Lithium X Energy

Year High 2.85 (New)

Year Low 0.35

Last 2.21

531%

- $CRH CRH Medical

Year High 5.50

2014 Low 0.65

Last 4.09

Up 529%

- $NXE NexGen Energy

Year High 2.78 (New)

2015 Low 0.40

Last 2.20

Up 450%

- $SBB Sabina Gold & Silver

Year High 1.66 (New)

Year Low 0.30

Last 1.61

Up 437%

- $PE Pure Energy

Year High 1.15 (New)

Year Low 0.18

Last 0.92

Up 411%

- $LTE Lite Access Technologies

Year High 1.80

Year Low 0.39

Last 1.53

Up 292%

- $KRN Karnalyte Resources

Year High 4.15

Year Low 0.52

Last 1.94

Up 273%

- $MAG Mag Silver

Year High 15.76 (New)

Year Low 6.90

Last 15.08 (New)

Up 219%

- $KOR Corvus Gold

Year High 1.08 (New)

Year Low 0.33

Last 0.95

Up 204%

- $PTM Platinum Group Metals

Year High 7.40

Year Low 1.35

Last 3.93

Up 202%

- $TV Trevali Mining

Year High 1.24

Year Low 0.245

Last 0.53

Up 116%

- $BAR Balmoral Resources

Year High 1.22

Year Low 0.33

Last 0.62

Up 88%

- $BTH Breathtec BioMedical

Year High 0.55

Year Low 0.37

Last 0.435

Up 18%

Recent Reports

"I'm with The Police" - TSXV 10-bagger update (April 18)

Eric Clapton: Rock'n Stock Talk (April 11)

On Jeff Beck, Elon Musk and the power of intention (April 4)

Kenny Rogers and the immutable law of reciprocity (March 27)

From the Four Seasons to Expo 86, and the Birth of CEO.CA (March 20)

1974 All Over Again (March 13)

The Trickle Down Theory: Large Gains in Junior Miners and Micro-Caps (March 7)

Finally, an Acorn for Us Mining Bulls (Feb. 29)

Why I Continue to Bet the Jockey in Canadian Micro-Caps (Feb. 21)

The Takeover Kings: $25 Billion to Shareholders and $22 Billion in Current Market Value (Jan. 12)

Betting on the Jockeys: The Yorkton Lithium Express (Oct. 19)

This article discusses highly speculative penny stocks. Nothing in this article should be construed as investment or professional advice of any kind. From time to time, the author may transact in securities mentioned. All facts are to be verified by the reader and all readers to do their own due diligence before investing including talking to a licensed financial advisor.