Your dose of crypto news and analysis from @BTO and @Goldfinger

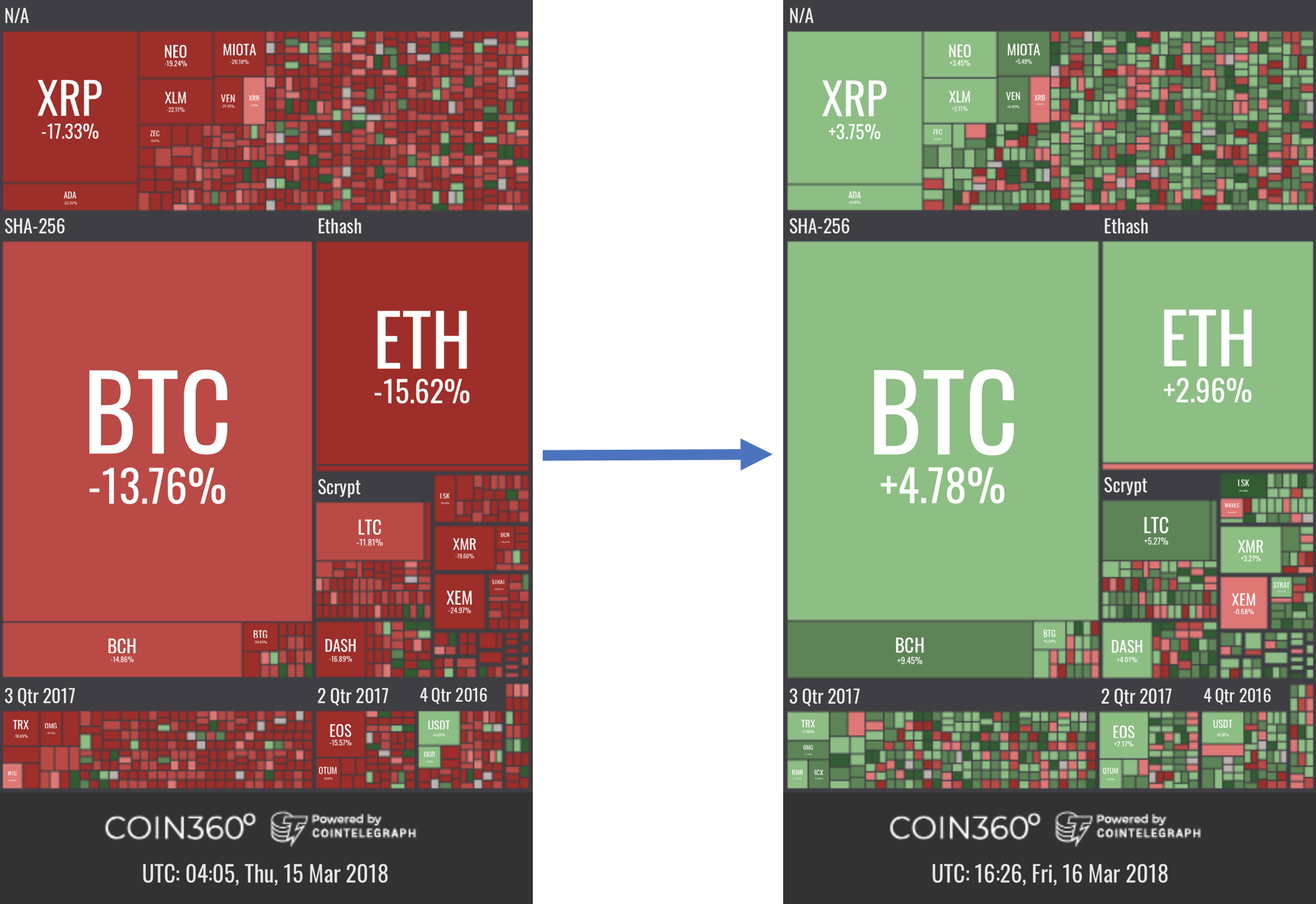

After what can only be described as an abysmal week in crypto land, today brought a much-needed reprieve in the form of some green:

And just in time for St. Patrick's Day!!

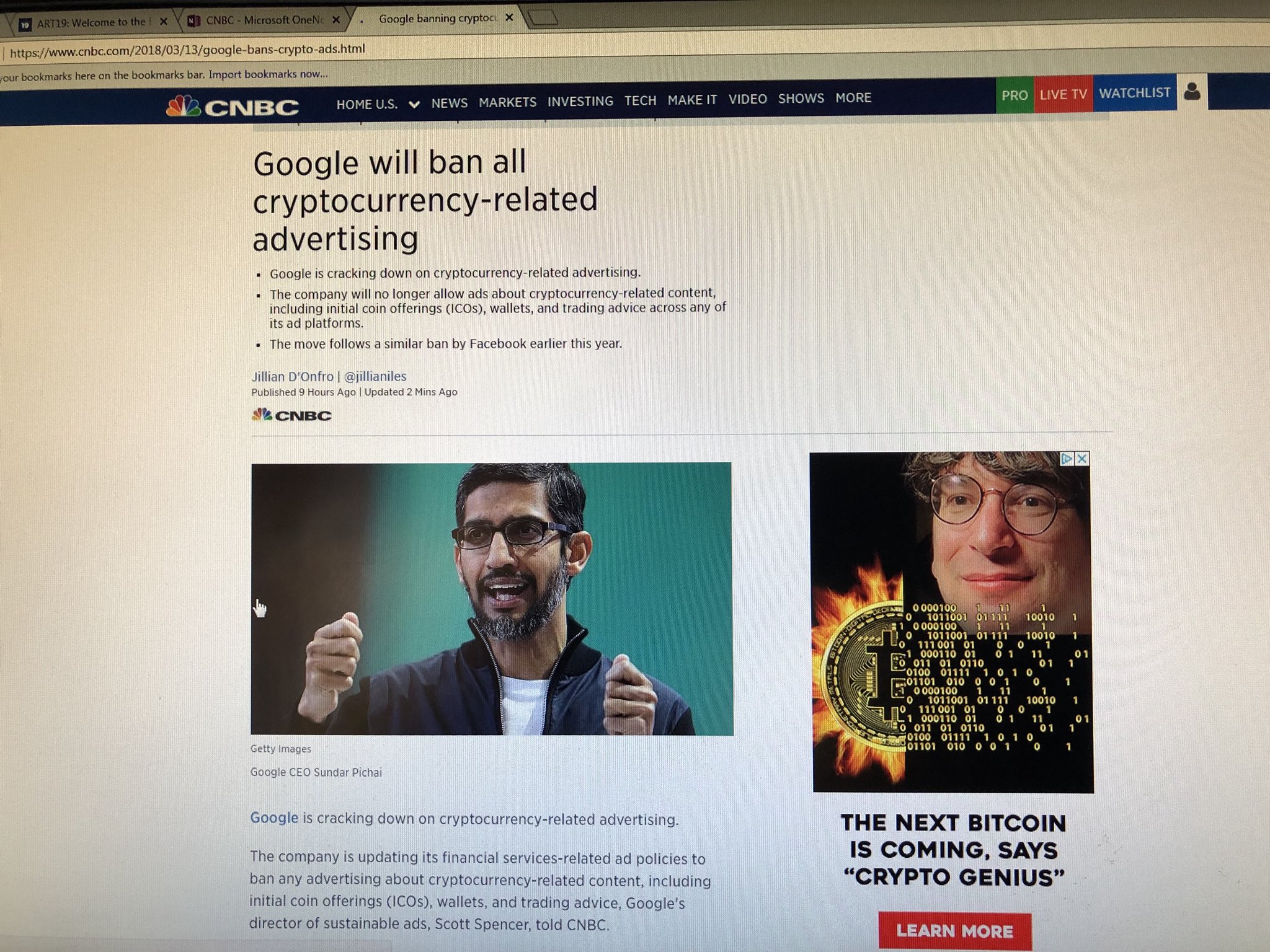

Why did we see all the red earlier in the week? Another big dump of FUD, of course, principally:

Note the juxtaposition of the Google-served crypto ad on this CNBC story about Google moving to ban crypto-related ads. But, alas, the headline is the main point. Google announced this week that it will ban all crypto-related ads beginning in June, much to the chagrin of Mr. Altucher, aka "Crypto Genius", and ICO fraudsters.

The other big news swirling this week had to do with Wednesday's U.S. House subcommittee hearing on initial coin offerings, and in particular this guy:

That's California Rep. Brad Sherman who — using a word long thought to have been left for dead in the 20th century — described cryptocurrencies as a "crock".

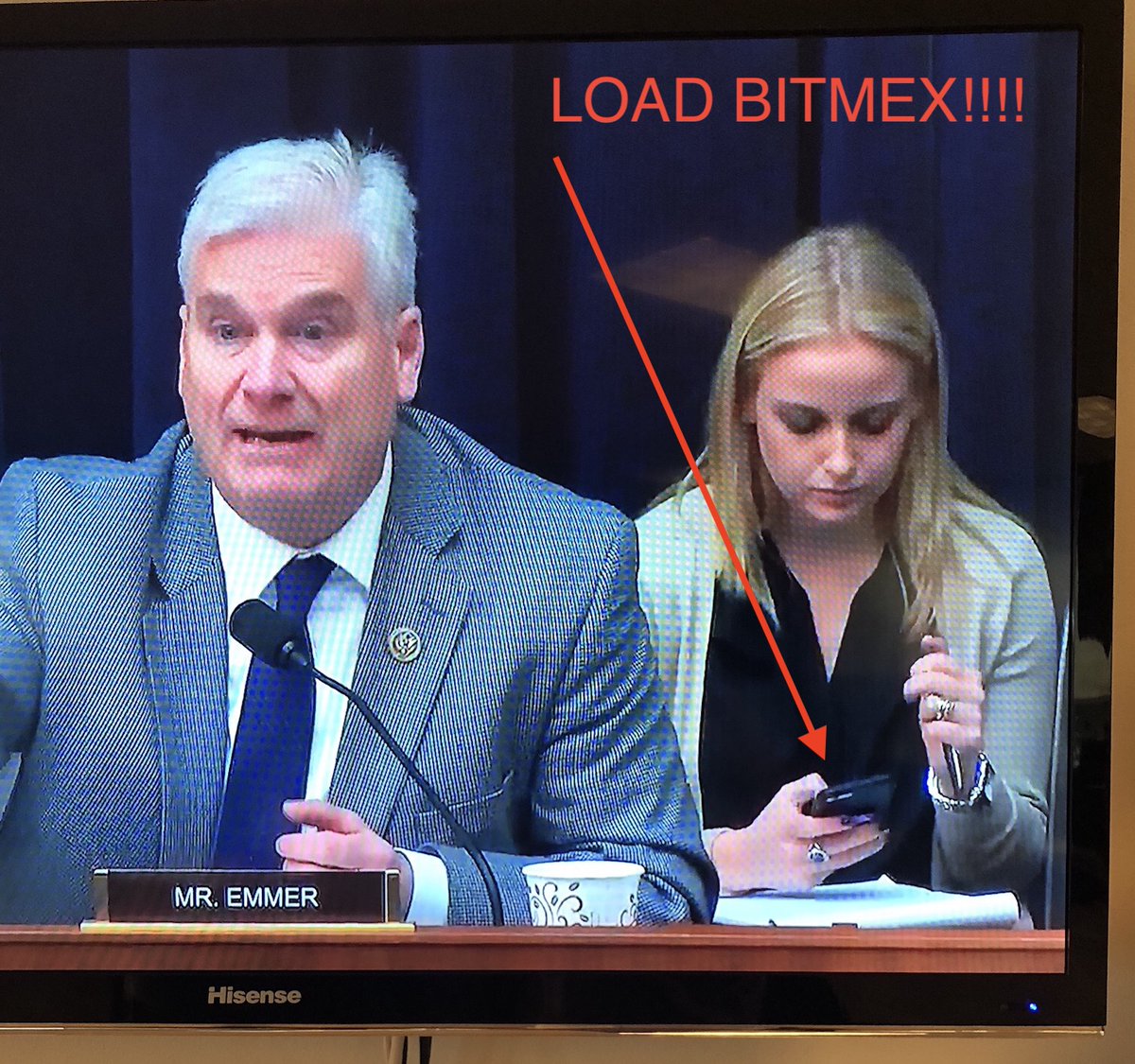

At the same hearing, however, emerged a new Crypto Dad, Minnesota Rep. Tom Emmer, who spoke passionately about the value of decentralization and innovation run by the people (and not stymied by government). Here he is:

All in all, we're way down on the week. Let’s see how some of the major cryptos fared overall this week (close UTC time last Friday to today):

- Bitcoin trading around US$8,570, down 8.2% on the week

- Ethereum trading around US$620, down 15.1% on the week

- Bitcoin Cash trading around US$1,020, down 4.1% on the week

- Litecoin trading around US$170, down 8.8% on the week

- Stellar trading around US$0.24, down 23.3% on the week

- Dash trading around US$430, down 13.9% on the week

- Monero trading around US$220, down 23.2% on the week

- Ethereum Classic trading around US$18.31, down 18.5% on the week

- ZCash trading around US$242, down 22.1% on the week

Not quite as bad as last week, but still... Ouch.

WTF did I miss this week in crypto?

Thomson Reuters Is Using Your Feelings About Bitcoin to Make Investors Rich https://www.coindesk.com/thomson-reuters-using-feelings-bitcoin-make-investors-rich/

Included in the latest release of the company's MarketPsych Indices product, a suite of investment tools analyzing everything from companies to sovereign bonds, the bitcoin sentiment data feed will use AI to analyze more than 400 sources of data, scouring news articles and social media posts in search of actionable insights.

Crypto exchanges are charging up to $1 million per #ICO to list tokens: 'It's pure capitalism' http://uk.businessinsider.com/cryptocurrency-exchanges-listing-tokens-cost-fees-ico-2018-3

Cryptocurrency exchanges are charging up to $1 million to list initial coin offerings on their platforms, according to multiple industry sources. Around half a dozen market participants, from investors to CEOs of companies with their own coins, told Business Insider that some exchanges are charging anywhere between $50,000 to $1 million to get their tokens listed.

Ether Takes Step Toward Institutional US Trading https://www.coindesk.com/ether-takes-step-toward-institutional-trading-in-us/

ConsenSys, the New York-based blockchain application startup, announced that it is partnering with TrueDigital, a new affiliate of online interest rate swap marketplace trueEx, in an effort to develop a benchmark price for ethereum's ether cryptocurrency. According to an announcement, the two firms are planning to design a target reference index for the price of ether (ETH), the second largest cryptocurrency by total value, as an initial step towards the goal of making more crypto trading products available for institutional investors.

Japan's Third-Largest Electricity Provider Is Testing Bitcoin On Lightning https://www.coindesk.com/japans-third-largest-electric-provider-testing-bitcoin-lightning/

Chubu Electric Power Co. has entered into a proof-of-concept with local bitcoin and Internet of Things (IoT) startup Nayuta, one that finds it exploring how bitcoin payments can be made via the Lightning Network, an in-development protocol that promises to cut costs for bitcoin users. Boasting 15,000 employees and more than 200 power generation facilities, Chubu is now using Lightning to prototype a new way of letting customers pay to charge an electric vehicle.

South Korea Could Ease Its ICO Ban https://www.coindesk.com/south-korea-may-lift-ico-ban/

The financial authorities have been talking to the country's tax agency, justice ministry, and other relevant government offices about a plan to allow #ICOs in Korea when certain conditions are met.

Winklevoss Twins Call for Creation of Cryptocurrency SRO-Like Entity https://www.financemagnates.com/cryptocurrency/news/winklevoss-twins-call-creation-cryptocurrency-sro-like-entity/

The brothers Winklevii advocated for creating an independent organization aimed at policing cryptocurrency platforms. Crypto is badly in need of some more constructive regulatory advancement. It is positive to see things like this. CFTC Commissioner Brian Quintenz has expressed approval of the idea.

Microsoft Starts Accepting Bitcoin Cash https://www.trustnodes.com/2018/03/13/microsoft-starts-accepting-bitcoin-cash

Microsoft now accepts payment in Bitcoin Cash for games, Xboxes, apps and all sort of things found on their online Microsoft Store.

Circle Rolls Out Cryptocurrency Investing App to 46 US States https://www.ccn.com/circle-rolls-out-cryptocurrency-investing-app-to-46-us-states/

On Tuesday, the Goldman Sachs-backed company sent emails to users who had participated in Circle Invest’s beta testing program, informing them that it had released version 1.0.1 of the mobile brokerage platform, which is available on both Apple and Android. Circle Invest — whose tagline is “crypto without the cryptic” — provides retail investors with exposure to Circle Trade, the company’s high-volume institutional trading desk. Unlike institutional buyers, however, Circle Invest users can purchase as invest as little as $1. The company does not charge commission for the service, although it says the spread between buy and sell orders is approximately one percent.

Billionaire Alan Howard Makes a Bet on Cryptocurrencies https://www.bloomberg.com/news/articles/2018-03-14/billionaire-alan-howard-is-said-to-make-bet-on-cryptocurrencies

Hedge fund billionaire Alan Howard made sizable personal investments in cryptocurrencies last year and plans to put more of his own money into digital assets and the blockchain technology behind them, according to people with knowledge of the matter. Other partners at the hedge fund firm he co-founded, Brevan Howard Asset Management, have independently made similar investments, the people said, asking not to be named because the information isn’t public. The investments are separate from the $9.1 billion hedge fund firm, and Brevan Howard does not trade cryptocurrencies, said the people.

Bitcoin's Highly-Anticipated Lightning Network Goes Live As Startup Raises $2.5 Million https://www.forbes.com/sites/ktorpey/2018/03/15/bitcoins-highly-anticipated-lightning-network-goes-live-as-startup-raises-2-5-million/

This is huge news. In a blog post published yesterday, Lightning Labs announced the beta release of their highly-anticipated Lightning Network Daemon (LND), which is a developer-friendly software client used to access Bitcoin’s Lightning Network. The Lightning Network has long been viewed as a tremendous breakthrough in terms of enabling faster, cheaper payments on top of the base Bitcoin blockchain and helping the cryptocurrency scale to many millions of new users in the coming years.

Twitter founder Jack Dorsey personally invested in Lightning Labs and is betting that bitcoin has a future as digital cash.

Lightning Network also passed 1000 active nodes and nearly 2000 channels on its mainnet. This marks a major milestone for the scaling solution. This impressive growth comes just three months after LN’s launch.

Peter Thiel's talk from yesterday in New York, queued up to the part where he starts discussing bitcoin

Crypto Featured for First Time in US Congress Economic Report https://www.coindesk.com/crypto-featured-first-time-us-congress-economic-report/

"Policymakers, regulators, and entrepreneurs should continue to work together to ensure developers can deploy these new blockchain technologies quickly and in a manner that protects Americans from fraud, theft, and abuse, while ensuring compliance with relevant regulations", says the report. It can be read in full here: https://www.congress.gov/115/crpt/hrpt596/CRPT-115hrpt596.pdf - head to page 201.

Security Settles on Ethereum in First-of-a-Kind Blockchain Transaction https://www.coindesk.com/security-settles-ethereum-first-kind-blockchain-transaction/

A company called Marex is issuing two separate structured notes. Both notes were created using ResonanceX, an investing platform built by Guillaume Chatain, a former managing director at JPMorgan Chase. The first note will be settled the old-fashioned way, on Clearstream, the European clearing house.

But the second, otherwise identical note will be registered, cleared and settled on the public ethereum blockchain. All the issuer has to do to change this parameter is select a different option from the drop-down menu on ResonanceX's dashboard.

The parallel issuance will test the idea, on an apples-to-apples basis, that blockchain offers a less expensive way to clear and settle financial instruments. And if that proves true, ResonanceX will allow future issuers to pick one over the other as easily as if they were changing an order on Amazon.

Coinbase Moves Into the British Market, Gets Barclays Bank Account, Gets FCA License https://www.trustnodes.com/2018/03/14/coinbase-moves-british-market-partners-barclays-gets-fca-license

British cryptonians can now instantly withdraw from Coinbase after the biggest crypto-broker and exchange started rolling out faster payments following their opening of a bank account with Barclays, the first of its kind.

Coinbase’s written testimony for the Subcommittee on Capital Markets, Securities, and Investment https://blog.coinbase.com/coinbases-written-testimony-for-the-subcommittee-on-capital-markets-securities-and-investment-47f8a260ce41

The is the written testimony of Mike Lempres, Chief Legal and Risk Officer at Coinbase, for the U.S. House subcommittee hearing this week. In it, Coinbase confirms that it serves over 20 million customers; stores more than $20 billion worth of digital currencies; has traded over $150 billion in assets; supports business in 32 countries; and has more than 250 employees in three offices (with full time contractors, it has nearly 1,000 dedicated personnel).

John McAfee Resurfaces With a Bang as Adviser to Crypto Startup https://www.bloomberg.com/news/articles/2018-03-14/john-mcafee-resurfaces-with-a-bang-as-adviser-to-crypto-startup

John McAfee disappeared from the public markets after MGT Capital Inc. severed ties with the controversial antivirus software developer, but now he’s back and advising a cryptocurrency startup that’s conducting -- surprise, surprise -- an initial coin offering.

Square's Merchants Are Willing to Accept Bitcoin, Survey Says https://www.bloomberg.com/news/articles/2018-03-14/square-s-merchants-are-willing-to-accept-bitcoin-survey-says

More than half of the retailers that use Square Inc.’s technology at the checkout stand would take Bitcoin as a form of payment, according to a new study. In a survey of around 100 U.S. merchants, Nomura Instinet found that 60 percent would accept Bitcoin in lieu of dollars. Respondents spanned various industries and had at least $100,000 of annual revenue. The 31-40 age group had the highest representation, with about 40 percent of participants falling under that category.

Royal Bank of Canada Explores Blockchain to Automate Credit Scores https://www.coindesk.com/royal-bank-of-canada-credit-scores-blockchain-patent-application/

The Royal Bank of Canada may be interested in putting credit scores on a blockchain. In a patent application released Thursday, the bank outlines a platform built on a blockchain that would automatically generate credit ratings using a borrower's historical and predictive data. The application as described proposes a system that would utilize more data sources than existing credit rating systems, improving the loan process while creating an immutable record.

Coins and tokens and stocks, oh my!

[Note — Net change and % change figures are from the close last Friday to the close today.]

HIVE Blockchain (TSXV:HIVE) — $HIVE — Last at $1.37; Net Change: -$0.09; % Change: -6.2%

Another down week in crypto, and the same goes for HIVE. But with today's reversal into the green, HIVE correlated pretty closely with Bitcoin and Ethereum, increasing +$0.15 (+12.3%) during today's trading session. For a new piece on HIVE, check out this article over at Seeking Alpha: https://seekingalpha.com/article/4156018-hive-blockchain-undervalued-pure-play-crypto-mining-stock. The writer recommends HIVE as a buy, noting the following:

HIVE Blockchain is the first pure play cryptocurrency mining company and probably provides the best exposure to cryptocurrency of any publicly traded stock. HIVE is cheap, given the growth prospects of the industry and the lack of institutional coverage. ... HIVE is trading at only 6x forward earnings and net present value per share. Moreover, Hive has about $0.51 per share in cash, cash deposits, currencies, and data/mining equipment, no debt, and many GPU assets that have significant resale value.

Overstock (NASDAQ:OSTK) — $OSTK — Last at US$45.70; Net Change: -US$15.40; % Change: -25.2%

Overstock had a terrible week, trading down along with cryptos, and then getting hammered again due to poor quarterly financials. CEO Patrick Byrne himself called it a "terrible" quarter. Revenue was down 13% for the period, due in part to what appears to be a collapse in search results. It seems the company is having problems with search engine optimization (SEO) and is getting badly beaten by Amazon and Wayfair in this regard.

Other crypto/blockchain-related stocks riding the wave:

- HashChain Technology (TSXV:KASH) — $KASH — Last at $0.315; Net Change: -$0.025; % Change: -7.4%

- Mogo Finance (TSX:MOGO) — $MOGO — Last at $4.19; Net Change: -$0.34; % Change: -7.5%

- Neptune Dash (TSXV:DASH) — $DASH — Last at $0.315; Net Change: -$0.015; % Change: -4.5%

- Riot Blockchain (NASDAQ:RIOT) — $RIOT — Last at US$8.29; Net Change: -US$0.95; % Change: -10.3%

- MGT Capital (OTC:MGTI) — $MGTI — Last at US$1.79; Net Change: +US$0.02; % Change: +1.1%

- Global Blockchain (TSXV:BLOC) — Last at $0.475; $BLOC — Net Change: +$0.015; % Change: +3.3%

- BTL Group (TSXV:BTL) — $BTL — Last at $6.70; Net Change: -$0.80; % Change: -10.7%

- NetCents Technology (CSE:NC) — Last at $1.27; $NC — Net Change: -$0.16; % Change: -11.2%

- eXeBlock Technology (CSE:XBLK) — Last at $0.315; $XBLK — Net Change: +$0.035; % Change: +12.5%

- BIG Blockchain Intelligence Group (CSE:BIGG) — $BIGG — Last at $0.60; Net Change: -$0.09; % Change: -13.0%

- And a few others that have been getting some attention: 360 Blockchain (CSE:CODE) — $CODE; Atlas Cloud (CSE:AKE) - $AKE; Block One Capital (TSXV:BLOK) - $BLOK; Calyx Bio-Ventures (TSXV:CYX) - $CYX; ePlay Digital (CSE:EPY) - $EPY; LeoNovus (TSXV:LTV) — $LTV; LottoGopher (CSE:LOTO) - $LOTO; HealthSpace Data Systems (CSE:HS); Stompy Bot (CSE:BOT); Imagination Park (CSE:IP); Blockchain Power Trust (TSXV:BPWR.UN) - $BPWR-UN; CryptoGlobal (TSXV:CPTO) - $CPTO; DMG Blockchain Solutions (TSXV:DMGI) - $DMGI; Hut 8 (TSXV:HUT) - $HUT.

Follow @Evenprime’s crypto watchlist should you wish to track the now dozens of names apparently in the crypto/blockchain game.

The CryptoTechnician Report

In lieu of the regular CryptoTechnician Report, check out this piece that @Goldfinger put out this week: https://ceo.ca/@goldfinger/crypto-capitulation-could-be-fast-approaching

He's also been putting up daily crypto links on his site, 321Ethereum. Always a good read to check the pulse each morning: http://321ethereum.com/the-best-in-crypto-3-16-18/

Lastly, @Goldfinger says the "death cross" is meaningless and is actually more of a BUY signal than a bearish sign because Bitcoin is in an ultra long term bull market just like the S&P 500.

Funny things we saw this week

Lil Windex - Bitcoin Ca$h (OFFICIAL VIDEO)

“Hey fuck Bitcoin Core. You’re just a buncha names. We the BCH gang. We run this game. So before you start talking just consider the fact that we’re the real money makers. We got millions in cash. And bitch we: strive for success/ we’re defined as the best/ and if you want your/ life to be blessed/ then come on by and invest/ just like I did/ and now my wife’s breasts/ have doubled in size on her chest/ Rrrrikikiki/ Ya [inaudible] motherfucker. BCH gang!”

BITCONNECT EDM REMIX

HODL!!

HBO’s Last Week Tonight Does Cryptocurrency, Slams BitConnect https://bitsonline.com/lwt-cryptocurrency-episode/ -- hard to find a youtube link that won't get taken down by HBO by the time you read this, so check it out on the show's facebook page. Well worth it!! https://www.facebook.com/LastWeekTonight/

Florida State Employee Arrested for Allegedly Mining Crypto at Work -- A state employee at Florida's Department of Citrus (FDoC) has been arrested for allegedly using official computers to mine cryptocurrencies. Don't do this, dummy.

Happy St. Paddy's Day, all!!

————————

DISCLAIMER — PLEASE READ CAREFULLY

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

The authors are online financial newsletter writers. They are focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, the authors are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Crypto Wars, especially if the investment involves a small, thinly-traded company that isn't well known or a crypto asset like Bitcoin or Ethereum.

Past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in this newsletter or on this website.

In many cases, the authors, and/or site owner/operator Tommy Humphreys, owns shares in the companies featured. For those reasons, please be aware that the authors can be considered extremely biased in regards to the companies written about and featured in Crypto Wars. Because of this, there is an inherent conflict of interest involved that may influence our perspective on these companies. This is why you should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. We may purchase more shares of any featured company for the purpose of selling them for our own profit and will buy or sell at any time without notice to anyone, including readers of this newsletter.

None of the authors, Tommy Humphreys, or Pacific Website Company Incorporated (dba CEO.CA) shall be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks or crypto assets, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

We do not undertake any obligation to publicly update or revise any statements made in this newsletter.