Please remember this is only for 1 Quarter, with the numbers of Q4 confirming the trend after the 3 new wells. For a full year this would be assumed 16 cents profits, tax free and also cashflow, with still more drilling this year.

The Operational Netbacks are very high and other expenses are very low. Easy cashflow with a clean balance sheet. Calculate the earnings to a full year and consider a higher WTI oil price than Q1, together you can see how low the P/E is for a company that has a turnaround situation since Q4 and a lot more proposed drilling locations. With the netbacks the future growth can easily be funded with internal cashflows. Thanks to a tax pool (note 17 in the annual financials was 51.3 mln) Vital Energy won’t have to pay taxes, or hardly depending on Canadian tax rules, for some time.

The future plans are stated in the MDA to increase production this year with 500 barrels, almost doubling current production. Together with an operational netback of CA$76 at a US$94 WTI this is a wonderful cash machine.

Insider Ownership:

Management owns more than 50% of the shares https://www.vitalenergyoil.com/investor/stockqoute.html

Investor Presentation:

That management has made an investor presentation brings confidence to me that they want to sell the company in the future, having a +50% ownership, or want to get paid using dividends when volume is higher. https://www.vitalenergyoil.com/investor/stockqoute.html

https://www.vitalenergyoil.com/presentations/Vital%20Assets%202022%20Presentation%20.pdf

Operational Netbacks:

Balance Sheet:

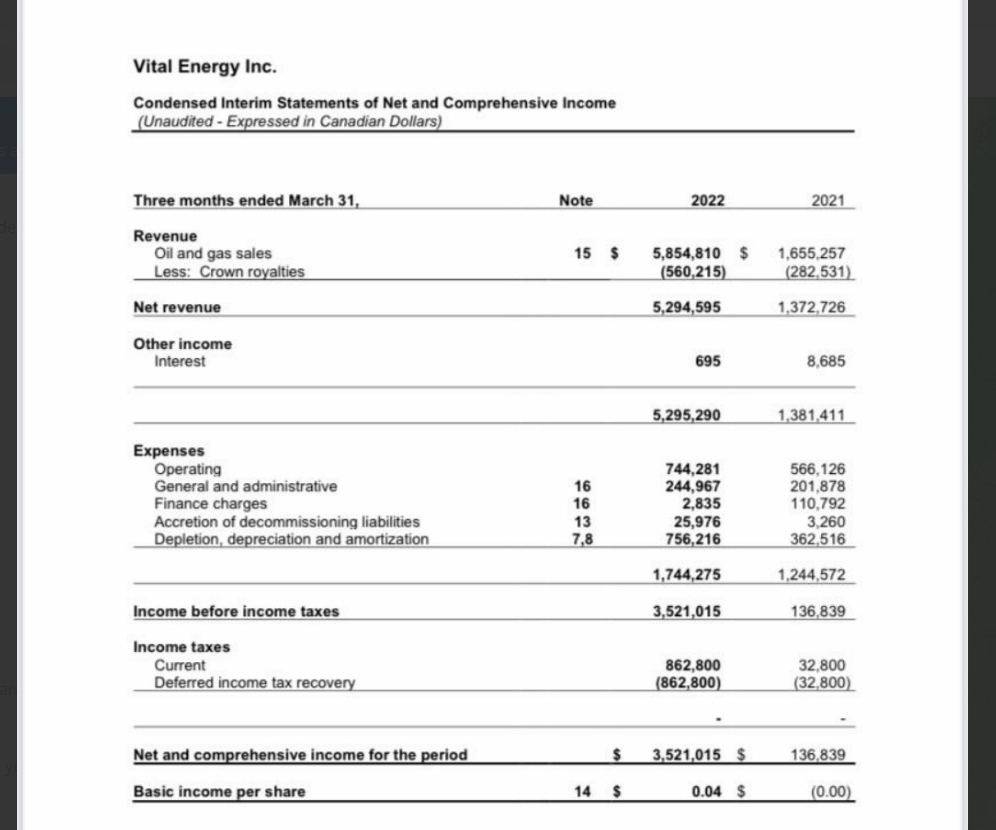

Income Statement:

Cashflow Statement:

As can be seen, cashflow goes directly into cash or short-term investments (current assets).

Outlook:

Tax Pool note 17 in the Annual Report:

This being 51.3 mln then they can continue for multiple years without paying taxes (mathematically, depends on the Canadian tax rules).

*Disclaimer: This is my personal opinion, please do your own homework