"At today's prices or the prices used in those reports apart from making sure we have uranium to fulfill our contract commitments our supply is better left in the ground." ~ Cameco CEO Tim Gitzel

I don't know how investor sentiment on Cameco (NYSE:CCJ, TSX:CCO) could get much worse than it is right now. The uranium sector is beleaguered and the uranium spot price continues to drift aimlessly near US$20/lb, a price which hardly makes any global uranium production profitable.

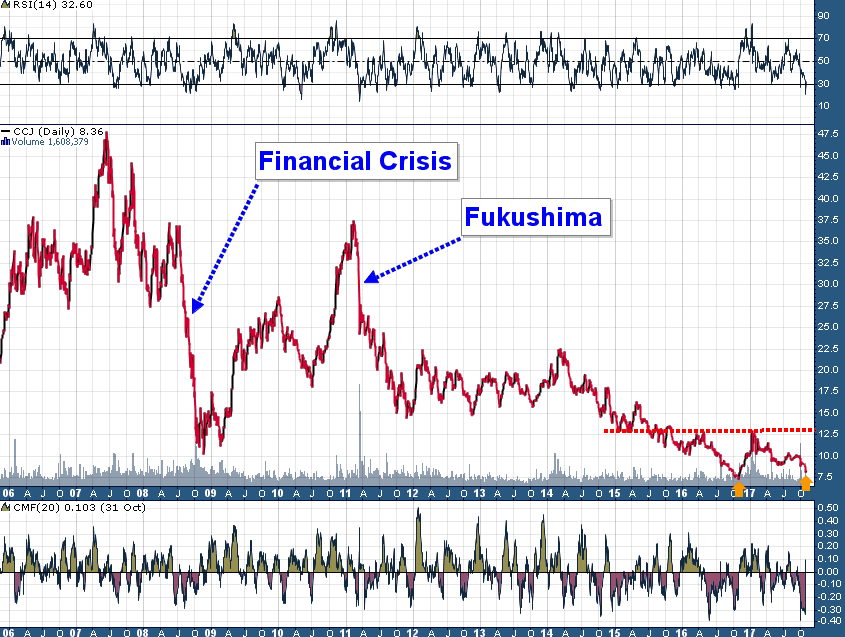

At its current share price (US$8.36/share) Cameco shares are priced at a 20% discount to book value which means that the market has already begun to discount the value of Cameco's assets due to the extremely challenging market conditions in the uranium sector.

What I find to be interesting is that CCJ is trying to put in place a higher low (higher than its low on 11/1/2016) despite the fact that Cameco's chart is about as oversold as it's ever been, and sentiment on the company couldn't be much worse after the company reported a disappointing quarter which included a quarterly loss and a full year production cut:

CCJ (Daily - 12 Year)

Since the salad days of 2007 it's been a rough decade for the uranium sector, and Cameco in particular. 2017 has been an especially dismal year for the uranium sector; even uranium exploration superstar, NexGen Energy (NYSE:NXE, TSX:NXE), is down nearly 50% from its peak earlier this year (February).

However, an investor should ask themselves "what else could go wrong at this point?"

Cameco CEO Tim Gitzel is unequivocally stating that the company will leave much of its uranium in the ground for now because they are not being incentivized to make the investments required to extend mine life at Cigar Lake or to increase production at McArthur River. The earnings outlook is murky at best and it is far from clear when (and if) the turn in the uranium market will come to fruition. Cameco shares are now priced for a fairly bleak environment and one must wonder how the stock would respond to even modestly good news? A rally up to the next major support/resistance area near US$13/share (55% above current levels) seems like a reasonable start.

This is the sort of risk/reward proposition that is a contrarian investor's dream.

Disclosure: Author is long CCJ shares at time of writing and may buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.