CEO.CA Weekly Wrap

A look at some of the week’s best chats and charts on CEO.CA, a community and platform for Canada’s venture stock markets.

Brought to you by CEO.CA Pro. Better mobile stock market data from $50/month.

It was an eventful week across the Canadian small/micro cap space, with many companies delivering news releases before the Canada Day holiday shortened week. One of the big stories of the week in the junior mining sector was Aurion Resources (TSX-V:AU), which delivered a notable NR on Wednesday that highlighted that Aurion had intersected a wide zone of gold mineralization in the first two drill holes of its recently initiated 2019 drilling campaign at the Aamurusko Northwest (NW) prospect on its wholly owned Risti Project in northern Finland.

Aurion shares had already rallied ~30% heading into Wednesday’s news, however, long-time Aurion shareholder @martin was quick to point out the significance of high-grade gold 600 meters northwest of the Aamurusko Main target area:

While the share price is now higher, @martin deduced that the significance of holes AM19094 and AM19095 more than made up for the higher market cap and share price. I believe this is an important example of how it can sometimes make sense to actually add to one’s position at higher levels.

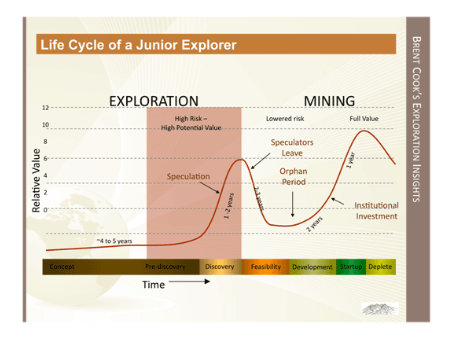

As a junior exploration company makes progress in making new discoveries, and further delineating previous discoveries, the market has a tendency to continue to sell into news and not necessarily give the company credit for further de-risking of its assets. The well known Lassonde Curve helps to illustrate the way the market tends to treat junior mining companies:

The good news for Aurion is that it is still in the “discovery phase” of the explorer life cycle as it continues to step-out successfully across its more than 100,000 hectare property package. Last Wednesday’s news was important because the first two drill holes (out of a proposed ten holes) of the 2019 drilling season at NW Aamurusko both intercepted significant gold mineralization (13.31 g/t gold over 19.54 meters, and 1.84 g/t gold over 31.12 meters) and both drill holes are being deepened (hole AM19094 also ended in mineralization and only partial assays have been received to date).

The remarkable aspect of Aurion’s Risti Project in northern Finland (of which Aamurusko is one of the prospects) is that Aurion has collected more than 5,000 rock samples averaging >8 g/t gold across the massive property package:

The Aamurusko Main zone is where Aurion intersected 789.1 grams/tonne gold over 2.9 meters last year, a drill intercept that sent AU shares soaring above $2.00 per share last September. With these first two drill holes from NW Aamurusko, Aurion has intersected bonanza grade gold mineralization 600 meters northwest of the Main zone in an area that has multiple rock samples grading more than 30 g/t gold:

The most exciting part of Risti is that this is a project that was previously completely unrecognized. Aurion is the first company to ever use diamond drilling to explore for high-grade gold mineralization on this property and it is also this blue-sky discovery potential that helps to explain why AU shares went bananas in 2017 after the company first reported its bonanza grade rock grab samples at Risti.

AU.V (Daily - 3 Year)

Malcolm Shaw of Hydra Capital delivered an excellent blog post on the latest NW Aamurusko results and offered a pithy paragraph that best sums up the current investment proposition in AU shares:

“All in all, what I am I thinking here? Patience. I think that with a $100 million market cap and likely some $12 million in the bank, Aurion’s valuation already speaks volumes about the project. This is the real deal. Kinross didn’t come in as a major shareholder here just for fun… and they know when you are exploring what are virgin targets in a property of this size, blind (i.e., mostly under surface cover), you need to be playing the long game. When or if the “eureka” market moment happens for Aurion is anyone’s guess, but today was a step in the right direction. If Aurion can keep putting one foot (i.e., drill hole) in front of the other this summer and start linking together something that looks like a coherent deposit, I think the market will continue to care.”

Another catalyst, which helps to explain the recent ~60% rally in AU, is a report from a Cormark analyst on his recent site visit to Risti. Cormark was impressed with the visit to Risti, noting, “The targets at Launi look much easier to drill than Aamurusko (veins outcrop with little topography for drill to deal with) and have shown Aamurusko like grades (>20 g/t) but with potentially better strike continuity.“

Cormark placed a $4.00 price target on AU shares and stated that they expect Aurion to be acquired before announcing a maiden resource.

This week I invited @oops to be a guest contributor. He is a father and private investor living in British Columbia, Canada - @oops has been a regular contributor to the Trading Lab since joining last year and he is one of my favorite “SEDAR sleuths” on CEO.ca.

Guest Contributor: @oops

Having access to CEO.ca Level 2 for real-time trading is crucial when it comes to placing a trade. Level 2 provides not only market depth, but includes recent trading activity, which is helpful in determining hidden orders which was seen in $AU Aurion Resources on Friday where there were two simultaneous iceberg sales at $1.55, but the bulls were relentless and pushed through to close at $1.59

There are other helpful tools out there, one of which is having access to real-time material information. I recommend that an investor obtain an app or service that has webpage change detection capability that provides notifications up to the minute. How this is utilized is by adding SEDAR URLs (or other websites) for a company that you want to track.

For example, $OG Organic Garage updated financials on SEDAR at 15:15 EST during market hours on Friday. Because of the notifications, I was notified while I was driving and I pulled over and gave the financials a quick glance. Although nothing warranted immediate changes to my holdings, I was a step ahead of the market. Organic Garage then released a NR regarding their 1st quarter financials at 16:20 EST after market closed.

Another effective tool, at US$9.95 per month, is a Stockwatch intermediate subscription. Although I despise their own added subjective sensationalized headlines, Stockwatch allows you to have up to 40 tickers on up to 10 portfolios on their intermediate level, this also includes Access to Standard Stockwatch Features.

Utilizing the Stockwatch email push notifications allows you to obtain NRs that may not be released on normal newswire services, and they also scrape SEDAR for Financials/MD&A on a timely basis. These push notifications have saved me a few times for companies that prefer to release negative drill results through less disseminated news services.

By having access to real time information, a person is able to make an informed decision regarding their investment, ahead of others.

Get CEO.CA/Pro for better trades. Plans from $50/month. Cancel anytime.

Disclosure: Author is long AU.V shares at the time of publishing and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.