It's not often that we get a monthly non-farm payrolls report that shows an increase of nearly 1,000,000 jobs in the US. Well that's what we got last Friday, and then we saw a big uptick in yields in the front/middle of the yield curve. Normally I'd expect gold to sell-off pretty hard in such a scenario, however, something unusual transpired when futures opened last night.

Gold (Hourly)

Gold briefly traded above $1730 and has spent most of the last 12 hours near unchanged from Thursday's close.

When markets do the opposite of what we would expect based upon the prevailing narrative (strong jobs report, surging consumer spending, rising yields, strong econ growth, etc.), it's time to pay closer attention.

Turning to the daily chart, it doesn't take Edwards & Magee to discern the potential for a double-bottom in gold:

Gold (Daily)

Sentiment is dreadful, and most don't trust any potentially bullish chart patterns in gold. The trend is still clearly lower on the above chart and it will require a weekly close above US$1,750 to confirm that a double-bottom is in place. It is also worth noting that even if gold climbs back above $1750 and begins a new uptrend, there will still be layers of resistance at levels of former support.

In other words, it will be a process and gold will climb a wall of worry, just like it always does.

Turning to junior mining, Damara Gold (TSX-V:DMR) released drill results from its Placer Mountain Gold Property in southern BC, Canada. The maiden drill program at Placer Mountain returned multiple near-surface gold-silver rich intersections including 1.00 meter of 48.60g/t gold and 30.8g/t silver in drillhole PG-20-001 starting at 15 meters downhole, and 4.0 meters of 7.07g/t gold and 101g/t silver in drillhole PG-20-005 starting at 29 meters downhole.

These are near-surface and fairly high-grade intersections, and I wonder if Damara should have used a wider PQ core in order to capture more of the nugget effect. In a February NR, Damara noted the Alpha Vein structure was up to 7 meters wide, so it would stand to reason that they may have missed out on some gold in the assaying of the core. The mineralization is shallow enough that I think using a larger diameter core might be a good idea in the future.

The Phase I program was designed to test the Alpha Vein, a gold mineralized quartz vein discovered during the construction of logging roads approximately 20 kilometers south of the Copper Mountain Mine near Princeton, BC. Damara’s Phase I drill program consisted of 9 holes drilled as a series of fans from 3 separate pad locations, testing for the presence of high-grade shoots along the vein and at depth.

This is a promising start for Damara at Placer Mountain and gives the company a lot of data to work with as it plans a much more comprehensive Summer 2021 exploration program that will include an airborne VTEM electromagnetic survey, soil geochemical sampling, detailed geological mapping, prospecting, trenching and channel sampling, with the aim of carrying out a second phase of drilling by mid to late Summer.

The Placer Mountain Property is a relatively unexplored area that has not seen any historic drilling. The Alpha Vein was only uncovered through logging operations in the area. Placer Mountain has never been mapped properly by a geologist, and the property has only seen some soil sampling, prospecting, and the ~500 meters of drilling that Damara carried out last December with three feet of snow on the ground.

What we do know is that the Placer Mountain Property hosts high-grade gold in volcanic rocks and it is located about 15 kilometers south of the Copper Mountain Mine:

Placer Mountain is also on trend with the Spences Bridge Gold Belt, but we do not know that these are Spences Bridge rocks (more work will need to be done to determine that).

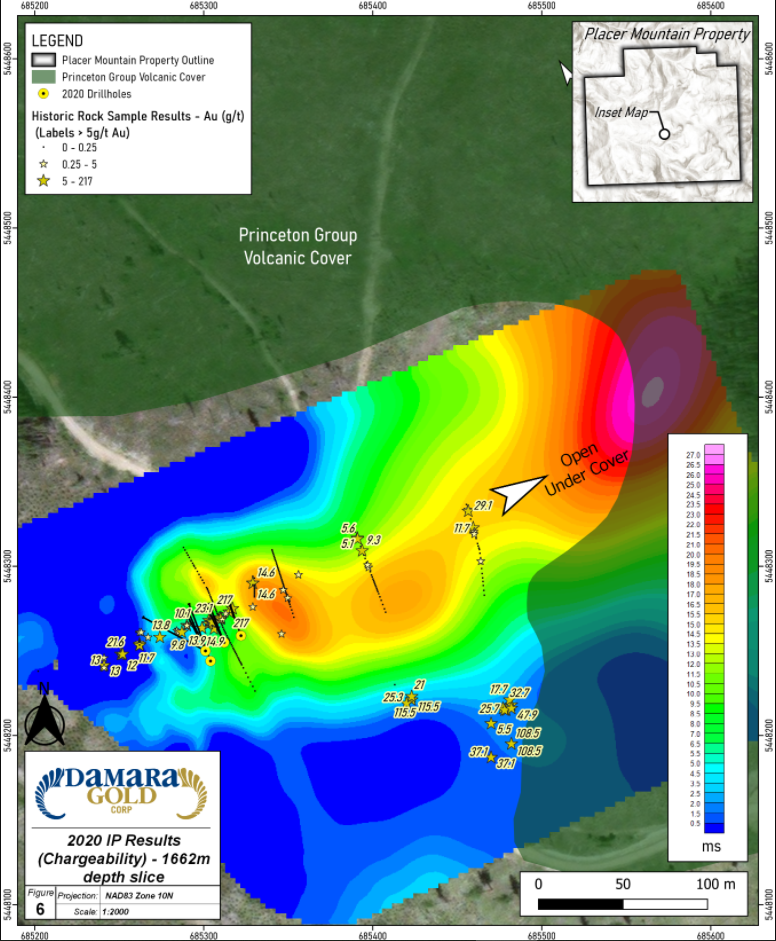

This Summer, Damara will more thoroughly explore, and potentially drill an area to the northeast of where December 2020 drilling took place:

There is a notable chargeability anomaly in the upper right of the above diagram, and the whole area is open under cover. There is also another surface showing about 3 kilometers to the northeast, which could potentially be where the Alpha Vein outcrops again.

Damara will need to raise money to carry out exploration at Placer Mountain this summer, and I expect they will have no trouble raising the money that they need. In the short term, the share price will likely consolidate in the $.10-$.12 area. However, I like Damara a lot as a Summer drill spec play and a C$4 or C$5 million market cap for the potential of a new gold discovery in a great location/jurisdiction seems like an attractive price to pay. I own Damara shares, it is one of my three picks in the 2021 Stock Picking Contest, and I am a buyer on weakness.

Disclosure: Author owns shares of DMR.V at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Damara Gold Corp.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.