After starting 2017 with an impressive ~8% gain the TSX-Venture Composite finds itself in an interesting spot near an area of important technical confluence:

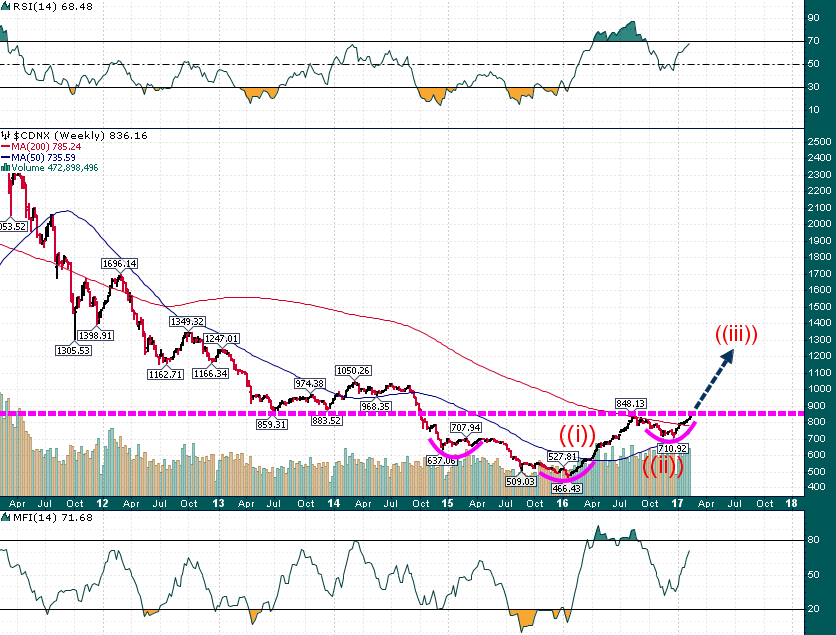

TSX-V (Weekly - 6 Year)

As you can see above the 850-885 area in the TSX-V is an important area of support/resistance. A breakout above 850 (rounding up from the August peak at 848) would offer a measured move target of ~1230. However, perhaps more importantly a move above 850 would offer a strong indication that we could be in the '3rd wave' of an Elliott Wave Cycle which began at the 466 low in January 2016.

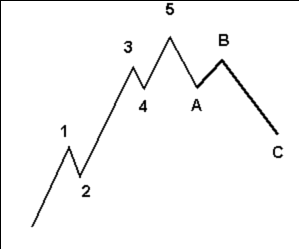

In a classic Elliott Wave Cycle the 3rd wave is usually the longest wave and often substantially exceeds wave one in magnitude as can be seen below:

If we are indeed in the 3rd wave of an Elliott Wave Cycle we could easily see the Venture rally above the 1400 level by the end of the year which would be a double from the December low at 710.

To put this into perspective, during the ~82% rally from January 2016 to August 2016 there were dozens of junior resource stocks that rallied 300%, 400%, even 1000%. This means that a move above 850 could set in motion another stunning rally which could see enormous gains among individual junior resource stocks that would far eclipse the gains made by the Venture Composite.

Downside levels of interest in the TSX-V are minor support near 825 followed by a more robust area of support/resistance 795-800.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.