The ‘conversation’ of markets is always coursing through my veins being an active market participant and financial blogger. As I go about my daily life I tend to notice things that strike me as out of the ordinary or game changing; events that stand out, stuff that has me do a double-take and say “Did that just happen?” There have been a few of these moments in the last several months.

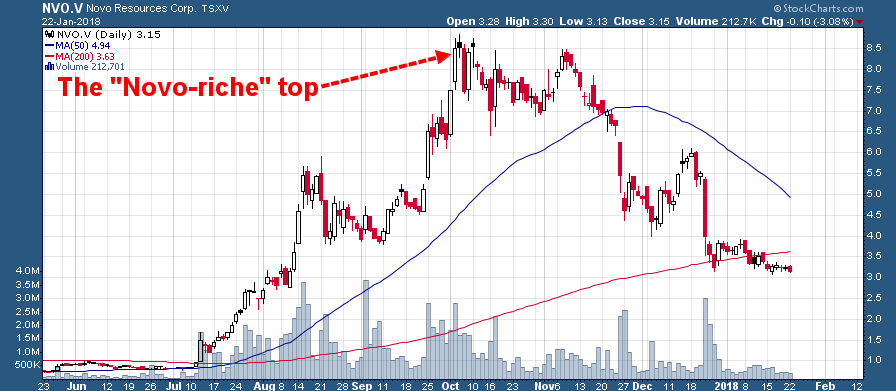

The first one which stands out to me took place on October 3rd, 2017 in Vancouver, Canada. I was attending the Subscriber Investment Summit at the Vancouver Convention Centre and literally from the moment I arrived to the moment I departed I was barraged with questions regarding Novo Resources (TSX-V:NVO, OTC:NSRPF). NVO shares had just risen ~1000% in the span of three months and I believe it was on this day that CEO.ca founder Tommy Humphreys coined the term “Novo-riche.”

Roughly a dozen people asked me what I thought about Novo, “How high do you think it can go?” “How many million ounces do you think they have?” “Is it Wits 2.0? Or maybe even better?”

It was interesting to me at the time because I had just sold Novo shares on the morning of this event for about a 20% gain on a multi-day trade. The stock continued to rise throughout the trading session on October 3rd, which only served to increase the excitement surrounding the stock, and in its CEO.ca channel.

As it turned out I definitely did not ‘top tick’ Novo. However, I came close as the stock put in an all-time high the following day.

My trading intuition (I sometimes refer to this as my “spidey senses”) that Novo was reaching a bullish emotional climax, which would soon result in a correction, turned out to be spot on.

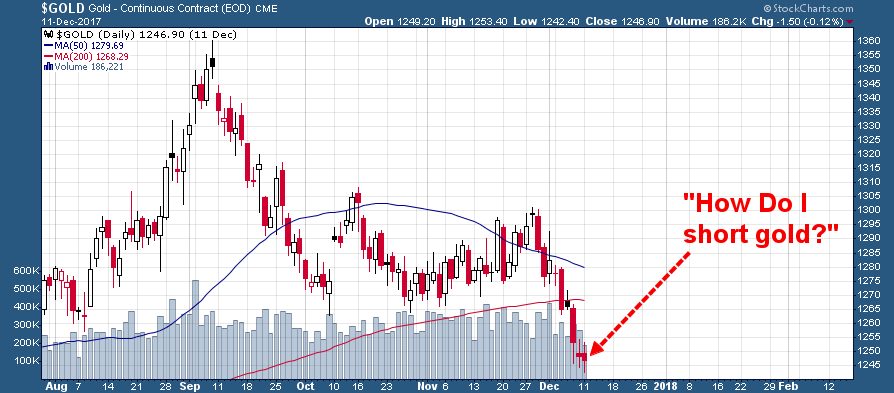

The next event that had me stand up and take notice occurred in December when John McAfee posted a tweet stating that gold was “inherently worthless.” A few days later my friend who is heavily into cryptocurrencies called me up to ask how he could profit from a crash in gold. This is someone who has never traded gold and never expressed an interest in precious metals, suddenly he wants to know how to sell short gold:

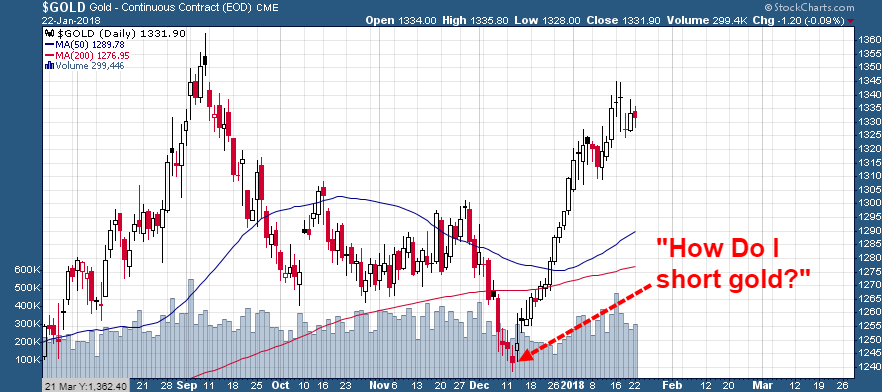

This unusual request had me do a double-take and I quickly pulled up the gold chart to explain that this probably wasn’t the best time to be thinking about shorting gold. However, he was adamant: “Gold will lose its place as a safe haven, people will flock to cryptos. Trillions could flow from gold to cryptos over the next couple of years.”

Trillions? Really?

I was able to talk him out of shorting gold (which would have turned out to be almost at the exact low in December) by explaining that he should at least wait for a bounce back to resistance near $1270.

It turned out that the phenomenon of people suddenly deciding it was time to short gold simply because Bitcoin was experiencing a parabolic rally was an excellent contrarian indicator that sentiment had reached a bearish extreme.

Thousands of years of human history which has deemed gold to be an exceptional store of value suddenly tossed away because we have encryption technology which enables people to transfer numbers on a screen to one another from anywhere in the world. It’s not different this time. Gold isn’t going away and there is plenty of room for precious metals and cryptocurrencies to coexist and complement one another.

The third and final event which made me double-take (actually a triple-take for this one) happened yesterday morning:

Cryptocurrency Mining Operation Launched by Oil and Gas Producer Iron Bridge Resources

An Alberta oil & gas producer venturing into cryptocurrency mining. Crazy right? Not really. In fact it might be genius.

My brother works in the oil & gas industry. Prior to his current position at Chevron he worked for Haliburton on the North Slope of Alaska. He told me that they have so much natural gas that they don’t have anything to do with it so they simply burn it off. Canadian oil & gas fields have the same situation with huge amounts of natural gas simply going to waste. Iron Bridge (TSX:IBR) is taking advantage of its geographic location (abundant natural gas and extremely cold climate) to create a significant competitive advantage:

“Part of ICT’s strategy involves the sourcing of cryptocurrency mining rigs using processing gear that is not experiencing the high levels of demand that many rig components currently are seeing. Being located in a cold jurisdiction where power is abundantly cheap, ICT is sourcing components that would be challenging to use in typical grid-connected and warmer climates. This is expected to further reduce capital costs and could be a sustainable competitive advantage in hosting.”

ICT (Iron Bridge’s cryptocurrency mining subsidiary) is launching a pilot cryptocurrency mining project utilizing “existing infrastructure and excess power generation from IBR’s Elmworth hydrocarbon processing battery, fired by IBR’s clean burning natural gas production, to provide power to the mining control center.”

This is genius. The question now becomes how many other oil & gas producers can leverage their underappreciated energy production in cold climates into creating crypto mining operations with significant cost advantages.

At the end of its news release Iron Bridge added the following:

“ICT is also in discussions with other natural gas producers to work with them on future commercial projects. As a result, ICT is interested in pursuing industrial scale hosting opportunities.”

Remember that Bitcoin miners are being shut down by the government in China. I’d say there is a strong probability that much of China’s Bitcoin mining industry is on its way to Canada. This is potentially a game changer for the Canadian oil & gas industry, in addition to a major win for cryptocurrencies; much of the bad press which cryptos have received recently has centered around how much energy production cryptocurrency mining uses and how it’s bad for the environment as a result of its energy consumption. With the potential to use clean natural gas in cold climates as a substantial source of energy in the global crypto-mining equation, suddenly that negative argument goes out the window.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.