I have never seen so many people admittedly put on tinfoil hats as in discussions over Turkey this weekend. It piques my interest to see conspiracy theories getting traction in mainstream discussions. The uncertainty around Turkey has led me to share what seems like an obvious trade idea: buying put options on Alacer Gold.

For your info, Alacer owns an 80% interest in a gold mine in Turkey. They are responsible for operations (through Anagold, I believe) and have delivered a good performance record. Alacer was profitable in 2015 with $235M in gold sales and $65M profit. They have announced good news in 2016 regarding their existing deposit and surrounding area. The future looks bright for Alacer in terms of the geology, engineering, and economics of their mine complex.

Although Alacer shares have moved up recently, they have lagged the market this year. You can see it clearly in comparison to XGD, the Global Gold ETF here:

On Friday, Alacer was a going concern. On Saturday they announced that they have implemented a 'contingency plan and all personnel are accounted for'. I am glad to see the company is on top of things and hope for the best.

I have not heard any news of nationalization out of Turkey yet, but have to wonder what will happen next. Alacer owns 80% of the mine and the other 20% is owned by Turkey-based Lidya Mining, who was involved in drilling the exciting Hot Maden project with Mariana Resources. I won't even try to speculate what could be going on behind the scenes here.

On center stage, this is an interesting setup for shares in Alacer. I see strong potential catalysts for upside and downside movements in the shares. There is negativity associated with the uncertainty around business in Turkey, but there is positivity around the fundamentals of the business. In fact, Alacer first caught my eyes several weeks ago as a potential catch-up play, but the recent developments have gotten me much more intrigued.

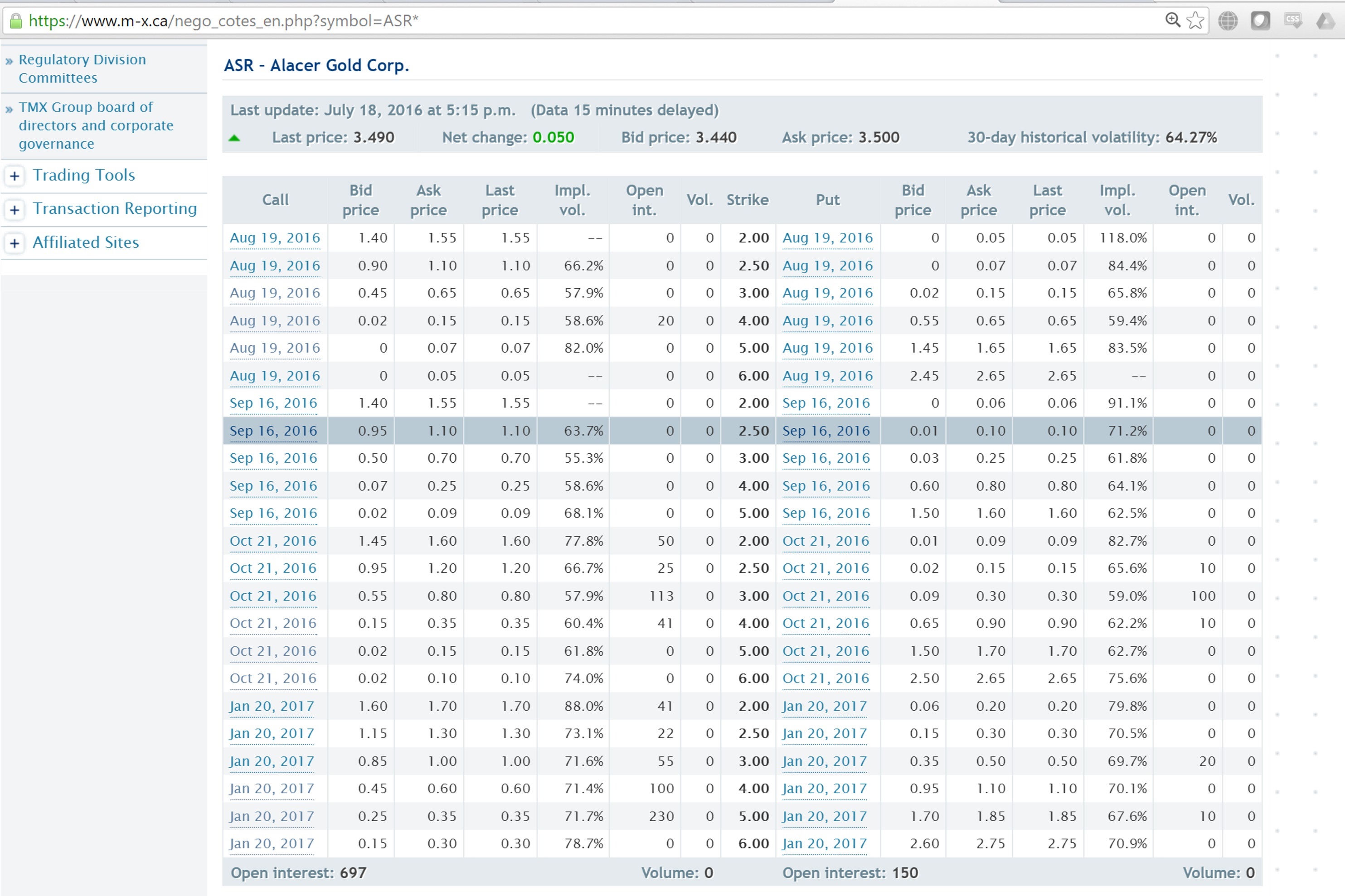

Buying puts on Alacer looks like an obvious trade to me here, but that does not mean it is a good one. In fact, I like both call and puts here -- long volatility! As of Friday, the Open Interest in all put options on Alacer was only 150 contracts, worth approximately $3500 in total premiums value for all outstanding contracts. The biggest OI for puts was in the October 3 strike, which are slightly OTM and had a low implied volatility. The OI for calls on Alacer was bigger than for puts, but still small.

For comparison, the XGD has much greater option activity. The OI for XGD calls is approximately 50K contracts. The OI for XGD puts is 10K, but there was a couple massive trades for 60K contracts in XGD puts on Friday at the January 11 and 14 strikes. It is interesting to note that one of these is ITM and the other is OTM, which looks like intelligent positioning for a downside bet on gold shares.

I, for one, am curious to learn more about Alacer going forward. I would like to see some analysis of the financials, like price/earnings for Alacer and some peers. I would also like to see some analysis of the options markets for Alacer and others. Finally, I hope to hear from Alacer Management as they figure out whether they face imminent changes or whether they can continue to deliver success in business as usual.