Introduction & disclaimer

Hello there. This is the first due diligence report that I have ever attempted to write. I'm a beginner investor with just a bit more than one year of experience so I would like to make it clear that I may make mistakes or that I may have misconceptions or misunderstandings regarding some very basic things. I would encourage You, the reader, to vet the data and to hopefully contact me if you think I've made any mistakes. I'm always happy to learn and to correct my mistakes so if You think You could teach me something then please don't hesitate to contact me. Any and all critique and feedback is appreciated.

I would like to thank all of the fantastic people of ceo.ca who share their knowledge and educate new investors like myself. Special thank-you's go to @Drjimjones, @zentrarian, @HHorseman and @Goldfinger but there are many more people I've learnt a good deal from. Thank you all for the invaluable help you've given me! And a shoutout to PAN MAN and the boys, you know who you are.

Finally, and this is an edit I later added, I would like to apologize for the long article. I really didn't intend it to become this long but I also didn't want to cut it into parts. I hope I can get some feedback regarding this from You as well.

DISCLAIMER: This is not financial advice. I may or may not currently own shares of this company, and I may sell a position at any point without warning. Please do your own due diligence and invest at your own risk. I am not a paid advertiser or promoter. I'm not a geo or any sort of professional, take everything I say with a grain of salt.

The company in a nutshell:

Integra Resources (TSXV:ITR, NYSE:ITRG) is a mineral exploration and development company with a single gold-silver project situated in South-Western Idaho near the Oregon state border. The company's sole project is the DeLamar Project, a past-producing mining area covering 8,100 hectares of which the company holds a 100% interest in. In addition to the DeLamar project, Intergra has acquired the War Eagle property immediately to the South-East of DeLamar as well as the Blacksheep property, a large early stage property immediately to the North-West of DeLamar. The project has M&I&I resources totaling 2,719,000oz Au and 128,754,000oz Ag (4,182,114oz AuEq at 1:80 Au:Ag). Total in-pit resources M&I&I are 1,244,000oz Au and 46,130,000oz Ag (1,820,625oz AuEq 1:80). Stripping ratio between the DeLamar and Florida Mountain open pits averages 1.09:1 waste:ore. The mineral resource estimate as outlined in the 2019 PEA consists of two areas, the large DeLamar mine area in the West and the Florida Mountain area in the East. Both were last operated by Kinross which acquired the DeLamar mine in 1993 and began mining Florida Mountain in 1994. All mining ceased in 1998 due to low gold prices and mine closure activities began in 2003. Reclamation was almost fully completed in 2014, only water management activities remain. Integra acquired the project from Kinross in 2017. The management team of Integra has proven past success in M&A: the same management team sold Integra Gold to Eldorado Gold for C$593M in 2017 May, at a 52% premium to share price at the time. CEO George Salamis told CRUXinvestor in an interview that the team "decided to stick together and follow the same recipe" as they did with their previous successful venture: acquiring and developing brownfield assets left behind by majors -- DeLamar.

After acquiring the project, Integra quickly advanced the project into a PEA stage. The 2019 PEA showcased the robust economics of the DeLamar Project:

The PEA envisions a 10 year LOM, low cost (Initial CAPEX US$161M) 124,000oz AuEq per annum heap leach operation with a 27,000tpd leach material processing rate. In addition to heap leaching the PEA plans for the construction of a 2,000tpd flotation concentrate processing plant which would be built in phase two of mine development using the cashflow from the phase one Florida Mountain oxides and transitional ore heap leaching. The concentrator would begin processing the higher grade unoxidized (sulphide) ore from Florida Mountain in year three. Finally in stage three, the DeLamar open pit would begin operation and the oxides and transitional ore would be heap leached with an added agglomeration step in the processing to increase recoveries there. The heap leach recoveries at Florida Mountain are 85-90% Au, 40% Ag; and the heap leach recoveries for DeLamar are 75-80% Au; 30% Ag. Milling recoveries for Florida Mountain sulhpides are 90% Au; 80% Ag. A significant part of the total resource base was left out of the PEA plan: the DeLamar mine sulphides were excluded from the PEA.

Guaranteed growth at the DeLamar mine

The PEA ignored the DeLamar sulphides from consideration due to a scarcity of metallurgical understanding in 2019, which the PFS (estimated to release in late 2021 or early 2022) will include in the mine plan. Integra expects to increase the production by at least 50% and possibly to >200,000oz AuEq per annum, and the life of mine will increase from the 10y LOM that was outlined in the PEA. The PFS will include increased leaching production -- 27,000tpd -> 32,000-35,000tpd -- and importantly a much bigger mill -- 2,000tpd -> 8,000-10,000tpd. This could increase the annual processing capacity from oxides and transitional ore by 18~30%, and annual processing capacity from sulphides by as much as 300~400%! A larger mill is justified by further sulphide resources being added into the mine plan at DeLamar, but also by the potential for high grade underground mineable resources at Florida Mountain and other areas on the property which I will get to later. The company highlights that due to the significant difference in silver recoveries via flotation as opposed to heap leaching, silver's portion of the total revenue is likely to increase. The total resource at DeLamar includes more than 106Moz Ag (27Moz Ag in-pit oxides/transitional outlined in PEA) and the improved silver recoveries allowed by a milling operation rather than a leaching operation (30% leaching recovery for silver oxides/transitional ore -> 70~80% possible milling recovery for silver sulhpides) will most likely significantly improve the project economics. However, the company notes that the capital expenditures are also likely to increase in the PFS. Let's take a closer look at how much known sulphide mineralization will be added into the production plan.

Everything shown in blue wasn't included in the 2019 PEA and will be included in the PFS considerations. This alone will mean a significant increase in production and life of mine. Moreover, note the drill hole intercepts outside of and proximal to the block model at the Sullivan Gulch zone in the image below. How many ounces can the company add at the DeLamar pit in addition to what was already excluded in the earlier economical assessment? The CEO says that some of the Sullivan Gulch area resources will be left outside of the PFS mine plan but there is little doubt that Sullivan Gulch will grow bigger with more drilling and that the results of said future drilling could potentially be added to another study possibly as soon as next year. Upside from Sullivan Gulch for the coming PFS is already guaranteed, but there are also proven zones of mineralization that will be left out of the PFS that can be added to future studies "risk-free".

Note the grade and continuity found recently at Sullivan Gulch during metallurgical drilling, and especially the high silver grades. The three intercepts highlighted in red in the upper image are wide, consistent and include higher grade areas. The higher grade intercepts immediately adjacent to the block model are likely to be included in a future open pit plan. From the 21 Oct 2021 NR:

IDM-21-201

- 0.66 grams per tonne (“g/t”) gold (“Au”) and 65.92 g/t silver (“Ag”) (1.51 g/t gold equivalent (“AuEq”)) over 160.33 meters (“m”)

- Including 1.32 g/t Au and 286.00 g/t Ag (5.00 g/t AuEq) over 1.52 m

- Including 2.20 g/t Au and 217.00 g/t Ag (4.99 g/t AuEq) over 3.04 m

- Including 0.55 g/t Au and 342.00 g/t Ag (4.95 g/t AuEq) over 1.98 m

- Including 5.11 g/t Au and 63.25 g/t Ag (5.92 g/t AuEq) over 1.53 m

IDM-21-202

- 0.55 g/t Au and 34.51 Ag (1.00 g/t AuEq) over 124.06 m

- Including 1.59 g/t Au and 466.00 g/t Ag (7.59 g/t AuEq) over 1.53 m

- Including 0.29 g/t Au and 444.00 g/t Ag (6.01 g/t AuEq) over 1.52 m

IDM-21-203

- 12.04 g/t Au and 63.02 g/t Ag (12.85 g/t AuEq) over 5.19 m

- 0.66 g/t Au and 65.51 g/t Ag (1.50 g/t AuEq) over 115.52 m

- Including 0.27 g/t Au and 606.00 g/t Ag (8.07 g/t AuEq) over 1.52 m

- Including 1.74 g/t Au and 606.00 g/t Ag (9.54 g/t AuEq) over 1.53 m

- Including 4.55 g/t Au and 339.87 g/t Ag (8.93 g/t AuEq) over 4.57 m

- Including 6.65 g/t Au and 11.38 g/t Ag (6.80 g/t AuEq) over 1.52 m

Drilling to date from Sullivan Gulch has so far increased the strike length by 1,000m, with a width of 200m and a depth of 350m. Unoxidized gravity is 2.34 according to the technical report. 1,000m x 200m x 350m x 2.34 = 163.8Mt. Sullivan Gulch alone may easily be able to increase the tonnage by well over a hundred million tonnes in addition to the ~130Mt current tonnage at DeLamar. IP surveys indicate potential to increase mineralized strike length by another 900m to the South. I don't think it would be an overstatement to speculate that the DeLamar mine resources could be more than doubled from the current 3.2Moz AuEq total to more than 6.4Moz AuEq. As for a conservative increase in mineable resources, I speculate an increase from the in-pit resource increase from 826koz AuEq to 1.5Moz AuEq, a 82% increase, with the addition of the sulphides and other drilling results to date at DeLamar.

Of course, the economics of any resource depend on more than just ounces in the ground (the current stripping ratio at DeLamar is 0.74:1 W:O and including more down-dipping mineralization would likely increase the ratio meaning more waste mined per ton of ore so it becomes a trade-off that needs to be considered economically) but I can consider this type of speculative upside just the gravy on top of the steak that is the guaranteed expansion of the DeLamar mine with the sulphides being added to the mine plan and the new broad intersections immediately peripheral to the block model. Even though only a part of Sullivan Gulch is included in the coming PFS more results will be included in a future study. The area is an excellent target for the company to focus its exploration efforts going forward due to the long widths of well distributed mineralization, a feature which characterizes the target area. Even further expansion potential at DeLamar may be realized elsewhere around the pit as well as mineralization remains open along strike and down dip generally to the South-South-West in many parts around DeLamar, as well as to the North-West towards the Milestone pit and Henrietta Ridge, but Sullivan Gulch in specific is a low hanging fruit.

High grade success at Florida Mountain

“Our targeted high-grade hit-rate in drilling is now 70% and is indicative of a thorough and increasing understanding of structural and geological controls of these veins and shoots.”

-George Salamis, CEO (31 Aug 2021 NR)

Moving onto the other area that was part of the PEA mine plan, Florida Mountain. Florida Mountain has oxidized and transitional ore near surface which makes it an ideal starter pit. In addition Florida Mountain ore does not require pre-leaching agglomeration. As such, and as discussed earlier, the PEA envisioned that mining would begin at Florida Mountain in stage one of the mining operation. Stage two would be beginning to process stockpiled sulhpide ore from Florida Mountain by year three via a flotation circuit. Heap leach recoveries for Florida Mountain are generally slightly better than at DeLamar and higher grade areas further encourage prioritizing operations at Florida Mountain. In addition, Florida Mountain is home to multiple nearly vertically dipping, North-Northwest striking fissure veins which were historically the target of underground mining. The veins and the mineralization that occurs in them do not have defined depths but it is assumed that they get thinner and more base metal bearing the further down they plunge, as is usual with low sulphidation deposits. Integra believes that there is significant potential to delineate an underground resource which may be subject to future underground mining after the open pit has been mined out. As such the company has focused its exploration efforts on drilling deeper at Florida Mountain in order to target this type of mineralization, and they have been getting high grade results from these fissure veins in addition to the broader bulk mineable results closer to surface. The current resources at FM total 1,135,000oz AuEq.

So says Mosser (1992):

"Host rocks display a definite influence on mineral distribution. Within the granodiorite and basalt, where most of the historic production occurred, the veins are narrow and tight. However, within the more reactive and permeable quartz-latite and rhyolite units, the mineralization is more disseminated so that significant bulk mineable potential exists..."

"Hypogene gold and silver mineralization varies little with depth across known levels and is dominated by electrum, acanthite, and the silver sulfo-selenide aguilarite....”

In other words broader disseminated bulk mineable mineralization is found, as elsewhere on the property, in quartz-latite and rhyolite, and in other volcanic rocks overlying basalt and granite. And high grade mineralization is hosted typically in the underlying granitic and basaltic rocks. Sulphide Au/Ag mineralization varies little with depth, in other words it should be more or less consistent across the known depth extent. This is fantastic for an underground operation. Consistency is great! That there is little variability going deeper is encouraging to me and in my opinion increases the chances of a modern underground mining operation with significant exploration potential. As shown in the image below, the company is considering making an adit underground and drilling the high grade shoots from underground rather than from surface.

The main portion of the Florida Mountain deposit encompasses the Black Jack - Trade Dollar vein which was the main focus of historical mining. According to the technical report, historical stopes extend for 600m beyond the Southern resource boundaries. There are a total of seven known vein structures, BJ-TD being the most productive of them all. The vein structures are similar in size and orientation to the BJ-TD structure. They have a combined strike length of over 7,000m and within the structures there are high grade shoots that have between 20m and 200m strike lengths and extend up to 400m down dip which are interpreted to have been developed at structural intersections. The widths of these high grade shoots vary from 1m to 8m. The company has chosen to focus their exploration on three of the seven structures -- the remaining Trade Dollar-Black Jack vein, the Alpine vein, and the Stone Cabin-Tip Top vein.

Integra's drilling to date after the PEA has focused on Florida Mountain. As such the company has intersected much mineralization outside of the block model. Of particular note is the "saddle zone" between the two historical open pits. Recent drilling has intersected broad higher grade portions at the "saddle zone" between the two pits at Florida Mountain which show clear signs of higher grade open pit optimization potential. Watch CEO George Salamis explain the recent drill results. Note that the results being discussed won't make it to the PFS but will instead be incorporated into future studies -- I think of it as guaranteed resource growth and derisking for the future, same as Sullivan Gulch at DeLamar. To view these results in more detail, see the 4 Nov 2021 NR.

That there is such resource expansion potential between two pits is fantastic because the stripping ratio should be relatively low and the results should in fact even decrease the stripping ratio in the next resource estimate at Florida Mountain. These are easy ounces to be added to future open pit plans. As seen in the image below, the recent Saddle Zone results fall within the current resource pit outline, meaning these new results will impact the amount of ounces mined for the same amount of tons mined, in other words more ore mined in relation to waste rock. The PEA from 2019 estimates a stripping ratio of 1.40:1 W:O for the FM pit -- this should improve with the results from the Saddle Zone, provided the pit outline stays unchanged.

Here's more drill intercepts outside of the block model from 2019-2021. These exclude higher grade highlight results for the sake of viewability as those are accompanied with text showing the intercept assays. Notice the resource expansion potential especially between the two open pits in the Saddle zone. Click on the images to expand them.

There are lots of high grade results below the open pit resource boundary that the company has been getting since 2019. George goes through these results briefly and explains their significance in this video below. Note the step-out results from Q4/2020 and Q1/2021, South and West respectively. I won't get into the drilling results but I encourage You to view the NR's that have come out to date Yourself to gain an appreciation for the quality of this project and the understanding of the area the geologists have attained during their exploration efforts. I also encourage You to make use of the 3D model Yourself on Integra's website and look around more. Do watch the videos of George explaining new results as they come out as well.

Consistent high-grade drill intercepts at Florida Mountain are showing strong continuity across multiple vein structures. Over the last three years we have intersected 92 high-grade gold-silver hits over 4.0 g/t AuEq covering strike lengths of 1,300 meters and depth extents of up to 400 m. (31 Aug 2021 NR)

The Company has now intercepted 103 drill hits over 4.0 g/t AuEq with a minimum width of 1.52 m at Florida Mountain. (4 Nov 2021 NR)

Speculating an increase of 100m x 200m x 100m x 2.46 (Florida Mountain transitional mineralized gravity as according to PEA), the mineralized tonnage at FM could conservatively increase by at least 4,920,000Mt, based on Saddle Zone results. The grades from Saddle Zone are significantly higher than the 0.64gpt AuEq M&I grade from the PEA -- assuming a 1.0gpt AuEq grade at Saddle Zone, the results so far could increase the ounces inside the open pit shell by at least 158koz AuEq from the current 960koz AuEq. Other, earlier results from FM that will be included in the PFS will likely increase the resources. I find it more difficult to speculate a conservative assumption for the coming PFS resource estimate but I think a 100-200koz AuEq increase is possible. In my opinion a conservative total in-pit resource expansion of 250koz AuEq at FM from the drill results to date is possible -- a 26% increase at least.

As for the high grade underground resource potential, the company has intersected >4.0gpt AuEq x 1.52m minimum width x 1,300m total strike length x (400m depth - 150m resource pit depth) max. depth extent x 2.46 gravity = 4,860,960g / 31.1 = 156koz AuEq underground resource expansion should be possible based on the drill results to date. I speculate a total of 400koz AuEq, or a minimum of 41% increase in mineable resources at FM. A maiden underground resource estimate may come out sometime in 2022 at the earliest as indicated by the company. In addition to these things, I am ignoring what potential resource expansion will result in the step-outs to the North and South at Florida Mountain.

But wait! There's more...

In addition to the immediate resource growth potential within and peripheral to the open pit as well as the underground resource potential below the pit at Florida Mountain, there are two areas of great interest to the East and West of Florida Mountain. To the West there is Rich Gulch which has historical underground workings, arsenic-in-soil anomalies, IP chargeability anomalies and historical drill results. And to the East there is the Florida Keys target area which is an area of anomalously high grade gold-in-soil as large in size as the current Florida Mountain resource area. Needless to say, the blue skies potential is immense and these areas offer sexy drill targets for resource expansion. George Salamis explains these target areas shortly in the video below (Florida Keys and Rich Gulch part begins at 9:00), but I'm going to include my own notes below the video.

At Rich Gulch, there is an impressive IP chargeability high. The three main vein structures (TD-BJ; SC-TT; Alpine) are seen in the IP chargeability results as warm, distinct colours, meaning vein structures and mineralization tend to be associated with high chargeability -- this is seen across the DeLamar project area. The IP anomalies coincide with an equally impressive area of anomalous arsenic-in-soil. The area has seen very limited historical drilling but the results as well as underground workings in the area are proof of mineralization and that the area is well worth exploring.

And at Florida Keys, a gold-in-soil anomaly of similar size and strength as the current resource area at Florida Mountain is present:

What these target areas represent is tremendous resource expansion potential that I'm happy to speculate on. First drilling has been completed at both Florida Keys and Rich Gulch and assays are pending. Florida Keys could eventually double the current resources and therefore add another 1Moz AuEq into the resource base. As for Rich Gulch, judging for the sheer size of the IP & soil anomalies I could see 2Moz AuEq being discovered. Conservatively, I see potential for Florida Mountain, Florida Keys and Rich Gulch areas to host at least a total of >4Moz AuEq in combined resources as exploration continues. That'll be a long ways off though and this is pure speculation on my part.

...And more...

There is another important target area I want to talk about. War Eagle is a well-developed and high priority target where Integra has been drilling some of the highest grade intercepts on the entire project area. War Eagle has underground workings, I'm uncertain whether drilling results from War Eagle will be included in the next resource estimate but nonetheless the results are noteworthy indeed and the area offers an important avenue for resource growth. Historical production numbers from War Eagle suggest higher grades than from elsewhere on the property. Interestingly, initial drilling has shown potential for high grade mineralization at War Eagle being hosted in the volcanic rocks overlying the granitic rocks as well as the granitic rocks themselves as elsewhere on the property where the granitic rocks host the high grade mineralization. The volcanic rocks go about 200m down dip before the host rock strata changes to granitic rocks.

Drilling highlights from War Eagle include:

IWE19-01:

- 10.88gpt Au & 115.31gpt Ag (12.38gpt AuEq) over 34.14m from 116.74m

- incl. 73.62gpt Au & 817.26gpt Ag (84.14gpt AuEq) over 4.27m from 116.74m

- incl. 9.93gpt Au & 48.34gpt Ag (10.55gpt AuEq) over 3.05m from 147.83m

- and 6.03gpt Au & 269.33gpt Ag (9.50gpt AuEq) over 2.13m from 315.16m

IWE20-014:

- 24.20gpt Au & 655.06gpt Ag (32.63gpt AuEq) over 7.62m from 133.50m

- incl. 2.95gpt Au & 14.46gpt Ag (3.13gpt AuEq) over 3.11m from 135.03m

- incl. 98.01gpt Au & 2,782.13gpt Ag (133.82gpt AuEq) over 1.77m from 138.14m

IWE20-016:

- 1.19gpt Au & 11.65gpt Ag (1.34gpt AuEq) over 30.63m from 182.27m

- incl. 8.46gpt Au & 9.11gpt Ag (8.57gpt AuEq) over 1.52m from 209.70m

Drilling to date has confirmed two separate areas along a N-NW strike where high grade mineralization occurs. The area drilled in 2019 showed a 300m strike length, and drilling in 2020 400m to the North of the 2019 drilling showed another 500m in strike length. In 2020, another high grade shoot was found 150m East of the targeted area in the Northern part of the mineralized strike. A combined strike length of 800m has been delineated by drilling at War Eagle to date, and the newly discovered structure is interpreted to have a strike length of 550m and is largely untested.

The soil anomalies at War Eagle also point toward a 1,000m long x 200m wide North-South trending area of interest 300m to the East of the drilling results to date. The area has seen little to no historical mining and drilling and is therefore a totally virginal exploration target. The geochemical anomaly is interpreted to be lateral leakage of underlying higher grade mineralization, the source is possibly the second shoot of mineralization discovered in the 2020 drill program:

Drilling at War Eagle recommenced in September 2021, and the target area provides further blue sky potential for the company.

...And there is still more!

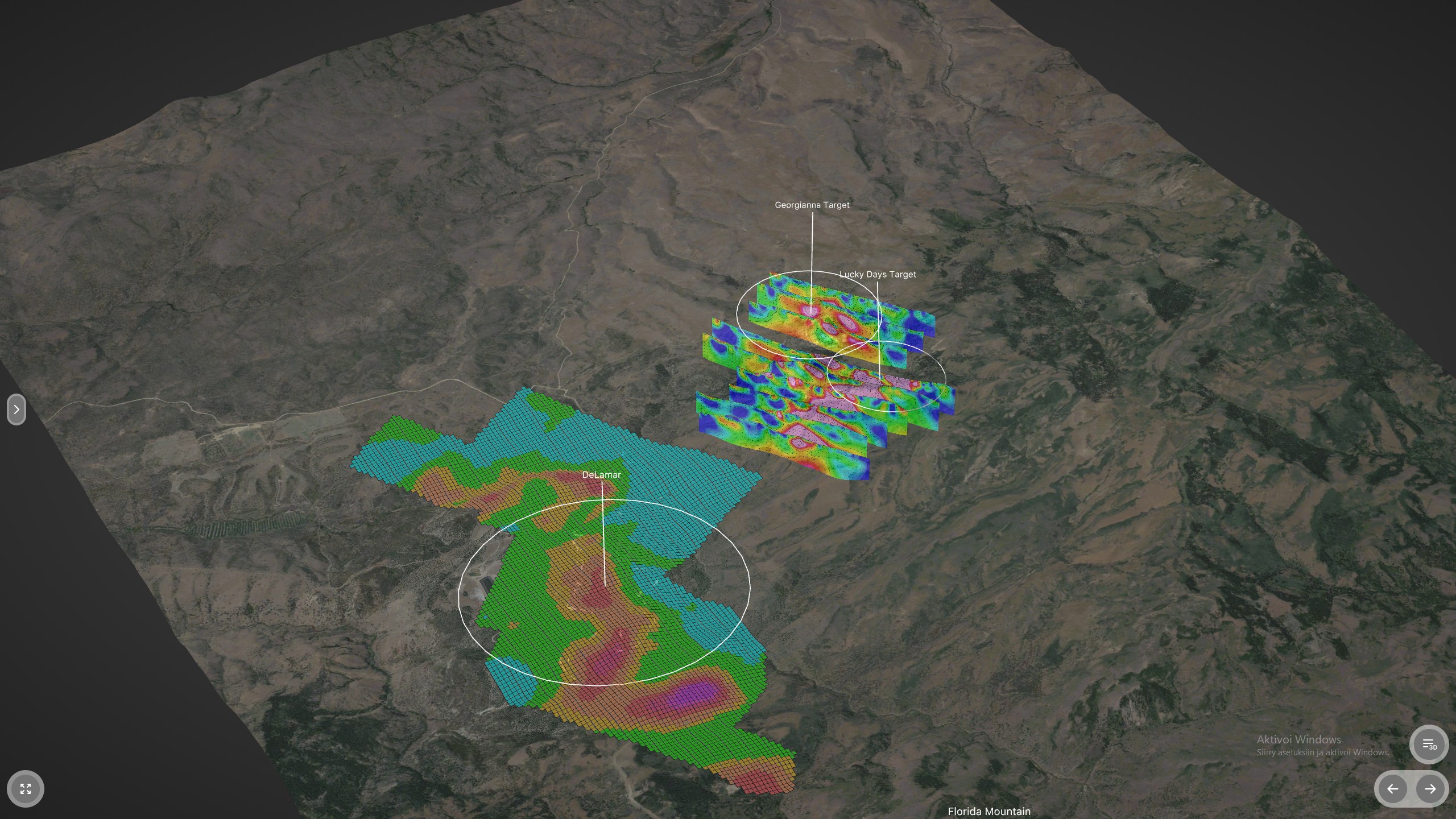

Finally Integra controls one more, large greenfields exploration area to the immediate North-West of the DeLamar mine area. This area is called Blacksheep and it's home to multiple different target areas that have seen little to no exploration or historical mining to date. Integra has done geochemical sampling and IP chargeability in the area, and drilling results have been received from three of the closest target areas to the DeLamar mine area, which are the Milestone, Georgianna and Lucky Days targets.

All of these target areas provide great greenfields potential and scale for the whole project at large. The entire Blacksheep district trend covers 6km, and many of the target areas have soil anomalies of over 1.5km in diameter. For the sake of my sanity and Yours I have chosen not to get into the results from Blacksheep but suffice to say that Blacksheep is pure blue skies goodness for resource expansion, a (massive) cherry on top of the DeLamar project.

I'll let George do the explaining to You, starting from 6:45 in this video:

The corporate side

“We’re the Gem State for a reason, and there’s never been a more exciting timing for Idaho to realize the potential of our diverse mineral resources. The building of responsible mines is a priority for the state, especially those with the potential to be strong contributors to their counties and communities.”

-Brad Little, governor of Idaho on Integra's DeLamar project (6 Oct 2021 NR)

Okay, they have a phenomenal project. But how about the corporate side of things? Is the company being run efficiently, are there any major risks, is there local support, can this ever be a mine and most importantly can Integra provide returns for shareholders?

Integra Resources has:

- A team with a proven track record of previous successes in exploration, development and M&A

- Robust cash position: ~C$27/~US$21 in the bank

- Strong share structure: ~62M Outstanding, ~6M options & RSUs/DSUs, 0 warrants = ~68M fully diluted

- Continued track record of good financings with little dilution

- Endorsements from the current governor of Idaho, Brad Little

- Previous 3-term Idaho governor Butch Otter as Director

- A track record of methodically moving forward with project development amid exploration efforts

- Tier 1 jurisdiction

- ESG compliance

- NYSE listing

There is one small risk which is accounted for in the balance sheet -- the water maintenance and monitoring left behind by Kinross. Environmental concerns regarding the water maintenance operations seem minimal, and the more relevant concern are the balance sheet liabilities. on a current basis the water maintenance costs between C$2-3M annually and C$40M in total. Considering all of these corporate side things I would say YES, Integra can and will create tremendous value for investors.

In conclusion...

Integra has a fully diluted market cap of C$183M and C$27M in cash. That's C$2.69/FD share. For this price You get:

- 4.4Moz AuEq in total resources (1.8Moz AuEq in-pit resources)

- Immediate, derisked resource growth: 1.8Moz -> 2.5~3Moz AuEq in-pit for the PFS?

- Immediate PFS study with 170~200koz AuEq annual production over more than 10 years and 50% increase in production profile from PEA

- Improved economics from the PEA which indicated 74% IRR and US$645M NPV5% at the current price of gold

- Long-term bulk tonnage and high grade resource growth potential: 4.4Moz AuEq -> +10Moz AuEq?

- Exceptional blue skies potential around the project area -- district scale opportunity

- Year-round drilling and 4+ rigs on site at the same time in warmer seasons

- "Hidden" silver exposure and leverage to silver price

- A competent management team with past successes and an ongoing track record of excellence

- Consistency in exploration successes and project development

- Local support

Great Bear was acquired for about C$1.8B and has anywhere between 10~20Moz Au in total (though no resource estimate has been made). Assuming that the company manages to discover 10Moz AuEq and that they will get taken out by a major for US$100/oz, the takeout price would end up being US$1B = C$1.28B. Assuming a 50% increase in FD shares, the potential return could be C$1.28B / (C$183M x 1.5) = 4.66x return, or a terminal value of C$12.54/FD share. Of course, this is a very rough assumption that only takes into account exploration potential and it doesn't consider economics at all, but I believe 10Moz AuEq is very attainable at DeLamar, Florida Mountain, War Eagle and Blacksheep. When it comes to the economics, the PEA is in my opinion a very encouraging endorsement for the entire DeLamar project. And I believe that majors will be lusting after a 200koz per annum operation with >50% IRR in a safe, supportive jurisdiction especially when Latin America is becoming increasingly hostile toward mining. Assuming US$800/oz AuEq average AISC and 200koz pa average production profile the project would on average net ($1,800 - $800) x 200,000 x 0.7 = $140M per year after taxes. I believe this would be an extremely attractive M&A target.

The share price is at a 52 week low and as with many other gold miners right now, the share price looks like a bargain. With the upcoming PFS acting as a major catalyst and with the increasingly aggressive exploration being undertaken by Integra as their understanding of the DeLamar project increases, the current share price is an opportunity for any investor looking for an undervalued low-risk opportunity in the gold mining sector.