Your dose of crypto news and analysis from @BTO and @Goldfinger

I'll be the first to admit I'm no chart reader or market analyst. Instead -- perhaps naïvely -- I make most of my investment decisions on intuition and feel (maybe a lil DD in there too). I wrote the below spiel 10 days ago attempting to verbalize and share a hypothesis I had: that the sudden run up in crypto pubco stocks that day, after a prolonged period of steady losses, was somehow foretelling what was to come -- a run up in cryptocurrencies themselves.

When I wrote that spiel:

- Global crypto market cap was at US$260 billion

- Bitcoin was at US$6,800

- Ethereum was at US$400

- HIVE had just had a big boost in volume -- 2.5M shares traded that day -- and had just posted its first real gain after several days on the decline (with low volume) -- up $0.10 (+9%) to $1.21; other crypto pubcos had similar or even larger gains

And now:

- Global crypto market cap is US$380 billion -- up +46%

- Bitcoin is at US$8,500 -- up +25%

- Ethereum is at US$590 -- up +48%

- HIVE closed out the week at $1.55 -- up +28.1%

Just a coincidence, or is there something to this theory?

Who cares. What matters now is what's to come. I'm thinking we're just at the very beginning of of major rally here in crypto. There's been a noticeable shift in sentiment across the crypto-related news sources I read -- from bearish to bullish -- and I think this "mini-rally", which shows there's still some serious life left in crypto, could fuel another major run up like we saw in 2017.

Zooming in on the January through September period in 2017, you can see when things started to take off, both in terms of volume and prices. It was around the beginning of May. What date is it today? April 20, 2018. Will we look back a year from now and say the same for this May? I wouldn't be surprised if we do.

It hasn't been all roses this week, though, at least not in the crypto pubco realm. Here's how the RIOT Blockchain story has unfolded (credit: @Vexmark on Twitter):

Let's see how some of the major cryptos fared just looking at this past week (close UTC time last Friday to today):

- Bitcoin trading around US$8,500, up +7.7% on the week

- Ethereum trading around US$590, up +19.7% on the week

- Bitcoin Cash trading around US$1,113, up +50.9% on the week

- Litecoin trading around US$152, up +21.3% on the week

- Stellar trading around US$0.37, up +52.2% on the week

- Dash trading around US$447, up +26.6% on the week

- Monero trading around US$254, up +34.8% on the week

- Ethereum Classic trading around US$19.22, up +23.1% on the week

- ZCash trading around US$278, up +22.0% on the week

WTF did I miss this week in crypto?

Malta Proposes Test to Define When ICOs Are Securities https://www.coindesk.com/malta-proposes-test-to-define-when-icos-are-securities/

The EU nation of Malta is moving closer to introducing a test that would clearly define when assets derived from initial coin offerings (ICOs) are securities.

Jihan Wu’s Ant Creek LLC Greenlighted for Mining in Walla Walla County https://bitsonline.com/ant-creek-mining/

Economic commissioners in Walla Walla County, a southeastern county in the U.S. state of Washington, have unanimously endorsed a land lease and purchase option for crypto-mining play Ant Creek LLC — governed solely by Jihan Wu, of Bitmain fame — permitting the company to set up a mining operation on a local 10-acre plot.

Barclays Launches Venture Capital Unit To Invest in Smart Contracts and Blockchain Tech https://www.trustnodes.com/2018/04/16/barclays-launches-venture-capital-unit-invest-smart-contracts-blockchain-tech

One of the biggest bank in the world has launched a Venture Capital (VC) unit with a focus on investing in blockchain technology, smart contracts and artificial intelligence. Ben Davey, formerly the head of strategy, is to lead Barclays UK Ventures (BUKV) who said they were to focus on “truly transformational new business lines” with the aim of “material contribution” to the bank’s bottom lines.

Inside the Jordan refugee camp that runs on blockchain. Syrian refugees could regain legal identities that were lost when they fled their homes. https://www.technologyreview.com/s/610806/inside-the-jordan-refugee-camp-that-runs-on-blockchain/

Started in early 2017, Building Blocks helps the World Food Programme (WFP) distribute cash-for-food aid to over 100,000 Syrian refugees in Jordan. By the end of this year, the program will cover all 500,000 refugees in the country. If the project succeeds, it could eventually speed the adoption of blockchain technologies at sister UN agencies and beyond.

The blockchain-based program will do far more than save money. It will tackle a central problem in any humanitarian crisis: how do you get people without government identity documents or a bank account into a financial and legal system where those things are prerequisites to getting a job and living a secure life?

Samsung is bringing crypto and blockchain tech closer to its core business https://qz.com/1253281/samsung-is-testing-blockchain-for-logistics-and-may-be-supplying-halong-mining-with-chips/

Samsung seems keen to put crypto at the core of its operations. Its semiconductor business, the world’s largest, is making chips for cryptocurrency mining. It also plans to use a blockchain to streamline the logistics of its mammoth electronics business. The effort could save the company 20% on shipping costs, according to Samsung’s logistics chief. The project is notable because it would serve Samsung Electronics, the heart of the conglomerate’s business empire. This unit generated $170 billion in revenue last year from consumer electronics, displays, and mobile phones.

Coinbase Acquires Earn.com, Appoints Founder as Its First CTO https://www.financemagnates.com/cryptocurrency/news/coinbase-acquires-earn-com-appoints-founder-first-cto/

Founded in 2013, Earn originally was developing chips and hardware for cryptocurrency mining. The startup had rebranded in 2017 from 21.co with the launch of its eponymous paid messaging platform, which allows senders to pay users in cryptocurrency to reply to emails and complete tasks.

It's the fifth acquisition Coinbase has made to date and the second since poaching LinkedIn's M&A boss Emilie Choi.

Lightning + NFC? The New Plan to Bring Bitcoin to Retail https://www.coindesk.com/lightning-nfc-new-plan-bring-bitcoin-retail/

A new proposal, submitted by developer Igor Cota, looks to standardize a way to connect lightning with NFC. He says, "I want the payments to be instant just like with the contactless cards we have here in Europe. A user would simply tap on the payment terminal and presto!" Further, Cota imagines turning any computer into a lightning point-of-sale terminal through the use of a $29 USB attachment, a route that has proven successful in his early tests.

Cryptos Are “Fast, Inexpensive,” Says Lagarde, They Can “Help Secure Property Rights, Increase Market Confidence and Promote Investment” https://www.trustnodes.com/2018/04/17/cryptos-fast-inexpensive-says-lagarde-can-help-secure-property-rights-increase-market-confidence-promote-investment

Christine Lagarde, head of the International Monetary Fund (IMF), stated yesterday that cryptocurrencies like bitcoin and ethereum “could have a significant impact on how we save, invest and pay our bills.”

Lagarde said that while cryptos have some downsides, they “enable fast and inexpensive financial transactions, while offering some of the convenience of cash.”

She further says blockchain technology can make “financial markets function more efficiently.” While smart contracts might “eliminate the need for some intermediaries.”

The Managing Director of IMF goes so far as to state digital currencies and blockchain technology may “help secure property rights, increase market confidence and promote investment,” in developing countries.

Cambridge Analytica planned to issue digital currency https://www.reuters.com/article/us-cambridge-analytica-cryptocurrency/cambridge-analytica-planned-to-issue-digital-currency-sources-idUSKBN1HO2UX

Apparently Cambridge Analytica was planning an ICO before the Facebook scandal caught fire lol

What Crypto Exchanges Are Saying About NY's New Inquiry https://www.coindesk.com/crypto-exchanges-saying-nys-new-inquiry/

On Tuesday, the office of New York Attorney General Eric Schneiderman launched an inquiry into 13 cryptocurrency exchanges. The exchanges named were Coinbase's GDAX, Gemini, bitFlyer USA, Bitfinex, Bitstamp USA, Kraken, Bittrex, Poloniex, Binance, Tidex.com, Gate.io, itBit and Huobi.Pro.

In a statement, Gemini CEO Tyler Winklevoss said his company "applauds" the Attorney General's inquiry, stating that "we look forward to cooperating with and submitted our responses to the questionnaire." "We continue to embrace thoughtful regulation and collaboration on our mission to help build the future of money," he added.

Kraken had a different response -- lol -- "I realized that we made the wise decision to get the hell out of New York three years ago and that we can dodge this bullet." Kraken announced that it would leave the state in 2015 due to the BitLicense, New York's cryptocurrency regulatory framework. In a blog post at the time, the exchange called the law "a creature so foul, so cruel that not even Kraken possesses the courage or strength to face its nasty, big, pointy teeth."

Huawei Unveils Hyperledger-Powered Blockchain Service Platform https://www.coindesk.com/huawei-unveils-hyperledger-based-blockchain-service-platform/

Telecommunications and smartphone provider Huawei has become the latest tech giant in China to launch a blockchain-as-a-service (BaaS) platform. ... According to the white paper, the BaaS platform currently allows clients to build smart contract applications that focus on supply chain, tokenized securities assets and public services such as ID verification and financial auditing.

'Big bitcoin heist' suspect escapes prison and flees Iceland 'on PM's plane' https://www.theguardian.com/technology/2018/apr/18/big-bitcoin-heist-suspect-sindri-thor-stefansson-escapes-prison-flees-iceland-pm-katrin-jakobsdottir-plane

Who's going to secure the rights to this plot-line for a movie? Crazy story.

Dow Jones Group Teams Up with Brave Software to Test Basic Attention Token https://bitcoinmagazine.com/articles/dow-jones-group-teams-brave-software-test-basic-attention-token/

In a collaborative effort to test the Brave platform and its digital advertising token, the Basic Attention Token (BAT), the Dow Jones Media Group has joined up with the Brave Software team.

On April 18, 2018, the two organizations announced that they will experiment with blockchain technology in the realm of digital advertising and media publication. This entails testing the Brave browser’s digital advertising platform and its native currency, BAT, across the Dow Jones Media Group’s brands, which includes Barron’s, the Wall Street Journal and MarketWatch.

Blockchain Is About to Revolutionize the Shipping Industry https://www.bloomberg.com/news/articles/2018-04-18/drowning-in-a-sea-of-paper-world-s-biggest-ships-seek-a-way-out

Maersk, APL, Hyundai race to build paperless cargo system. Adoption of blockchain could generate $1 trillion in trade.

The Craigslist of Crypto Is Making Millions Where Bitcoin Is Needed Most https://www.coindesk.com/cryptos-craigslist-localbitcoins-making-millions-bitcoin-needed/

$27 million. That's how much revenue LocalBitcoins is now generating annually off a business that started back in 2011, all with an investment of just a few thousand dollars. One of the longest-running and most controversial bitcoin companies, the decidedly low-fi website now has roughly 20 employees worldwide and 4 million registered accounts.

Four Harvard Students Jump Into the Crypto Hedge-Fund Craze https://www.bloomberg.com/news/articles/2018-04-20/four-harvard-students-jump-on-the-crypto-hedge-fund-bandwagon

In the 1970s, Bill Gates and Steve Ballmer revolutionized operating system software. Thirty years later, Mark Zuckerberg helped pioneer social networking. So what’s the latest generation of Harvard tech entrepreneurs up to? Looking to cash in on cryptocurrency, of course. Sign of the times. Bushra Hamid, the 19-year-old daughter of Syrian immigrants, has teamed up with three schoolmates to form Plympton Capital, a hedge fund for investing in digital currencies. Hamid says they aim to launch in six to eight weeks, starting with $1 million. Plympton, named for a street in Cambridge, Massachusetts, has already raised $700,000 from friends and family.

“We don’t necessarily know a lot,” when it comes to the ins and outs of Wall Street, Hamid said, but when it comes to crypto, “they have full trust in us.”

Crimea, Annexed by Russia, Intends to Go Crypto https://bitsonline.com/crimea-crypto-sanctions/

Crimea, a Black Sea peninsular region that was annexed by Russia from Ukraine in 2014, is preparing a development program based on blockchain and crypto in a bid to bypass international sanctions slapped on the territory following the annexation. The development scheme, which is being prepared with the Russian association of cryptocurrencies and blockchain, stipulates the issuance of Crimea’s digital currency that could be used to pay for goods and services, to facilitate ICOs as a funding tool for local companies, to create a local crypto exchange, and more.

AWS Is Making Hyperledger and Ethereum Easier to Use https://www.coindesk.com/aws-making-easier-use-hyperledger-fabric-ethereum/

Amazon Web Services, the e-commerce giant's cloud computing arm, has unveiled a new service for launching out-of-the-box blockchain networks for the ethereum and Hyperledger Fabric protocols. In a blog post published on Wednesday, AWS chief evangelist Jeff Barr wrote that the newly available "templates" allow clients to "launch an ethereum (either public or private) or Hyperledger Fabric (private) network in a matter of minutes and with just a few clicks."

JPMorgan Trial Puts Debt Issuance on a Blockchain https://www.coindesk.com/jpmorgan-trial-puts-debt-issuance-on-a-blockchain/

JPMorgan Chase has partnered with National Bank of Canada and other major firms to trial a blockchain platform aimed to improve the debt issuance process. As reported by Reuters, the investment bank said in a statement Friday that the trial, which took place on Wednesday, mirrored a $150 million offering the same day by the the National Bank of Canada of a one-year floating-rate Yankee certificate of deposit. The trial also saw participation from Goldman Sachs Asset Management, Pfizer, Legg Mason Inc's Western Asset and others. David Furlong, senior vice president of blockchain at National Bank of Canada, said in a statement that blockchain technology "has the potential to bring about major change in the financial services industry."

“Haven’t Heard This Much Excitement About Ethereum Since the iPhone” Says Chris Dixon https://www.trustnodes.com/2018/04/20/havent-heard-much-excitement-ethereum-since-iphone-says-chris-dixon

“Every 10-15 years there’s a major new transition… to me, Ethereum is the most important technology of the decade, for sure. I don’t even think it’s going to be questionable.”

So says Chris Dixon, the 46 year old coder turned entrepreneur turned VC, rising to the point Bloomberg named him the top angel investor in the technology industry.

“I work with developers and entrepreneurs all the time, coming from companies like Google and Facebook and so on. I haven’t heard this much excitement about Ethereum, Solidity and all those things… since probably the iPhone. Just the number of times it’s mentioned, the number of stories I hear…” Dixon says in an interview with Adam Draper of BoostVC.

Pornhub Adds Crypto Payment Option With Verge Token https://www.coindesk.com/pornhub-adds-crypto-payment-option-verge-token/

Finally, I can pay for porn using cryptocurrency!! Wait -- what? Pay for porn? Who does that?

As far as the Verge coin goes, there were hints of a big partnership to be announced, and speculation ran the price up to around US$0.11 per XVG, but the market didn't like the actual announcement when it came, with XVG now trading down around US$0.069. Here's someone's take on what happened:

Pornhub did, however, have a sweet burn aimed at Litecoin founder Charlie Lee, who infamously sold all his LTC at the height of the market:

Quebec Chief Scientist: Bitcoin 'Not A Magnet For Illicit Transactions' https://www.forbes.com/sites/astanley/2018/04/18/quebec-chief-scientist-bitcoin-not-a-magnet-for-illicit-transactions/#1ac9fd8137f5

The Chief Scientist of Canada’s second most populous province says concerns that Bitcoin is being used for illicit activities like money laundering and tax evasion are largely overblown, according to a new post on the agency’s website. “Bitcoin is not above the law, nor is it a magnet for illicit transactions: it forms only a tiny part of the criminal money circulating around the planet,” explains the note, which was prepared by Agence Science-Presse and Fonds de Recherche du Québec - a government research fund - and posted to website of Quebec's Chief Scientist Rémi Quirion.

Coins and tokens and stocks, oh my!

[Note — Net change and % change figures are from the close last Friday to the close today.]

HIVE Blockchain (TSXV:HIVE) — $HIVE — Last at $1.55; Net Change: +$0.15; % Change: +10.7%

Another positive week in the books for crypto and for HIVE, which seems to be trading in tandem with BTC/ETH. Today, in particular, was very encouraging, with HIVE posting its highest volume day since mid-January -- over 7 million shares traded (including ATS) -- and rising $0.17 on the day (+12.3%) to close out the week at $1.55. More in the CryptoTechnician Report below.

Be sure to check out HIVE advisor and Genesis founder, Marco Streng, on Vice News tonight on HBO -- sneak peak available here: https://twitter.com/vicenews/status/986603298307366912

Ethereum Capital (NEO:ETHC) — $ETHC — New listing; Last at $2.40; Net Change: -$0.10; % Change: -4.0% (from pre-trading financing price)

I've been watching for this one to start trading as it has a strong team and had made a couple of waves in the media back when the story was first announced. But in a bit of a strange move, the firm opted to de-list from the TSX-V and launch on the NEO exchange, and even more strangely its "business plan" -- at least initially -- will involve investing the funds raised from its investors in Ethereum. In other words, simply buying and holding ETH "as a strategic asset". Maybe they have grand plans for what to do with that ETH. We shall see. The market has not been impressed, with it trading as low as to $2.00 in its first day of trading (yesterday) -- a $0.50 (-20%) decline from its last financing price of $2.50. It bounced back today, on the strength of the crypto market as a whole, to close out the week at $2.40.

Other crypto/blockchain-related stocks riding the wave:

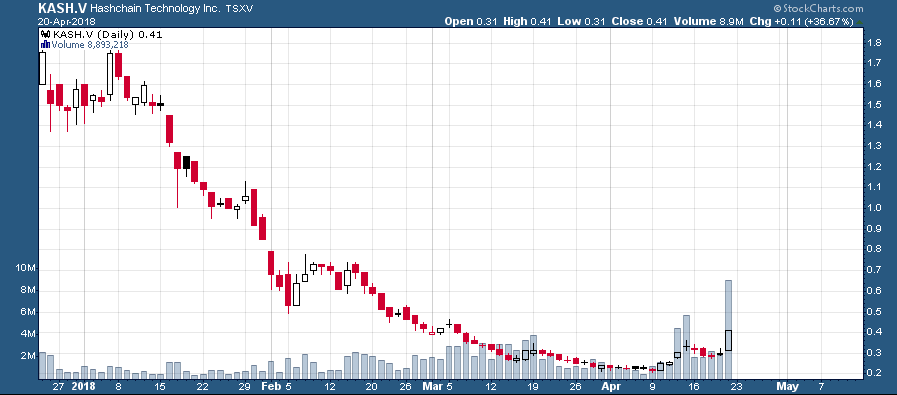

- HashChain Technology (TSXV:KASH) — $KASH — Last at $0.41; Net Change: +$0.075; % Change: +22.4%

- Mogo Finance (TSX:MOGO) — $MOGO — Last at $3.40; Net Change: -$0.12; % Change: -3.4%

- Overstock (NASDAQ:OSTK) — $OSTK — Last at US$36.65; Net Change: -US$0.75; % Change: -2.0%

- Neptune Dash (TSXV:DASH) — $DASH — Last at $0.35; Net Change: +$0.05; % Change: +16.7%

- Riot Blockchain (NASDAQ:RIOT) — $RIOT — Last at US$6.65; Net Change: -US$1.10; % Change: -14.2%

- MGT Capital (OTC:MGTI) — $MGTI — Last at US$1.66; Net Change: +US$0.31; % Change: +23.0%

- Global Blockchain (TSXV:BLOC) — Last at $0.46; $BLOC — Net Change: +$0.05; % Change: +12.2%

- BTL Group (TSXV:BTL) — $BTL — Last at $7.73; Net Change: +$0.08; % Change: +1.0%

- NetCents Technology (CSE:NC) — Last at $2.71; $NC — Net Change: +$0.11; % Change: +4.2% (HALTED MID-DAY TODAY)

- eXeBlock Technology (CSE:XBLK) — Last at $0.255; $XBLK — Net Change: +$0.005; % Change: +2.0%

- BIG Blockchain Intelligence Group (CSE:BIGG) — $BIGG — Last at $0.61; Net Change: +$0.08; % Change: +15.1%

- And a few others that have been getting some attention: 360 Blockchain (CSE:CODE) — $CODE; Atlas Cloud (CSE:AKE) - $AKE; Block One Capital (TSXV:BLOK) - $BLOK; Calyx Bio-Ventures (TSXV:CYX) - $CYX; ePlay Digital (CSE:EPY) - $EPY; LeoNovus (TSXV:LTV) — $LTV; LottoGopher (CSE:LOTO) - $LOTO; HealthSpace Data Systems (CSE:HS); Blocplay Entertainment (CSE:PLAY); Blockchain Power Trust (TSXV:BPWR.UN) - $BPWR-UN; CryptoGlobal (TSXV:CPTO) - $CPTO; DMG Blockchain Solutions (TSXV:DMGI) - $DMGI; Hut 8 (TSXV:HUT) $HUT; Netcoins (CSE:NETC) - $NETC; Datametrex (TSXV:DM) - $DM

Follow @Evenprime’s crypto watchlist should you wish to track the now dozens of names apparently in the crypto/blockchain game.

The CryptoTechnician Report

A HUGE week for cryptocurrencies with total crypto market capitalization rising from US$310 billion last Friday to nearly US$380 billion as I write these words. Bitcoin has vaulted back above the $8,500 level, however, crypto investors should fully expect the $9,200 area to offer stiff resistance.

With this week's rally, Ethereum has come within a whisker of $600 again and as I pointed out earlier in the week Ether has a shot of rallying above $700 on this move.

There is an important area of potential resistance between $600 and $625 which could slow down the #2 crypto's advance over the weekend:

$575 followed by $535 should offer support in the event of a pullback.

The green shoots in crypto stocks that we have been talking about for more than two weeks came into full bloom today with some large advances from some of the more notable crypto stocks, such as KASH.V (+36.67%), DASH.V (+18.64%), and HIVE.V (+12.32%).

KASH traded record daily volume during Friday's session, the next level of potential resistance is C$.50. Above C$.50 the open gap up at C$.85 could come into focus:

HIVE, the largest crypto stock in Canada by market capitalization, traded more than 5 million shares during Friday's session and posted its highest daily close since early March:

The April 10th low at C$1.07 has the makings of a major long term bottom as evidenced by the bullish momentum and volume divergences that occurred along with that low in price. The early April decline in HIVE shares has the makings of a market that was "all sold-out" -- i.e. price made fresh lows on light volume simply due to a lack of buyers, not due to aggressive selling.

Upside levels of interest in HIVE are up at C$1.80 followed by C$2.00. HIVE investors aren't out of the woods yet by any means but there are strong signs that the worst may be behind us.

As always happens in markets, the upside price action in the crypto sector during the last couple of weeks has tremendously improved sentiment in the sector. We will have to see if a test of the $9,200 level in Bitcoin will coincide with a sudden re-emergence of interest in the crypto sector. Such a combination of events would likely mark a short/medium term top in the sector.

Funny things we saw this week

What is Ethereum? As explained by a porn star:

Dumb question

German bitcoin rap: "Hodln"

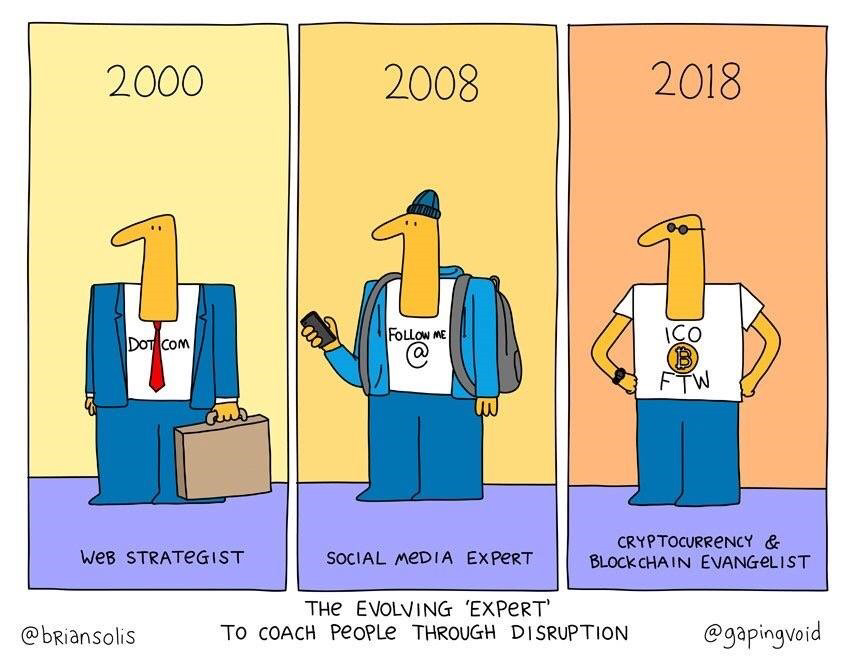

Experts...

Bitcoin Hodlers vs FIAT holders

————————

DISCLAIMER — PLEASE READ CAREFULLY

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

The authors are online financial newsletter writers. They are focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, the authors are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Crypto Wars, especially if the investment involves a small, thinly-traded company that isn't well known or a crypto asset like Bitcoin or Ethereum.

Past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in this newsletter or on this website.

In many cases, the authors, and/or site owner/operator Tommy Humphreys, owns shares in the companies featured. For those reasons, please be aware that the authors can be considered extremely biased in regards to the companies written about and featured in Crypto Wars. Because of this, there is an inherent conflict of interest involved that may influence our perspective on these companies. This is why you should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. We may purchase more shares of any featured company for the purpose of selling them for our own profit and will buy or sell at any time without notice to anyone, including readers of this newsletter.

None of the authors, Tommy Humphreys, or Pacific Website Company Incorporated (dba CEO.CA) shall be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks or crypto assets, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

We do not undertake any obligation to publicly update or revise any statements made in this newsletter.