Your dose of crypto news and analysis from @BTO and @Goldfinger

Sorry for that horrible mental image painted by this week's headline, which comes from the mouth of none other than Buffett sidekick, Charlie Munger. In the wake of Berkshire Hathaway's annual investor shindig, Munger was quoted in an interview as saying, “The computer science behind bitcoin is a great triumph of the human mind... They created a product that’s hard to create more of but not impossible. [But] I see an artificial speculative medium,” in which people can sell it to someone else at a higher value with no intrinsic value behind it. It’s “anti-social, stupid and immoral,” he said.

When asked to elaborate on the "immoral" point, he continued unabashed: “Suppose you could make a lot of money trading freshly harvested baby brains. Would you do it? To me bitcoin is almost as bad.” Wow! That's harsh, man.

And then we had Buffett himself with this one:

Actually, I think he in fact called bitcoin "rat poison squared", which I suppose is exponentially worse than your run-of-the-mill rat poison...

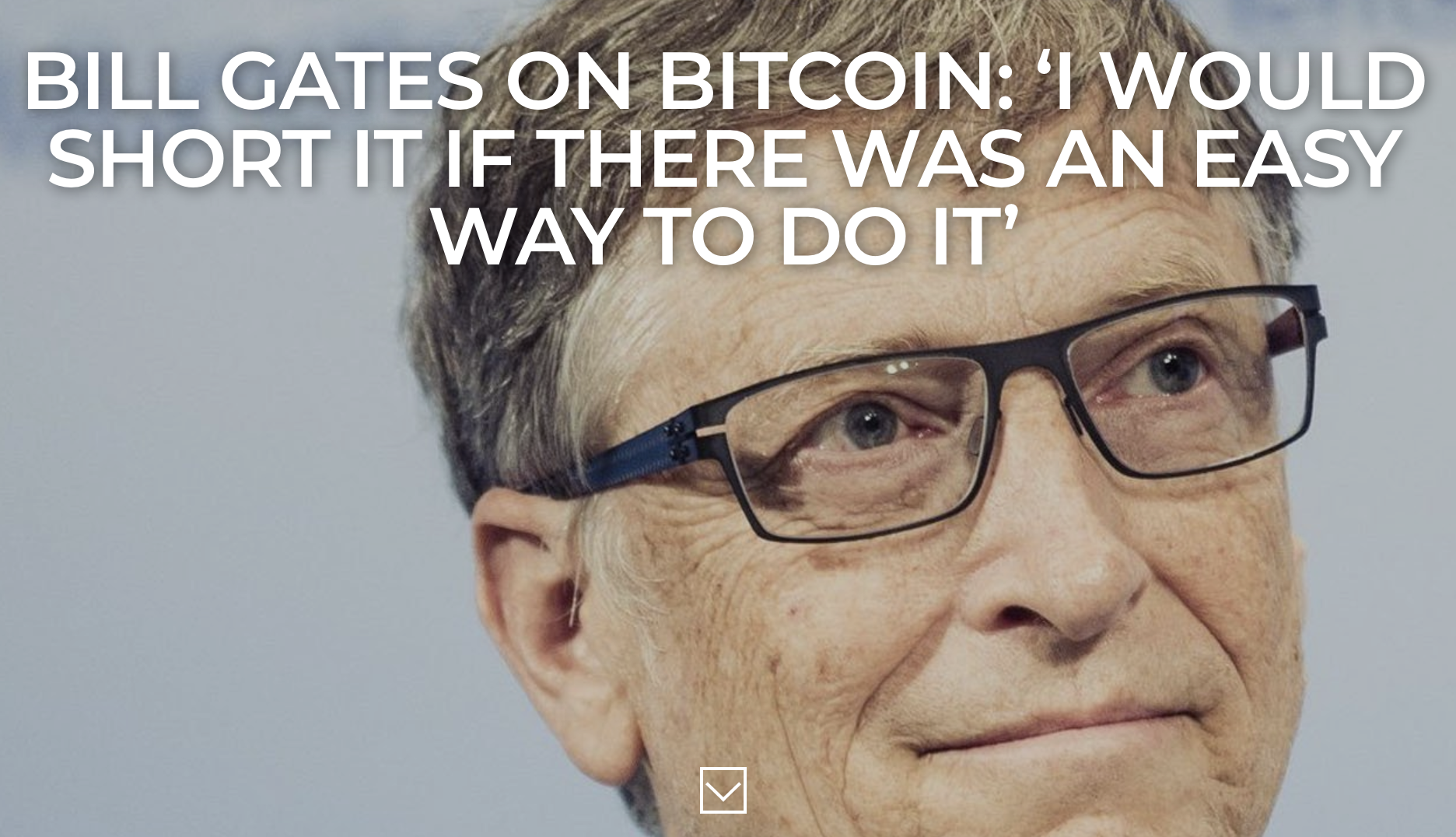

And last, but not least, we had $BRK director Bill Gates (at least all three are aligned in their crypto disdain):

And with that, the Three Musketeers left a path of crypto destruction:

The words of these influential gentleman, plus the following widely-distributed stories yesterday / this morning...

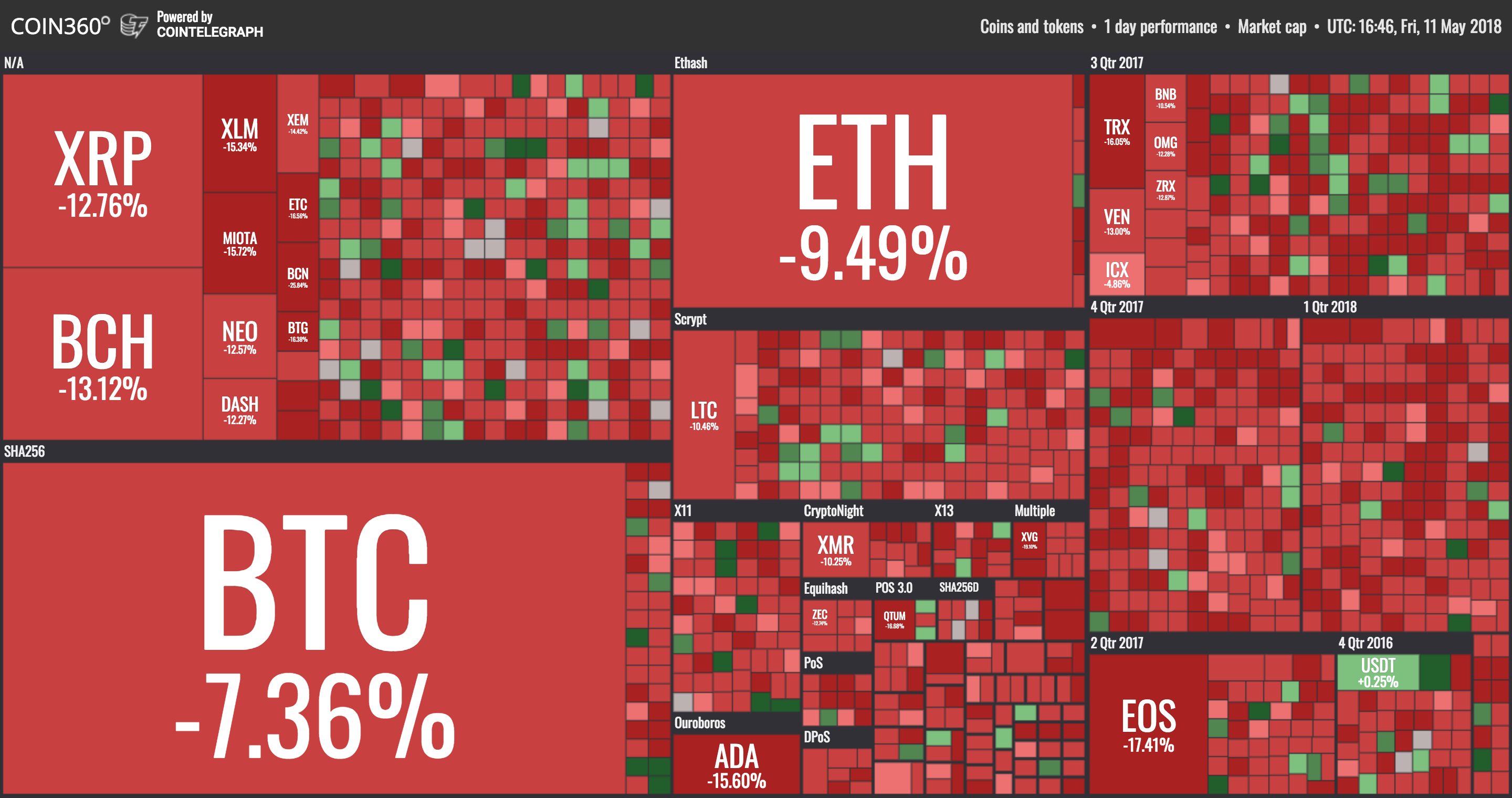

... left the crypto world in a state of panic today:

It's all just temporary FUD in my books, but can't blame folks for panicking. FUD can be scary!!

Don't worry, all will be well again in cryptoland when we get the Consensus bump next week. at least so says Tom Lee:

Yes, perma-bull Lee (who has actually been right about a lot of things -- remember the post-Tax Day bump?) says, “We expect the Consensus rally to be even larger than past years." The event may draw more than 7,000 people, a surge from roughly 2,750 a year ago, Lee said. Last time, when new attendance doubled, Bitcoin rose 69% during the conference and 138% in the two months afterward, he said.

Bottom line: big boom next week. It's simple science guys...

And -- with all due respect -- forget what the old guys are saying about crypto anyway. Listen to guys like Chamath Palihapitiya instead, who is a Warren Buffett 'disciple' but says he's dead wrong about Bitcoin:

Let's see how some of the major cryptos fared just looking at this past week (close UTC time last Friday to today):

- Bitcoin trading around US$8,620, down -11.1% on the week

- Ethereum trading around US$690, down -12.2% on the week

- Bitcoin Cash trading around US$1,395, down -8.1% on the week

- Litecoin trading around US$139, down -17.4% on the week

- Stellar trading around US$0.33, down -24.3% on the week

- Dash trading around US$400, down -17.6% on the week

- Monero trading around US$206, down -14.7% on the week

- Ethereum Classic trading around US$18.41, down -17.8% on the week

- ZCash trading around US$245, down -17.4% on the week

WTF did I miss this week in crypto?

Ripple Hit With Class-Action Suit Over ‘Never Ending ICO’ https://www.bloomberg.com/news/articles/2018-05-04/ripple-hit-with-class-action-suit-over-never-ending-ico

Ripple Labs Inc., the fintech startup that controls the world’s third-largest cryptocurrency, was hit by a lawsuit alleging that it led a scheme to raise hundreds of millions of dollars through unregistered sales of its XRP tokens. The San Francisco-based company created billions of coins “out of thin air” and then profited by selling them to the public in “what is essentially a never-ending initial coin offering,” the class-action complaint filed Thursday in the Superior Court of California said. Ripple violated state and federal laws by offering unregistered securities to retail investors, the filing said.

More specifically, Plaintiff Ryan Coffey is suing Ripple Labs (“individually and on behalf of all others similarly situated”) and its CEO Brad Garlinghouse. He argues that because people 1) paid money to obtain tokens, 2) “reasonably expected” to profit from this ownership (based on the promotional effort of the Ripple team), and 3) this profit was conditional on the management decisions of the Ripple team, XRP tokens “have all the traditional hallmarks of a security.”

NBA Superstar Steph Curry Is Now the First Celebrity CryptoKitty https://www.coindesk.com/nba-superstar-steph-curry-now-first-celebrity-cryptokitty/

Curry will be launching the first-ever celebrity-branded CryptoKitty, said Caty Tedman, head of partnerships for the startup behind the tokenized digital cats. The move is part of an effort to expand the collectibles app by adding branded tokens, which may extend beyond celebrities and include other popular icons. "We are launching a series of Steph Curry CryptoKitties, so there will be three exclusive Steph Curry CryptoKitties [which] will be representative of his personalities," she told CoinDesk. "The first will be sold by him, and it'll be up to him whether he wants to sell the other two."

Korea to Relax Cryptocurrency Curbs Under New FSS Chief https://www.ccn.com/korea-to-relax-cryptocurrency-curbs-under-new-fss-chief/

The incoming head of Korea’s primary financial regulator has reportedly confirmed that the authority will look to ease regulations on domestic cryptocurrency trading. Speaking to reporters on Sunday after being approved by President Moon Jae-in to lead the Financial Supervisory Service (FSS), new governor Yoon Suk-heun said the regulator will look at revising some regulations applied to the cryptocurrency market, The Korea Times reports.

Following this, it was reported that South Korea's ban on initial coin offerings (ICOs) could be eased in the coming months. An anonymous source told the Korea Times newspaper: "The financial authorities have been talking to the country's tax agency, justice ministry, and other relevant government offices about a plan to allow ICOs in Korea when certain conditions are met."

Crypto Pioneers Head to Brooklyn to Reshape Finance https://www.bloomberg.com/news/articles/2018-05-07/-cryptolandia-blockchain-pioneers-take-root-in-hipster-brooklyn

The building looks abandoned, but inside the graffiti-covered door, 200 workers tap at laptops with the goal of reshaping the world. The employees of ConsenSys Inc., the blockchain startup co-created by Ethereum guru Joseph Lubin, have taken over the space at 49 Bogart St. in the Bushwick neighborhood of Brooklyn, New York. Inside its brick walls, they hope to develop new technology to decentralize and democratize a host of things, including the way we record real estate deals, track art ownership and pay people for work. Outside the walls, they’ve helped transform the neighborhood in a way that’s reminiscent of precincts in London, San Francisco and Hong Kong.

Bitcoin Sees Wall Street Warm to Trading Virtual Currency https://www.nytimes.com/2018/05/07/technology/bitcoin-new-york-stock-exchange.html

The parent company of the New York Stock Exchange has been working on an online trading platform that would allow large investors to buy and hold Bitcoin, according to emails and documents viewed by The New York Times and four people briefed on the effort who asked to remain anonymous because the plans were still confidential. The platform would entail the trading of actual Bitcoin, not futures, which would be a first for a traditional player like NYSE.

ZCash Foundation to Make ASIC Resistance ‘Immediate Technical Priority’ https://www.ccn.com/zcash-foundation-to-make-asic-resistance-immediate-technical-priority/

The Zcash Foundation has announced that it will make maintaining ASIC resistance an “immediate technical priority” in response to Chinese mining hardware manufacturer Bitmain’s claim that is has developed an application-specific integrated circuit (ASIC) miner that is compatible with the Equihash mining algorithm.

In a statement penned by executive director Josh Cincinnati, the Zcash Foundation said that it will immediately begin devoting resources to investigating the “presence and power of ASICs on the Zcash network,” as well as convene a technical advisory board to provide “scientifically grounded inputs” on the matter.

United Nations Expanding Blockchain Use to Help Syrian Refugees https://bitsonline.com/united-nations-blockchain-refugees/

Since the year 2017, a project from the United Nations World Food Programme associated with the Ethereum blockchain called “Building Blocks” has been helping provide aid to Syrian refugees. As of January 2018, through a cash-for-food blockchain-based system, Building Blocks has provided aid to over 100,000 refugees who reside in refugee camps. Given the success of that project, The World Food Programme has plans to expand it to 500,000 Syrian refugees by the year 2019.

SEC Commissioner Cautions Against 'Blanket' ICO Classification https://www.coindesk.com/sec-commissioner-cautions-blanket-ico-classification/

Commissioner Hester Peirce told the audience at the Medici Conference last week: "My fear that regulators will grab hold of the shovels and buckets is why I am often wary of so-called regulatory sandboxes. I am entirely in favor of finding ways to make appropriate regulatory allowances that clear the way for innovation to flourish. What troubles me about sandboxes, however, is that the regulator is typically sitting there next to the entrepreneurs."

Peirce went on to argue in her ICO-focused speech that "open communication" between regulators and those they regulate is possible without a sandbox, and instead advocated for a "lifeguard" approach in which the regulator "watches over what is happening, but she is not sitting with sandcastle builders monitoring their every design decision."

The Wealthy Are Hoarding $10 Billion of Bitcoin in Bunkers https://www.bloomberg.com/news/articles/2018-05-09/bunkers-for-the-wealthy-are-said-to-hoard-10-billion-of-bitcoin

Argentine entrepreneur Wences Casares has spent the past several years persuading Silicon Valley millionaires and billionaires that Bitcoin is the global currency of the future, that they need to buy some, and that he’s the man to safeguard it. His startup, Xapo, has built a network of underground vaults on five continents, including one in a decommissioned Swiss military bunker. 360 video:

Bloomberg, Billionaire Bull Novogratz Partner to Launch Cryptocurrency Price Index https://www.ccn.com/bloomberg-inks-deal-with-novogratz-founded-galaxy-digital-to-launch-cryptocurrency-price-index/

Billionaire Mike Novogratz and Bloomberg LP on Wednesday announced that they are teaming up to launch the Bloomberg Galaxy Crypto Index (BGCI), which will track the aggregate performance of a basket of large-cap cryptocurrencies. “Today’s launch of the Bloomberg Galaxy Crypto Index reflects our clients’ growing interest in cryptocurrencies,” said Alan Campbell, Global Product Manager for Bloomberg Indices. “The index brings our rigorous approach to index construction to cryptos and will provide investors with a transparent benchmark to gauge the performance of the broader market.”

Sticking with Novo, he was also quoted this week as saying every investor should buy crypto. "It's almost essential for every investor to have at least 1% to 2% of their portfolio" in crypto, said Novogratz on CNN. It's "almost irresponsible" not to invest in Bitcoin, he added.

Bitmain’s Biggest Bitcoin Mining Rival Plots $1 Billion Hong Kong IPO https://www.ccn.com/bitmains-biggest-bitcoin-mining-rival-plots-1-billion-hong-kong-ipo/

Canaan Creative, China’s second-largest bitcoin mining hardware manufacturer, plans to raise $1 billion through an initial public offering (IPO) on the Hong Kong Stock Exchange (SEHK). The South China Morning Post reported on Wednesday that the Hangzhou-based firm will be the first blockchain startup to list on the SEHK, though sources also say that a final decision has not yet been made.

Japan's Bitcoin King Poaches Wall Street Talent for Crypto Empire https://www.bloomberg.com/news/articles/2018-05-09/ex-goldman-trader-hires-former-rivals-to-build-a-crypto-empire

The Goldman Sachs Group Inc. alumnus, who turned bitFlyer Inc. into Japan’s largest Bitcoin exchange, is scooping up traders and bankers from both his old employer and former rivals as he embarks on an ambitious international expansion. Kano’s team, which includes a former fixed-income desk head at Barclays Plc and an ex-senior private banker at Credit Suisse Group AG, has doubled to more than 150 people in the past six months and is on pace to top 300 before year-end.

$363 Million: Robinhood Raises Big to Build 'Largest Crypto Platform' https://www.coindesk.com/363-million-robinhood-raises-big-to-build-largest-crypto-platform/

U.S.-based mobile stock trading app Robinhood has announced a $363 million series D funding round that it says will allow the firm to expand its cryptocurrency trading service nationwide by end of 2018. According to a statement published on Thursday, the funding round values the firm at $5.6 billion and was led by DST Global, with Iconiq, Capital G, Sequoia Capital and KPCB also participating.

This Crypto Vending Machine Can Tell If You're 21 And Sell You Beer https://www.coindesk.com/the-worlds-first-crypto-beer-vending-machine-has-arrived/

Civic will unveil the world's first "crypto beer vending machine" at CoinDesk's Consensus 2018 next week. No gimmick, Civic sees the prototype, built and branded in partnership with beverage giant Anheuser-Busch, as a way to demonstrate the utility of blockchain-based identity verification schemes. In short, any conference attendee will be able to walk up to the machine with their Civic app, where they can verify whether they are of legal age and make a purchase.

Facebook May Issue Its Own Cryptocurrency: Report https://www.ccn.com/facebook-may-issue-its-own-cryptocurrency-report/

Citing anonymous sources familiar with the matter, senior Cheddar reporter Alex Heath said that Facebook is holding serious, high-level discussions about directing the focus of its blockchain research team toward releasing its own cryptocurrency. Heath says: “Sources say that Facebook is specifically interested in creating its own digital token, which would allow its more than two billion users to facilitate transactions without government-backed currency. Facebook is also looking at other ways that it could use this core blockchain technology that underpins these popular cryptocurrencies like bitcoin and ethereum." He added that the company is also evaluating how it can use blockchain technology to improve identity verification and secure its backend infrastructure — perhaps even including how it manages customer data.

Bank of Canada, TMX say blockchain feasible for securities settlement https://www.reuters.com/article/us-canada-tech-blockchain/bank-of-canada-tmx-say-blockchain-feasible-for-securities-settlement-idUSKBN1IC18G

Canada’s central bank, Toronto Stock Exchange operator TMX Group, and non-profit organization Payments Canada said today that tests had shown blockchain technology can be used for automating instantaneous securities settlements. The three organizations said that they had developed an integrated securities and payment settlement platform using a distributed ledger, the same technology that underpins cryptocurrencies like bitcoin, and found that cash and assets can be tokenized to complete an instant settlement.

Huawei to Offer BTC.com Bitcoin Wallet in App Store https://www.bloomberg.com/news/articles/2018-05-10/huawei-is-about-to-give-chinese-users-easier-access-to-bitcoin

Users of Huawei’s mobile phones will be able to download Bitcoin wallets on their devices for the first time starting today. Huawei, the world’s third-biggest handset maker, is releasing BTC.com’s Bitcoin wallet in its AppGallery, according to an e-mail statement by the company. The BTC.com wallet will be the first cryptocurrency app offered by Shenzhen-based Huawei. The AppGallery will be pre-installed on all new Huawei and Honor phones and will be rolled out to older devices in the coming months.

BTC.com, which also controls the world’s largest Bitcoin mining pool, is owned by mining hardware manufacturer Bitmain Technologies. As reported a while back, Huawei is considering developing a mobile phone targeting blockchain-based applications.

CNBC: Venture Capitalist Tim Draper: Bitcoin Is The Most Secure Place To Put Your Money

Ledger Nano S featured in hit TV show, Billions

Coins and tokens and stocks, oh my!

[Note — Net change and % change figures are from the close last Friday to the close today .]

HIVE Blockchain (TSXV:HIVE) — $HIVE — Last at $1.30; Net Change: -$0.19; % Change: -12.8%

Not much to report this week re: HIVE or other pubco crypto/blockchain plays, other than that those which have been trading more-or-less alongside cryptos themselves (like HIVE) saw sharp declines on the week. Upcoming events to look forward to on the HIVE front include the next set of quarterly financials, and the opening of the company's first Bitcoin mine in September.

In the meantime, check out Chairman Frank Holmes' article on Business Insider: Bitcoin could replace cash in 10 years http://www.businessinsider.com/bitcoin-might-replace-cash-10-years-2018-5 -- and his latest interview on The Northern Miner Podcast – episode 104: Frank Holmes on gold, the global economy and cryptocurrencies http://www.northernminer.com/news/the-northern-miner-podcast-episode-104-frank-holmes-on-gold-the-global-economy-and-cryptocurrencies/1003796067/

And, hot off the presses, Kitco just put out a video of their recent site visit to one of HIVE's mines -- very cool to see:

Other crypto/blockchain-related stocks riding the wave:

- HashChain Technology (TSXV:KASH) — $KASH — Last at $0.245; Net Change: -$0.07; % Change: -22.2%

- Mogo Finance (TSX:MOGO) — $MOGO — Last at $3.52; Net Change: +$0.09; % Change: +2.6%

- Overstock (NASDAQ:OSTK) — $OSTK — Last at US$36.55; Net Change: -US$1.10; % Change: -2.9%

- Riot Blockchain (NASDAQ:RIOT) — $RIOT — Last at US$7.38; Net Change: -US$0.18; % Change: -2.4%

- Neptune Dash (TSXV:DASH) — $DASH — Last at $0.315; Net Change: -$0.07; % Change: -18.2%

- Ethereum Capital (NEO:ETHC) — $ETHC — Last at $2.11; Net Change: -$0.29; % Change: -12.1%

- MGT Capital (OTC:MGTI) — $MGTI — Last at US$1.30; Net Change: -US$0.40; % Change: -23.5%

- Global Blockchain (CSE:BLOC) — Last at $0.41; $BLOC — Net Change: -$0.10; % Change: -19.6%

- BTL Group (TSXV:BTL) — $BTL — Last at $6.35; Net Change: -$0.39; % Change: -5.8%

- NetCents Technology (CSE:NC) — Last at $2.71; $NC — Net Change: $0.00; % Change: 0.0% (HALTED ALL WEEK)

- eXeBlock Technology (CSE:XBLK) — Last at $0.225; $XBLK — Net Change: +$0.008; % Change: +3.4%

- BIG Blockchain Intelligence Group (CSE:BIGG) — $BIGG — Last at $0.370; Net Change: -$0.035; % Change: -8.6%

- And a few others that have been getting some attention: 360 Blockchain (CSE:CODE) — $CODE; Atlas Cloud (CSE:AKE) - $AKE; Block One Capital (TSXV:BLOK) - $BLOK; Calyx Bio-Ventures (TSXV:CYX) - $CYX; ePlay Digital (CSE:EPY) - $EPY; LeoNovus (TSXV:LTV) — $LTV; LottoGopher (CSE:LOTO) - $LOTO; HealthSpace Data Systems (CSE:HS); Blocplay Entertainment (CSE:PLAY); Blockchain Power Trust (TSXV:BPWR.UN) - $BPWR-UN; CryptoGlobal (TSXV:CPTO) - $CPTO; DMG Blockchain Solutions (TSXV:DMGI) - $DMGI; Hut 8 (TSXV:HUT) $HUT; Netcoins (CSE:NETC) - $NETC; Datametrex (TSXV:DM) - $DM

Follow @Evenprime’s crypto watchlist should you wish to track the now dozens of names apparently in the crypto/blockchain game.

The CryptoTechnician Report

This week, the 'green shoots' we have been pointing out in the crypto sector for the last month began to wilt. The proximate cause of this week's downward price action was likely an interview in which two of the most successful investors in history (Charlie Munger and Warren Buffett) had nothing good to say about Bitcoin and its crypto brethren -- https://www.cnbc.com/video/2018/05/07/munger-bitcoin-is-worthless-artificial-gold.html. Whether Munger and Buffett's comments have any rooting in reality is still to be decided, but these men can move markets and affect investor sentiment, which they definitely did this week in the cryptocurrency sector.

In fairness, Bitcoin was already starting to roll over after running into stiff resistance near $10,000. Buffett and Munger's comments may have simply served to accelerate a technical move that was already underway.

A head & shoulders top pattern had its neckline breached overnight and this pattern has a downside target of $7,800-$8,000:

On the daily time frame, a test of important support near $7,800 would actually be quite healthy. Such a decline would also help to reset investor sentiment on the crypto sector after it began to get a bit euphoric again last week.

I conducted a Twitter poll on Wednesday, after writing this post about the technical setup in Monero -- http://321ethereum.com/why-monero-could-be-headed-for-all-time-highs-this-summer/. I asked the question "Will Monero (XMR) fall below $160 or rise above $300 first?" and I was slightly surprised that 56% of poll respondents said that Monero will rise above $300 first.

Considering that Monero has been in a downtrend for the last couple of weeks I was surprised that the poll respondents were still fairly optimistic.

I think we are likely to see another 1-2 weeks of sideways-to-lower price action in cryptos before the next rally begins. With Monero this will likely mean a test of MAJOR support at $160 before 50%+ rally up to the mid-$200s:

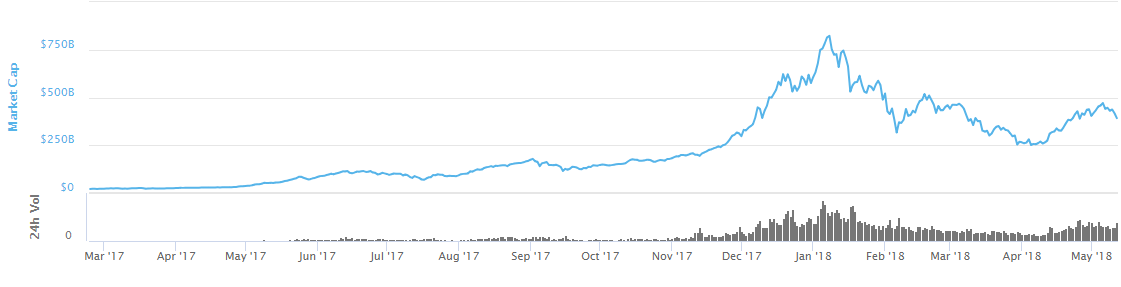

Finally, total crypto market cap peaked at $US470 billion on Saturday May 6th, the US$460-$470 billion market cap area has clearly proven to be resistance. A 50% retrace of the April/May crypto rally would bring total market capitalization back down near US$360 billion - I believe such a scenario is quite likely over the next 1-2 weeks:

One more thing... There has been some commentary this week about a so called "Death Cross" (when the 50-day moving average crosses below the 200-day moving average on a closing basis) in Bitcoin - this belongs firmly in the "ignore" category. As pointed out by @SentimenTrader on Twitter, there have been 4 death crosses in Bitcoin's history and after 3 out of 4 of these death crosses Bitcoin rallied significantly:

A death cross in itself is not a reason to short any market, and as we have seen on many occasions in the S&P 500, it can in fact be a great time to be a buyer if one has a long enough time frame.

Funny things we saw this week

MUST WATCH: Pied Piper's Bertram Gilfoyle talks (rants) to Bloomberg's @EmilyChangTV about the company's recent ICO and his opinion of banks, paper money and VCs (he's not a fan).

And here he is on the show giving his PPT presentation -- LOL:

The website that Silicon Valley show creators set up for Pied Piper is pretty fun to read as well: http://www.piedpiper.com/ -- and Gilfoyle's complete deck can be downloaded on the site here: http://www.piedpiper.com/app/themes/pied-piper/dist/images/Cryptocurrency_Presentation.pdf

Astrology...

Ever played "banking"?

Tony Stark uses Bitcoin

————————

DISCLAIMER — PLEASE READ CAREFULLY

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

The authors are online financial newsletter writers. They are focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, the authors are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Crypto Wars, especially if the investment involves a small, thinly-traded company that isn't well known or a crypto asset like Bitcoin or Ethereum.

Past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in this newsletter or on this website.

In many cases, the authors, and/or site owner/operator Tommy Humphreys, owns shares in the companies featured. For those reasons, please be aware that the authors can be considered extremely biased in regards to the companies written about and featured in Crypto Wars. Because of this, there is an inherent conflict of interest involved that may influence our perspective on these companies. This is why you should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. We may purchase more shares of any featured company for the purpose of selling them for our own profit and will buy or sell at any time without notice to anyone, including readers of this newsletter.

None of the authors, Tommy Humphreys, or Pacific Website Company Incorporated (dba CEO.CA) shall be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks or crypto assets, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

We do not undertake any obligation to publicly update or revise any statements made in this newsletter.