Your dose of crypto news and analysis from @BTO and @Goldfinger

The media’s assault on crypto continued this week, with Bloomberg reporting that the U.S. Commodity Futures Trading Commission (CFTC) sent subpoenas to Bitfinex and Tether last week. With the exchange (Bitfinex) and US Dollar-pegged token issuer (Tether) having been in the media quite a bit this month already (due to a break-down in their relationship with auditor Friedman LLP), the news that U.S. regulators are now looking into their affairs — which some claim involve fraudulent crypto market manipulation (see @Bitfinexed) — sent shockwaves through the cryptosphere. That is, until we learned that Bloomberg had made an error in its initial reporting. In fact, the subpoenas were sent nearly two months ago — on Dec. 6, 2017...

And then yesterday, while presenting India’s 2018-19 budget, Finance Minister Arun Jaitley signalled a crackdown on cryptocurrency usage. Some outlets — unsurprisingly — did not report the full story.

In reality, Jaitley’s remarks are primarily a rehash of what we already knew of the government’s stance on cryptocurrencies. He made no mention of an explicit ban on Bitcoin or any other cryptocurrency, but rather a clampdown on the use of cryptocurrencies “in financing illegitimate activities or as part of the payment system”. In other words, no suggestion of any ban on cryptocurrency exchanges or cryptocurrencies outright.

Notwithstanding this, the correction (plunge) continued overnight and into this morning, with Bitcoin dipping its toes below the US$8,000 mark, and the overall market cap of cryptos going south of US$350 billion, leading bitcoiners to ask themselves questions like:

But then — a glimmer of hope:

And then a bit of a rally back up to US$8,600 BTC and US$410 billion crypto market cap — where we are at the time of writing.

So, is the glass half-empty or half-full for you? Is the crypto market down 40% from its all-time high, or is it up 2x over 3 months?

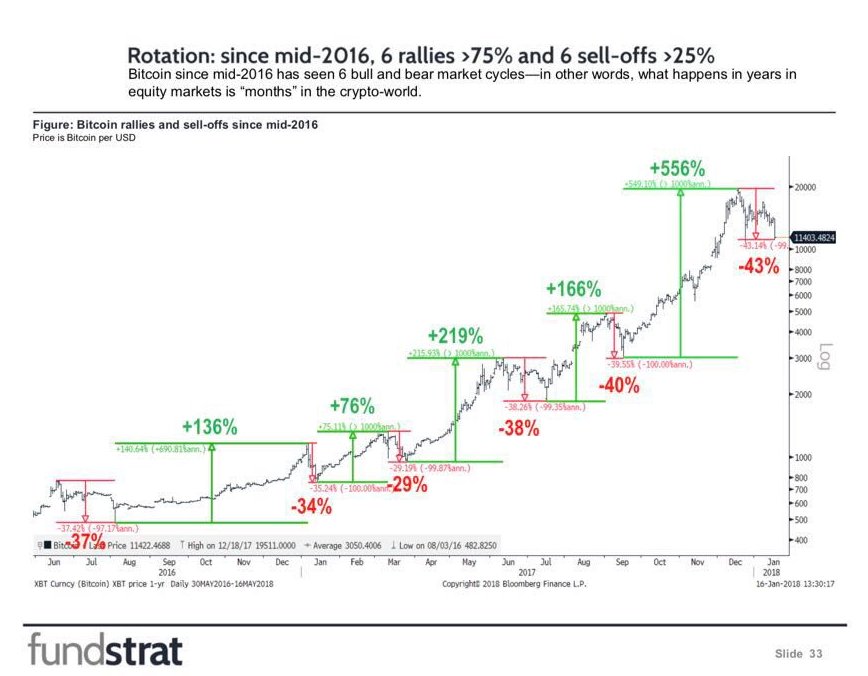

I know which side I'm on. With catalysts like Lightning Network to come soon, I predict 2018 will be another breakout year for crypto. Just today, Lightning Network reached 1,000 mainnet payment channels... Plus, history has a way of repeating itself in crypto, and quite rapidly:

Let’s take a look at the performance (or should I say, lack thereof) of some of the major cryptos this week (close UTC time last Friday to today):

- Bitcoin trading around US$8,600, down 23% on the week

- Ethereum trading around US$885, down 16% on the week

- Bitcoin Cash trading around US$1,160, down 28% on the week

- Stellar trading around US$0.39, down 39% on the week

- Litecoin trading around US$126, down 28% on the week

- Dash trading around US$560, down 28% on the week

- Monero trading around US$231, down 29% on the week

- Ethereum Classic trading around US$22, down 24% on the week

- ZCash trading around US$366, down 20% on the week

WTF did I miss this week in crypto?

South Korea’s Largest E-Commerce Platform is Integrating 12 Cryptocurrencies Including Bitcoin — https://www.ccn.com/south-koreas-largest-e-commerce-platform-integrating-12-cryptocurrencies-including-bitcoin/

WeMakePrice, better known as Wemepu, one of South Korea’s largest e-commerce platforms, is integrating 12 cryptocurrencies including Bitcoin, Ethereum, and Litecoin in collaboration with Bithumb, the country’s largest cryptocurrency exchange.

Bitcoin Accepted! Japanese Electronics Retail Giant Begins Crypto Payments — https://www.ccn.com/bitcoin-accepted-japanese-electronics-retail-giant-begins-crypto-payments/

In similar news to the above story, Yamada Denki, one of the largest consumer electronics retail chains in Japan, has launched Bitcoin payments at two Tokyo-based stores before a planned nationwide rollout in all its stores. The retailer threw its support for Bitcoin adoption among consumers, stating: “In addition to diversifying means, we will implement initiatives to improve bitcoin recognition and usage promotion. With the introduction of bitcoin payment service, we respond to the diverse needs of our customers both in Japan and overseas.”

World Famous Brothel Bunny Ranch Considers Accepting Bitcoin — https://www.ccn.com/world-famous-bunny-ranch-brothel-considers-accepting-cryptocurrency/

The Nevada-based Bunny Ranch, one of the most popular and famour brothels in the world, is considering accepting Bitcoin payments according to owner Dennis Hof. Hof, who owns seven brothels in Nevada, said he is exploring Bitcoin in response to requests from his customers, who he said include some of the world’s wealthiest men.

Coincheck Hack May Lead to On-Site Inspections of Other Japanese Exchanges — https://www.ccn.com/coincheck-hack-may-lead-to-on-site-inspections-of-other-japanese-exchanges/

In the wake of the US$500 million Coincheck hack, Japan’s Financial Services Agency (FSA) said that it may conduct on-site inspections of other domestic cryptocurrency exchanges in response to last week’s Coincheck hack.

Samsung confirms it is making ASIC chips for cryptocurrency mining — https://techcrunch.com/2018/01/31/samsung-confirms-asic-chips/

“Samsung’s foundry business is currently engaged in the manufacturing of cryptocurrency mining chips. However we are unable to disclose further details regarding our customers,” a company spokesperson told TechCrunch. The statement follows reports in Korea media which claimed that the tech giant had made the move in collaboration with an unnamed Chinese distribution partner. Samsung already produces high-capacity memory chips for GPUs, which are conventionally used to handle graphics on computers but are also deployed for mining purposes.

Fundstrat’s Tom Lee: “Great Crypto Rotation” Coming in 2018 — https://bitsonline.com/tom-lee-crypto-rotation/

Wall Street’s resident cryptocurrency bull Tom Lee predicts there will be very pronounced cyclical rotations between “small cap” and “big cap” projects over the next 12 months. He said, “There’s just a lot more potential, right? […] In some ways, if we look at NEO and its development, it looks a lot like Ethereum did at the start of 2017. So there’s a lot of potential for NEO, the NEOs and even EOSs, to do quite well. I actually think the easiest use case for cryptocurrencies actually is store of value today, which is bitcoin, but I think that financial corridors are obviously very obvious use case, and I think that’s what these tokens are addressing.”

Facebook bans ads promoting cryptocurrencies, ICOs — https://www.facebook.com/business/news/new-ads-policy-improving-integrity-and-security-of-financial-product-and-services-ads

Citing core advertising principles that “ads should be safe” and that “we build for people first”, Facebook announced a new policy this week to “prohibit ads that promote financial products and services that are frequently associated with misleading or deceptive promotional practices, such as binary options, initial coin offerings and cryptocurrency”. More on this here.

Japan’s biggest chat app is launching a cryptocurrency exchange — https://qz.com/1193770/japanese-chat-app-line-is-launching-a-cryptocurrency-exchange/

Line, which has more than 200 million monthly active users worldwide, announced on Jan. 31 that it is planning to launch a cryptocurrency exchange. The Tokyo-based chat app said in a statement that it has filed an application for registering a crypto exchange with Japan’s financial regulator, and that the application is currently under review. The company will also launch a variety of financial services, including a place to trade cryptocurrencies, within the chat app. These new initiatives will be operated by Line Financial, a subsidiary established earlier this month.

South Korea Won't Ban Crypto Trading, Says Minister — https://www.coindesk.com/south-korea-doesnt-intend-to-ban-crypto-trading-says-finance-minister/

In response to a question from a lawmaker on the government's plans for regulation of the crypto industry, South Korean finance minister Kim Dong-yeon said, “There is no intention to ban or suppress the cryptocurrency [market]... Regulating exchanges is [the government’s] immediate task.”

SEC, CFTC Chiefs Set for Senate Crypto Hearing — https://www.coindesk.com/sec-cftc-chiefs-set-senate-crypto-hearing-next-week/

The Feb. 6 hearing will be broadcast live online. I will definitely be tuning in.

Bitfury Enters Bitcoin Crime-Fighting Business — https://www.coindesk.com/bitfury-enters-bitcoin-crime-fighting-business-crystal-launch/

After years of working with government agencies leery of bitcoin's seedy past, the blockchain services firm best known for its bitcoin transaction processing business has decided to take matters into its own hands. Launched this week, a number of tools collectively identified as “Crystal” are intended to make it easy for users to identify and investigate criminal activity on the world's largest blockchain.

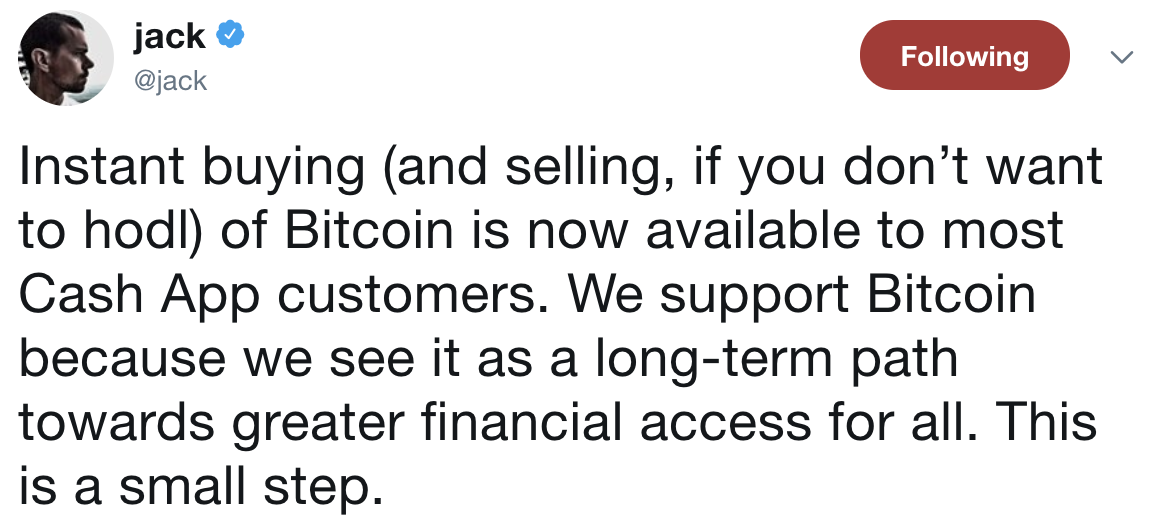

Square Cash expands bitcoin buying and selling to all users — https://techcrunch.com/2018/01/31/square-cash-expands-bitcoin-buying-and-selling-to-all-users/

Square’s peer-to-peer payment app, Square Cash, has expanded its Bitcoin trial to enable nearly all users to buy and sell Bitcoin using the app. Square (and Twitter) founder Jack Dorsey took the opportunity to personally throw his support behind crypto with this tweet:

The key to bitcoin’s next breakout may lie in Google search — https://www.cnbc.com/2018/01/27/the-key-to-bitcoins-next-breakout-may-lie-in-google-search.html

The first analyst to follow bitcoin sees a very accessible way to track its next big move. DataTrek Research's co-Founder, Nick Colas, said recently that the key is looking into Google search and wallet growth. “By looking at the number of people who search for the word 'bitcoin' on Google, which has roughly a 60 percent market share of search globally, we get a pretty good sense of where the interest is,” he told CNBC's "Trading Nation" this week. If you want to follow along, head over the Google Trends by clicking here.

UPS Might Be Making a Locker That Accepts Bitcoin — https://www.coindesk.com/ups-might-making-locker-accepts-bitcoin/

This would actually be pretty neat. Global shipping giant UPS may be looking at accepting Bitcoin through an item-exchange locker service, newly published patent filings show. UPS is eyeing a system of locker banks that can take digital forms of payment, including Bitcoin, where a party trading or selling an item can leave it in the locker for a buyer to pick up at their convenience.

Mnuchin Calls for Crypto Regulatory Talk At G20 Summit — https://www.coindesk.com/mnuchin-talk-crypto-regulation-g20-summit/

U.S. Treasury Secretary Steven Mnuchin has indicated he is planning to raise the subject of cryptocurrency regulation during an upcoming G20 summit to be held in Argentina in March. Speaking at the Senate Banking Committee on Tuesday, Mnuchin said that he does not believe cryptocurrencies are threat to the financial market stability, though he is concerned about their use in money laundering and other illegal activities.

Coins and tokens and stocks, oh my!

[Note — Net change and % change figures are from the close last Friday to the close today.]

HIVE Blockchain (TSXV:HIVE) — $HIVE — Net Change: -$0.64; % Change: -22.9%

In my opinion, HIVE’s edge in the long-run, over all other blockchain/crypto pubco plays out there, is their close relationship with Genesis Mining and its founder, Marco Streng. And I believe those HIVE shareholders who can stomach the pain of what we’ve seen thus far in 2018 in the crypto market, or take the opportunity to accumulate a larger position, will be rewarded generously in time. Crypto mining is extremely profitable at scale. I’d urge you to read this in-depth profile of Marco: “Meet the 28-year-old building a Bitcoin empire”.

Other crypto/blockchain-related stocks riding the wave (more RED):

- HashChain Technology (TSXV:KASH) — $KASH — Net Change: -$0.77; % Change: -38.1%

- Mogo Finance (TSX:MOGO) — $MOGO — Net Change: -$1.04; % Change: -17.2%

- Neptune Dash (TSXV:DASH) — $DASH — Net Change: -$0.04; % Change: -10.1%

- Overstock (NASDAQ:OSTK) — $OSTK — Net Change: -US$18.45; % Change: -24.8%

- MGT Capital (OTC:MGTI) — $MGTI — Net Change: -US$0.64; % Change: -19.7%

- LeoNovus (TSXV:LTV) — $LTV — Net Change: -$0.055; % Change: -20.8%

- Global Blockchain (TSXV:BLOC) — $BLOC — Net Change: -$0.54; % Change: -33.8%

- BTL Group (TSXV:BTL) — $BTL — Net Change: -$1.01; % Change: -10.0%

- NetCents Technology (CSE:NC) — $NC — Net Change: -$0.57; % Change: -19.7%

- 360 Blockchain (CSE:CODE) — $CODE — Net Change: -$0.055; % Change: -31.4%

- Riot Blockchain (NASDAQ:RIOT) — $RIOT — Net Change: -US$4.97; % Change: -29.0%

- eXeBlock Technology (CSE:XBLK) — $XBLK — Net Change: -$0.29; % Change: -45.3%

- BIG Blockchain Intelligence Group Inc. (CSE:BIGG) — $BIGG — Net Change: -$0.31; % Change: -21.8%

- And a few others that have been getting some attention: Atlas Cloud (CSE:AKE) - $AKE; Block One Capital (TSXV:BLOK) - $BLOK; Calyx Bio-Ventures (TSXV:CYX) - $CYX; ePlay Digital (CSE:EPY) - $EPY; LottoGopher (CSE:LOTO) - $LOTO; HealthSpace Data Systems (CSE:HS); Blocplay Entertainment (CSE:PLAY; formerly BOT); Imagination Park (CSE:IP); Blockchain Power Trust (TSXV:BPWR.UN) - $BPWR-UN.

Follow @Evenprime’s crypto watchlist should you wish to track the now dozens of names apparently in the crypto/blockchain game.

The CryptoTechnician Report

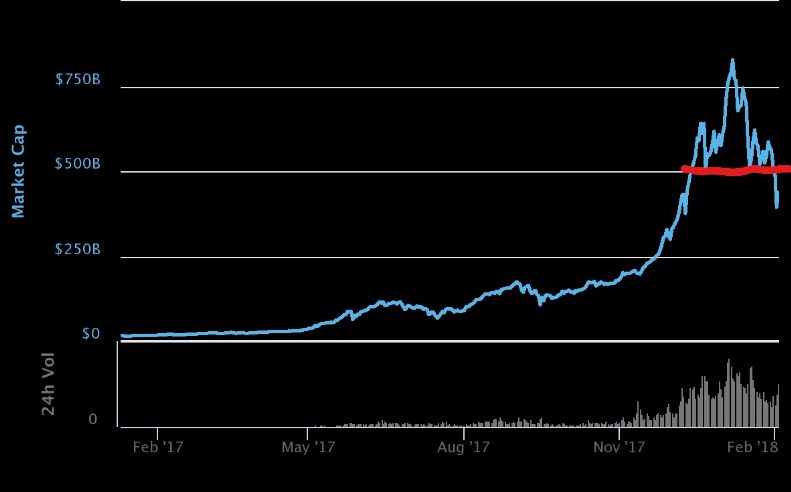

Another extremely rough week for crypto bulls as another US$200 billion gets shaved off of total crypto market capitalization from Sunday night's high (January 28th) to Friday morning's low (February 2nd).

While Bitcoin dropping below $8,000 at Friday morning's low was certainly the headline grabber, the most ominous news of the week came in the form of a classic head & shoulders top on the total crypto market cap chart:

The H&S top in the above chart is textbook in that the left shoulder exhibits higher volume than the right shoulder, and the left shoulder even peaked at a slightly higher level than the right shoulder. The neckline is clear as day at the round number $500 billion level and the neckline breach brings with it a ~$200 billion total market cap target.

Turning to Bitcoin we can see that a 'fat-pitch' buy setup occurred at Friday morning's low as Bitcoin fell to an area of technical confluence just below $8,000:

The oversold snapback rally has so far managed to make it back to previous support at $9,200. The question that crypto bulls need to answer now is: “Can Bitcoin make it back above $10,000 before having to retest the $7,750 low or is $9,200 all it can muster on this bounce?”

If the $10,000 level cannot be retaken quickly it will likely mean that we are in for more downside sooner rather than later.

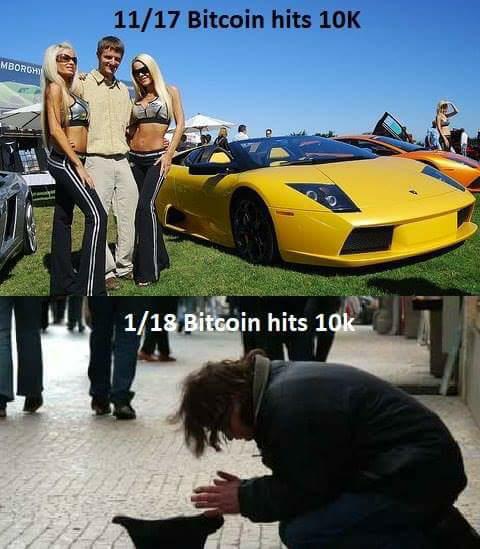

Funny things we saw this week

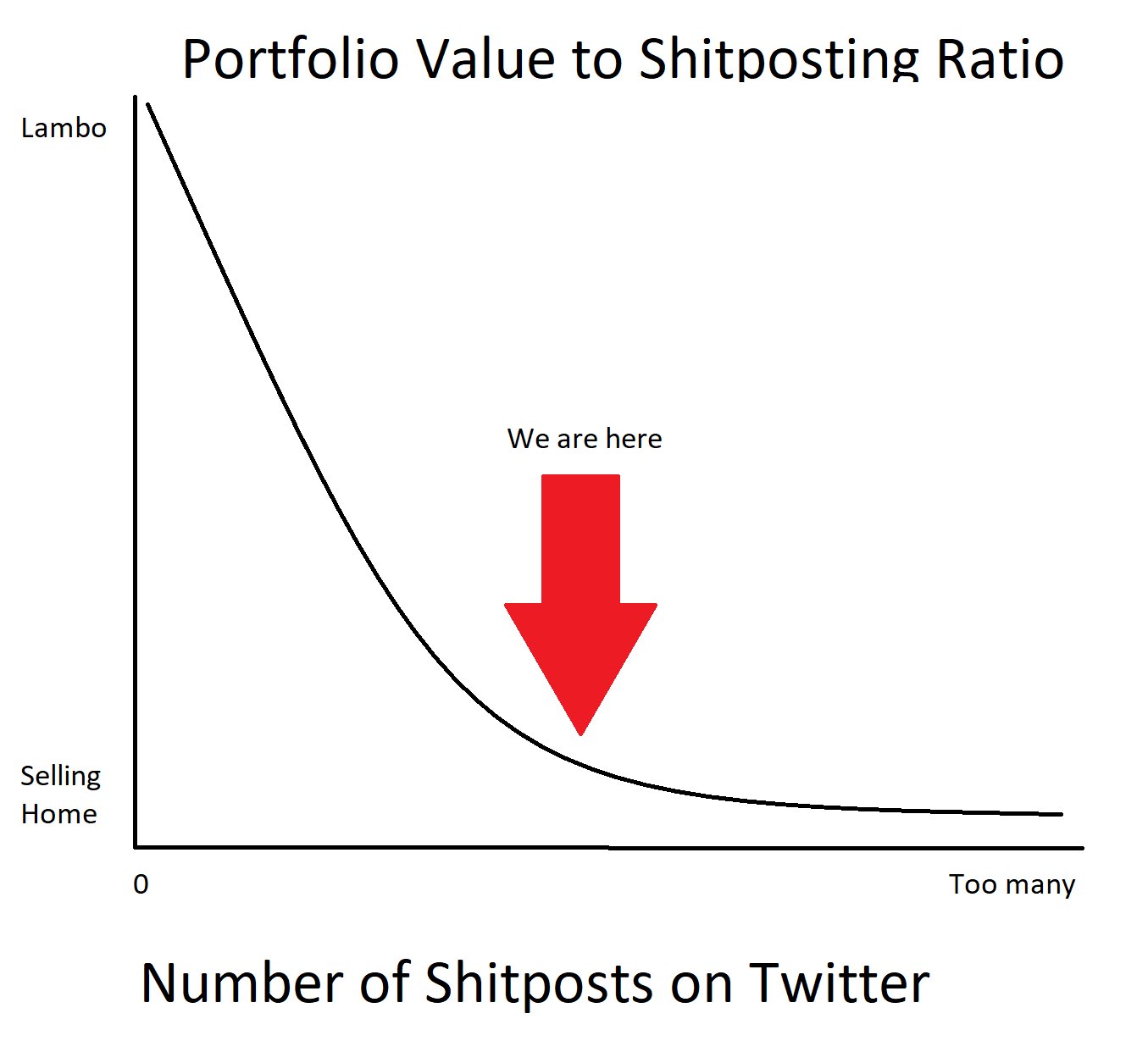

This week saw a resurgence of Lambo memes:

Is that porn?

Bitcoin HODLER since early 2013 confronting new investors on recent crash:

Buying Cryptos in 2018:

Buy the tip, sell the dip:

————————

DISCLAIMER — PLEASE READ CAREFULLY

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

The authors are online financial newsletter writers. They are focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, the authors are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Crypto Wars, especially if the investment involves a small, thinly-traded company that isn't well known or a crypto asset like Bitcoin or Ethereum.

Past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in this newsletter or on this website.

In many cases, the authors, and/or site owner/operator Tommy Humphreys, owns shares in the companies featured. For those reasons, please be aware that the authors can be considered extremely biased in regards to the companies written about and featured in Crypto Wars. Because of this, there is an inherent conflict of interest involved that may influence our perspective on these companies. This is why you should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. We may purchase more shares of any featured company for the purpose of selling them for our own profit and will buy or sell at any time without notice to anyone, including readers of this newsletter.

None of the authors, Tommy Humphreys, or Pacific Website Company Incorporated (dba CEO.CA) shall be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks or crypto assets, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

We do not undertake any obligation to publicly update or revise any statements made in this newsletter.