Ayawilca; 2017 drilling at South Zone

This article was first published on www.criticalinvestor.eu, a platform for junior mining investors

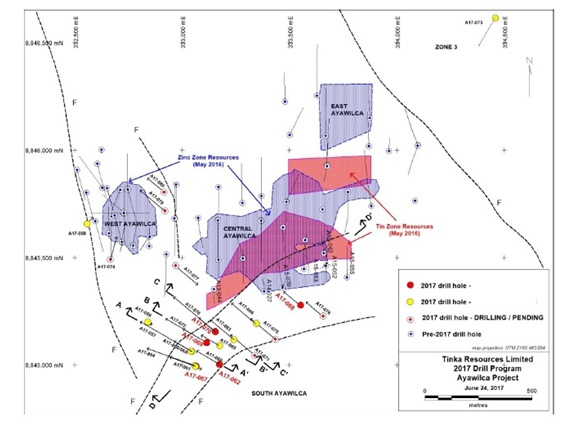

After two new sets of drill results it was time for another update, to show possible implications on future resource potential for Ayawilca. Both sets didn't have huge ramifications for this, but are interesting enough to discuss individually. The eyecatcher for me was the returned blank for hole A17-073, which was drilled in the first target of Zone 3, a zone of which I hold the mineralized potential in even higher regard than South, when looking at available exploration/geophysics data so far. This first Zone 3 result wasn't ideal of course, but management (and myself) still has high hopes for their model of Zone 3, as the targeted area is large. New targets are being drilled at the moment, as well as other targets in other zones (Chaucha, West and Valley), almost ready to being announced, so I am curious what comes out of this. In the mean time, I will discuss my view on the development of Ayawilca in this update.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates or forecasts regarding Tinka’s performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka’s management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

The last drill results were mixed as mentioned, but not to the degree that all is or should be lost. Remember, Hemlo and Eskay Creek each needed over 65 drill holes before they struck gold.

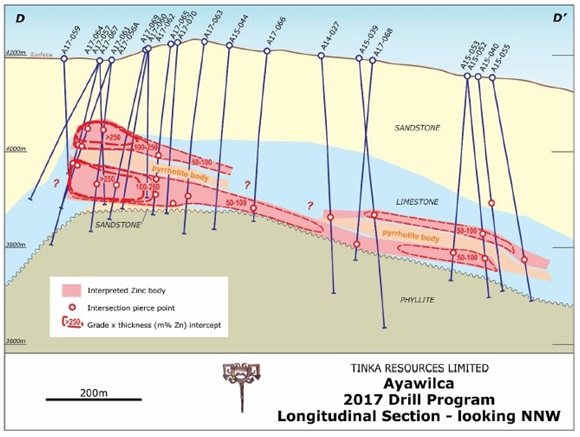

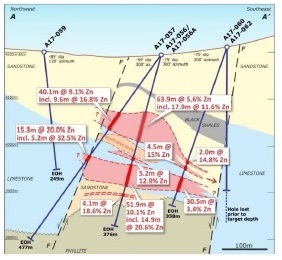

The set of drill results of June 28 served more or less as infill drilling (069, 070) and checking of bounderies of mineralization along faults (062) and magnetics (067), and further connection between South and Central (068). I found the results of 062, 067 and 068 according expectations when extrapolating earlier results and geophysics, and 069 and 070 came in slightly below my expectations as the very thick intercepts of 056 seemed to drop off more quickly than anticipated in my earlier estimates, especially since they were in between 056 and 063, which were the two best intercepts to date. As a reminder, hole 056 returned 63.9m@5.6%Zn AND 51.9m@10.1%Zn (and extension hole 056A added 9.5m@9.3%Zn AND 4.1m@18.6%Zn), and hole 063 came in at 47.7m@11.3%Zn.

Aside from the freak grades intercepted at Ivanhoe Mines' league-of-its-own Kipushi project which has an average zinc grade of 35%, doubling the average grade of any other zinc project on the planet, Tinka absolutely delivered several world class intercepts here. Nevertheless, I did assume 069 and 070 to return thicker intercepts as a consequence, to indicate better continuity closely along the SW/SE fault, as mineralization appeared stronger there so far for South. Instead it turned out to be less continuous, but still good:

Hole A17-069:

• 29.3 metres at 10.4 % zinc, 17 g/t silver & 278 g/t indium from 271.4 metres depth, including

o 12.1 metres at 19.1 % zinc, 25 g/t silver & 440 g/t indium from 287.3 metres depth;

Hole A17-070:

• 1.6 metres at 15.4 % zinc, 40 g/t silver & 529 g/t indium from 306.8 metres depth; and

• 39.3* metres at 7.1 % zinc, 13 g/t silver & 100 g/t indium from 317.5 metres depth, including

o 8.0 metres at 20.9 % zinc, 19 g/t silver & 265 g/t indium from 340.0 metres depth;

* includes 4.3 metres of no recovery assumed zero grade

The other three holes were according to expectations as mentioned, although 067 dropped off very quickly (about 50m apart) relatively to 056/056A as well, almost indicating 056/056A as a pretty narrow chimney style center of mineralization.

Hole A17-068:

• 0.75 metres at 6.1 % zinc, 11.6 % lead & 210 g/t silver from 343.55 metres depth;

• 6.0 metres at 4.0 % zinc & 46 g/t silver from 382 metres depth;

Hole A17-062:

• 0.65 metres at 33.6 % zinc, 0.3 % lead & 166 g/t silver from 152.4 metres depth (vein);

Hole was lost prior to target depth at 313 metres

Hole A17-067:

• 8.6 metres at 2.7 % zinc & 39 g/t silver from 256.4 metres depth.

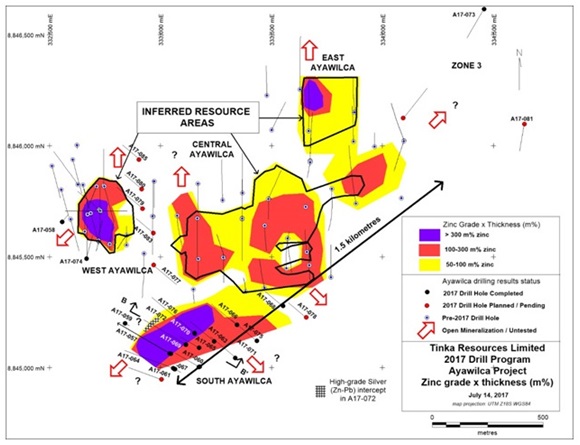

If 069 and 070 came in at 60-80m intercepts, South Ayawilca alone would have been enough to lift Ayawilca into the 40Mt Tier I target range as tonnage would increase very rapidly. Instead it seems Tinka is on its way for a 10-12Mt target on South Zone, which is still very good for a first step out Zone, and has to look for other targets to increase tonnage much further as intended. In order to achieve this, Tinka management defined a drill program for Zone 3, Chaucha and Valley, which is now underway. The first hole drilled on Zone 3 is 073, and was unsuccessful as reported as part of the July 17 news release.

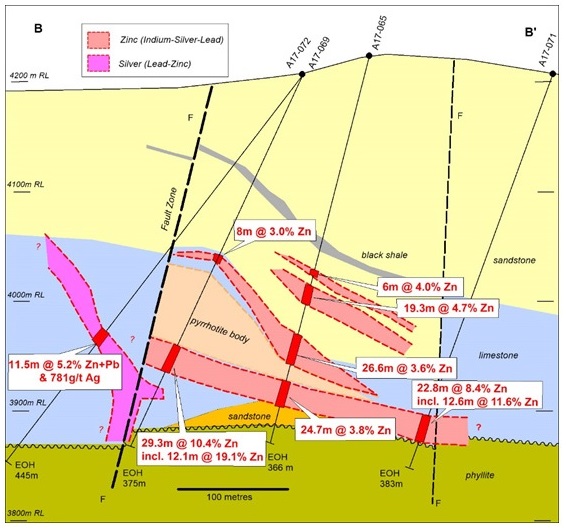

On the other hand, holes 072 and 075 were surprising to the upside, as 072 indicated mineralization north of the SW/NE fault for the first time, and 075 returned a much thicker intercept (20.8m) than anticipated, as nearby South-Central connnecting holes 066 and 068 sported just 6m and 3.5m+5m intercepts. Hole 072 also intercepted high grade silver over a short distance for the first time (2m@3167g/t Ag), but as it is the first time and not a long intercept, this is not material in my view. The zinc-lead intercept could indicate decent new additional tonnage though:

Key Highlights

Hole A17-071 (South Ayawilca):

• 22.8 metres at 8.4 % zinc, 0.8 % lead, & 35 g/t silver from 327.2 metres depth, including

o 12.6 metres at 11.6 % zinc, 0.9 % lead, & 35 g/t silver from 332.4 metres depth;

Hole A17-072 (South Ayawilca):

• 11.5 metres at 2.9 % zinc, 2.3 % lead & 781 g/t silver from 294.5 metres depth, including

o 2.0 metres at 5.6 % zinc, 5.5 % lead & 3167 g/t silver from 302.0 metres depth;

Hole A17-075 (South Ayawilca):

• 20.8 metres* at 5.0 % zinc, 11 g/t silver & 44 g/t indium from 359.0 metres depth, including

o 3.5 metres at 10.2 % zinc, 17 g/t silver & 96 g/t indium from 376.3 metres depth;

* includes 1.7 metres of no recovery assumed zero grade

Hole A17-074 (West Ayawilca):

• 2.2 metres at 31.0 % zinc, 0.1 % lead & 138 g/t silver from 71.4 metres depth (vein), and

• 0.7 metres at 18.3 % zinc & 38 g/t silver from 148.0 metres depth (vein);

Hole A17-073 (Zone 3):

The first hole at Zone 3, drilled 700 metres east of the existing East Ayawilca Inferred Resource, was completed to a depth of 710 metres. Replacement sulphide mineralization was encountered, mostly pyrite with minor sphalerite, over a 15-metre interval near the base of the carbonate sequence which hosts mineralization elsewhere. At Ayawilca, pyrite occurs on the margins of the zinc mineralization, so we interpret this as an indication that significant zinc mineralization may be close by. A follow-up hole (A17-081) is in progress, with one more hole planned for Zone 3 in this program.

Clearly hole 073 didn't return any mineralization despite the much greater depth, which is obviously a slight disappointment for a first hole on a new target, but the target is very large and represents many more opportunities. I always keep Hemlo and Eskay in mind, which both took over 65 drill holes to even hit first mineralization, so Tinka not hitting at the first attempt isn't the end of the world for me. When talking to management, it appeared that they found alteration in the limestone, and this usually happens by a heat source nearby. And such a heat source could be metal precipitating along certain structures. On top of this, they also didn't encounter pyrrhotite or magnetite like they did at other mineralized zones like South, where zinc was located around bodies of pyrrhotite:

The pyrrhothite/magnetite is the source of the magnetics in case of Ayawilca, as zinc isn't magnetic at all. However, there must be a huge source of magnetics as is clearly indicated by the surveys, so the task for the geologists is clear here regarding Zone 3. The situation is different compared to South Zone as hole 056 was at an absolute peak for magnetics, and Zone 3 doesn't appear to have this, so looking for mineralization isn't as clear cut here. The company has been finding copper soil samples along the Zone 3 fault, which could indicate further tin presence as well, as tin often combines with copper. The tin results are still underway and will be combined as mentioned in my latest article.

Drilling on the other targets Chaucha (3 holes) and Valley (2 holes) is almost completed now, and results are expected soon. These holes are drilled at 200-250m depth. Tinka also completed 4 holes on the West Zone (north east of this area), to infill drill a gap in drilling, and step out to the north east, and assays are pending here as well, and will certainly be part of the first batch of results coming out.

At the moment the company is drilling with 3 rigs (down from 4) in order to save cash, and returned to the South Zone again (don't know the numbers of those holes), chasing the extensions. The third hole at Zone 3 is being drilled at the moment (092), following the finished third hole at Valley (091).

There will be no need to stop drilling in October because of rains in Peru, but this could slow things down a bit too. Tinka has applied for additional permitting east of Zone 3, which could take a couple of months for approval.

Something that's interesting is advanced met work for the South Zone, which probably will come out in October. Management indicated to me that they are aiming for Trevali/Santander level recoveries of clean con of 85-90% which would be very high. This will certainly be PEA level, and will be done for West and South first, as this will be the starter part of any operation. The met work for recoveries for the Central Zone will follow at a later stage.

Management is still looking for the central feeder structure as discussed in my latest article, but hasn't found it yet. Actively looking for this would probably need much deeper drilling which is much more costly, so the focus is at the relatively more near surface targets.

When interpreting the latest drill results, a fairly complex mineralized orebody shape arises. Mineralization also appears to be more layered than anticipated in my earlier estimate, but the envelope also looks to be wider than anticipated, closer aligning the two SW/NE faults and even crossing them with probably vein type mineralization.

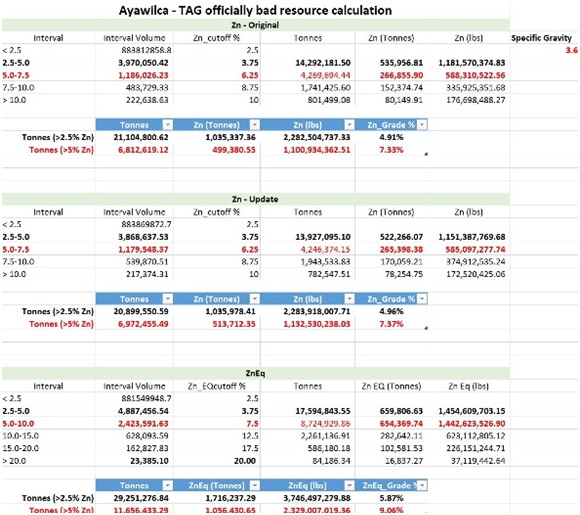

Because of these changed dimensions, layering and a few smaller intercepts than anticipated, my ball park estimate came down slightly from 11.5Mt to 10.5Mt (5%ZnEq cut-off) at a gravity of 3.3t/m3 which is conservative. The mineralized zone is shaping up to be pretty complex now, so I was more than happy to get in contact with renowned blogger/geologist The Angry Geologist, who uses professional software to model potential orebodies. At my friendly request, he also modeled a 5%ZnEq cut-off resource so it could be better compared to the existing resource estimate, and I was happy to see it came pretty close to mine:

As can be seen, he estimated 11.65Mt at a very nice ZnEq grade of 9.06%, which is slightly higher tonnage than me, but he also uses a gravity of 3.6t/m3 which adds about 10% in tonnage here. I am not completely sure what area of influence he uses for each drill core, as we had a discussion about assuming continuity vs useful area of influence, but with the current amount of drill results I assume he comes close for continuity to my assumed "continuous continuity" hand drawn model. Needless to say that his model is much more accurate than mine for datapoint calculation, as he contacted Tinka management in order to obtain the exact drill collar locations and other drill data necessary to model each assay professionally.

As much more data and assumptions goes into an official NI43-101 resource estimate, the Angry Geologist clearly states by himself that this resource estimate is an "officially bad resource calculation", and mine is even worse, please take all this estimating with the proverbial solid amount of salt and wishful thinking, as the only thing to rely on will be the upcoming NI43-101 compliant resource estimate by Tinka Resources itself, which has a soft planning target for the end of this year, depending on results.

The same goes for the PEA, which will also be dependent on resource growth, and will be planned after the resource estimate. In any case, NPV targets by me and new analyst coverage exceed $300-400M targets based on just the current resource of 18.8Mt, so if Tinka manages to prove up 30Mt as I am convinced it will, a PEA NPV8 target of $400M (= C$500M) will be the bare super-conservative minimum for Ayawilca. For example, GMP estimates an NPV8 of $428M @$1.10/lb Zn based on a capex of $400M and as mentioned the current resource of 18.8Mt. Also keep in mind the conservative long term zinc price of $1.10/lb Zn, which is below the current price of $1.25/lb Zn. This is all without the tin resource, which has slightly less profitable economics according to my estimates compared to the zinc equivalent resource at current metal prices, but could still provide a very useful add-on. The fully diluted marketcap of Tinka is 249M shares @C$0.65 = C$161.8M, which is roughly a third of the current estimated NPV8, which obviously indicates a lot of upside when the project advances further.

Don't let the significant marketcap fool you, as the Ayawilca pounds in the ground rank among the most profitable around, and combined with increasing size I view this as a very attractive asset as a consequence. Let's see what the next batch of assays will show us regarding Zone 3, Chaucha, West, Valley, faults, feeders, copper and possibly tin, so lots of things going on at the same time, every one of them capable of adding meaningful information and tonnage to an already potentially very economic deposit.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at http://www.criticalinvestor.eu/, in order to get an email notice of my new articles soon after they are published.

The author is not a registered investment advisor, and has a long position in this stock. Tinka Resources is a sponsoring company. The views, opinions, estimates or forecasts regarding Tinka’s performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka’s management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author or any other mentioned third parties.

All facts are to be checked by the reader. For more information go to www.tinkaresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.