This article was first published on http://www.criticalinvestor.eu/, a platform for junior mining investors

Executive Summary:

- After Neil Woodyer left Endeavour Mining as a CEO in 2016, he teamed up with mining titan Frank Giustra, to set up Leagold

- They managed to buy the Los Filos gold mine from Goldcorp in Mexico for US$350M

- After giving this a closer look, it seems a profitable acquisition for Leagold

- Development potential provides significant upside in a few years

- Management is aiming at aggressive growth in order to build the next mid tier producer

Los Filos Mine; aerial view heap leach pads

1. Introduction

Sometimes it happens that an asset can benefit from a new set of eyes looking at it from a different perspective. That is exactly what seems to be happening at the Los Filos mine in Mexico. Goldcorp, the previous operator of this mine decided to focus on other projects due to its new 20/20/20 strategy (in the next 5 years achievement of 20% growth in gold production, 20% growth in gold reserves and a 20% reduction in our all-in sustaining costs) put in place by new CEO Garofalo, and put the mine up for sale.

Several parties were interested, but Leagold Mining made the winning bid. Leagold appeared to be a special purpose vehicle; created for the sole purpose to acquire this mine in Mexico’s Guerrero Gold Belt but it is meant for much more. Looking at the company’s management team, built around well-known founders Neil Woodyer and Frank Giustra, the Los Filos mine is the very first step of Leagold Mining. This company is destined to achieve great accomplishments, and the current valuation of the company is definitely just the beginning.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

Leagold (LMC.V) just finalized the financing which was completed simultaneously with the acquisition of the Los Filos mine. As the company’s management team is one of the main parts of the investment thesis, I will discuss the executives later in this article.

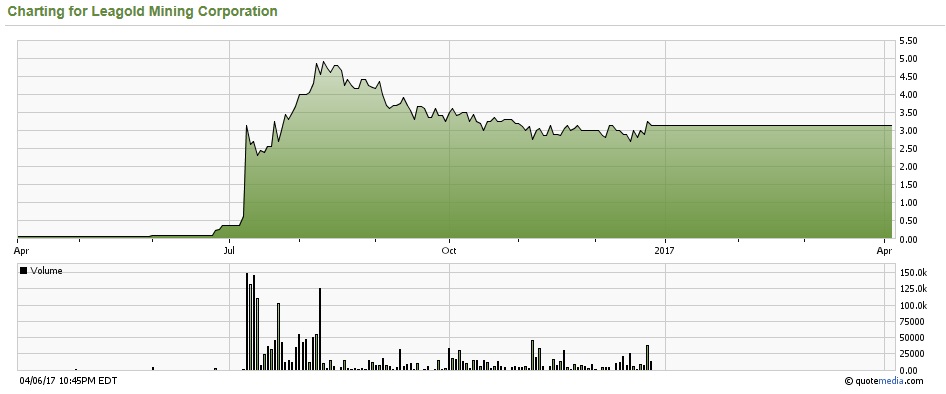

Trading in Leagold is currently still halted (however it will resume trading on Monday April 10) as the company has just completed the acquisition of the Los Filos project from Goldcorp. The Company is also closing the concurrent financings to fund the purchase and to make sure it has additional working capital to ensure a smooth transition.

After all financings (two equity financings and one debt financing) will have been completed, Leagold will have 151 million shares outstanding, giving it a pro-forma market capitalization of approximately C$415M, based on the C$2.75 share price level the company is raising money at. As this acquisition will be a complete game-changer for Leagold, which was a shell until now, the average daily volume should increase pretty fast, making this one of the most liquid companies on the TSX Venture. It doesn’t happen every day to see a shell acquiring a producing asset with an average annual output of in excess of 200,000 ounces of gold, giving it instant cash flow to immediately pursue its growth plans, to advance towards a mid-tier producer.

After the financings management will own approximately 9%, which means its interests are aligned with the interests of the shareholders. With Neil Woodyer and Frank Giustra as founders of Leagold, we have no doubt this company is destined to be successful.

One of the most important aspects of Leagold Mining isn’t necessarily the asset, but the human capital running the company. After all, a good or bad management can make or break an investment case. A good management can make an average project good, but a bad management can totally ruin a good project.

It would be a serious understatement to say Leagold isn’t the management’s first rodeo. The company’s CEO is Neil Woodyer, a man we have the utmost respect for.

In 2007, Woodyer decided to convert Endeavour Financial into a full-fledged mining company, rather than being a financier. Endeavour started off by acquiring Crew Gold and Etruscan Resources and continued to grow at an extremely fast pace after acquiring five other gold companies, and appeared to be very good and efficient in integrating, revamping and optimizing acquired operations on time and on budget. I still love the buy out story of Avion Gold, where the first actions after the take over were sending away and replacing all contractors, personnel and mine management of the Tabakoto mine, as existing operations were hopelessly inefficient.

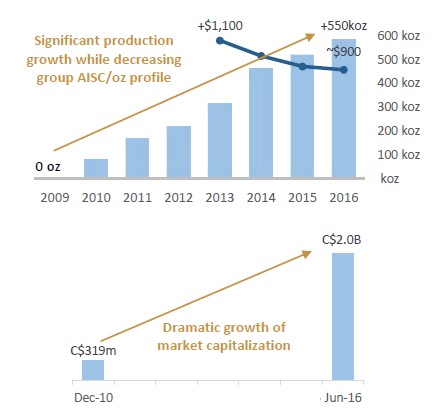

The real apotheosis came in 2015 when Endeavour Mining announced the acquisition of La Mancha Resources and the Ity mine. This immediately catapulted Endeavour Mining (EDVMF) into the ranks of major producers, and the purchase of True Gold Mining for its production-ready project in Burkina Faso was the final step for Endeavour Mining, which aims to produce in excess of 600,000 ounces of gold in 2017. A true class-act, which was rewarded with a substantial increase in Endeavour’s market capitalization.

Endeavour Mining; market cap growth

I have no doubt the Endeavour growth pattern will be used as the blueprint for Leagold, as the company doesn’t hide the fact it wants to grow this company into a significant gold producer as well, as featured prominently on the homepage and in its presentation.

Management already indicated this in this news release from January 12, 2017 when announcing the acquisition of Los Filos from Goldcorp:

"Leagold aims to build a new mid-tier gold producer with a focus on opportunities in Latin America; Los Filos is the first acquisition"

It will be very clear by now that the Los Filos mine will be the first stepping stone and the incoming cash flow will then be used to fund the acquisition and development of new projects.

Chairman Frank Giustra is in a league of his own. Having founded 5 (multi) billion dollar resource companies (for example Pacific Stratus Energy, the predecessor of Pacific Rubiales Energy, and Wheaton River, predecessor of Goldcorp and Silver Wheaton(SLW)) and a multi billion dollar film studio (Lionsgate), he became a billionaire himself because of it. That wasn't the only master stroke, as Giustra did some remarkable things before he started founding companies himself. For example, when he was still with Yorkton Securities, an investment bank, he funded some of the most lucrative deals in the history of mining, as he did the first financing of Robert Friedland's Diamond Fields. It will be clear he made a lot of money for himself and his clients and investors, and it looks like Leagold is his largest undertaking at the moment, after returning to mining almost 2 years ago, and hopefully poised for lots of gains along the road again.

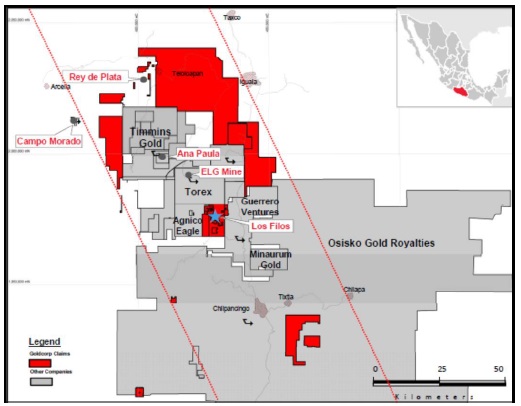

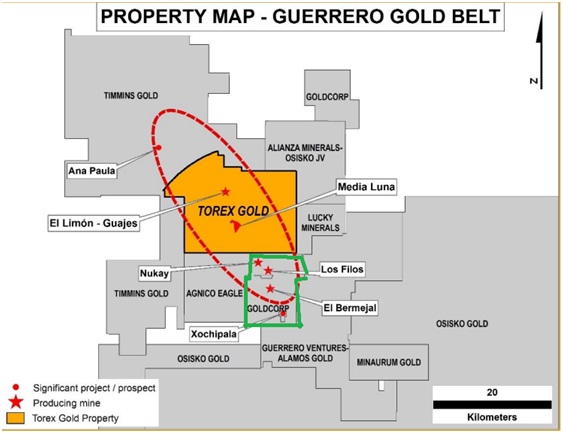

The company’s flagship project, Los Filos, is located in Mexico where a lot of mining activity takes place, and has a solid mining culture. According to the Fraser Survey of 2016, Mexico scores #53 out of 104 jurisdictions for Policy Perception Index (PPI), which is average for Latin American countries. However, I would definitely like to pay some attention to the Guerrero region, where the Los Filos mine is located.

The region hasn’t been the most stable region in Mexico as there is a lot of crime going on, and most companies operating in the region are really investing in safety to make sure their projects and the integrity of the staff are ensured. Goldcorp and nearby Torex (TORXF) have had some serious issues with security on the access roads to the sites. Whereas the situation currently seems to be under control, I do like to work with a certain margin of safety, and therefore will apply a 10% discount rate to the company’s producing mine later on.

Additionally, the fact the company is focusing on Mexico might be really interesting, considering President Trump’s aggressive stance towards the country. The Mexican Peso has regained some of its ground after falling by in excess of 20% on the back of Trump’s election, but the currency exchange rate might play an important role in Leagold’s future. After all, its mine plans are based on an USD/MXN exchange rate of 21 Peso’s per US Dollar, but the Peso is currently approximately 10% stronger than budgeted, which might have a (slightly) negative impact on Leagold’s Net Present Value (NPV) and Internal Rate of Return (IRR), which I will discuss later on.

3. The project

The Los Filos mine is one of the largest gold mines in Mexico, and in The Americas in general. The open pit mine produces in excess of 200,000 ounces of gold per year on a pretty consistent basis (231,000 ounces in 2016). And not only is it a large mine, Goldcorp has always been able to keep the production costs very low, and the anticipated AISC is just $850/oz (AISC $878/oz in 2016). This was definitely one of the key points to attract numerous potential buyers.

Los Filos Mine; location map

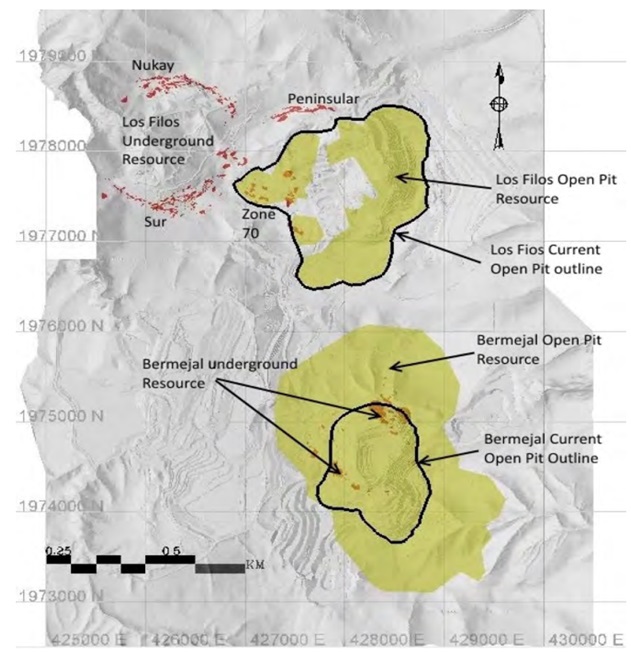

The mine is located in the Guerrero Gold Belt, approximately 225 kilometers south of Mexico City, the capital of the country. As the property is located near a major highway, the trip from Mexico City to Los Filos usually takes less than four hours, by car. That is a major advantage as it is efficient to bring people in either via the highway, or the nearby airstrip. Los Filos also has immediate access to water and power, which implies very good infrastructure, a big plus for any mining project.

Claim map

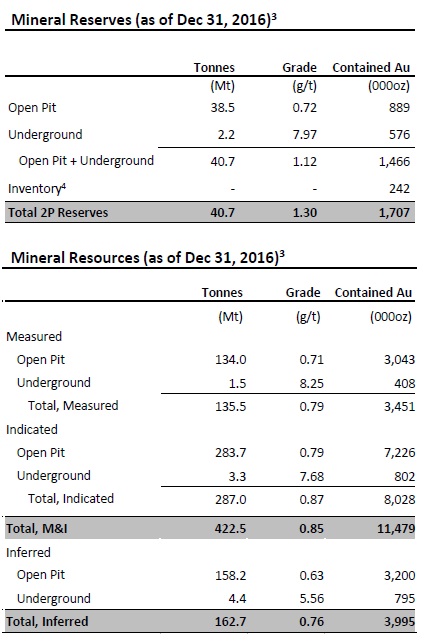

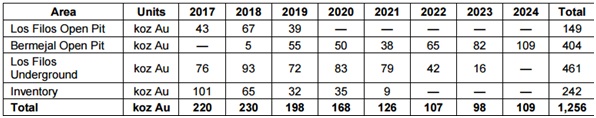

Production at Los Filos began in 2008 when mining commenced at the open pit mine, and all gold has been recovered through a simple heap leach operation, followed by an adsorption-desorption-recovery process. The current open pit and underground mining operations still contains millions of tonnes of ore in reserves, as can be seen here in this table representing Reserves and Resources:

2016 resource statement (excluding silver)

The current mine plan expects to cease the mining operations at the Los Filos pit in 2019. This doesn’t mean the entire mine will be shut down, as the Bermejal open pit is expected to be brought back in production in 2018 (mining at Bermejal is currently suspended until the Los Filos open pit is mined out). The Los Filos underground mine continues operations to 2023.

Aerial view of operations

From 2019 to 2024, the majority of the ore (9,000 tpd) will be sourced from the Bermejal open pit (90%), whereas the Los Filos underground mine will contribute approximately 1,000 tpd (10%). The underground ore has a higher average grade and results in a combined production profile of in excess of 150,000 ounces of gold per year until 2020, where after the combined output will gradually decrease, as shown in the next image:

Existing production schedule Los Filos

With a total sustaining capex of US$79M and a total gold production of almost 1.2M oz Au, the capital efficiency is very high as the sustaining capex per produced ounce of gold will be less than US$65/oz Au, resulting in a low all in sustaining cost (AISC) of US$805/oz Au, or C$1073/oz. And that is quite low, considering this includes the continuous development of the Los Filos underground mine, which traditionally isn’t cheap at all, with AISC frequently surpassing C$1200/oz levels.

An independent consultants, Stantec, completed a technical report for Leagold and presented an economic study based on the mine plan with 1.26Moz Au being produced from the two open pits and the Los Filos underground mine.

Using the base case scenario of US$1200/oz Au, the current mine plan boasts an after-tax NPV5 of US$334M. The company’s technical report also provides a sensitivity analysis, and I am glad to see that even at an average gold price of US$1100/oz Au, the after-tax NPV5 is still US$263M and even if I would apply a 10% discount rate, the NPV would still be in excess of U$230M. This emphasizes the strong operating margins at Los Filos.

Notwithstanding this, it is needed to closely monitor the US Dollar / Mexican Peso exchange rate.

USD/Peso exchange rate; source Stockcharts

An exchange rate of 21 Peso’s per US Dollar was used, but the Mexican Peso is currently in excess of 10% more expensive than budgeted (as can be seen in the above image). This will very likely have a (modest) negative impact on the NPV and production costs as the local costs will be a bit higher when expressed in US Dollar. Not a deal-breaker, but it’s definitely something to keep in mind, as local costs for operations like this are usually 40-50% in local currencies.

4. Bermejal Underground: Expansion at a bargain

At first sight, it doesn’t seem to make a lot of sense to pay US$350M for a mine which has an estimated after-tax NPV5 of just US$334M. But Leagold is focusing on the next phase at the Los Filos mine. On top of the two open pits and the Los Filos underground mine, a second underground deposit was defined close to the Bermejal open pit mine.

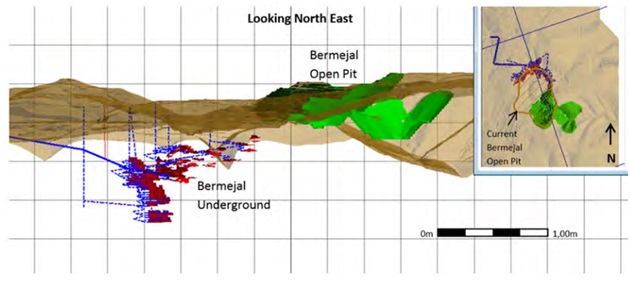

Schematic mine plan 3D

Leagold has already commissioned a technical report on the Bermejal underground zone, and the economics of a potential underground mine seem to be pretty strong according to a 2017 PEA. Keep in mind the capex and opex estimates were estimated based on just a PEA which usually has a margin of error of 25-35%, but given the extensive experience in the region and the fact two open pit mines and one underground mine have already been brought in production, I assume this PEA to be more credible, advanced and reliable than other PEA’s, which tend to be just a first look at economics and mine plan.

The initial capital expenditures at Bermejal will be very low, as Leagold thinks it will need less than US$50M to bring the underground mine into production in 2019. Of course, as it is an underground mine, the sustaining capex will be relatively high in the first few years of the mine life as the company will be completing as much underground development as possible to make the mining process as efficient as possible.

So on top of the US$47M in initial capex, the Bermejal project will require an additional US$106M in sustaining capex, of which the majority will be spent in the first three years of the mine life (US$87M) before almost being negligible from the fourth year on. Considering the total amount of gold to be recovered from Bermejal is expected to be 1.39Moz Au, the total capital intensity (initial capex + sustaining capex divided by the total amount of recovered gold) is just US$110/oz which is extremely low for a project of this size, as this usually attributes to US$200-300/oz.

Pit/resource outlines

This shouldn’t come as a surprise. After all, the surface infrastructure is already present and doesn’t need to be tweaked in order to process the Bermejal underground ore. So Leagold will only have to complete the underground development which isn’t too expensive considering the mineralization isn’t too deep. This allows Leagold to reach the ore by constructing a ramp, rather than digging a shaft.

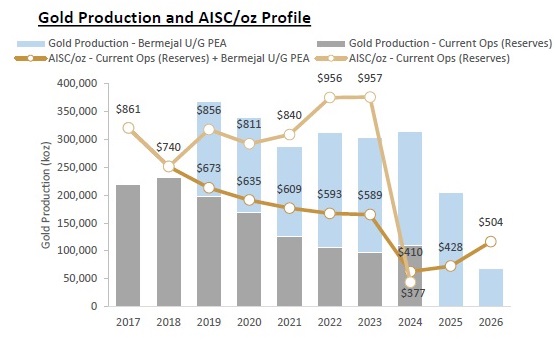

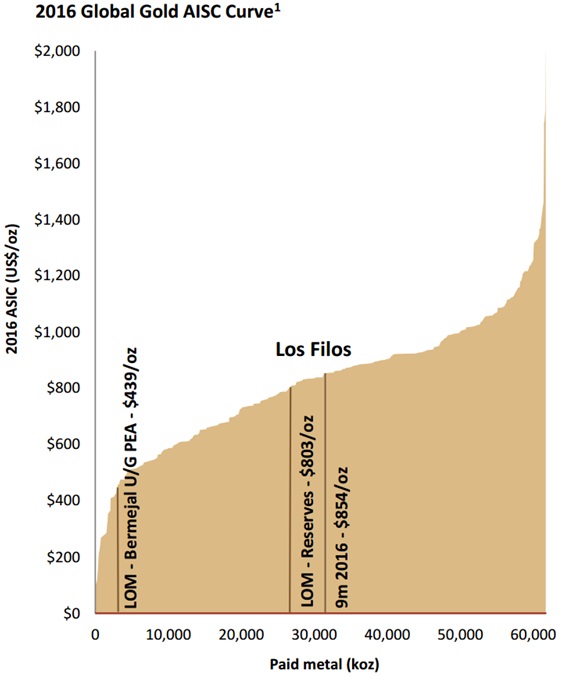

The PEA has been based on a resource estimate of 8.9Mt at an average grade of almost 6 g/t gold and 24 g/t silver. Taking the mining dilution into account, Leagold is anticipating a total mill feed of 10.5Mt at an average grade of 5.15 g/t. This ore will be processed during an 8 year life of mine (LOM) wherein a total of 1.4Moz Au will be produced, starting in 2019. The average all in sustaining cost (AISC) is expected to be less than US$450/oz Au, which will make this one of the few high-margin pure gold mines in the world. This chart basically tells it all why Leagold is poised for growth, production will rise considerably and the AISC goes down substantially too:

Existing vs. Planned production/AISC scenarios

The base case used in the underground mine scenario contains a gold price of US$1300/oz, which is more than 8% higher than the mine plan of the current operations. This indicates Leagold is more or less expecting a higher gold price, which isn't very conservative. To remain cautious, I will only look at the economics using a gold price of US$1200/oz.

And thanks to the extremely low initial capital expenditures, the after-tax IRR approaches 100%, whereas the NPV5 comes in at US$418M. Using a 10% discount rate (which might be a safer thing to do in Guerrero), the Bermejal underground mine still boasts an after-tax NPV10 of US$315M. Again, this scenario also uses an USD/MXN exchange rate of 21, versus the current exchange rate of 18.75 Peso’s per American Dollar.

5. The deal

Leagold finalized quite an arrangement, and will pay Goldcorp US$350M which consists of US$279M in cash and US$71M worth of shares of Leagold. This share position will incentivize Goldcorp to make the transition go as smooth as possible and allows the senior producer to retain exposure to the asset as well.

The funding of the acquisition could be broken down in three major parts. First of all, Leagold completed a C$179M subscription receipt offering, priced at C$2.75 per subscription right. These rights will be converted into common shares of Leagold now that the transaction is completed.

A second tranche is a direct US$50M equity placement at the exact same terms of the subscription receipt offering. Orion Resources partners will take the entire US$50M, to ensure an equity stake of approximately 24% in the company.

A final piece of the financing puzzle is an US$150M loan facility, provided by Orion as well. This 5-year loan will have an interest rate of the 3 month LIBOR interest rate (or 1%, whichever is the highest), increased by 700 basis points (7%). This isn’t a cheap loan (considering the interest rate will be at least 8%) and as Leagold doesn’t have to start repaying the loan until the third year, the principal amount will have increased to US$175M, which will then have to be repaid in 12 quarterly installments.

The acquisition financing also provides for a gold offtake to Orion of 50% of the gold production at market prices from the Los Filos Mine, until cumulative delivery of 1.1 million ounces to Orion.

A gold offtake isn't very common, it is more of a base metal/commodity thing, but to see Orion buying without a discount at market prices isn't hurting Leagold's cash flows.

Based on the expected cash flow profile of the company, this shouldn’t be a problem at all, considering the high margin Bermejal underground will start to produce gold in 2019 at a margin of almost US$800/oz (considering the Bermejal UG AISC is less than US$500/oz!). This puts the project at the bottom quartile of the producing gold mines in the world, as shown here:

AISC vs. amounts of gold paid/produced

When all is said and done, Leagold will have approximately 151M shares out, for a pro-forma market capitalization of C$415M.

I will discuss in the next paragraph why I consider this to be a good deal for Leagold, and although Garofalo has a strong financial background, it shows you it isn't easy to outsmart guys like Woodyer and Giustra.

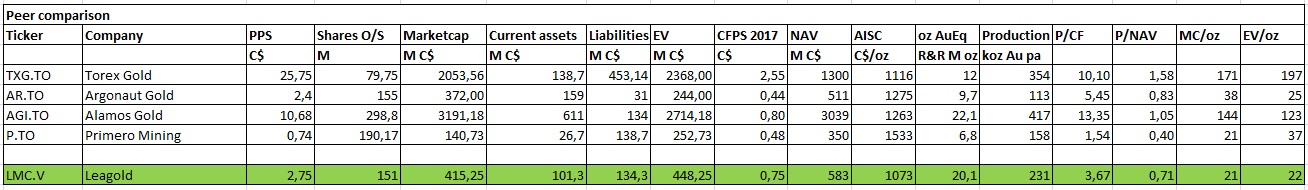

6. Peer comparison

One should always compare apples with apples, and the best example might be to use Torex Gold (TXG.TO) as main example to value Leagold. Not only does Torex Gold have the same production profile, it is also located literally down the road from Los Filos, in the Guerrero Gold Belt.

As Torex Gold will also see its AISC drop below US$800/oz in 2019 (which will happen at Los Filos as the high-grade Bermejal underground mine will be ramping up its production rate), this company might be the very best way to get an idea of how Leagold’s valuation compares to Torex Gold.

Neighbours Torex and Leagold; claims map

The results are appealing. Using a discount rate of 7% and a gold price of US$1300/oz, the NPV of the Morelos asset is estimated at just US$1.3B (or approximately C$16 per share of Torex Gold). This means Torex is currently trading at more than 1.5 times the NPV of its only operating project. Torex does have a large development project which might be incorporated in the mine plan later on, but so does Leagold. I have compiled a table with some other, more or less comparable companies, based on publicly available data, as well as the research reports from colleagues at Canaccord and RBC.

Please note, whereas Leagold appears to be pretty cheap based on the EV or market cap per ounce in the ground of Torex and Alamos, not all of Leagold’s ounces are part of the mine plan. A larger Bermejal open pit mine would have a strip ratio of 5:1, but there definitely needs to be a higher gold price before these additional ounces would be added to the mine plan.

The pro forma cash flow for Leagold is calculated like this: EBITDA US$113M - US$43M depreciation etc - US$10M overhead = US$60M net income. Corp taxes are about 30% including Mexican royalties, resulting in US$18M. Operational CF is EBITDA - G&A - taxes = US$85M = C$113M. This does not take expensed exploration activities, currency fluctuations and changes in working capital into consideration.

Based on operational cash flow, Leagold appears to be really cheap, although it has a much more profitable asset than for example Primero's. So if we would use a conservative MC/CF multiple of 5, this would implicate a share price target of C$3.75. And this is still half of Torex's multiple, operating in the same region with the same kind of assets. And of course there is the expansion scenario with Bermejal Underground, commencing in 2019, increasing production from 260koz to 360koz, and lowering AISC from US$861/oz to US$673/oz. A quick back of the envelope calculation generates almost double the cash flow, implying almost a possible further doubling of the share price, if the current multiple would stay this low, which I find a bit hard to believe. So there is plenty of upside, and it will be clear by now that I view a C$2.75 share price as undervalued.

It’s not easy to crystallize the value of Mexico-focused gold miners from a global point of view, as there are very few purely Mexico-focused gold producers. That being said, Leagold is trading substantially lower than Torex Gold, which might be the best company to compare it with both on a P/NAV basis as well on an enterprise value per ounce in the ground basis.

Using a gold price of US$1200/oz Au, the after-tax NPV10 of Los Filos and Bermejal is about US$612M. This means Leagold acquired the Los Filos district for just 0.6 times (and even 0.5 times at current gold prices) the NPV of the assets which can be seen as a staged producing asset with very low capex needs, and that is quite a good deal. Goldcorp was no longer interested in developing Los Filos due to the relatively short mine life of the deposits and the new 20/20/20 policy, but this acquisition was a real opportunity for Leagold.

After deducting the net debt and the estimated total cost of this debt, I end up with an estimated fair value of C$545M for Leagold which is approximately C$3.60 per share. Keep in mind this is based on a discount rate of 10%, and if I would apply a lower discount rate, the NAV/share increases to well over C$4.

This once again emphasizes, that Leagold management has done a great job in its negotiations with Goldcorp. The relative valuation of Leagold (based on the capital raise) seems to be considerably lower than the value the market is giving Torex Gold, the only other real peer producer in the Guerrero Gold Belt. But the real value will come from future expansion programs. Considering a much higher share price at the start, which could limit dilution, and a much better asset to begin with, I fancy the chances of Leagold to become another $2B mid tier producer like Endeavour Mining even faster, depending on the price of gold and stockmarket/mining sentiment of course as always. And although it is Guerrero, I prefer this jurisdiction over the even more adventurous West African jurisdictions of Endeavour Mining.

7. Conclusion

Goldcorp was no longer interested in developing Los Filos due to the new 20/20/20 policy of new CEO Garofalo, but this acquisition was a real opportunity for Venture junior Leagold. Not only could rainmakers Woodyer and Giustra buy this mine at a serious discount, the inbuilt expansion opportunity with Bermejal Underground is impressive, and will position Leagold as one of the lowest cost gold producers around in a few years time. I don't see too many differences with peer Torex, and view a near-term re-rating based on the current situation as imminent.

Besides this, I do expect this management team, having build several multi billion dollar companies together and individually, not to sit on their hands on the M&A front before 2019. As a consequence, the making of an Endeavour Mining 2.0 could materialize sooner than many would think, and I'm looking forward to proceedings as a shareholder.

I hope I will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu/, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. All facts are to be checked by the reader. For more information go to www.leagold.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Los Filos Mine