DOC’S THESIS For VOLCANIC GOLD MINES:

For a long time, no one would work in Guatemala but that has changed very recently with gov’t reforms, because of that, opportunities exist that have been overlooked and forgotten. Even though there have been world-class discoveries it still remains vastly underexplored. VG has recently optioned a dominant land position that sits on a very attractive geological setting that has been proven to create multi-million oz high-grade gold and +200 million oz silver deposits.

The tectonics, age of rocks, volcanics, plate subduction, multi shear zones, lithology are dynamically deposed to create large high-grade gold and silver deposits. VG’s land package has never been drilled below a true depth of 150 meters even though numerous intercepts from the surface of ore grade high-grade gold and silver mineralization has been discovered multiple times in the very limited drilling that has been conducted. The depth is important, very important..... you’ll soon understand...

The Holly and Banderas Projects sit above two high-grade gold and silver systems: a LOW SULPHIDATION EPITHERMAL (high-grade gold and silver) and an INTERMEDIATE SULPHIDATION EPITHERMAL (high-grade gold and silver plus lead and zinc, (The base metal credits can pay for the whole operation in some cases) both systems inherently collect, concentrate and precipitate high-grade gold and silver within the confines of the Boiling Zone, typical starting depth of a Boiling Zone is 200-300 meters below the water table and can continue vertically down for 800-1000 meters. The average width of a boiling zone worldwide is typically 300 meters thick. The Boiling Zone has never been tested, never, not 1 single drill hole has gone below 150 meters in true depth. Never. The tell is the leakage above that created the high-grade gold and silver veins outcropping at surface.

Educational moment

Part of becoming a successful investor is to understand what it is and what it’s not and what it reasonably could be so you don’t get seduced by flashy press releases or research writers or promoters.

Resources for your own Due DIligence, but not limited to

-High, Low, Intermediate Epithermal Deposits read: https://pubs.usgs.gov/sir/2010/5070/q/sir20105070q.pdf

-Watch this youtube by Sprott Edu: https://www.youtube.com/watch?v=xYwLTlX3XAM&feature=youtu.be

-Company presentation: https://www.volgold.com/site/assets/files/1241/2020-11-04-cp-vg.pdf

-Property 43-101: https://www.sedar.com/CheckCode.do

-Link for the most recent financial filing: https://www.sedar.com/CheckCode.do

-Executive Compensation statement, (this shows management isn't raping the treasury: https://www.sedar.com/GetFile.do?lang=EN&docClass=30&issuerNo=00026053&issuerType=03&projectNo=02934789&docId=4549610

Volcanic Gold Mines is completely cashed up for multiple large drill programs (over $13 million in cash) and won’t be raising capital again for a long time. Its huge cash balance makes up a majority of its market capital 55% and that’s just plain silly. The share structure is very tight, under 50 million shares and tightly held by insiders, they have Silvercorp as a strategic investor, which owns 19.9%, and Bluestone (Lundin Group), Silvercorp, Pan American as well as the Majors as potential takeover suitors ($discovery$ = $bidding war$). And because it’s relatively new very few eyes are watching yet.

The cherry on the cake, aside from high-grade gold and silver, they also have large bulk tonnage potential. They will be the first to issue a resource on this property after drilling 15000-20000 meters in 2021, drill permits will arrives soon and the drills will start.

Excellent geology, lots of cash, seasoned team, tight share structure, no over-hangs, new project and still very unknown, strategic investor, high insider ownership, low G&A, aggressive drill program on multiple targets…incredibly cheap, cheap, cheap….

“Yes” I own it, I added to my focused portfolio over the last 3 weeks (between .42-.55 cents), and “No” I don’t get paid or compensated for the research I do. I love using my skills and sharing, teaching others to better understand how to evaluate opportunities in the JR mining sector.

So why is it cheap? Pretty simple, a PP was done in Oct at .55 with a half warrant at .70 with no 4-month hold, some clipped the warrant and drove the stock from the .70’s to below .55, then tax-loss season kicked it temporarily into the 40’s but when tax lose season ended it has begun its repricing. So that being said let’s look at some data and introduce you to a company that I believe has incredible risk/reward potential because:

A) It’s drill proven high-grade gold and silver land package, some past drill results:

19.1- 19.2 m. 343 g/t Au, 10,300 g/t Ag. (It’s very narrow but exciting.) but it’s a veinlet, they are found in swarms (see 43-101)

6.0 m of 43.56 g/t Au, 1618 g/t Ag.

5.1 m of 58.26 g/t Au and 1937 g/t Ag

B) Incredibly fortified balance sheet and tight share structure, so that means limited dilution in the next 18 months and with success the warrants, the majority of which priced well above current price will fund into 2023-2024

C) Seasoned management team, If you go to the website you will see a lot of board members with ties to Fortuna Silver and Silver Corp (both large producers with market caps. that exceed $1.4 billion dollars each in need of reserves to replace production.

SIMON RIDGWAY

Founder, Director, President and Chief Executive Officer

Simon Ridgway is a co-founder of Fortuna Silver Mines Inc., a prospector, a mining financier and a Casey Research Explorer’s League inductee. Mr. Ridgway and the exploration teams under his guidance have discovered gold deposits in Honduras, Guatemala and Nicaragua and a silver/gold deposit in Mexico. His companies have raised over CAD$450 million for exploration and development projects since 2003, including a recently completed $100M bought deal for Fortuna Silver Mines. Mr. Ridgway is the Chairman of Fortuna Silver and Radius Gold Inc., and CEO of CROPS Inc.

MICHAEL POVEY

Director and Chairman

Mike Povey is a mining engineer with over 40 years of worldwide experience in the resource sector in a wide range of commodities. He has held senior management positions in various public companies including Rio Tinto and Anglo American, with surface and underground mining operations in Africa, North America, and Australia. Over the past 20 years, Mike has held positions as Chairman, Managing Director and Technical Director of several ASX and AIM listed companies where he has led project acquisitions, exploration programs, JV negotiations and equity raisings. Mike is a Chartered Engineer and a Member of the Australasian Institute of Mining and Metallurgy and holds a number of Certificates of Competency, including a West Australian Mine Managers Certificate.

BRUCE SMITH

Technical Advisor

Geologist and Environmental Engineer with 26 years global exploration experience. Led team that discovered +100Moz Chinchillas Silver Mine in Argentina. Worked in Guatemala since 1998 and fluent in Spanish. 43-101 QP accredited.

RODRIGO MATIAS

Chief Exploration Geologist

Geologist with 30 years prospecting and discovery in Guatemala and Central America. Initial prospecting discoveries include Escobal, Cerro Blanco, Navidad, Trebol, Tambor, Holly, Banderas, Sastre, Amalia and many more. NOTE: Rodrigo is a serial successful exploration geologist.

END OF THESIS now for the data…..

Volcanic Gold Mines (VG) (VLMZF)

The Company is a mineral exploration and development company. The Company’s principal property, and its only material property for the purposes of NI 43-101, is the Holly-Banderas gold-silver project (the “Holly-Banderas Project”), located in southeastern Guatemala. In May 2020, Radius Gold Inc. (“Radius”), a related party to the Company, granted to the Company an exclusive option for four years following the receipt of the necessary permits to allow the commencement of drilling to acquire a 60% interest in the Holly-Banderas Project. Radius also granted the Company an exclusive right for two years following July 27, 2020 to evaluate the other property interests of Radius in eastern Guatemala (the “Additional Guatemala Properties”) and to enter into an agreement to acquire an interest in any of the Additional Guatemala Properties on reasonable mutually-agreed-upon terms.

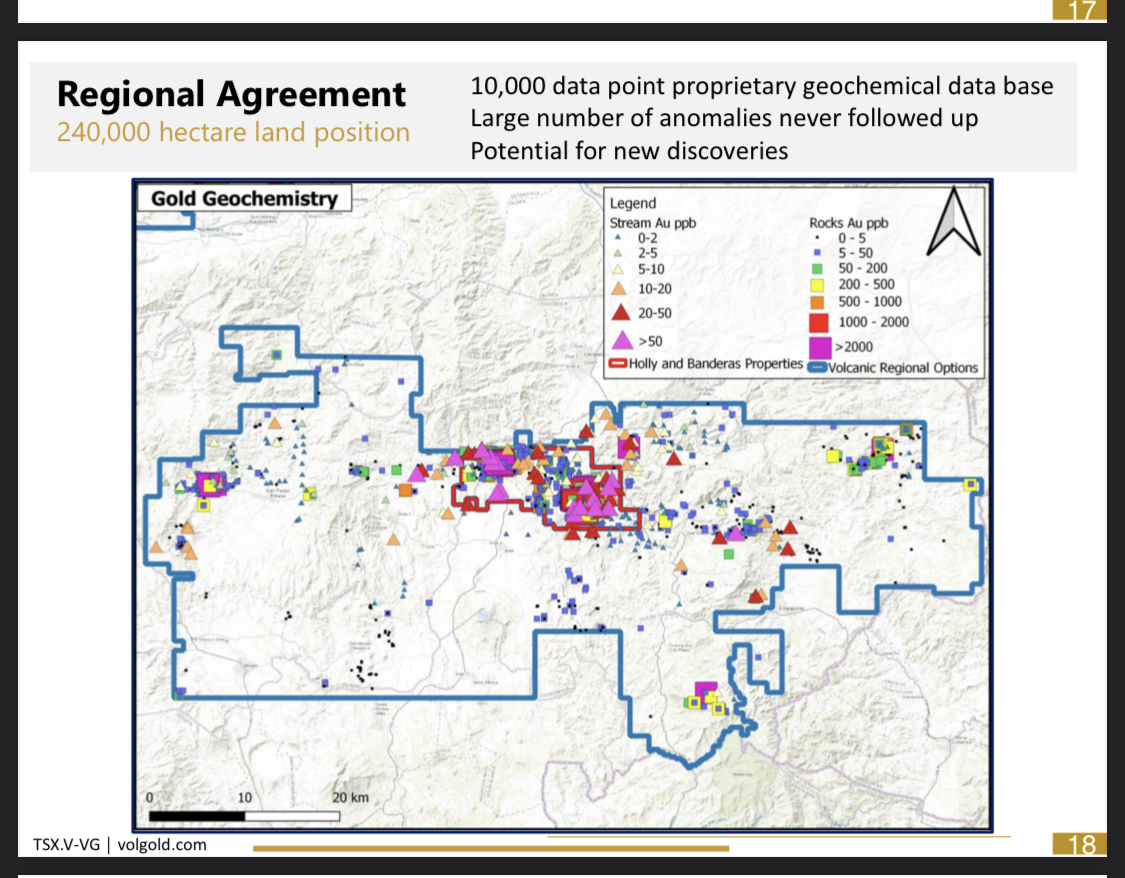

Total Land position under option: 240,000 hectare

Share Price: $ 0.54

Market Cap: $23.9 Million

Cash: $13.2 Million

Enterprise Value: $10.7 Million

Note: If you do the math their cash as a percentage of Market Capital = 55% is hard cash in the treasury, each share is backed by 55% cash, that cash serves as downside protection in my view.

Shares Issued.............44,267,480 (that’s it)

LARGEST SHAREHOLDER

Silvercorp Metals Inc. SVM.TO, market cap $1.4 billion, holds indirectly 19.9% of the issued and outstanding Common Shares and recently maintained it’s pro-rata ownership in buying an additional C$1,714,405 of shares at $0.55 in Oct. 2020 $8.6 Million financing.

Options and warrants*............................25,385,169

Warrants

Expiry Date

March 8, 2022 1,851,237 Exercise price: $5.60

July 26, 2022 11’497,330 Exercise price: $0.30

April 20, 2022 6’273’250 Exercise price: $0.70

Management Options

Expire Date

Oct 2029. 2,525,000 Exercise Price: $0.57

Other Warrants/Options (incentive, broker, etc)

Expire Date

3-5years 3’238’352 Exercise Price: $0.70

Fully Diluted shares..................................69,652,649

NOTE: Value of all warrants and options if exercised to the treasury (excluding the warrants priced at $5.60) = $11.6 Million. +40% of the warrants and options are priced 40% higher than the current price, +60% are priced higher than the current share price.

HOLLY PROJECT

Summary

• Intersection of Jocotan fault and Ipala graben fault

• High-grade mineralization

• Best drilling 6.00 m @ 43.56 g/t gold and 1,618 g/t silver

• Possible fast track to establishing high-grade gold resource

• Holly is 60km by paved road to Bluestone’s planned processing plant

-Multiple high-grade structures cutting the regional Jocotan fault

-Just 15 shallow historic drill holes (less 150 m). NOTE: JUST 15 holes drilled ever! 15 holes..

-Large scale bulk tonnage and potential high-grade feeder drill targets.

-Intersection of Jocotan fault and Ipala graben fault Key features of both Escobal and Cerro Blanco

BANDERAS PROJECT

Summary

• Large caldera and rhyolite dome complex with gold-silver rich epithermal veins and breccias extending over 9 km2

• Brecciated dome margin targets at Zapote

• High-grade mineralization in multiple drill intercepts

• Including 1.5 m @ 70 g/t gold and 516 g/t silver, and 6.7 m @ 4 g/t gold and 70 g/t silver

• Historic drilling is limited shallow holes

• 49 holes , <7500 meters, tested less than 200 vertical meters

Zapote target

-brecciated margin of the large Banderas Rhyolite dome, mostly covered by rubble and slope deposits

-3.5km strike length gold silver geochemical target - undrilled

-Vein zone-predicted to converge at depth

-Vein zone-Alteration and geological studies indicate a deep source

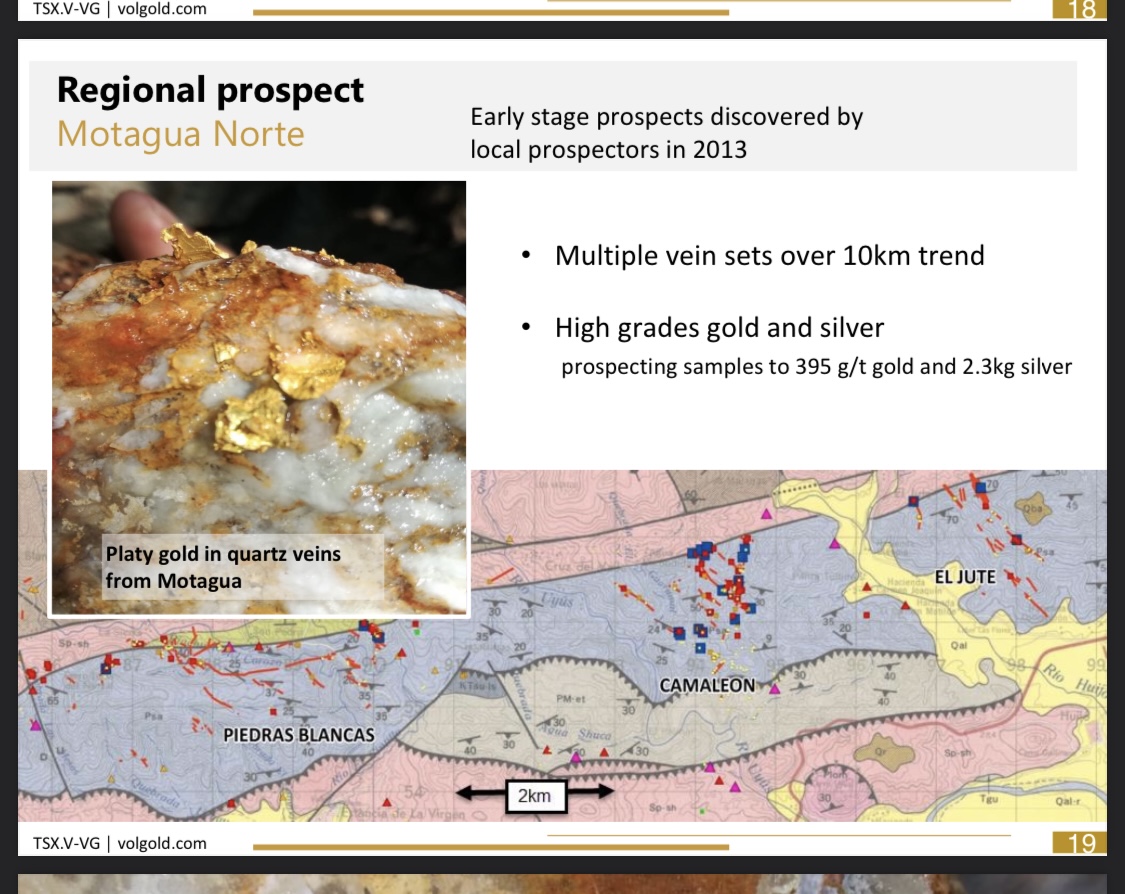

Motagua Norte

-Multiple vein sets over 10km trend -High grades gold and silver, prospecting samples to 395 g/t gold and 2.3kg silver

The Neighbours:

ESCOBAL (PAN AMERICAN SILVER)

The Escobal deposit is an intermediate sulphidation Ag-Au-Pb-Zn system. Escobal is located approximately 69 km to the west-southwest of the Holly-Banderas Property and the Property concession application package on its western boundary abuts onto Pan American’s concessions.

Escobal is located south of the Jocotán fault and hosted in veins 10 to 30 m wide that cut Subinal formation sediments as well as overlying Cenozoic intermediate volcanic rocks, and are present over a strike length of 1700 m and 800 m vertically. There are some similarities between the geology at Escobal and the Holly-Banderas Property: they are both hosted in the same volcanic-sedimentary stratigraphy to the south of the Jocotán fault, and both associated with extensional structures related to movement on the Motagua Suture Zone. A notable feature is the association at Escobal of mineralization with east trending faults and dilation jogs, a structural setting and mineralization style which also exists at the Holly-Banderas Property but which has not been significantly drill tested during previous programs.

DOC’S THEME NOTE: When discovered at first the near-surface mineralized vein size potential was deemed too small at the time to warrant further interest. It wasn’t until they drilled below 250 meters that they realized this was a huge economical discovery well over 264 million ops of silver equiv. At 300g/t

CERRO BLANCO (BLUESTONE RESOURCES INC. LUNDIN GROUP)

Cerro Blanco is a hot spring-type gold deposit. Located approximately 36 km SSW of the Project area, 1.5 million gold ozs at +10g/t

DOC’S THEME NOTE: Initial drilling at Cerro Blanco intersected wide zones of anomalous to low-grade gold and silver values, it wasn’t until the deeper drilling encounter the ore high-grade gold and silver values.

THEME: What’s the theme in this regional geologic area? Grades and width get dramatically high at depth below 200-300 meters, no one has drilled below 150 meters on Volcanic’s land package.

THE BULLET POINTS

-To date three defined mineralized zones have been encountered on the property; Holly Zone, Banderas Zone, and El Zapote Zone.

-The Holly Zone has been traced for 1.2 kilometers in length, averaging between two and six meters in width, is currently drill tested to 125 meters depth, and the zone remains open along strike and to depth.

-The Banderas Zone has been traced for 2 kilometers in length, averaging between one and three meters in width, is currently drill tested to 175 meters depth, and the zone remains open along strike and to depth. The El Zapote Zone has been traced for 1.5 kilometers in length, with an unknown width estimated to be between 2 and 10 meters, is untested at depth and the zone remains open along strike and to depth.

-Drilling on the Holly-Banderas Project has included both Reverse Circulation (RC) and Dimond (DDH) drilling. Between 2002 and 2011, 14 RC holes totaling 2,153 meters and 49 DDH holes totaling 9,139 meters were completed.

-Overall, between 2002 and 2011 drilling on the Holly-Banderas Project totals 63 drill holes, with 15 on the Holly Prospect and 48 on Banderas. Drilling on the Holly-Banderas Project resulted in 45 mineralized intercepts which average 2.7 meters in length (unknown true width) and with average grades of 7.1 g/t Au and 135 g/t Ag.

-Drilling at the Holly Zone includes 11 mineralized intercepts which average 4.9 meters in length (unknown true width) and with average grades of 9.4 g/t Au and 315 g/t Ag.

-Drilling at the Banderas Zone includes 34 mineralized intercepts which average 2.0 meters in length (unknown true width) and with average grades of 6.4 g/t Au and 77 g/t Ag.

-The average drill hole length is approximately 145 m, with the majority of these at a plunge of -45 to -60 degrees. Consequently, the mineralized systems have rarely been tested to depths greater than 150 m, on any of the prospects, and the Holly and Banderas projects warrant significant further drill testing to get to the boiling zone where these types of deposits concentrate gold and silver. Imagine if they are getting economical grades and widths above the Boiling Zone from fluids that leaked up and out, what could be there?

Other Considerations for successful future mine…..

INFRASTRUCTURE

The Project is located ~15 km south of the town of Chiquimula, population, according to the 2018 Population Census, of 111,505. Logistics can easily be carried out from this regional hub, capital of the same-named department. Local labor in the Project area is easily sourced, most commonly from the closest village or town to particular Project activities. Radius’ subsidiary company MSP maintains an exploration office near Chiquimula, as well as a corporate office in Guatemala City.

The Holly-Banderas Project is an exploration stage project and to the extent relevant there has been sufficient surface rights for exploration activities, as well as sufficient availability and sources of power, water, and personnel, needed to support exploration and drilling activities.

GEO-PORN TIME

Bulk tonnage potential.

LOOK AT THE SIZE OF THE FAULT and the cross-cutting shear zone, the Fault independently hasn’t been drill test.

Road cut through the Jocotan fault, 150m wide regional mega shear – not drill tested

The intersection of Jocotan fault and Ipala graben fault Key features of both Escobal and Cerro Blanco

High-grade mineralization Best drilling 6.00 m @ 43.56 g/t gold and 1,618 g/t silver

Just 15 shallow historic drill holes (less than 150 m)

Possible fast track to establish high-grade gold resource, Holly is 60km by paved road to Bluestone’s planned processing plant

Holly Ridge

Large scale bulk tonnage and potential high-grade feeder drill targets.

Banderas Project

Zapote 3.5km strike length gold-silver geochemical target– UNDRILLED

-Banderas Target Gold Silver Veins within rhyolite dome

-Zapote Target Brecciated dome margin +3.5km trend open

LOOK AT THE SIZE of the GOLD IN ROCK DISTRIBUTION, the square boxes, and that’s at the surface.

GEOLOGICAL SETTING AND MINERALIZATION

REGIONAL GEOLOGY

The geology of Guatemala consists of two major crustal blocks, the Maya and the Chortís Blocks, part of the North American and Caribbean tectonic plates, respectively, separated by the Motagua Suture Zone (“MSZ”) a composite suture zone some 400 km long and up to 80 km wide that links the Cayman trough pull-apart basin in the Caribbean Sea to the subduction zone of the Cocos plate (Ratschbacher et al., 2009). Figure 7 shows the geometry the Caribbean, and Cocos plates in relation to Guatemala and the Project.

The Chortís block, which encompasses much of northern Central America, including all of Guatemala south of the MSZ, consists of a basement of Precambrian to Paleozoic continental metamorphic rocks. The Maya block to the north of the MSZ similarly consists of basement metamorphic rocks of continental origin. The two blocks contain different suites of high- pressure assemblage rocks of different ages (Harlow et al., 2004), and are generally interpreted as representing the collision of the North American and proto-Caribbean plates along a subduction zone during the Cretaceous (Ratschbacher et al., 2009). The generalized geology of the southeastern part of Guatemala is shown in Figure 8.

The MSZ developed as a sinistral wrench fault zone from the Late Cretaceous – Early Cenozoic due to differing velocities of the Caribbean and North American plates, and movement on the suture is ongoing to the present. The MSZ encompasses three major faults systems representing the time-evolution of the suture (from north to south the Polochic, Motagua, and Jocotán–Chamelecón faults), as well as ophiolitic serpentinite, jadeite, and eclogite representing relics of Cenozoic ocean crust preserved in the collision zone. In Guatemala, the Chortís block metamorphic rocks are largely covered by Cenozoic volcanic and volcano- sedimentary rocks and Quaternary bimodal volcanic rocks.

Recent plate tectonic reconstructions (Rogers & Mann, 2007) suggest that the Jocotán – Chamelecón fault was active from the Early Miocene (20 Ma) to the Late Miocene (8 Ma), at which point the plate boundary shifted northwards to the Polochic fault. The Polochic was the main plate boundary until the early Pliocene (4 Ma), after which movement began on the Motagua fault. Recent work suggests the possibility that the plate boundary today encompasses more than simply the MSZ, as evidence suggests that neither the Polochic nor the Motagua fault extends all the way to the Cocos plate subduction zone (Guzmán-Speziale, 2010). Instead, it is proposed that the Ixcán fault, located in Guatemala north of the Polochic, and the Concordia fault located in southeast Mexico, are both also part of the plate boundary deformation zone, indicating that it is probably more complex than previously imagined. The Motagua, Polochic, Ixcan and Concordia faults are all historically and recently active (Lyon-Caen et al., 2006, Guzmán-Speziale, 2010). Estimates from the Cayman trough indicate total Cenozoic displacements of the plate boundary zone of over 1000 km (Rosencrantz et al., 1988), but there is controversy as to how much displacement was accommodated by the faults of the MSZ (e.g. Donnelly et al.,1990). South of the MSZ, extensional deformation presents a variety of orientations and types: both fault-perpendicular and -parallel grabens and normal faults have been described. The crustal domains separated by fault-perpendicular normal faults had been previously interpreted as crustal blocks rotating around the bend formed by the MSZ at the southern edge of the North American plate (Burkart & Self, 1985). More recently, the styles of extension seen south of the MSZ have been interpreted to be functions of the divergence angle between plate movement vectors and azimuth of the plate margin fault (Rogers & Mann, 2007). As these vary spatially and temporally due to fault geometry and shifting of the principle plate boundary fault from the Jocotán to the Motagua, multiple and overlapping expressions of the extension are to be expected.

PROPERTY GEOLOGY

The Property, near its northern boundary, straddles the Jocotán fault and extends southwards into the Cenozoic and Quaternary volcanic and volcano-sedimentary rocks of the Chortís block, Caribbean plate. Nomenclature interpretation of lithologies encountered on the Property and their geological context has varied between workers and companies over the time period the property has been explored.

LITHOLOGIES

The Project area lithologies are well-described in a regional context by Donnelly et al. (1990), and the generic descriptions given below are largely taken from this work. As encountered in the Project area roughly from north to south (see Figure 9), they are summarily described as follows:

Santa Rosa Group phyllites:

The rocks exposed to the north of the Jocotán fault in the Project area consist of quartz- mica phyllites probably belonging to the San Diego phyllites. These were originally correlated with the Santa Rosa Group, which is generally defined as encompassing all the late Paleozoic clastic sedimentary rocks of the Maya Block. The Group comprises sandstones and conglomerates in its lower part, and grade to shales in the upper. Santa Rosa Group rocks are extensive in outcrop in western Guatemala and Chiapas, Mexico, and thin eastwards.

Subinal formation conglomerates:

Widespread in southeastern Guatemala, the Cenozoic-aged Subinal formation consists of fluvial red sandstones and conglomerates, with frequent scattered tuff beds throughout and minor evaporite beds. Age dating of an andesite clast in a conglomerate yielded a K-Ar age of 42 Ma (Deaton & Burkart, 1984). The thickness of this unit varies regionally in southeastern Guatemala from 100 m to 1000 m (Burkart, 1965). On company maps these are frequently referred to as La Joya sequence sediments. Padre Miguel Group volcanics:

These Miocene-aged ignimbrites, lahars, air-fall ash, sandstones, conglomerates, and basalts overlie the Subinal formation conglomerates. They are widespread across most of southern Guatemala, western Honduras, northern El Salvador and Central Nicaragua. The ignimbrites of the Padre Miguel formation have been dated as erupting between 19 Ma until 14 Ma, but the age of the volcanic rocks on the Property is unknown. The most recent Padre Miguel group volcanic rocks in southeastern Guatemala have been assigned the name San Jacinto formation (Reynolds ,1980), and most workers on the Property have assigned to it the volcanic rocks.

Quaternary volcanics:

Basalt flows cap the Cenozoic volcanic rocks. On government maps, these are all interpreted as Quaternary, although there is some evidence that some of these are as old as 13 Ma, while others are as recent as Holocene. Volcanic morphology is generally well preserved in all cases, and it is difficult to distinguish on the basis of morphology lone.

STRUCTURES

The dominant mapped orientation of geological structures on the Property is NNW (Figure 9), and these correspond to normal extensional brittle faults that cross-cut all lithologic units. Mineralization appears to be associated with NNW trending faults and is itself cross-cut by post-mineral faults in the same general orientations.

A topographic lineament analysis map of the Property is shown in Figure 10. It includes a gradient map of the tilt angle of the digital elevation model and the results of a structure detection algorithm applied to the same data. Tilt angles are frequently used to highlight structural features in magnetic data. However, when faults have a topographic expression, the same technique can be used to interpret topographic data. The Jocotan Fault which crosses the northern portion of the area WSW to ENE is evident most notably in the segment near the Holly Zone. The general NW grain of the gradient image is reflective of the dominant fault pattern on the Property, but the structure detection algorithm interprets several NE trending structures on the Property, whose meaning is less clear, but possibly indicative of less obvious structural features or volcanic edifices.

DEPOSIT TYPES

The Banderas, El Zapote, and Holly zones display compositional, textural, alteration, and rock association characteristics consistent with a low sulphidation epithermal Au-Ag mineralized environment, and some characteristics consistent with a intermediate sulphidation epithermal environment. Low and intermediate sulphidation epithermal deposits can be summarized as follows:

LOW SULPHIDATION EPITHERMAL DEPOSITS

Low sulphidation epithermal deposit types are typically associated with subaerial bi-modal volcanic suites in extensional settings, and result from the boiling of hydrothermal waters and metal deposition in veins along fluid conduits, typically brittle faults and permeable lithologies. They are not usually proximal to intrusive magmatism, although a distal heat source is usually posited. Deposits present vein-filling crustiform and collo form quartz and chalcedony, and carbonate- replacement textures (bladed quartz after calcite). Open-space veins, banded veins, and vein breccias dominate, but stockwork ore is common. Most deposits show complex histories as fluid conduits open, deposit quartz and metals, seal, brecciate and re- open, re- deposit, etc. Sulphides are typically on the order of < 1-2 vol %, with Au ± Ag as the main metals, with minor Zn, Pb, Cu, Mo, As, Sb, and Hg. Mineralogy of sulphides is pyrite ± arsenopyrite plus minor base metals minerals. The Ag:Au ratio in low sulphidation deposits is typically <15. Alteration assemblages associated with the fluid conduits are typically zoned outwards, with quartz-adularia associated with mineralization, an alteration halo in the host rock that includes smectite and illite-smectite at shallow levels and illite-adularia at deeper, more metal- favourable levels. More distal propylitic alteration assemblages are common. Nearer to paleo- surfaces, more acidic phases such as alunite, kaolinite, and opaline silica are often present at the sinter level. The fluids which give rise to the types of deposits are of near-neutral pH and meteoric or mixed meteoric-magmatic in origin, at fairly low temperatures (<250°C). The metal productive zone is generally considered to be from >200 m to up to 700 m below the paleo-water table, depths that correlate with illite alteration in the wall rock and banded quartz to quartz vein textures. Most known low-sulphidation epithermal deposits are Cretaceous in age or younger, although examples as old as Archean are known. This is most likely due to preservation, as due to their high levels of emplacement relative to paleo-topography, older epithermal deposits are more likely to be eroded away than younger.

INTERMEDIATE SULPHIDATION EPITHERMAL DEPOSITS Intermediate sulphidation epithermal deposits are texturally very similar to low sulphidation deposits, with many of the same characteristics: crustiform and colloform quartz, vein breccias and stockworks, etc. Typically, these deposits have Ag:Au ratios in the hundreds to thousands, sulphides on the order of, and contain between 0 and 5%lead and zinc. The hydrothermal systems giving rise to these types of epithermal deposits are frequently interpreted as having a more important magmatic component than in the case of low sulphidation deposits.

Some recent examples of the mineralization their neighbor have drilled:

That's enough for now. Enjoy.

"Doc Jones: I’m enjoying early retirement after a long, successful, and fulfilling career as an investment professional with a focus on the resource sector (including oil and gas). I employ common sense, Fundamental, bottoms-up analysis that incorporates but not limited to currency exchange rates, cost of labor, raw materials cost, geology, Metallurgy, cost of capital, infrastructure, macro influencing factors, capital discipline by management, etc.

Research, research, research.

I run a highly concentrated and focused portfolio. If you want to invest alongside me, do your own due diligence, it’s your money, your responsibility.

The best investment you can make is in your own education.

I am driven by the hunt for value and truth. This is my passion in life. I’m a big research nerd. Always double-check and only trust the numbers that you have vetted.

Commit to memory: “all ozs in the ground are NOT created equal” understanding this basic principle will increase your wealth and your ability to sleep at night...

Best,

Doc Jones"