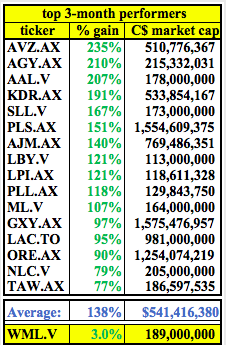

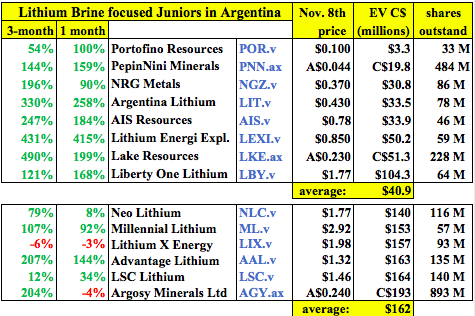

Wealth Minerals Ltd. (TSX-V: WML) / (OTCQX: WMLLF) has been completely overlooked in a spectacular 3-month rally in many, many lithium (“Li“) juniors. The average return of the 16 lithium stocks listed below is 138%, by comparison, Wealth is up just 3%. These aren’t micro-caps, the average market cap = $541 M. In this article I ponder why that might be.

Lithium Americas (TSX: LAC) / (OTCQX: LACDF) hit the $1 billion market cap milestone last month when the share price touched $2.27 and again at the split adjusted price of $11.25 on November 8th. Almost all, I estimate 90%, ($900 M) of that valuation, is ascribed to the Company’s JV with SQM (NYSE: SQM) in Argentina, on the world-class Cauchari-Olaroz project. 100% of that project, sitting on 70k hectares in the Jujuy province of northwestern Argentina, is now valued by the market at nearly $2 billion. [LAC owns 45.75% of the project, so $900 M / 0.4575 = $1.97 billion]

Cauchari-Olaroz has a BFS on it, off-take agreements in place, is fully-funded, and is expected to be in production within 2 years. The takeaway– a world-class, sizable, (but not giant), high-grade, (but not ultra-high-grade), Li brine project that’s 2 years from commercial production in Argentina is valued at roughly $2 billion. Cauchari-Olaroz is an important benchmark valuation because individual lithium brine projects are hard to value if they are part of a much larger company like SQM or Albemarle Corp. (NYSE: ALB) or sizable junior like Galaxy Resources (ASX: GXY).

Orocobre Ltd. (ASX: ORE) is the other best comp for stand-alone Li brine operations. ORE has a market cap of $1.25 billion, and it owns 66.5% of its flagship Salar de Olaroz lithium facility. Assuming that 90% of Orocobre’s valuation is attributable to Salar de Olaroz, 100% of this producing operation is valued by the market at ~$1.86 billion. This, for an operation running at an annual rate of ~14,000 tonnes of lithium carbonate per year (~9,310 tonnes (66.5%) attributable to Orocobre).

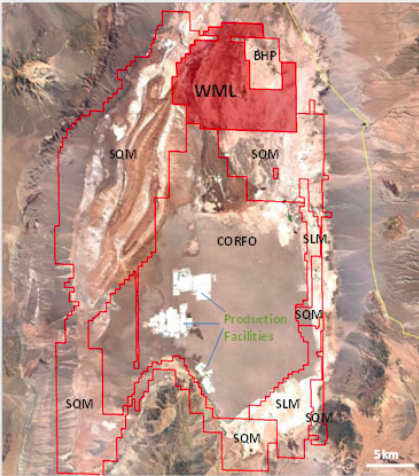

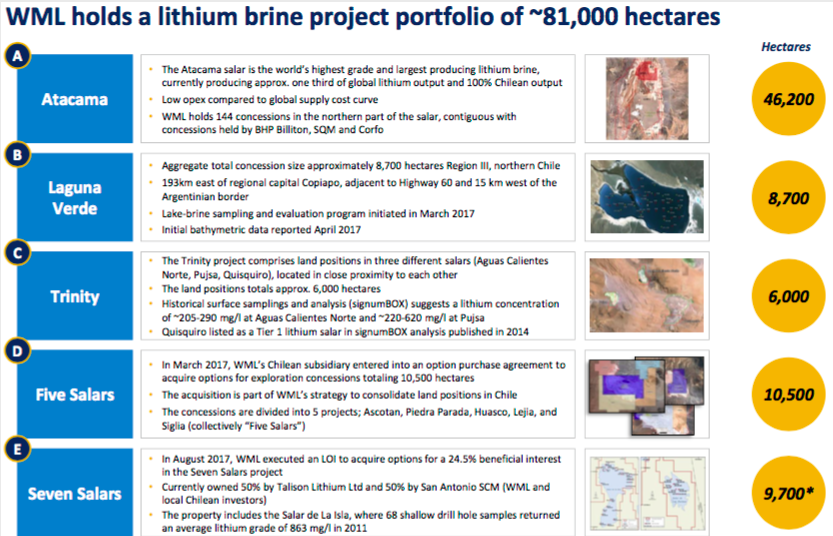

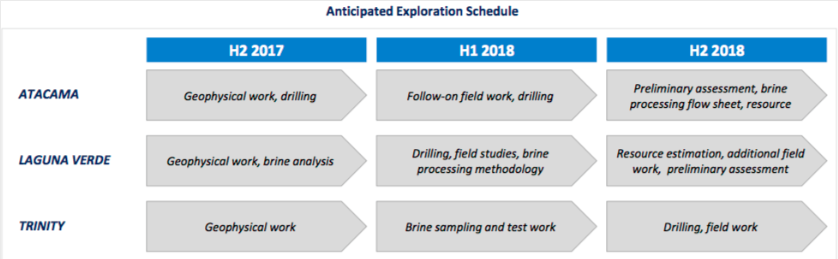

What does this portend for Wealth Minerals’ Atacama project in Chile? Consider Wealth’s crown jewel project, it controls 100% of 46,200 hectares in the single best salar on earth. The Atacama project is larger than many entire salars that peer projects in Argentina are on. The Li grade that Albemarle and SQM are working with at their respective production facilities is more than double that of Cauchari-Olaroz. I remind readers that Wealth has no exploration results /data (yet) on their Atacama project, but they are within 40-50 km of the world’s best Li brine mines.

Wealth’s project will probably not be put into production by Wealth, but by a battery, car, utility or larger Li company in partnership with Wealth and/or a Chilean entity. Even if Wealth’s project is 6 years from initial production, it’s still worth a tremendous amount in today’s dollars. I see no reason why Wealth’s Atacama project could not be a $2 billion project like Cauchari-Olaroz. How much might a $2 billion project in 4 years (at which time, like Cauchari-Olaroz, it would potentially be 2 years from production) be worth today?

How much would it be worth to a major that could comfortably afford to fund the project (call it US$1 billion in total funding over 6 years). A company like Volkswagen, Daimler, BYD, SAIC, LG Chem? I believe it could be worth a lot more than Wealth’s entire market cap of $189 M.

There are probably over a hundred significant EV manufacturers / battery makers (+ cathode material suppliers) / Li producers / energy storage & utility companies, plus — commodity trading houses & investment groups– that are trying to 1) secure Li off-take agreements, or 2) invest directly in Li projects, or 3) invest in Li juniors. How many meaningful brine and hard rock projects (say, 15k tonnes of LCE/yr. or more) are there in the world that could possibly be in production within 6 years? I’m guessing 30-40 have a reasonable shot and 15-20 might make it into commercial production by 2023-24.

Of those, several are already spoken for (at least some strategic investor(s) / off-take agreement(s) already in place). So, 100+ groups fighting for perhaps 12-15 viable projects.

Wealth’s Atacama project represents just ~60% of the Company’s entire land package in Chile. So, Wealth could sell Atacama outright and still have a top Li junior in South America (with the best early-stage Li assets in Chile). Away from the Atacama project, there are still ~35,000 net hectares remaining, including the 7 salars & 5 salars projects.

Compared to LAC’s Cauchari-Olaroz valued at nearly $2 billion, Wealth Minerals’ entire market cap = $189 M. Attributing 60% of that $189 M = $113 M, to the Atacama project, suggests that Cauchari-Olaroz is valued at approximately 18 times that of Wealth’s Atacama project. To be fair, Wealth’s project is very early-stage, probably 6 years from commercial production, whereas the LAC/SQM project is within 2 years of production. Still, 18x the valuation seems a bit steep to me. I fully expect that valuation gap to shrink as exploration results from Wealth begin to hit the market.

Here’s another company for readers to think about; AVZ Minerals’ (ASX: AVZ) 60%-owned Manono project in the Democratic Republic of Congo (“DRC“). 100% of AVZ’s project is valued by the market at $851 M (1.773 billion shares outstanding x A$0.295 share price) divided by 60% ownership of Manono). Manono is relatively early-stage, (there are some drill holes on it), and it’s a massive hard rock project, one of the largest in the world.

However, the DRC is a highly risky place to do business and there’s virtually no nearby infrastructure. The nearest seaport for the export of Manono’s Li to Asia is about 2,400 km away. There needs to be hundreds and hundreds of kms of road & rail line constructed for the project to get off the ground. A hydro-power plant needs a significant overhaul as well.

That’s lots of moving parts for a dangerous and unpredictable country in Africa, a country known to North American investors for child labor abuses. Yet, Manono is valued at ~7 times that of Wealth’s flagship Atacama project.

Chile has the single-best Li brine bearing salars in the world, the lowest-cost production in the industry comes from Chile’s Atacama salar where SQM and Albemarle continue to print money by evaporating water. Yet investors are willing to pay ~7 times the valuation to potentially develop a world-class Li asset in the DRC? And, ~18 times Wealth’s Atacama project valuation to set up shop in Argentina with a project that’s well more advanced, but possibly smaller in size & grade than what Wealth’s Atacama project could become?

Clearly there’s a big disconnect, Chile is suffering from negative investor sentiment (with regard to Li) while neighboring Argentina a enjoying strong positive sentiment. That’s why a number of Argentina focused Li brine juniors have soared in recent months (see chart). However, when sentiment changes, there will be a tsunami of investment capital flowing into Chile. There aren’t that many boats to get lifted, Wealth Minerals is one of the few.

What will it take to improve investor sentiment for Li juniors in Chile? That’s simple. Investors want clarity on the rules, regulations, royalties, taxation of non-domestic Li companies. Investors want to know for sure that Wealth Minerals will be permitted to exploit and sell Li outside of Chile. Clarifications are coming, it’s taking a long time, but they’re coming. The powers that be are expected to put in place a new set of guidelines in 1q 2018.

In the meantime, I’m told that Codelco’s ongoing process of choosing an international partner to develop its Maricunga Li project will unfold in coming months (perhaps as soon as this month) and that it will demonstrate some of the new rules & regulations that will be formalized next year.

Once the investment world becomes more comfortable with Chile being open to new Li players, it will be increasingly difficult to justify the large relative valuation discounts mentioned earlier. At the same time, the interested parties that have been looking at various funding and strategic initiatives with Wealth will gain the added confidence to make a move.

As readers know, many of the players looking for Li security of supply have Enterprise Values (“EV“) well into the US$ billions / tens of billions. Wealth’s EV is ~US$ 146 M. I think the odds are way better than 50/50 that Wealth Minerals (TSX-V: WML) / (OTCQB: WMLLF) executes on one or more transformational corporate initiatives over the next few months.

Initiatives like a major farm-out of the Atacama project, a strategic investment in the Company by a prominent industry player (Auto or Battery maker, large Li Producer, Utility, Private Equity or Sovereign Wealth Fund) or an outright sale of the Company. Any of these events would likely cause Wealth Minerals shares to rally, perhaps by a lot.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Wealth Minerals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Wealth Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Wealth Minerals and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.