This week gold attempted to break-out above $1360 for what is essentially its 3rd attempt to surpass the vaunted level this year (and 4th time in the last eight months). While the failed breakout, and $30+ downside reversal, certainly isn't what gold bulls were hoping for, it's not time to panic and throw in the towel on gold just yet.

Gold (Daily)

So far June gold futures have been as low as $1336.70, essentially back to where the market was trading Tuesday morning before fears of World War Three took hold of market participants. While $1340 is of some significance, a much more important layer of support exists down near $1325-$1330.

I view the price action of the last couple of days to be primarily noise driven, however, the burst above $1360 on heavy trading volume has certainly served to 'soften up' some of the resistance between $1360 and $1370. In fact, I view the odds of a successful breakout on the next push above $1360 to be quite good. This means that the current shakeout could be the final one before a much awaited rally above $1400 takes place.

While there has been a great deal of noise in markets this year, especially in gold, it's worth noting that gold is clearly benefiting from some fundamental demand in the face of rising real interest rates:

US 10-Year Treasury Real Yields

While the decline in the US Dollar Index has provided a tailwind to gold priced in US dollar terms, the move in bonds and rates has been much more substantial in magnitude. In addition, gold has historically traded with a strong negative correlation to real rates - the fact that this correlation has turned more positive recently is highly noteworthy (in a bullish way).

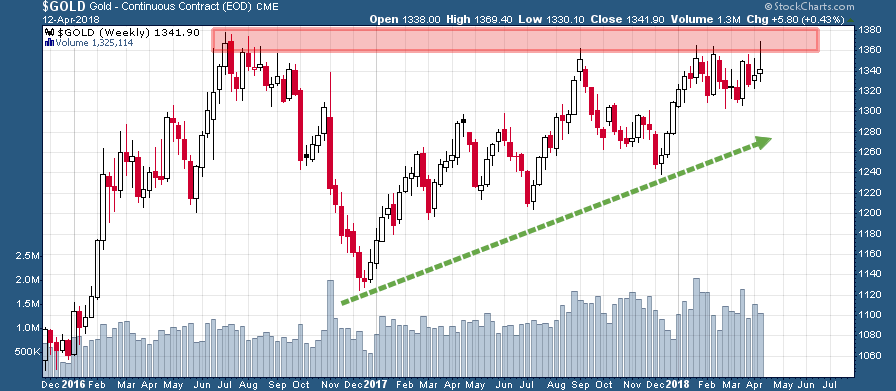

Correlations go through cycles just like price, just when we think we've got a certain market figured out the correlations shift and trading algos go haywire. While there are a multitude of variables which affect the day-to-day price movements of gold, the trend in price since the December 2015 low is clear:

Gold (Weekly - December 2015-April 2018)

The simplest analysis is the best analysis and price action in gold since December 2016 has been characterized by higher lows, higher highs, and repeated tests of the same area of resistance. ($1360+). Therefore, while another failed breakout in gold isn't great news for gold bulls, this week's price action hasn't done anything to fundamentally alter the longer term technical picture. From a long term structural standpoint another downside shakeout is actually healthier than a fleeting upside price burst on fears of military conflict between Russia and the US.

A dip back to US$1300 in gold would be a gift and gold bulls should buy that dip!

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.