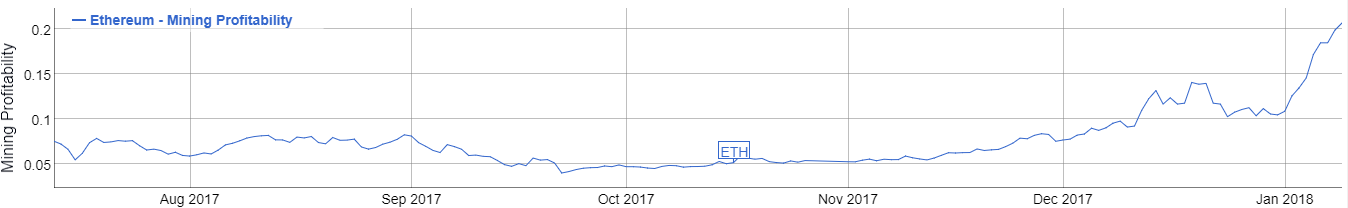

Ethereum mining profitability has soared in recent weeks in unison with the price of Ethereum:

In addition, Ethereum now holds a record high percentage of the total cryptocurrency market (~17.5%) while Bitcoin now holds a record low percentage of the total market (~33%).

A company which I have been following since it began trading on September 18th, HIVE Blockchain (TSX-V:HIVE, OTC:PRELF), has focused on mining Ethereum (it also mines to a lesser extent Z Cash and Ethereum Classic). HIVE has been aggressively building out scale at an unprecedented pace during the last 3 ½ months. With its recent C$115 million capital raise HIVE is expected to be able to fully fund the completion of the 20.0 MW Sweden Bitcoin Data Centre and the 6.8 MW Phase 3 Expansion at the Sweden GPU Data Centre.

Upon completion of all planned phases HIVE will have a total of 24.2 MW of GPU-based and 20.0 MW of ASIC-based mining capacity across Sweden and Iceland. One of the knocks on HIVE has been the company’s lack of transparency regarding hashing power which would allow analysts to more accurately forecast the company’s rate of mining and the size of its coin portfolio. However, it’s not difficult to develop a rough estimate of HIVE’s profitability as well as an estimate of the size of its current cryptocurrency coin portfolio.

I estimate US$25,000 in gross revenue for each 1 MW of mining capacity using a US$1,000 price for each Ethereum coin. Once the planned build-out is fully completed that would mean US$610,000 in daily GPU-based revenue – using a ~65% gross margin (derived from the margin seen in financials reported on November 29th) these estimates would translate to US$400,000 in daily EBITDA which would in turn translate to US$146 million in annual EBITDA from GPU-based mining.

If we add in the planned 20.0 MW of ASIC-based mining capacity (Bitcoin and Litecoin are mined using ASIC-based hardware) and use similar gross revenue estimations and gross margins we are able to derive an additional US$325,000 in daily EBITDA (~US$119 million in annual EBITDA). We now have US$265 million of annual EBITDA using conservative crypto prices (below current market levels), but now it’s time to factor in depreciation (very important for tax purposes). HIVE is able to depreciate its mining equipment and data centers at a rapid rate which reduces taxable income. Once all planned phases are built-out HIVE could easily depreciate up to US$25 million in the first year. If we then subtract US$50 million of G&A expenses (general and administrative) we get US$190 million of pre-tax net income. Given the favorable tax status that cryptocurrencies have in Switzerland, where HIVE’s trading operations are located, US$190 million of pre-tax net income likely translates into at least US$160 million of after tax net income.

What is US$265 million of free cash flow and US$160 of after tax net income worth in the market these days? Putting a 10x multiple on the net income number gives us US$1.6 billion which equates to roughly C$6.75/share for HIVE shares (using a $1.25 USD/CAD exchange rate and a 300 million share count for HIVE). At HIVE’s current share price of C$3.40 we could say the market is giving HIVE a 5x earnings multiple for these future earnings and quite likely not even factoring in growth, more likely the market is expecting cryptocurrency mining margins to decline towards zero over time. If you believe like I do that cryptocurrencies could eventually grow to a multi-trillion dollar market and that Ethereum will grow to be the largest cryptocurrency by market cap then HIVE is a great way to position yourself.

To be clear, this is a rough analysis and I am going on the best available information I can find until we receive the next quarterly financials at the end of February. I feel like I was probably conservative in some of my analysis including G&A (too high), tax rate, and crypto prices.

There are a few catalysts which I anticipate can help move HIVE’s valuation back towards the upper end of its historical price range:

- Announcement of completion of Phase 1 in Sweden.

- HIVE shares added to more ETFs as they begin trading, such as Reality Shares Nasdaq Blockchain Economy Index.

- An announcement regarding institutional block sales of newly mined “virgin” coins – this is another area of the cryptocurrency market in which HIVE is a pioneer.

- Quarterly earnings report (end of February).

HIVE also has another advantage by being located in extremely safe jurisdictions with low temperatures and low energy costs (Iceland and Sweden). The importance of jurisdiction was recently highlighted by China’s government announcing that it will be unwinding its cryptocurrency industry. HIVE shares look cheap to me and a double from current levels over the next 12 months seems like a reasonable, and actually potentially conservative, forecast.

From a technical chart standpoint HIVE looks like it’s getting ready to make a big move soon (low volume and narrow range consolidations often precede high energy, high volume breakouts) – a breakout above C$4.15 would target a move up to C$5.25 and send HIVE shares well on their way back towards the all-time high and my fundamental fair value target of C$6.75:

HIVE.V (Daily)

Do your own due diligence. It’s your money and your responsibility.

Disclosure: Author is long HIVE shares at the time of publishing and may buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, publicly available information including from HIVE’s corporate presentation, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.