The situation is rather bleak for Bitcoin and the cryptocurrency space as a whole today. It's not just the 24-hour percentage losses that are the problem, it's where we've been and how we got to this point that's the bigger problem:

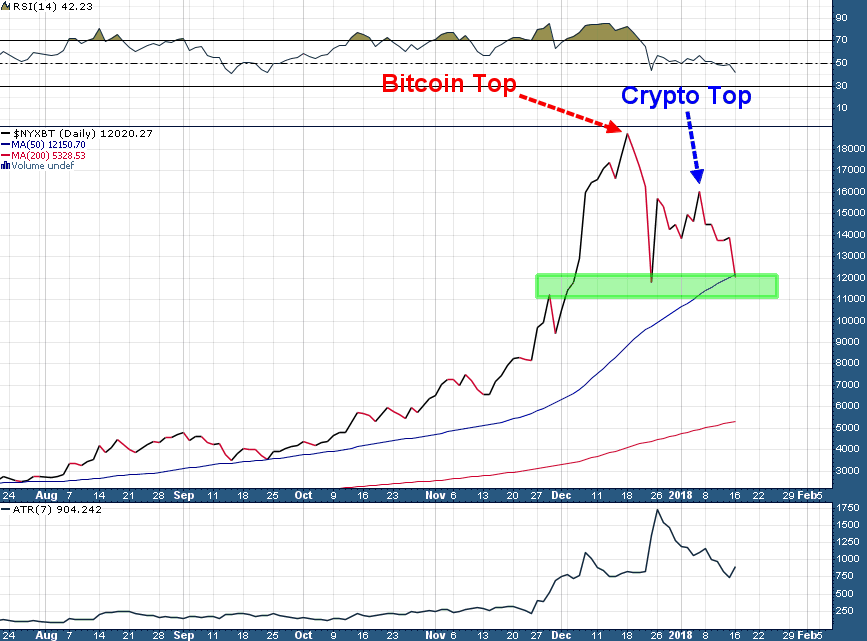

NYSE Bitcoin Index (Daily)

I could use a dozen charts to make my point here, however, simple and concise is usually better. Bitcoin peaked just below $20,000 on December 17th, however, the entire cryptocurrency space (all those alt-coins such as Ripple, Stellar, Dash, etc.) continued to rally for three more weeks after Bitcoin had peaked; total cryptocurrency market capitalization reached roughly US$830 billion at its peak on Sunday January 7th, 2018.

This 'divergence' between Bitcoin and the entire sector is important and adds to the bearish backdrop right now. Here's why:

- The daily all-time highs in Bitcoin we saw throughout October, November, and into December served to generate enormous enthusiasm in cryptocurrencies.

- This enthusiasm caused a huge rush of retail investors to chase the sector (more than 100,000 Coinbase accounts opened on a daily basis, Binance closing to new accounts, etc.).

- It has been the retail rush during the last couple of months (basically since Thanksgiving) that caused the alt-coins to keep rising even after Bitcoin had topped. In fact James Altucher's 'Master Course' hooks people in by promising to help you "find the next Bitcoin."

What has happened since January 7th (crypto market cap all-time high) is extremely important because this is the first correction (now a crash and no longer just a correction) that this herd of retail bandwagon crypto investors has experienced, and it's a brutal one. It began as a slow bleed (as it usually does) last week and has since accelerated into an avalanche of selling.

What happens next is even more important. The crypto herd doesn't have a plan to sell, after all any time a crypto bull is asked any question about selling they usually respond with something like "I'm HODLing (holding forever)". I wonder if they will still be HODLing if Bitcoin breaks through the green shaded rectangle in the chart above.

This is a unique and crucial moment for the cryptocurrency sector and nobody knows what's going to happen next; we've never seen a market like cryptocurrencies (more retail participation than institutional participation, no short selling, essentially zero regulation etc.) and we've certainly never been here before. However, human psychology doesn't change much over time and based upon the context of how cryptos got to this moment it seems to me like there is a good chance of further downside in the short term.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.