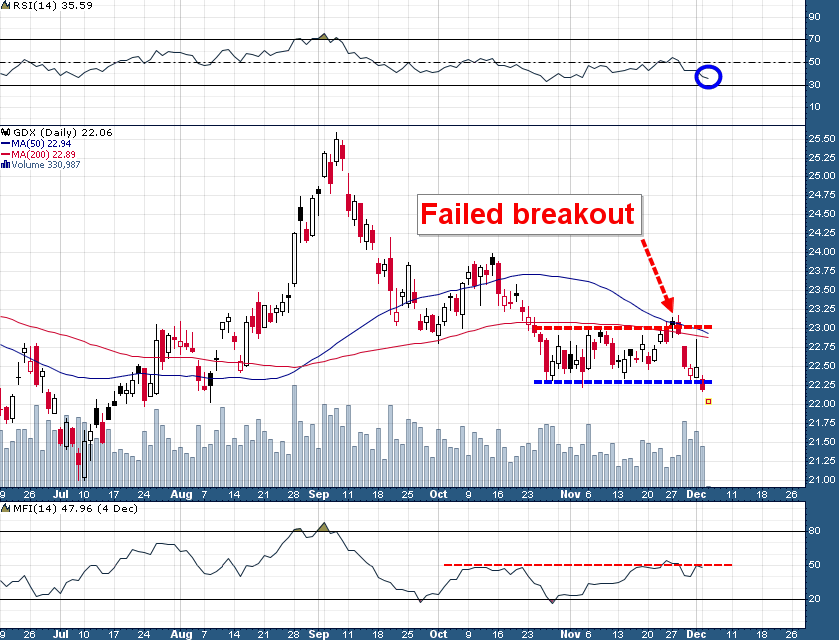

The gold mining sector as represented by the GDX is experiencing follow-through selling after breaking key support yesterday:

GDX (Daily)

A failed breakout above resistance ($23.00) at the end of November has resulted in a fairly sharp downside move in the last week. The fact that GDX is not close to being oversold means that a larger downside move, perhaps to test the July lows near $21, may be in order.

To find out how Goldfinger is trading the gold mining sector, as well as individual equities and ETFs subscribe to the Trading Lab today!

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.