Gold has broken below support at $1310 this morning and the GDX is set to open near a crucial area of confluence:

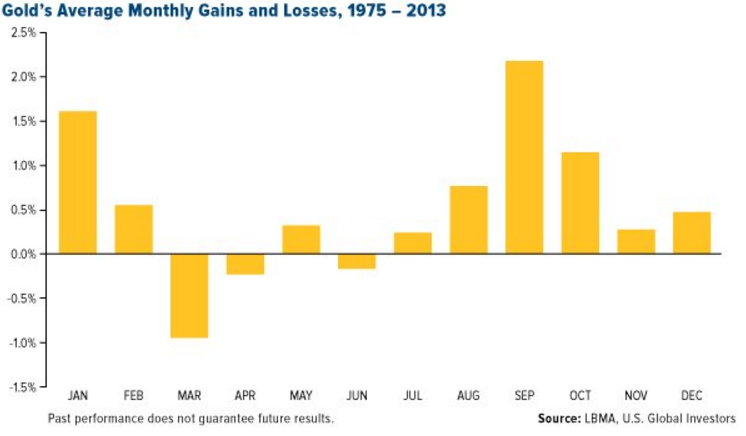

The gold miners have now shed roughly 20% since the August peak and we are now entering the most bullish month of the year for sector. Although gold has fallen four consecutive years during the month of September, going back to 1975 September has been a very strong month historically:

Gold and the miners are facing an interesting moment; either buyers are about to show up and support near $25 on GDX and $1300 in gold will hold OR the correction is about to transition into a much deeper bear market cycle. With the Labor Day weekend and the seasonal transition into the fall my intuition tells me that a tradable bottom is close at hand (1-2 days).

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher ofEnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.comfor important risk disclosures. It’s your money and your responsibility.