A hot topic of conversation during the last week has been the performance of gold mining shares as gold has, to some extent, broken out to the upside. The two largest trading vehicles to gain exposure to the gold mining sector are GDX and GDXJ; GDX is sitting just below its flat 200-day moving average while GDXJ is quite a bit under its 200-day moving average.

During the last few trading sessions we have seen some pronounced underperformance in GDXJ with this ETF trading as much as 3.5% lower during yesterday's session while gold itself was barely changed on the day. Some of this certainly has to do with changes being made to this ETF in order to accommodate its larger size, however, the fact is that the entire sector is generally acting quite lackluster.

During periods in which the precious metals sector was on the verge of a major rally we have always seen gold mining shares lead the way with very large gains (see January/February 2016 or even the beginning of this year). The fact is that it's not happening this time around even as gold & silver prices remain relatively well bid.

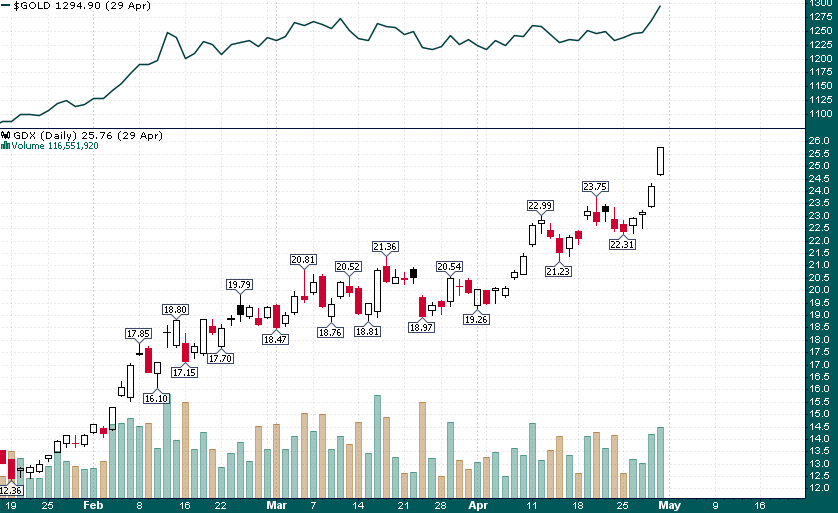

GDX & Gold (January 18-April 29 2016)

GDX more than doubled from its January 2016 low through the end of April 2016 as gold advanced from about $1080/oz to nearly $1300 (+~20%) during the same time frame.

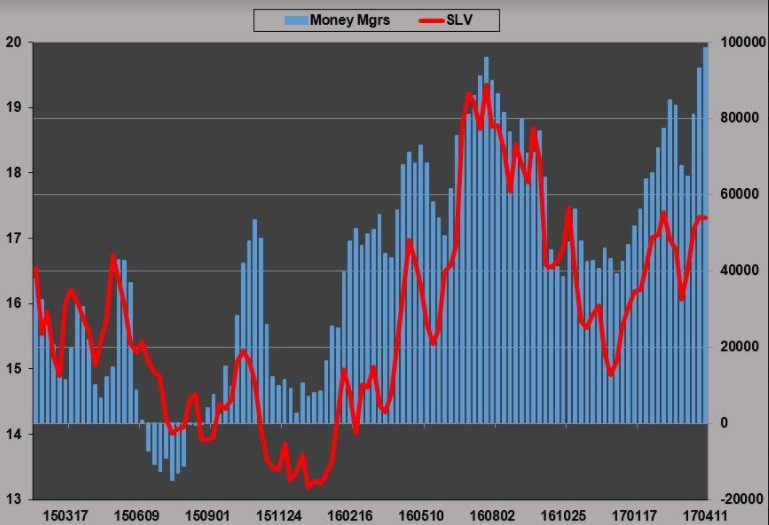

From my vantage point the lackluster performance in mining shares is an indication that there is not much institutional support for this rally. Hedge funds simply aren't buying into mining shares, not even the largest producers, because they don't see much upside from current levels. This could have to do with the negative seasonality that is approaching or other factors (profitability concerns or a macro outlook that isn't favorable to the sector etc.). The fact that the vast majority of precious metals mining shares are well below their February highs while gold is ~2% above its February highs is one of the largest divergences I have seen in this sector. Throw in frothy sentiment and heavy net futures length (silver futures currently have a record net speculative length) and we have a recipe for a correction.

The divergence in silver is especially noteworthy because in every futures contract there is both a long and a short; if futures speculators are holding a record net long position silver then producers are holding a record net short position. What's particularly interesting about this 'confrontation' in silver futures is that it is taking place at a much lower price level than last summer when silver futures open interest reached its previous record:

You can also see that large specs (typically CTAs and hedge funds) in silver futures are trend following (they buy more as price goes higher and reduce positions as price declines), yet they have accumulated quite a large long position without much price response in recent weeks. This could be an indication that producers have been more aggressive with hedging as we have certainly seen quite a lot of resistance in the $18.00-$18.50 area in silver.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.