Only a week after I commiserated over the ultra-low volatility market environment we have been experiencing for the last several months, markets handed us a massive surge in volatility with a nearly 400 point drop in the Dow Industrials and a stunning 46% surge in the $VIX:

VIX (Daily)

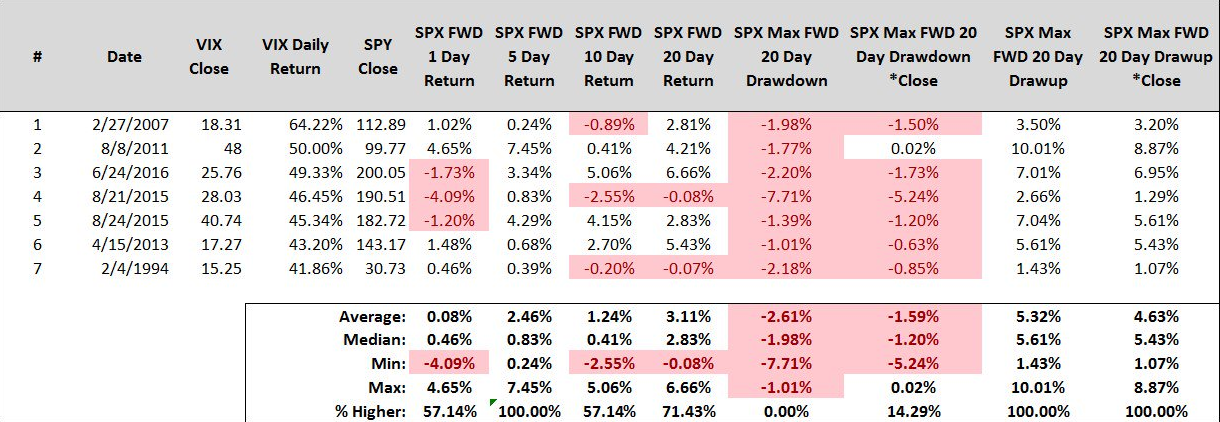

Single day VIX surges of more than 45% are far from common and before today these outsized VIX spikes could be counted on one hand (today was the 6th single day spike of 45% or more in the VIX):

Several things stand out about the above dates and the forward returns for the S&P 500:

- These large $VIX surges often occurred at, or very close to a tradable low in the S&P 500.

- A period of increased equity market volatility often followed these large one-day $VIX spikes.

- Today's 46.38% surge in the VIX came from the lowest previous day's close of any of the above 40%+ spikes.

- All of the above VIX spikes saw positive forward 5-day returns in the S&P 500 and very strong average 20-day returns for the S&P of 3.11% including a 6.66% return last summer.

The takeaway is that large surges in the VIX often turn out to be short term buying opportunities in equities, however, today's market action is also likely to be a warning that we have just entered a higher volatility market paradigm for the foreseeable future. Moreover, a 15 handle on the VIX is not high by historical standards. In fact we have typically seen the VIX surge to above 20 before fear was sufficiently elevated for a sustainable low in equities to be put in place.

To find out how I am trading this latest surge in volatility in addition to real-time analysis and trade setups in gold mining shares, precious metals, ETFs, and many individual equities subscribe to the Trading Lab today!

DISCLAIMER: The work included in this article is based on current events, corporate presentations, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.comfor important risk disclosures. It’s your money and your responsibility.