By James Kwantes

Resource Opportunities

What follows is a rather subjective look at the insider transactions that caught my eye for the May 17, 2018 edition of the nightly SEDI insiders dump, which lands late at night.

Insider buying can be a useful barometer of a company's health or stock level. But it's no fail-safe measure. Just ask any junior mining CEOs or insiders who have been loading up and ""averaging down"" since 2012, as the stocks grinded lower and lower and lower. Also, studies have shown that insiders tend to be early with their buying, suggesting that their stocks do typically drop further before any recovery.

What I like about tracking insider buying -- an important component of my investment newsletter, Resource Opportunities -- is that insiders are participating in the public market along with retail punters and speculators. No seed shares, no rich private placements -- just paying the going rate in the open market.

I am happy to announce a standing offer for CEO.ca members, who can now get their first year of Resource Opportunities for just $199 US, a $100 discount. Use coupon code CEO to receive $100 off when subscribing at www.resourceopportunities.com. In a weak market over the past year, our portfolio company gains have included 146% (zinc company), 73% (tin), 65% (graphene) and 43% (gold).

If I have missed any insider transactions that you consider significant, please feel free to include them in the Comments.

Westshore Terminals ($WTE)

Billionaire Jimmy Pattison -- by most accounts Canada's richest person with a fortune pegged at $7.1 billion US -- has been adding to his stake in Westshore Terminals, a public company which he controls. Westshore is Canada's largest coal exporting terminal, shipping out thermal and met coal that arrives by rail mostly from the Powder River basin of Montana and Wyoming. Japan and Korea are the two largest markets.

Pattison bought 50,000 shares at $23.40, taking his personal stake in Westshore to about 14.7% (he likely owns more through holding companies). Pattison grew up in a small town in Depression-era Saskatchewan. His private business empire includes everything from forestry products, grocery stores and billboards to car dealerships and Ripley's Believe it or Not! Interestingly, Westshore Terminals is also buying back its own shares at these levels.

Fun facts: Pattison has a history of purchasing famous objects and using them to market his businesses. In 1985 he paid $2 million for a psychedelically painted Rolls-Royce once owned by John Lennon (it's now in the Royal B.C. Museum in Victoria and you should go see it if you live there).

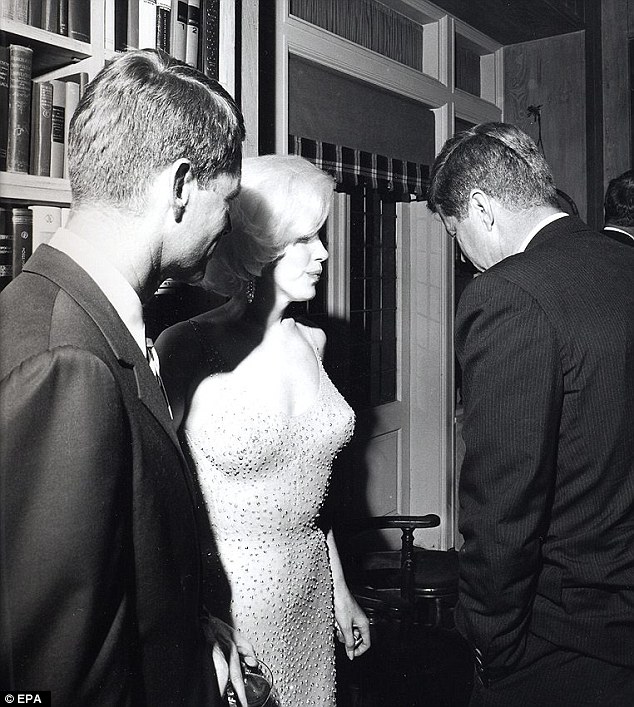

One of Pattison's latest purchases is the curve-hugging, rhinestone-studded dress that Marilyn Monroe wore when she sang a scandalously sensual rendition of Happy Birthday to President John F. Kennedy at a 1962 MSG gala in his honour. The dress will be exhibited in the community hall at Luseland, Sask., his hometown.

Rockhaven Resources ($RK)

Major shareholder Strategic Metals, the Yukon-focused project generator, continues to buy Rockhaven shares, most recently adding 125,000 shares at 14 cents. Strategic now owns 61,695,212 shares, or a 40.1% stake in Rockhaven. Strategic Metals is one of three Resource Opportunities sponsor companies. Rockhaven is working on an updated resource for its road-accessible Klaza deposit, which will be followed by a new PEA. Klaza's maiden resource estimate showed 1.358 million ounces of gold (average grade 4.48 g/t) and 26.9 million ounces of silver (average grade 89 g/t), as well as lead and zinc (all Inferred).

Osisko Mining ($OSK)

Osisko is run by some titans of the Canadian mining sector, including Sean Roosen, Robert Wares (executive vice-president exploration) and John Burzynski (president/CEO). The company recently announced a maiden resource estimate for its Windfall deposit in Quebec's Abitibi greenstone belt: 601,000 ounces of gold at average grades of 7.85 g/t (Indicated) and 2.3 million ounces at 6.7 g/t (Inferred).

Wares, who founded the original Osisko, has been adding to his stake. The latest buys come from CEO Burzynski and Jose Vizquerra, executive vice-president of strategic development. Burzynski bought 50,000 shares at $2.22 (he was a large seller in February at higher prices) and Vizquerra purchased 20,000 shares at $2.20. The latter has been steadily adding to his Osisko stake since the end of March.

Erdene Resource Development ($ERD)

Insiders continue to add at Erdene, whose shares are trading at 34 cents after hitting highs above $1.30 in the spring of 2017 on excitement about Bayan Khundii, its high-grade Mongolian gold discovery. The company is working on a maiden resource estimate for Bayan Khundii, expected in the third quarter. Drilling at the project continues.

The most recent buyer has been director Anna Biolik, who bought 15,000 shares at 37-38 cents. It's a very modest purchase but follows much larger purchases by director John Byrne, who owns about 3.4% of Erdene's outstanding shares.

CanWel Building Materials Group ($CWX)

Sometimes it's not the insider buying or selling that catches your eye, but who the insiders are. CanWel is run by Vancouver entrepreneur Amar Doman, who is a great insider from the point of view of adding in the public market and owning large stakes in companies he runs (16.7% for CanWel). Tree Island Steel ($TSL) is another major holding.

CanWel shares have been on a run in recent sessions since nailing their first-quarter results, reporting large increases in revenue, EBITDA and net earnings. But what caught my eye was one of the board members: Kelvin Dushnisky, the president of Barrick Gold ($ABX) since August 2015. Call it a bit of a lumber hedge for Dushnisky's exposure to the volatile (and often painful) gold sector.

And lumber has been a hell of a hedge of late. Lumber futures prices have skyrocketed from US$470 to $625 in the past two months and the longer-term charts -- check out the 10-year chart -- are very impressive too. Here's a Globe and Mail story about it that -- full circle -- quotes Jimmy Pattison, who owns nearly half of Canfor Corp. ($CFP) and 10% of West Fraser Timber ($WFT).

Disclosure: Rockhaven, Strategic Metals and Erdene are Resource Opportunities portfolio companies, and Strategic Metals is one of three sponsor companies (the others are North Arrow Minerals and Klondike Gold). I own stock in Rockhaven, Strategic and Erdene and am biased. This article is for information purposes only, and all investors should do their own due diligence. Insider buying is not necessarily a signal that the stock will rise.