TORONTO, Sept. 9, 2019 /CNW/ - Cobalt 27 Capital Corp. ("Cobalt 27" or the "Company") (TSXV: KBLT)(OTCQX: CBLLF)(FRA: 27O), is pleased to announce quarterly production results from its 8.56% direct equity interest in the world class Ramu integrated nickel and cobalt operation ("Ramu"). In the quarter ending June 30, 2019 Ramu produced 22,490 tonnes of mixed hydroxide product ("MHP") containing 8,767 tonnes of Ni and 793 tonnes of Co. Year to date production at Ramu is 16,430 tonnes of contained nickel and 1,497 tonnes of contained cobalt. Ramu is one of the few High-Pressure Acid Leaching ("HPAL") operations commissioned since 1999 that has met expectations with respect to capacity and cost as per below:

2018 | 2019 | |||||||

Q1 | Q2 | Q3 | Q4 | Full Year | Q1 | Q2 | H1 | |

Ore Processed (dry kt) | 879 | 952 | 922 | 966 | 3,719 | 800 | 959 | 1,759 |

MHP Produced (dry tonne) | 21,688 | 23,949 | 22,750 | 23,871 | 92,258 | 19,653 | 22,490 | 42,143 |

Contained Nickel (tonne) | 8,210 | 9,159 | 8,804 | 9,182 | 35,355 | 7,663 | 8,767 | 16,430 |

Contained Cobalt (tonne) | 774 | 870 | 793 | 838 | 3,275 | 704 | 793 | 1,497 |

Nickel Capacity Utilization (% of design1) | 97% | 108% | 104% | 108% | 104% | 90% | 103% | 97% |

MHP Shipped (dry tonnne) | 23,827 | 17,114 | 1,352 | 24,272 | 66,565 | 17,219 | 24,607 | 41,826 |

Contained Nickel (tonne) | 9,024 | 6,999 | 524 | 9,413 | 25,960 | 6,588 | 9,457 | 16,045 |

Contained Cobalt (tonne) | 861 | 655 | 48 | 865 | 2,429 | 609 | 861 | 1,470 |

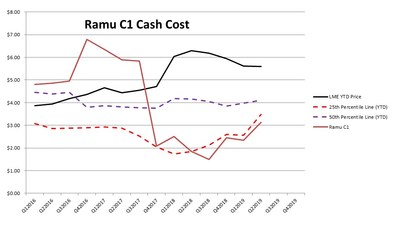

C1 Cash Cost2 | $2.50 | $1.84 | $1.50 | $2.46 | $2.46 | $2.34 | $3.14 | $3.14 |

C1 Cash Cost for 25thPercentile2 | $1.73 | $1.85 | $2.12 | $2.60 | $2.60 | $2.56 | $3.48 | $3.48 |

(1) | Based on Ramu design capacity of 34,000 tonne/year of contained Ni |

(2) | As reported by Wood Mackenzie on a full year basis |

"The Ramu operation continues to demonstrate that it is a top tier nickel asset. Cash costs continue to be in the bottom quartile with annual production consistently at or above design capacity. Production remains on track to produce 34,000 tonnes of Ni and 3,300 tonnes of Co in 2019. With nickel prices now trading around $8.00 per pound, Ramu is generating significant free cash flow which will enable the Company's attributable 8.56% share to be used to repay its debt." commented Anthony Milewski, Chairman and Chief Executive Officer of Cobalt 27.

Nickel is currently trading at approximately US$7.94 per pound on the LME representing a 38% increase from the June 30th price of US$ 5.74 per pound and an increase of 68% from the January 2, 2019 price of US$4.73 per pound, when the Company announced its acquisition of Highlands Pacific. Nickel remains in high demand for lithium ion batteries which are fueled by the surge in the electrification of the automobile. In addition, nickel has enjoyed strong demand in the production of stainless steel in 2018 and 2019 and LME stocks have declined to approximately 150,000 tonnes compared to over 370,000 tonnes at the end of 2017.

About Ramu

- Construction and commissioning of the US$2.1 billion Ramu mine was completed in 2012 by owner/operator Metallurgical Corp of China ("MCC"), as its cornerstone asset in a nickel-focused resource portfolio.

- Ramu is a large scale nickel-cobalt mine with total estimated reserves of 1 billion pounds of nickel and 100 million pounds of cobalt. Management currently estimates a mine life of 30+ years.

- Ramu exceeded annual production projections in 2017 and 2018, with 34,666 tonnes of contained nickel and 3,308 tonnes of contained cobalt in 2017 and 35,535 tonnes of contained nickel and 3,275 tonnes of contained cobalt in 2018.

- Ramu is among the most efficient integrated lateritic nickel-cobalt operations in the world, ranking in the bottom quartile of the global nickel asset cost curve as per below.

On July 24, 2019 the Company issued a NI 43-101Technical Report for the Ramu Nickel Cobalt Project ("Technical Report"). The report was based on mineral resource and reserves as of December 31, 2017 as per the tables below:

Ramu Mineral Resources – 31 December 2017 | |||

Category | Tonnage | Nickel Grade | Cobalt Grade |

Mt | % | % | |

Measured | 34 | 0.9 | 0.1 |

Indicated | 42 | 0.9 | 0.1 |

Measured + Indicated | 76 | 0.9 | 0.1 |

Inferred | 60 | 1.0 | 0.1 |

Note: resources at a cut off of 0.5% Ni; resources are inclusive of reserves; the figures may not add exactly due to rounding; resources do not include the +2mm rock fragments in the rocky saprolite layers; Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability; the Mineral Resources are classified according to the 2014 CIM Definition Standards |

Ramu Mineral Reserves – 31 December 2017 | |||

Category | Tonnage | Nickel Grade | Cobalt Grade |

Mt | % | % | |

Proven | 24 | 0.9 | 0.1 |

Probable | 33 | 0.9 | 0.1 |

Total | 56 | 0.9 | 0.1 |

Note: Mineral Reserves at a cut-off grade of 0.5% Ni, which is not materially different from the 0.58% nickel equivalent cut-off grade used in the previous year; reserves are included in resources; the figures may not add exactly due to rounding; reserves do not include the +2mm rock fragments in the rocky saprolite layers; the Mineral Reserves are classified according to the 2014 CIM Definition Standards |

For the year ending December 31, 2018 Ramu mined 6.350 million wet metric tonnes of material from the reserve base, of which 3,719 million dry metric tonnes were fed to the process. This was consistent with the mining plan referenced in the Technical Report. The Company expects to issue an updated statement of Ramu's Resource and Reserve statements later this year, accounting for mining activity that MCC has conducted since December 31, 2017.

About Cobalt 27 Capital Corp.

Cobalt 27 Capital Corp. is a leading battery metals streaming company offering exposure to metals integral to key technologies of the electric vehicle and energy storage markets. Cobalt 27 holds an 8.56% joint venture interest in the long-life, world-class Ramu operation which currently delivers near-term attributable nickel and cobalt production. Cobalt 27 also manages a portfolio of 11 royalties. Cobalt 27 also owns physical cobalt and a cobalt stream on the Voisey's Bay mine.

NI 43-101 Matters

The majority owner and operator of Ramu is MCC Ramu Nico Ltd., a wholly-owned subsidiary of Metallurgical Corporation of China Limited which is listed on the Hong Kong Stock Exchange (Stock Code "1618") and on the Shanghai Stock Exchange. Other than information derived from the Technical Report, the scientific and technical information in this news release with respect to the Ramu project has been prepared by MCC in its capacity as operator of Ramu.

The mineral resource estimate for Ramu in the Technical Report as set out in this news release was classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (November 2010) by Dr Qingping Deng, of Behre Dolbear Australia Pty Ltd. ("BDA"), and the mineral reserve estimate for Ramu in the Technical Report as set out in this news release was classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (November 2010) by Peter D. Ingham, of BDA, each of whom is an independent "qualified person" as defined by Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Other disclosures of a scientific or technical nature in respect of Ramu in this news release have been reviewed on behalf of Cobalt 27 by Mr. Robert Osborne P.Eng., geologist and President of Osborne Laterite Geology Service Inc., an independent consultant to Cobalt 27 and a "qualified person" as defined in NI 43-101.

For further information please visit the Company website at www.cobalt27.com or contact:

Betty Joy LeBlanc, BA, MBA

Director, Corporate Communications

+1-604-828-0999

info@cobalt27.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has either approved or disapproved of the contents of this press release.

Forward-Looking Information: This news release contains certain information which constitutes 'forward-looking statements' and 'forward-looking information' within the meaning of applicable Canadian securities laws. Forward-looking statements in this news release include, without limitation: statements pertaining to Cobalt 27's management's expectations with respect to estimates of mineral resources and mineral reserves at Ramu; statements pertaining to future production and mining costs at Ramu; statements pertaining to estimated mine life at Ramu; statements pertaining to the expected timing for completion of and release of updated reserve and mineral resource estimates; and statements pertaining to future events or future performance. Forward-looking statements involve known and unknown risks and uncertainties, most of which are beyond the Company's control. For more details on these and other risk factors see the Company's most recent Annual Information Form on file with Canadian securities regulatory authorities on SEDAR at www.sedar.com under the heading "Risk Factors". Should one or more of the risks or uncertainties underlying these forward-looking statements materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements. Accordingly, undue reliance should not be placed on these forward-looking statements.

The forward-looking statements contained herein are made as of the date of this release and, other than as required by applicable securities laws, the Company does not assume any obligation to update or revise it to reflect new events or circumstances. The forward-looking statements contained in this release are expressly qualified by this cautionary statement.