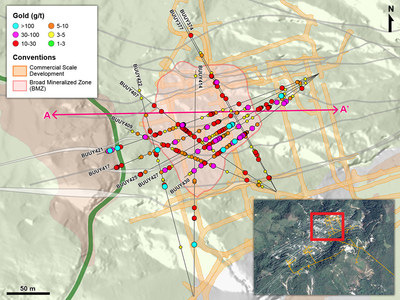

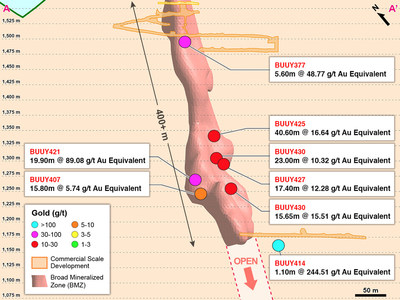

- Broad Mineralized Zone 1 ("BMZ1") drilling continues to intercept high-grade gold over broad widths at lower elevations approaching the Higabra Tunnel.

- BUUY421 intercepted the highest grade X thickness of gold mineralization to date in BMZ1 as follows:

- 19.90 metres @ 89.08 g/t gold equivalent, including a spectacular sub-interval of 0.50 metres @ 3,194.51 g/t gold equivalent (1,267 metre-elevation).

- Multiple additional drill-holes in BMZ1, covering approximately 250 vertical metres of elevation, intercepted high-grade gold over excellent thicknesses with results as follows:

- 40.60 metres @ 16.64 g/t gold equivalent (BUUY425, 1,331 metre-elevation)

- 15.65 metres @ 15.51 g/t gold equivalent (BUUY430, 1,262 metre-elevation)

- 17.40 metres @ 12.28 g/t gold equivalent (BUUY427, 1,288 metre elevation)

- 23.00 metres @ 10.32 g/t gold equivalent (BUUY430, 1,307 metre-elevation)

- 5.60 metres @ 48.77 g/t gold equivalent (BUUY377, 1,495 metre-elevation)

BMZ1's vertical extent now totals more than 400 metres and the drill results reported herein highlight the potential for future mineral resource expansion. - A single drill hole was completed from a chamber in the Higabra Tunnel (lower elevation) and intercepted high-grade gold in multiple intercepts, all of which are located outside of the January 2019 mineral resource estimate block model, with highlight results as follows:

- 1.10 metres @ 244.51 g/t gold equivalent (BUUY414, 1,163 metre-elevation)

- 1.05 metres @ 22.89 g/t gold equivalent (BUUY414, 1,157 metre-elevation).

Given the close proximity of the high-grade gold intercepted in this hole to the future processing plant currently under construction, additional drilling will be carried out to ascertain if a new high-grade pay-shoot can be outlined for potential mining in early production years.

TORONTO, Feb.12, 2019 /CNW/ - Continental Gold Inc. (TSX:CNL; OTCQX:CGOOF) ("Continental" or the "Company") is pleased to announce additional high-grade assay results from 12 holes drilled into the Yaraguá system as part of the drilling program at its 100%-owned Buriticá project in Antioquia, Colombia. The Company plans to drill up to 73,500 metres in 2019, consisting of approximately 55,000 metres of capitalized definition drilling and approximately 18,500 metres of exploration-led infill drilling primarily targeting the broad mineralized zones ("BMZ").

"Buriticá continues to impress. On January 30, we announced an updated mineral resource estimate, which delivered significant across-the-board growth and ranks our Buriticá deposit alongside a very scarce list of deposits globally in terms of size and grade. The Buriticá global mineral resource inventory now sits at slightly greater than 12 million gold equivalent ounces at over 10 grams per tonne (see Table 2). The drill intercepts reported today remind us that the Buriticá system is far from defined and will continue to grow well into the future. We look forward to receiving results from the combined 73,500-metre definition and infill drilling program planned for 2019," said Ari Sussman, CEO. "Most importantly, construction of the Buriticá mine remains on schedule for first gold pour in H1 2020."

Ten drill holes tested BMZ1, with all holes successfully intercepting high-grade gold over broad thicknesses. The highest grade drill intercept (grade X thickness) achieved to date in BMZ1 was encountered on the western flank of the zone at a median elevation of 1,267 metres, assaying:

- 19.90 metres @ 88.91 g/t gold and 13 g/t silver, including an ultra high-grade sub-interval of 0.50 metres @ 3,190 g/t gold and 338 g/t silver (BUUY421).

Three of the drill holes testing BMZ1 were designed to step-out along the eastern edge of the plunge of the zone in an area with no prior drilling. All three holes intercepted high-grade gold over excellent widths as follows:

- 40.60 metres @ 16.55 g/t gold and 7 g/t silver (BUUY425, 1,331 metre elevation)

- 15.65 metres @ 15.36 g/t gold and 10.4 g/t silver (BUUY430, 1,262 metre elevation)

- 17.40 metres @ 11.99 g/t gold and 21.6 g/t silver (BUUY427, 1,288 metre elevation)

- 23.00 metres @ 10.20 g/t gold and 8.3 g/t silver (BUUY430, 1,307 metre elevation)

Table I: Drill Hole Results

Hole ID | From | To | Intercept | Gold** | Silver** | Gold | Mid-Point |

BUUY374 | 16.80 | 18.00 | 1.20 | 13.09 | 56.5 | 13.84 | 1497 |

47.90 | 51.80 | 3.90 | 7.43 | 7.7 | 7.53 | 1493 | |

incl | 47.90 | 48.50 | 0.60 | 20.70 | 18.0 | 20.94 | 1494 |

and | 51.30 | 51.80 | 0.50 | 22.80 | 3.1 | 22.84 | 1493 |

122.70 | 123.25 | 0.55 | 13.65 | 97.9 | 14.96 | 1484 | |

144.70 | 146.50 | 1.80 | 12.24 | 7.9 | 12.34 | 1481 | |

incl | 144.70 | 145.20 | 0.50 | 30.20 | 15.1 | 30.40 | 1481 |

148.50 | 148.80 | 0.30 | 35.59 | 53.4 | 36.30 | 1481 | |

156.20 | 157.80 | 1.60 | 2.18 | 4.2 | 2.24 | 1480 | |

180.70 | 184.40 | 3.70 | 3.11 | 8.2 | 3.22 | 1477 | |

207.00 | 210.00 | 3.00 | 7.44 | 20.8 | 7.71 | 1474 | |

incl | 207.00 | 207.60 | 0.60 | 22.00 | 58.4 | 22.78 | 1474 |

BUUY377 | 17.50 | 18.00 | 0.50 | 11.10 | 36.1 | 11.58 | 1499 |

41.70 | 42.20 | 0.50 | 10.35 | 8.2 | 10.46 | 1498 | |

126.70 | 128.50 | 1.80 | 6.84 | 31.1 | 7.25 | 1495 | |

incl | 126.70 | 127.30 | 0.60 | 17.40 | 78.6 | 18.45 | 1495 |

138.80 | 140.80 | 2.00 | 10.01 | 6.6 | 10.10 | 1495 | |

incl | 138.80 | 139.40 | 0.60 | 22.10 | 13.4 | 22.28 | 1495 |

143.50 | 144.10 | 0.60 | 15.65 | 38.8 | 16.17 | 1495 | |

(BMZ1) | 148.70 | 154.30 | 5.60 | 48.03 | 55.7 | 48.77 | 1495 |

incl | 148.70 | 151.20 | 2.50 | 101.34 | 121.0 | 102.96 | 1495 |

BUUY405 | Failed to Reach Target Depth Due to Faulting | ||||||

BUUY407 | 46.60 | 49.30 | 2.70 | 1.86 | 1.5 | 1.88 | 1455 |

94.50 | 95.00 | 0.50 | 11.30 | 7.5 | 11.40 | 1413 | |

204.70 | 206.75 | 2.05 | 24.22 | 45.0 | 24.82 | 1314 | |

incl | 204.70 | 205.25 | 0.55 | 83.40 | 26.4 | 83.75 | 1315 |

211.30 | 212.30 | 1.00 | 7.75 | 6.3 | 7.83 | 1309 | |

235.00 | 236.15 | 1.15 | 12.25 | 11.4 | 12.41 | 1288 | |

242.10 | 246.00 | 3.90 | 1.38 | 3.2 | 1.42 | 1280 | |

249.60 | 251.90 | 2.30 | 6.13 | 8.3 | 6.24 | 1264 | |

incl | 249.60 | 250.30 | 0.70 | 10.95 | 4.9 | 11.02 | 1276 |

261.90 | 263.60 | 1.70 | 3.91 | 2.5 | 3.94 | 1264 | |

(BMZ1) | 269.40 | 285.20 | 15.80 | 5.25 | 36.8 | 5.74 | 1245 |

incl | 274.00 | 274.50 | 0.50 | 20.00 | 15.4 | 20.21 | 1255 |

and | 275.10 | 275.60 | 0.50 | 29.00 | 101.0 | 30.35 | 1254 |

and | 281.20 | 282.20 | 1.00 | 15.20 | 10.1 | 15.33 | 1248 |

and | 284.70 | 285.20 | 0.50 | 16.00 | 790.0 | 26.53 | 1245 |

296.00 | 297.50 | 1.50 | 5.53 | 39.0 | 6.05 | 1234 | |

incl | 296.50 | 297.00 | 0.50 | 10.70 | 4.3 | 10.76 | 1235 |

342.10 | 343.20 | 1.10 | 6.86 | 35.9 | 7.34 | 1197 | |

incl | 342.10 | 342.60 | 0.50 | 10.95 | 59.5 | 11.74 | 1197 |

361.50 | 363.00 | 1.50 | 6.45 | 28.9 | 6.84 | 1180 | |

incl | 362.00 | 362.50 | 0.50 | 13.65 | 70.6 | 14.59 | 1180 |

BUUY409 | 50.10 | 51.35 | 1.25 | 4.31 | 7.7 | 4.41 | 1452 |

53.80 | 55.80 | 2.00 | 2.89 | 28.5 | 3.27 | 1448 | |

87.25 | 87.80 | 0.55 | 11.65 | 18.9 | 11.90 | 1418 | |

190.50 | 191.00 | 0.50 | 30.40 | 21.7 | 30.69 | 1324 | |

197.00 | 197.80 | 0.80 | 5.18 | 12.1 | 5.34 | 1318 | |

227.80 | 228.90 | 1.10 | 5.10 | 12.6 | 5.26 | 1290 | |

238.10 | 246.55 | 2.35 | 1.66 | 3.6 | 1.67 | 1274 | |

(BMZ1) | 273.50 | 286.10 | 12.60 | 2.40 | 4.0 | 2.45 | 1238 |

(BMZ1) | 295.50 | 306.45 | 10.95 | 3.05 | 4.1 | 3.10 | 1218 |

incl | 300.95 | 301.45 | 0.50 | 10.70 | 6.1 | 10.78 | 1224 |

334.10 | 335.75 | 1.65 | 2.85 | 6.2 | 2.93 | 1193 | |

337.30 | 339.00 | 1.70 | 9.28 | 89.7 | 10.48 | 1190 | |

incl | 338.40 | 339.00 | 0.60 | 20.10 | 231.0 | 23.18 | 1190 |

388.85 | 393.00 | 4.15 | 13.22 | 224.0 | 16.21 | 1142 | |

incl | 390.90 | 391.45 | 0.55 | 62.40 | 1220.0 | 78.67 | 1143 |

and | 392.50 | 393.00 | 0.50 | 24.50 | 100.0 | 25.83 | 1142 |

BUUY414 | 61.20 | 62.30 | 1.10 | 236.57 | 596.0 | 244.51 | 1163 |

incl | 61.20 | 61.75 | 0.55 | 465.00 | 452.0 | 471.03 | 1164 |

92.00 | 93.05 | 1.05 | 20.15 | 205.5 | 22.89 | 1157 | |

104.60 | 105.75 | 1.15 | 8.25 | 6.1 | 8.34 | 1155 | |

incl | 104.60 | 105.25 | 0.65 | 13.25 | 5.8 | 13.33 | 1155 |

135.00 | 137.20 | 2.20 | 4.38 | 10.3 | 4.52 | 1149 | |

BUUY417 | 36.20 | 37.30 | 1.10 | 3.73 | 7.5 | 3.83 | 1455 |

139.00 | 141.40 | 2.40 | 12.15 | 73.1 | 13.12 | 1376 | |

incl | 139.00 | 139.50 | 0.50 | 49.50 | 315.0 | 53.70 | 1377 |

160.00 | 161.70 | 1.70 | 5.67 | 4.7 | 5.73 | 1360 | |

173.20 | 173.90 | 0.70 | 11.15 | 7.9 | 11.26 | 1351 | |

193.35 | 199.65 | 5.70 | 6.22 | 10.7 | 6.36 | 1326 | |

incl | 197.20 | 199.65 | 2.45 | 10.37 | 15.0 | 10.57 | 1331 |

202.70 | 207.30 | 4.60 | 4.65 | 6.8 | 4.74 | 1326 | |

219.20 | 223.00 | 3.80 | 6.71 | 4.1 | 6.76 | 1314 | |

incl | 219.20 | 219.70 | 0.50 | 33.20 | 5.0 | 33.27 | 1316 |

227.60 | 229.80 | 2.20 | 1.70 | 15.1 | 1.90 | 1309 | |

234.90 | 236.25 | 1.35 | 7.84 | 7.3 | 7.94 | 1304 | |

251.70 | 252.30 | 0.60 | 8.47 | 5.0 | 8.54 | 1291 | |

(BMZ1) | 281.35 | 284.40 | 3.05 | 19.16 | 29.2 | 19.55 | 1265 |

incl | 281.35 | 281.90 | 0.55 | 87.70 | 137.0 | 89.53 | 1269 |

293.40 | 295.60 | 2.20 | 4.68 | 6.5 | 4.77 | 1259 | |

incl | 295.00 | 295.60 | 0.60 | 10.35 | 4.1 | 10.40 | 1259 |

313.40 | 315.10 | 1.70 | 45.50 | 40.7 | 46.04 | 1245 | |

incl | 314.60 | 315.10 | 0.50 | 144.00 | 127.0 | 145.69 | 1245 |

320.00 | 321.10 | 1.10 | 4.69 | 7.4 | 4.79 | 1237 | |

323.30 | 325.80 | 2.50 | 1.32 | 28.6 | 1.71 | 1237 | |

327.50 | 329.30 | 1.80 | 2.23 | 4.3 | 2.29 | 1235 | |

343.30 | 344.80 | 1.50 | 3.05 | 4.4 | 3.11 | 1223 | |

380.50 | 381.00 | 0.50 | 20.00 | 12.7 | 20.17 | 1197 | |

387.90 | 390.50 | 2.60 | 13.38 | 10.4 | 13.52 | 1190 | |

incl | 387.90 | 388.40 | 0.50 | 26.20 | 18.4 | 26.45 | 1192 |

and | 389.50 | 390.50 | 1.00 | 21.00 | 16.7 | 21.22 | 1190 |

BUUY421 | 34.85 | 36.35 | 1.50 | 4.46 | 6.0 | 4.54 | 1458 |

57.10 | 62.45 | 5.35 | 5.43 | 33.1 | 5.87 | 1440 | |

incl | 61.00 | 61.95 | 0.95 | 14.29 | 143.0 | 16.20 | 1441 |

132.35 | 132.85 | 0.50 | 15.60 | 196.0 | 18.21 | 1394 | |

174.60 | 179.45 | 4.85 | 10.82 | 16.4 | 11.03 | 1361 | |

incl | 175.80 | 176.35 | 0.55 | 23.00 | 23.1 | 23.31 | 1365 |

and | 178.00 | 179.45 | 1.45 | 20.91 | 29.8 | 21.31 | 1364 |

222.75 | 226.90 | 4.15 | 47.26 | 129.9 | 48.99 | 1332 | |

incl | 223.50 | 224.50 | 1.00 | 97.10 | 220.0 | 100.03 | 1334 |

240.15 | 240.80 | 0.65 | 8.26 | 5.6 | 8.33 | 1323 | |

243.60 | 246.50 | 2.90 | 1.61 | 2.1 | 1.64 | 1320 | |

260.70 | 270.10 | 9.40 | 5.48 | 7.8 | 5.58 | 1305 | |

incl | 261.30 | 261.90 | 0.60 | 23.00 | 15.8 | 23.21 | 1310 |

and | 268.20 | 268.90 | 0.70 | 27.30 | 57.8 | 28.07 | 1305 |

280.60 | 282.40 | 1.80 | 3.08 | 3.7 | 3.13 | 1297 | |

(BMZ1) | 323.50 | 343.40 | 19.90 | 88.91 | 13.0 | 89.08 | 1270 |

incl | 328.55 | 329.05 | 0.50 | 3190.00 | 338.0 | 3194.51 | 1267 |

and | 340.25 | 340.80 | 0.55 | 150.00 | 50.4 | 150.67 | 1260 |

344.60 | 345.70 | 1.10 | 3.57 | 5.1 | 3.64 | 1257 | |

BUUY422 | 133.05 | 135.90 | 2.85 | 37.93 | 38.3 | 38.44 | 1200 |

incl | 133.05 | 133.55 | 0.50 | 180.50 | 206.0 | 183.25 | 1200 |

140.65 | 142.30 | 1.65 | 3.14 | 4.7 | 3.21 | 1201 | |

171.90 | 174.10 | 2.20 | 5.70 | 5.3 | 5.77 | 1207 | |

incl | 173.55 | 174.10 | 0.55 | 10.65 | 11.0 | 10.80 | 1207 |

193.50 | 196.15 | 2.65 | 1.30 | 30.4 | 1.70 | 1211 | |

200.40 | 202.70 | 2.30 | 5.71 | 214.7 | 8.57 | 1213 | |

incl | 200.40 | 202.00 | 0.50 | 17.80 | 882.0 | 29.56 | 1212 |

220.00 | 221.10 | 1.10 | 4.22 | 4.2 | 4.28 | 1216 | |

BUUY425 | 65.50 | 66.80 | 1.30 | 3.44 | 33.3 | 3.89 | 1435 |

71.85 | 73.90 | 2.05 | 43.30 | 15.1 | 43.50 | 1429 | |

incl | 72.90 | 73.40 | 0.50 | 118.00 | 29.5 | 118.39 | 1429 |

91.80 | 92.35 | 0.55 | 10.70 | 24.0 | 11.02 | 1416 | |

102.35 | 103.00 | 0.65 | 10.55 | 128.0 | 12.26 | 1408 | |

110.00 | 114.85 | 4.85 | 5.02 | 136.0 | 6.83 | 1399 | |

incl | 114.20 | 114.85 | 0.65 | 11.10 | 1.6 | 11.12 | 1399 |

118.15 | 118.70 | 0.55 | 28.10 | 77.3 | 29.13 | 1396 | |

138.30 | 141.40 | 3.10 | 2.12 | 6.3 | 2.20 | 1380 | |

143.50 | 146.95 | 3.45 | 1.46 | 4.6 | 1.52 | 1376 | |

(BMZ1) | 167.90 | 208.50 | 40.60 | 16.55 | 7.0 | 16.64 | 1331 |

incl | 169.50 | 170.00 | 0.50 | 458.00 | 104.0 | 459.39 | 1359 |

and | 174.35 | 175.70 | 1.35 | 238.00 | 39.7 | 238.53 | 1355 |

213.80 | 214.45 | 0.65 | 9.08 | 3.8 | 9.13 | 1326 | |

220.25 | 222.45 | 2.20 | 12.37 | 19.7 | 12.64 | 1321 | |

incl | 220.80 | 221.90 | 1.10 | 21.37 | 36.2 | 21.85 | 1321 |

and | 220.80 | 221.30 | 0.50 | 32.80 | 51.6 | 33.49 | 1321 |

342.00 | 344.50 | 2.50 | 14.04 | 34.4 | 14.50 | 1234 | |

incl | 342.50 | 343.00 | 0.50 | 27.90 | 25.5 | 28.24 | 1235 |

and | 343.50 | 344.00 | 0.50 | 29.30 | 52.0 | 29.99 | 1234 |

BUUY427 | 85.10 | 87.25 | 2.15 | 3.29 | 10.3 | 3.43 | 1413 |

97.65 | 98.25 | 0.60 | 35.10 | 12.5 | 35.27 | 1404 | |

103.30 | 105.90 | 2.60 | 1.62 | 4.7 | 1.69 | 1398 | |

112.80 | 115.05 | 2.25 | 6.29 | 43.5 | 6.87 | 1391 | |

incl | 114.35 | 115.05 | 0.70 | 11.35 | 36.4 | 11.84 | 1391 |

116.10 | 117.90 | 1.80 | 15.13 | 11.4 | 15.28 | 1389 | |

incl | 116.10 | 116.70 | 0.60 | 26.80 | 14.1 | 26.99 | 1389 |

181.00 | 185.50 | 4.85 | 9.05 | 7.8 | 9.15 | 1288 | |

incl | 181.00 | 181.70 | 0.70 | 45.90 | 23.4 | 46.21 | 1339 |

(BMZ1) | 220.10 | 237.50 | 17.40 | 11.99 | 21.6 | 12.28 | 1288 |

incl | 221.40 | 222.90 | 1.50 | 34.27 | 54.7 | 35.00 | 1307 |

and | 229.80 | 230.80 | 1.00 | 55.85 | 75.9 | 56.86 | 1301 |

253.10 | 253.60 | 0.50 | 21.10 | 39.6 | 21.63 | 1284 | |

266.70 | 269.70 | 3.00 | 6.15 | 10.7 | 6.29 | 1272 | |

incl | 266.70 | 267.20 | 0.50 | 31.00 | 42.3 | 31.56 | 1274 |

322.00 | 323.50 | 1.50 | 7.01 | 9.3 | 7.14 | 1232 | |

incl | 323.00 | 323.50 | 0.50 | 17.60 | 20.5 | 17.87 | 1232 |

331.50 | 332.00 | 0.50 | 38.10 | 8.8 | 38.22 | 1226 | |

338.60 | 339.10 | 0.50 | 7.99 | 7.2 | 8.09 | 1221 | |

BUUY430 | 47.50 | 48.00 | 0.50 | 21.40 | 16.2 | 21.63 | 1442 |

78.20 | 81.60 | 3.40 | 2.58 | 2.3 | 2.61 | 1415 | |

89.20 | 91.10 | 1.90 | 32.33 | 348.9 | 37.32 | 1407 | |

incl | 90.20 | 91.10 | 0.90 | 66.70 | 733.0 | 77.17 | 1406 |

93.80 | 98.20 | 4.40 | 12.01 | 18.5 | 12.27 | 1399 | |

incl | 95.80 | 96.90 | 1.10 | 32.23 | 38.4 | 32.78 | 1402 |

164.70 | 165.80 | 1.10 | 5.08 | 16.6 | 5.31 | 1345 | |

178.20 | 178.75 | 0.55 | 63.90 | 13.0 | 64.09 | 1334 | |

(BMZ1) | 189.90 | 212.90 | 23.00 | 10.20 | 8.3 | 10.32 | 1307 |

incl | 206.00 | 207.35 | 1.35 | 41.76 | 8.4 | 41.88 | 1311 |

and | 209.20 | 211.30 | 2.10 | 29.12 | 19.6 | 29.40 | 1308 |

(BMZ1) | 222.60 | 227.65 | 5.05 | 33.02 | 19.7 | 33.31 | 1294 |

incl | 222.60 | 223.10 | 0.50 | 136.50 | 34.5 | 136.99 | 1298 |

235.20 | 237.20 | 2.00 | 3.65 | 4.3 | 3.71 | 1286 | |

242.00 | 243.00 | 1.00 | 7.80 | 7.9 | 7.91 | 1282 | |

(BMZ1) | 250.75 | 266.40 | 15.65 | 15.36 | 10.4 | 15.51 | 1262 |

incl | 251.75 | 252.40 | 0.65 | 226.00 | 94.7 | 227.35 | 1274 |

270.50 | 272.00 | 1.50 | 3.81 | 3.2 | 3.85 | 1258 | |

273.20 | 275.80 | 2.60 | 3.13 | 3.2 | 3.18 | 1255 | |

297.80 | 299.80 | 2.00 | 9.13 | 11.9 | 9.30 | 1235 | |

incl | 297.80 | 298.30 | 0.50 | 15.65 | 22.4 | 15.97 | 1236 |

307.30 | 308.30 | 1.00 | 26.87 | 26.1 | 27.24 | 1228 | |

incl | 307.80 | 308.30 | 0.50 | 49.30 | 49.4 | 50.01 | 1227 |

325.20 | 326.85 | 1.65 | 29.85 | 36.7 | 30.38 | 1212 | |

incl | 325.20 | 325.80 | 0.60 | 59.80 | 71.2 | 60.82 | 1213 |

333.05 | 335.70 | 2.65 | 2.03 | 5.7 | 2.11 | 1205 | |

* | Intercepts calculated for minimum intervals of 0.5 metres. BUUY holes reported are between 65-100% true widths. Internal dilution within reported intervals generally does not proposed mine plan parameters |

** | Grades herein are reported as uncapped values |

*** | Gold equivalent in this release and table was calculated at Au:Ag ratio of 1:75 with no assumptions made for metallurgical recovery rates |

Table II: Mineral Resource Estimate Update, January 26, 2019 (based on a 3 g/t gold cut-off grade)*

Buriticá Resource Statement 3g/t Au cut-off | ||||||||

Resource | Grades | Metal | ||||||

Category | Tonnes | Gold | Silver | Gold | Gold | Silver | Gold | |

Yaraguá & Veta Sur | Measured | 1.28 | 14.50 | 61.2 | 15.5 | 0.60 | 2.5 | 0.64 |

Indicated | 14.16 | 10.18 | 40.1 | 10.9 | 4.63 | 18.3 | 4.94 | |

M&I | 15.45 | 10.54 | 41.8 | 11.2 | 5.23 | 20.8 | 5.58 | |

Inferred | 20.36 | 8.87 | 39.3 | 9.5 | 5.81 | 25.8 | 6.24 | |

Broad Mineralized | Measured | 0.12 | 5.15 | 14.7 | 5.4 | 0.02 | 0.1 | 0.02 |

Indicated | 0.46 | 4.50 | 11.6 | 4.7 | 0.07 | 0.2 | 0.07 | |

M&I | 0.58 | 4.64 | 12.3 | 4.8 | 0.09 | 0.2 | 0.09 | |

Inferred | 1.51 | 4.41 | 9.4 | 4.6 | 0.21 | 0.5 | 0.22 | |

Total | Measured | 1.40 | 13.70 | 57.2 | 14.7 | 0.62 | 2.6 | 0.66 |

Indicated | 14.62 | 10.00 | 39.2 | 10.7 | 4.70 | 18.4 | 5.01 | |

M&I | 16.02 | 10.32 | 40.8 | 11.0 | 5.32 | 21.0 | 5.67 | |

Inferred | 21.87 | 8.56 | 37.3 | 9.2 | 6.02 | 26.2 | 6.46 | |

1. | The updated mineral resource estimate for the Buriticá Project was prepared by Continental under the guidance and supervision of Mr. Ivor W.O. Jones, M.Sc., FAusIMM, CPgeo, P.Geo, who is an independent Qualified person (QP) under NI 43-101 guidelines. See Company release of January 30, 2019 for detailed information on the updated mineral resource estimate. |

2. | Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The mineral resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council. |

3. | The quantity and grade of reported Inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading the inferred mineral resource to an indicated or measured mineral resource category. |

4. | Contained metal and tonnes figures in totals may differ due to rounding. |

5. | Gold equivalent grades and ounces was calculated at silver/gold ratio of 60:1. This formula is consistent with the May 11, 2015 Mineral Resource Estimate and is produced for comparative purposes only. |

6. | Mineral Resources have been prepared to a minimum 1 metre mining width. |

Geological Description of the Buriticá Project

Continental's 100%-owned, 75,583-hectare project, Buriticá, contains several known areas of high-grade gold and silver mineralization, of base metal carbonate-style variably overprinted by texturally and chemically distinctive high-grade mineralization. The two most extensively explored of these areas (the Yaraguá and Veta Sur systems) are central to this land package. The Yaraguá system has been drilled along 1,350 metres of strike and 1,800 vertical metres and partially sampled in underground developments. The Veta Sur system has been drilled along 1,300+ metres of strike and 1,800 vertical metres and has been partially sampled in underground developments. Both systems are characterized by multiple, steeply-dipping veins and broader, more disseminated mineralization and both remain open at depth and along strike, at high grades.

BMZ Details

The BMZ consists of a group of modelled precious metal-bearing veins in the current mineral resource estimate block model with mineralization occurring between these veins, generally in the form of veinlets at oblique angles to strike. The majority of the mineralization between modelled veins is not in the current mineral resource estimate, providing potential upside both in terms of identifying significantly broader and more productive zones for mining and increased mineral resources. To date, the Company has identified up to seven BMZ targets for testing and will systematically drill each target zone as underground mine development advances. BMZ1 encompasses a matrix of the east-west trending FW, San Antonio and HW veins as well as a package of a NW‑SE vein and subsidiary veinlets.

Technical Information

Mauricio Castañeda, Vice-President, Exploration of the Company and a Qualified Person for the purpose of NI 43‑101, has prepared or supervised the preparation of, or approved, as applicable, the technical information contained in this press release.

Reported intervals include minimum weighted averages of 3 g/t gold equivalent (75:1 Au/Ag) over core lengths of at least 1.0 metres. Assays are uncut except where indicated.

Besides rigorous chain-of-custody procedures, the Company utilized a comprehensive quality control/quality assurance program for the channel samples. All quality control anomalies were addressed and/or corrected as necessary to assure reliable assay results; no material quality control issues were encountered in the course of the program. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. Although historic correlation between analytical results from the Company's internal laboratory and certified independent laboratories for gold and silver analysis have been within acceptable limits, the Company's internal laboratory is neither independent nor certified under NI 43-101 guidelines and, as such, channel sampling results in this release should only be taken by the reader as indicative of future potential.

For exploration and infill core drilling, the Company applied its standard protocols for sampling and assay. HQ and NQ core is sawn or split with one-half shipped to a sample preparation lab in Medellín run by ALS Colombia Limited ("ALS") in Colombia, whereas BQ core samples are full core. Samples are then shipped for analysis to an ALS-certified assay laboratory in Lima, Peru. The remainder of the core is stored in a secured storage facility for future assay verification. Blanks, duplicates and certified reference standards are inserted into the sample stream to monitor laboratory performance and a portion of the samples are periodically check assayed at SGS Colombia S.A., a certified assay laboratory in Medellín, Colombia.

For stope definition core drilling, the Company applied its standard protocols for sampling and assay. The HQ3 samples were full core and provided sample widths between 0.2 to 1.0 metres weighing approximately 2 to 8 kilograms. Custody of the Samples were transferred at the mine site to Actlabs Colombia using rigorous chain-of-custody procedures. Full-core HQ3 samples are prepped and analyzed at Actlabs Colombia's ISO 9001 accredited assay in Medellín, Colombia. The remainder of crushed rejects and pulps are stored in a secured storage facility for future assay verification. Blanks, pulps duplicates, coarse duplicates and purchased certified reference standards are inserted into the sample stream to monitor laboratory performance. A portion of the samples are periodically check-assayed at ALS Peru's ISO 9001 accredited assay laboratory in Lima, Peru.

The Company does not receive assay results for drill holes in sequential order; however, all significant assay results are publicly reported.

For information on the Buriticá project, please refer to the technical report, prepared in accordance with NI 43‑101, entitled "Buriticá Project NI 43–101 Technical Report Feasibility Study, Antioquia, Colombia" and dated March 29, 2016 with an effective date of February 24, 2016, led by independent consultants JDS Energy & Mining Inc. The technical report is available on SEDAR at www.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.continentalgold.com.

About Continental Gold

Continental Gold is the leading large-scale gold mining company in Colombia and is presently developing it's 100% owned Buriticá project in Antioquia. Buriticá is one of the largest and highest-grade gold projects in the world and is being advanced utilizing best practices for mine construction, environmental care and community inclusion. Led by an international management team with a successful record of discovering, financing and developing large high-grade gold deposits in Latin America, the Buriticá project is on schedule with first gold pour anticipated during the first half of 2020. Additional details on Continental Gold's suite of gold exploration properties are also available at www.continentalgold.com.

Forward-Looking Statements

This press release contains or refers to forward-looking information under Canadian securities legislation—including statements regarding: estimation of mineral resources; advancing the Buriticá project and construction completion; drilling results and advancement in respect of the BMZ mineralization; mine production planning; exploration results and potential mineralization; commercial production and exploration and mine development plans—and is based on current expectations that involve a number of significant business risks and uncertainties. Forward-looking statements are subject to other factors that could cause actual results to differ materially from expected results. Readers should not place undue reliance on forward-looking statements. Factors that could cause actual results to differ materially from any forward-looking statement include, but are not limited to, an inability to advance the Buriticá project to the next level, failure to convert estimated mineral resources to reserves, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry. Specific reference is made to the most recent Annual Information Form on file with Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements. All the forward-looking statements made in this press release are qualified by these cautionary statements and are made as of the date hereof. The Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by law.

Differences in Reporting of Resource Estimates

This press release was prepared in accordance with Canadian standards, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms "inferred mineral resources," "indicated mineral resources," "measured mineral resources" and "mineral resources" that may be used or referenced in this press release are Canadian mining terms as defined in accordance with National Instrument 43‑101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resources and Mineral Reserves (the "CIM Standards"). The CIM Standards differ significantly from standards in the United States. While the terms "mineral resource," "measured mineral resources," "indicated mineral resources," and "inferred mineral resources" are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves. Readers are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, United States companies are only permitted to report mineralization that does not constitute "reserves" by standards in the United States as in place tonnage and grade without reference to unit measures. Accordingly, information regarding resources contained or referenced in this press release containing descriptions of our mineral deposits may not be comparable to similar information made public by United States companies.

SOURCE Continental Gold Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2019/12/c6044.html