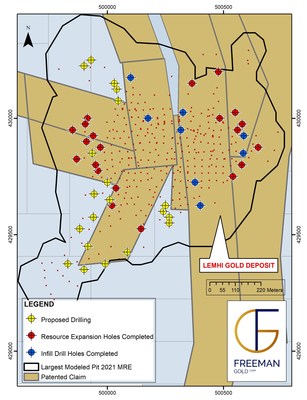

- Plan of Operations approves drilling on 28 new pads off patented claims

- Allows testing of 4 high priority exploration targets and 22 resource expansion and infill drill holes within the northwest, southwest and southern margins of the Lemhi Gold Deposit

- 5 new holes (>700 m) completed at Beauty with rush assays pending

- Completed 21 step out / resource expansion and 8 infill drill holes for a total of 7,926 metres on Phase 2 drilling at Lemhi. Samples from 14 drill holes are at the lab awaiting analysis.

Toronto Venture Stock Exchange: FMAN

VANCOUVER, BC, May 31, 2022 /CNW/ - Freeman Gold Corp. (TSXV: FMAN) (OTCQX: FMANF) (FSE: 3WU) ("Freeman" or the "Company") is pleased to report it has received approval of a Plan of Operations ("Plan") application to the USDA-Forest Service ("USFS"), Salmon and Challis National Forests, North Fork Ranger District, submitted in September 2021. The Plan was approved May 23, 2022, as POO-2021-081646.

"The approval allows us to drill test key extensions of the Lemhi Gold Deposit to maximize the near surface oxide ounce count. We are very much looking forward to drill testing exiting new targets in our underexplored land package. After our success at Beauty, we are very optimistic that additional gold mineralization can be discovered in the property package," commented Paul Matysek, Executive Chairman of the Company. "We are extremely pleased with the support and collaboration received from the USFS and its staff and hope we can build upon this positive relationship as we develop the Lemhi Deposit."

The Plan includes the construction of 28 drill pads of which 22 are selected for resource infill and expansion at the Lemhi Gold Deposit. These drill pads are situated within Freeman's Bureau of Land Management ("BLM") claims in the northwest, southwest and southern margins of the Lemhi Gold Deposit. The remaining six drill pads are designed to test high priority targets 2, 3 and 7 as defined in the new release dated May 6, 2021, which contain rock grab samples up to 38.23 grams per tonne gold ("g/t Au"). An additional drill pad has been permitted in the northwest portion of the claim block to partially test a coincidental Induced Polarization ("IP") Target, also defined by Freeman as Target 11. All these targets have never been drill-tested, like the Beauty Zone discovery drilled in late 2021 (see press release dated March 22, 2022).

- Target 2: Rock grab samples returned assays 2.55 g/t Au up to 32.8 g/t Au;

- Target 3: Rock grab samples in historic trenches reported 2.88 g/t Au up to 38.23 g/t Au;

- Target 7: Rock grab samples in historic trenches from 1.05 g/t Au up to 12.1 g/t Au;

- Target 11: Priority NNW trending IP anomaly.

The Company continues to drill at both the newly discovered Beauty Zone and the Lemhi Gold Deposit. To date, 37 drill holes have been completed, totalling 8,977 metres.

Five new diamond drill holes totalling 721.5 metres have been completed at the Beauty Zone, following up on the discovery hole which intersected 68.23 g/t Au over 6 metres (March 22, 2022). Drilling has stepped out up to 90 metres along strike and about 75 metres down dip, testing the extent of the high-grade mineralized structures encountered in the discovery holes. All new drill holes have intercepted the structure with widths varying between 2 and 6 metres with the exception of hole FG22-023 which encountered a 6-metre void where the structure was projected. The void is interpreted as the remains of historical mining. Three holes have been logged, sampled, and delivered to the assay laboratory. A rush has been placed on these samples to ensure timely return of results in order to plan the subsequent round of drilling.

As of May 30, 2022, a total of 29 new drill holes have been completed at Lemhi for a total of 7,926 metres. These holes have been primarily designed to test on strike extensions of the known resource (21 drill holes) as well as infill in certain parts of the gold deposit (8 drill holes). In particular, the drill program has focused on areas currently modelled as pit waste because of no or sparse drill data. All ounces added in these areas, even if low grade, will add value to the project as it will be converting in pit waste material to resources (Figure attached). An additional 19 holes approximately 4,800 m have been planned as part of the Phase 2 drilling program. See Figure 1.

Fourteen drill holes from Lemhi have been logged, sampled and sent to the laboratory. Analytical results are pending. Two drills continue to operate at Lemhi.

The Company also announces that, further to its news release of September 15, 2020, it has agreed to issue, subject to acceptance by the TSX Venture Exchange (the "Exchange"), a further cash payment in the amount of US$100,000 and issue an additional 375,000 common shares in its capital in connection with the acquisition of the Moon #100 and Moon #101 unpatented mining claims ("Moon Claims"), located within the historical resource area of Lemhi gold project.

On September 4, 2020, the Company entered into a purchase and sale agreement to acquire 100% ownership of the Moon Claims for cash consideration of US$150,000 and share consideration of 375,000 Freeman common shares. Subsequent to the transaction and in order to overcome certain mineral title matters, the Company entered into a follow up purchase and sale agreement on June 23, 2021 (the "Execution Date"), pursuant to which the Company agreed to make payment of an additional US$100,000 and issue a further 375,000 common shares in its capital (the "Final Consideration Shares") within one year of the Execution Date in order to complete the Moon Claims acquisition.

Closing of the acquisition and the issuance of the Final Considerations Shares remains subject to certain conditions, including receipt of all necessary approvals, including the approval of the Exchange. The deemed value per Final Consideration Share is $0.33 being the current Discounted Market Price (as defined in the policies of the Exchange) per common share of the Company. The Final Consideration Shares will be subject to a statutory hold period expiring four months and one day from the date of issuance of such securities.

Freeman Gold Corp. is a mineral exploration company focused on the development of its 100% owned Lemhi Gold property (the "Project"). The Project comprises 30 square kilometres of highly prospective land, hosting a near-surface oxide gold resource. The pit constrained National Instrument 43-101 ("NI 43- 101") compliant mineral resource estimate is comprised of 749,800 oz gold ("Au") at 1.02 grams per tonne ("g/t") in 22.94 million tonnes (Indicated) and 250,300 oz Au at 1.01 g/t Au in 7.83 million tonnes (Inferred). See the NI 43-101 technical report titled "Maiden Resource Technical Report for the Lemhi Gold Project, Lemhi County, Idaho, USA" with an effective date of June 1, 2021, and signing date of July 30, 2021, as prepared by APEX Geoscience Ltd. and F. Wright Consulting Inc. available under the Company's profile on SEDAR (www.sedar.com). The Company is focused on growing and advancing the Project towards a production decision. The technical content of this news release has been reviewed and approved by Dean Besserer, P.Geo., VP Exploration of the Company and a Qualified Person as defined by NI 43- 101.

On Behalf of the Company

William Randall

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This press release contains "forward‐looking information or statements" within the meaning of Canadian securities laws, which may include, but are not limited to statements relating to further exploration, including proposed drilling, of the Lemhi Gold Deposit, the issuance of the Final Consideration Shares and regulatory approvals thereto, and the Company's future business plans. All statements in this release, other than statements of historical facts that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ from those in the forward-looking statements. Such forward-looking information reflects the Company's views with respect to future events and is subject to risks, uncertainties, and assumptions. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/freeman-gold-receives-approval-of-plan-of-operations-and-provides-lemhi-gold-project-update-301557713.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/freeman-gold-receives-approval-of-plan-of-operations-and-provides-lemhi-gold-project-update-301557713.html

SOURCE Freeman Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2022/31/c9329.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2022/31/c9329.html