Product addresses growing incidence of identify fraud from data breaches

Subscription-based offering represents Mogo's fifth product and highlights power of the company's digital platform

Opens up significant new revenue opportunity for Mogo

VANCOUVER, Nov. 28, 2017 /CNW/ - Mogo Finance Technology Inc. (TSX: MOGO; OTCQX: MOGOF) ("Mogo" or the "Company"), one of Canada's leading financial technology companies, today announced it has launched MogoProtect, a new digital solution to help consumers protect themselves against identify fraud.

"With data breaches happening almost daily, most people don't realize they've been compromised until the damage is already done. The potential effects of identify fraud – financial losses, reduced creditworthiness – can be devastating, making it more important than ever for everyone to watch for signs of suspicious activity and unexpected inquiries into their credit file," said David Feller, Founder and CEO of Mogo. "With MogoProtect, we are introducing a highly convenient and affordable mobile first solution to help Canadians detect potential fraud and stop it before it becomes a real issue. At $8.99 per month, it's roughly half the price of comparable solutions in the market, and we believe MogoProtect offers an unmatched, mobile-first user experience."

In a recent Gallup poll, Americans ranked identity theft as their single greatest worry1, in part because of the potential impact on their financial life. Take the recent story of a Canadian woman whose identity was stolen, allowing thieves to get two mortgages in her name that totaled CDN$500,000. After she investigated her own case, she found out that the thieves had tried to borrow money at 12 or more financial companies. Nobody can prevent identity theft but a solution like MogoProtect would have alerted her when any of those lenders did an inquiry into her Equifax credit bureau, which would have given her a chance to help stop the fraud before it happened.

"There are approximately 26 million Canadians with a credit score and, increasingly, we believe every Canadian will need a solution like this because the consequences of identity fraud can be so severe," added Greg Feller, President & CFO of Mogo. "Not only does this product represent a significant new revenue opportunity for Mogo, it highlights the power and value of our technology platform, as this product was conceived, built and launched within three months – a tremendous achievement by our team. This subscription revenue stream aligns with our strategic focus on growing the other product revenue and fees segment of our business, and we will continue to introduce new fee-based products in the coming quarters, including our new cryptocurrency account in the first quarter of 2018. These innovative products will help us achieve our target of 800,000 to 1,000,000 members by the end of 2018."

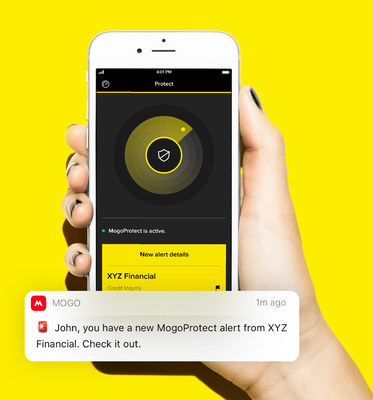

MogoProtect monitors your Equifax credit bureau and notifies you by push notification and email whenever a company makes an inquiry, which happens when you consent to a credit check while opening a new bank account or completing an application for credit. If you notice a suspicious inquiry, MogoProtect will guide you through the next steps to help prevent the fraud.

"Our mission is to empower Canadians to manage their financial health in the most convenient way possible, and we plan to eventually offer all the solutions that someone needs to manage their financial health, all from one convenient digital account," continued David Feller. "We chose MogoProtect as our fifth product, because we truly believe that identity fraud is one of the greatest risks to consumers' financial health. In studying the market, we also noticed a big gap in both a mobile-first solution and an affordable one. MogoProtect is meant to solve this gap."

MogoProtect is seamlessly integrated into the MogoAcccount and can be accessed through the Mogo app (iOS and Android versions).

Mogo's multi-product platform includes:

- Canada's first free credit score monitoring solution

- MogoProtect: A simple and affordable mobile solution to help protect against identity fraud

- MogoMortgage: Digitally led mortgage experience which was recently awarded Best Use of Mobile Technology by the Canadian Mortgage Association

- MogoCard: Canada's first digital spending account accessible through the Mogo Platinum Prepaid Visa®

- MogoMoney: Canada's first full-spectrum consumer loan solution with a "Level-up" program that rewards consumers for consistent payments with lower rates or higher loan amounts

- Upcoming MogoCrypto: A trusted way to buy & sell Bitcoin, launching in Q1 2018

1 http://news.gallup.com/poll/221270/cybercrime-tops-americans-crime-worries.aspx

About Mogo

Mogo (TSX: MOGO; OTCQX: MOGOF) — a Vancouver-based financial technology company— is focused on building the best digital financial services experience for the next generation of Canadians. Mogo's platform currently delivers five innovative products designed to help consumers get in control of their financial health. Built mobile first, users can sign up for a free MogoAccount in only three minutes and get access to free credit score monitoring, identity fraud protection, the Mogo Platinum Prepaid Visa® Card, mortgages and personal loans. The platform was engineered to deliver multiple financial products at scale and enable the launch of additional new innovative products, including the Company's recently announced MogoCrypto account which is expected to launch early in 2018. With more than 500,000 members and growing, Mogo continues to execute on its vision of becoming the financial brand for the next generation of Canadians. To learn more, please visit mogo.ca or download the mobile app (iOS or Android).

Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements regarding Mogo's member growth, platform, brand, current products and plans to launch new products including the recently announced MogoCrypto account. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual financial results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. Mogo's growth and its ability to expand into new products and markets are subject to a number of conditions, many of which are outside of Mogo's control. For a description of the risks associated with Mogo's business please refer to the "Risk Factors" section of Mogo's annual information form dated March 7, 2017, which is available at www.sedar.com. Except as required by law, Mogo disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

SOURCE Mogo Finance Technology Inc

View original content with multimedia: http://www.newswire.ca/en/releases/archive/November2017/28/c8066.html