/NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES./

(All financial figures in US Dollars unless otherwise stated)

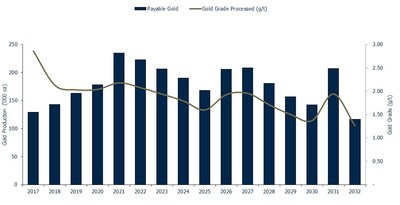

MELBOURNE, June 26, 2017 /CNW/ - OceanaGold Corporation (TSX/ASX: OGC) (the "Company") is pleased to announce the completion of the Haile Optimisation Study ("Optimisation Study" or "Study") where results demonstrate enhanced value through upgraded mineral reserves, increased annual gold production, longer mine life and robust economics.

Key Highlights

- Increased Proven and Probable gold reserves by over 70% from 2.02 Moz to 3.46 Moz

- Announced a maiden reserve on the Horseshoe deposit of 0.44 Moz.

- Revised mine plan that includes larger open pit operations for a 16-year mine life and an underground operation at Horseshoe for a 6-year mine life.

- Planned expansion of the process plant from 3 Mtpa to 4 Mtpa to support higher mining rates and increased annual production.

- Robust economics with undiscounted pre-tax cash flows of $1.4 billion based on current reserves plus an additional $400 million of undiscounted cash flows inclusive of total current resources.

- Further extensional and standalone exploration potential to increase value and mine life.

Mick Wilkes, OceanaGold President and CEO said, "The solid economics of the Haile Optimisation Study clearly demonstrate what we have long believed to be the inherent value of this top-tier asset in South Carolina. Mineral reserves have now increased over 70% from original estimates, supporting increased annual production while increasing mine life to at least 16 years. The maiden reserve at the Horseshoe deposit of 0.44 Moz and a larger open pit operation within our existing land package is a positive outcome."

"We expect significant cash flow generation from Haile where the Study has determined $1.4 billion in undiscounted pre-tax cash flows on current reserves only and $1.8 billion including total current mining inventory."

He added, "Very shortly, we will commence the permitting process and work closely with the regulator and all stakeholders to advance the Haile expansion project to construction. In the meantime, we continue to ramp up operations and drill targets at depth and along strike to further add to the already significant resource base. These targets include Palomino and beneath the Snake pit both of which were not included in the study and represent potential additional value of the asset."

Revised Mineral Resources & Reserves

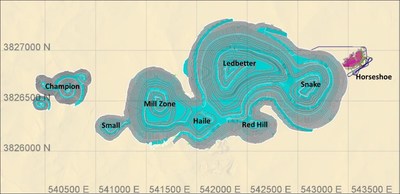

Proven and Probable Reserves have increased over 70% from previous estimates to 3.46 Moz of gold. Following a successful resource definition drill program on the upper portion of the Horseshoe deposit in 2016, the Company is pleased to announce a maiden Reserve 0.44 Moz for the Horseshoe underground, which also has a total Inferred Resource of 0.20 Moz.

The Company has revised the mine plan and design of the surface operations. Pit optimisations were run on a $1,300/oz gold price assumption with an $1,150/oz gold price shell selected for pit design (previously $950/oz gold price). This has resulted in larger pits with the total open pit reserves now standing at 3.02 Moz of gold.

|

Table 1 – Updated Haile | |||||||||||||

|

PROJECT |

Cut-off |

PROVEN |

PROBABLE |

PROVEN & PROBABALE | |||||||||

|

AREA |

Mt |

Au g/t |

Au Moz |

Mt |

Au g/t |

Au Moz |

Mt |

Au g/t |

Au Moz | ||||

|

HAILE Open Pit |

0.45g/t Au |

7.55 |

1.97 |

0.48 |

47.5 |

1.66 |

2.54 |

55.0 |

1.71 |

3.02 | |||

|

HAILE Underground |

1.50g/t Au |

3.12 |

4.38 |

0.44 |

3.12 |

4.38 |

0.44 | ||||||

|

TOTAL |

7.55 |

1.97 |

0.48 |

50.6 |

1.83 |

2.98 |

58.2 |

1.85 |

3.46 | ||||

|

Table 2 – Haile Measured & Indicated Resources | |||||||||||||

|

PROJECT |

Cut-off |

MEASURED |

INDICATED |

MEASURED & INDICATED | |||||||||

|

AREA |

Mt |

Au g/t |

Au Moz |

Mt |

Au g/t |

Au Moz |

Mt |

Au g/t |

Au Moz | ||||

|

HAILE Open Pit |

0.45g/t Au |

7.06 |

1.97 |

0.45 |

52.2 |

1.63 |

2.73 |

59.2 |

1.67 |

3.17 | |||

|

HAILE Underground |

1.17g/t Au |

2.71 |

5.68 |

0.49 |

2.71 |

5.68 |

0.49 | ||||||

|

TOTAL |

7.06 |

1.97 |

0.45 |

54.9 |

1.83 |

3.22 |

61.9 |

1.84 |

3.67 | ||||

|

Table 3 – Haile Inferred Resource | |||||||||||||

|

PROJECT |

INFERRED RESOURCE |

||||||||||||

|

AREA |

Cut-Off |

Mt |

Au g/t |

Au Moz |

|||||||||

|

HAILE Open Pit |

0.45g/t Au |

11 |

1.4 |

0.49 |

|||||||||

|

HAILE Underground |

1.17g/t Au |

1.2 |

5.0 |

0.20 |

|||||||||

|

TOTAL |

12 |

1.7 |

0.69 |

||||||||||

|

Reserves are reported within mine designs based on US$1,300/oz gold price assumption |

|

Estimates of contained metal do not make allowances for processing losses |

|

Resources are reported inclusive of reserves |

|

Mineral resources that are not ore reserves do not have demonstrated economic viability |

|

The open pit resource is reported within a US$1,500/oz optimised shell |

|

The underground resource cut-off grade is based on US$1,500/oz gold price |

|

All figures are rounded to reflect the relative accuracy of the estimates |

Revised Haile Mine Plan

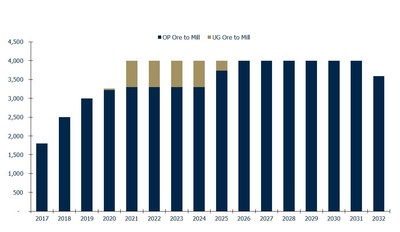

With the larger open pits and inclusion of an underground operation at Horseshoe, the Company has revised the overall mine plan. Following completion of construction of an underground operation and expansion of the process plant, ore feed will be sourced at a rate of 3.3 million tonnes per year from surface operations and 0.7 million tonnes per year from underground. The open pit operations currently have a mine life of 16 years while the Horseshoe underground has a mine life of 6 years.

The larger open pits necessitate the need for additional tailings and waste capacity including the addition of a new PAG cell, however the revised design is within the Company's existing land package.

|

Table 4 – Mining Physicals (based on Reserves only) | ||

|

Mine Production |

Value |

Units |

|

Open Pit | ||

|

Ore |

55.0 |

Mt |

|

Waste |

481.2 |

Mt |

|

Strip Ratio |

8.7 : 1 |

waste:ore |

|

Average Gold Grade |

1.71 |

g/t |

|

Contained Gold |

3,018 |

koz |

|

Underground | ||

|

Ore |

3.1 |

Mt |

|

Average Gold Grade |

4.38 |

g/t |

|

Contained Gold |

439 |

koz |

|

Combined | ||

|

Total Ore |

58.2 |

Mt |

|

Total Waste |

481.2 |

Mt |

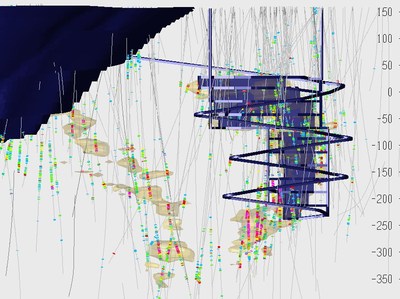

The Horseshoe deposit will be accessed from a portal originating from the north wall of the Snake open pit, where the Company recently commenced mining ore, four months ahead of schedule. The mining method for Horseshoe will be long-hole open stoping at a rate of 0.7 Mtpa from a single access and backfilled with cemented rock fill. Mining costs are estimated to range between $35 and $40 per tonne mined. The Company expects first ore from the underground in 2021 with pre-production development capital costs estimated to be $55 million (excluding pre-production operating cost).

Once underground, the Company will develop exploration drives to further drill the Horseshoe deposit at depth and carry out additional and more comprehensive fan drilling of nearby underground target Palomino and mineralisation beneath the Snake pit.

Process Plant

The Study has identified an opportunity to expand the process plant from 3 Mtpa to 4 Mtpa to support the higher overall mining rate. With the Company ramping-up and fine tuning the process plant over the course of 2017, the Study has used a conservative approach to estimate the additional plant required to achieve the higher throughput rate. The Company does expect to identify opportunities to reduce its upgraded plant to achieve the higher throughout rates which would then in turn reduce capital costs. The current estimated capital cost to upgrade the process plant is $67 million.

Haile Optimisation Study Economics

The results of the Study have demonstrated robust economics with undiscounted pre-tax cash flows of $1.4 billion based on current reserves only plus an additional $400 million inclusive of total current mining inventory.

The capital cost associated with the pre-production development of the Horseshoe underground is estimated to be $55 million, while the initial capital cost associated with a larger open pit and associated mining infrastructure is expected to be $132 million, which includes $60 million allocated for upgrading the mining fleet. The expansion of the process plant to 4 Mtpa is estimated to be $67 million with potential costs savings identified as the plant is currently ramping up. Overall sustaining capital cost is expected to be $245 million over the 16-year mine life.

Operating costs for surface operations are expected to reduce to between $1.45 to $1.55 per tonne mined while underground mining costs at Horseshoe are expected to range between $35 and $40 per tonne milled. Processing costs are expected to remain unchanged at $10 to $11 per tonne milled.

|

Table 5 – Capital Costs | |||

|

Description |

Initial Capital |

LOM Sustaining Capital |

Total |

|

Open Pit |

67 |

75 |

142 |

|

Underground |

55 |

26 |

81 |

|

Process Plant |

67 |

25 |

92 |

|

Site Infrastructure |

65 |

119 |

184 |

|

Total |

254 |

245 |

499 |

Over the course of the coming months, the Company will release an updated National Instrument ("NI") 43-101 Technical Report in relation to the updated mine plan and design at Haile. Furthermore, the Company will prepare the permitting application for the larger open pit, underground mine, associated infrastructure and expanded process plant. The Company expects the start of underground development in 2019 with first underground ore processed in 2021.

About OceanaGold

OceanaGold Corporation is a mid-tier, high-margin, multinational gold producer with assets located in the Philippines, New Zealand and the United States. The Company's assets encompass its flagship operation, the Didipio Gold-Copper Mine located on the island of Luzon in the Philippines. On the North Island of New Zealand, the Company operates the high-grade Waihi Gold Mine while on the South Island of New Zealand, the Company operates the largest gold mine in the country at the Macraes Goldfield which is made up of a series of open pit mines and the Frasers underground mine. In the United States, the Company is currently commissioning the Haile Gold Mine, a top-tier asset located in South Carolina. OceanaGold also has a significant pipeline of organic growth and exploration opportunities in the Americas and Asia-Pacific regions.

OceanaGold has operated sustainably over the past 27 years with a proven track-record for environmental management and community and social engagement. The Company has a strong social license to operate and works collaboratively with its valued stakeholders to identify and invest in social programs that are designed to build capacity and not dependency.

In 2017, the Company expects to produce 550,000 to 600,000 ounces of gold and 18,000 to 19,000 tonnes of copper with sector leading All-In Sustaining Costs that range from $600 to $650 per ounce sold.

Technical Disclosure

The updates of Proven and Probable Reserves above have been verified by, are based on and fairly represent information compiled by or prepared by Mr. J.G. Moore and Mr B. van Brunt. Messrs. Moorer and van Brunt are a full-time employees of Oceana Gold (New Zealand) Limited and Haile Gold Mine, Inc respectively. Mr Moore is a Member and Chartered Professional with the Australasian Institute of Mining and Metallurgy. Mr van Brunt is a Fellow of the Australasian Institute of Mining and Metallurgy. All such persons are "qualified persons" for the purposes of NI 43-101 and have sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as a "competent person" as defined in the JORC Code.

Messrs Moore and van Brunt consent to inclusion in this public release of the matters based on their information in the form and context in which it appears.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed "forward-looking" within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company's expectations regarding the generation of free cash flow, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks, sovereign risks, risk of suspension and those risk factors identified in the Company's most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company's name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward-looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company's control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

SOURCE OceanaGold Corporation

View original content with multimedia: http://www.newswire.ca/en/releases/archive/June2017/26/c7359.html