Early Exploration Results Makes This One To Watch in a New Uranium Bull

It has been a hot summer for uranium bulls with lots of noise driving new waves of excitement. In the midst of all the political posturing, one exploration company released results that should keep junior mining speculators up at night.

When IsoEnergy (TSXV:ISO) acquired the Larocque East project for $20,000 and 1 million shares from Cameco in May 2018, Vice President of Exploration Steve Blower noted that "the probability of additional exploration success is relatively high".

However, the fact that ISO simultaneously released news of 7 holes with no significant mineralization from the nearby Geiger property, may have contributed to what has been a muted market response since the news hit the wire last week. Mr. Blower may have assigned a high probability to exploration success at Larocque East, but I don't think he expected this.

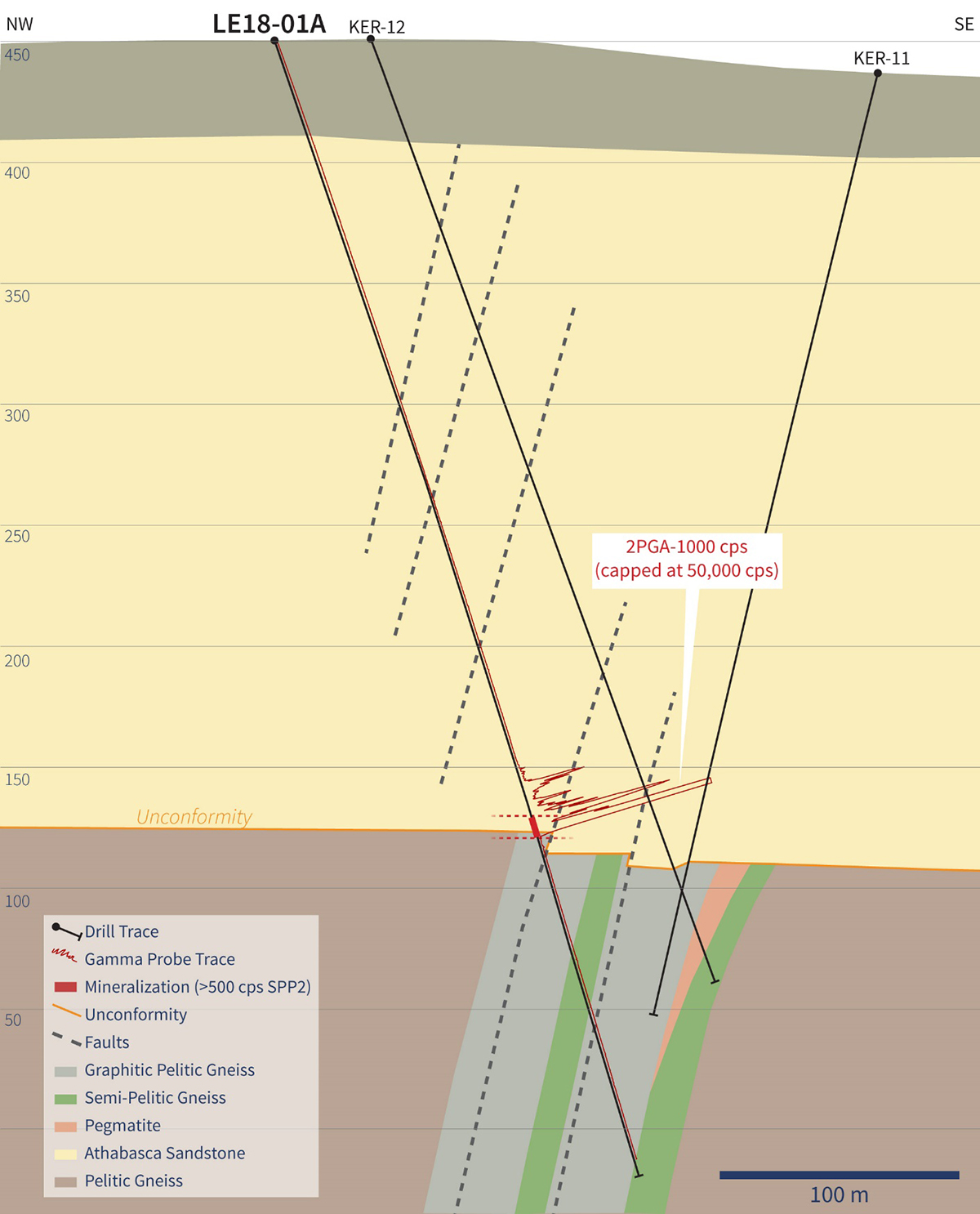

When they got the core back to surface, they saw the right visual cues with pitchblende associated with hematite around the all-important unconformity where uranium deposits in the Athabasca basin are often found. Then, they tested it with a handheld scintillometer.

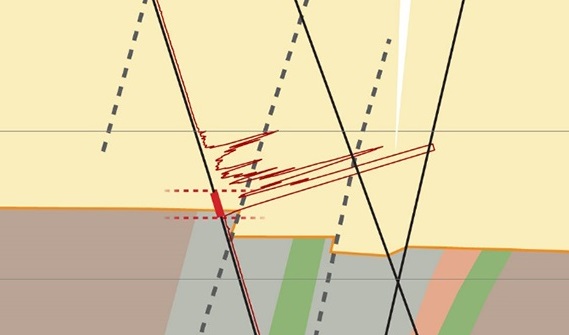

In the ISO news release from July 25, they reported an 8.5 metre interval with elevated radioactivity that includes a "1.0-metre-long zone of strong radioactivity that measures >15,000cps, which is off-scale on the instrument."

Now, scintillometer readings are not assays. These are highly sensitive instruments that measure radioactivity qualitatively. Prudent investors exercise caution with scintillometer results, as the measurements may not be directly related to uranium grades. I am not a uranium specialist, but I trust the IsoEnergy team to get this important technical aspect of the exploration process correct. For one thing, ownership by major shareholders and insiders is approximately 75%.

Whatever your views on scintillometer counts, this kind of off-scale reading should ring some alarm bells – in a good way.

One place I've seen this kind of off-scale reading in a discovery drill hole is at Arrow, which is the largest undeveloped uranium deposit in the Athabasca Basin owned by NexGen Energy (TSX:NXE). NexGen owns over 50% of IsoEnergy and key people who were involved in the Arrow discovery are at the helm of IsoEnergy today: Craig Parry, IsoEnergy President & CEO, was a founding and current member of the NexGen Board of Directors. Leigh Curyer, President and CEO of NexGen, is IsoEnergy Chairman.

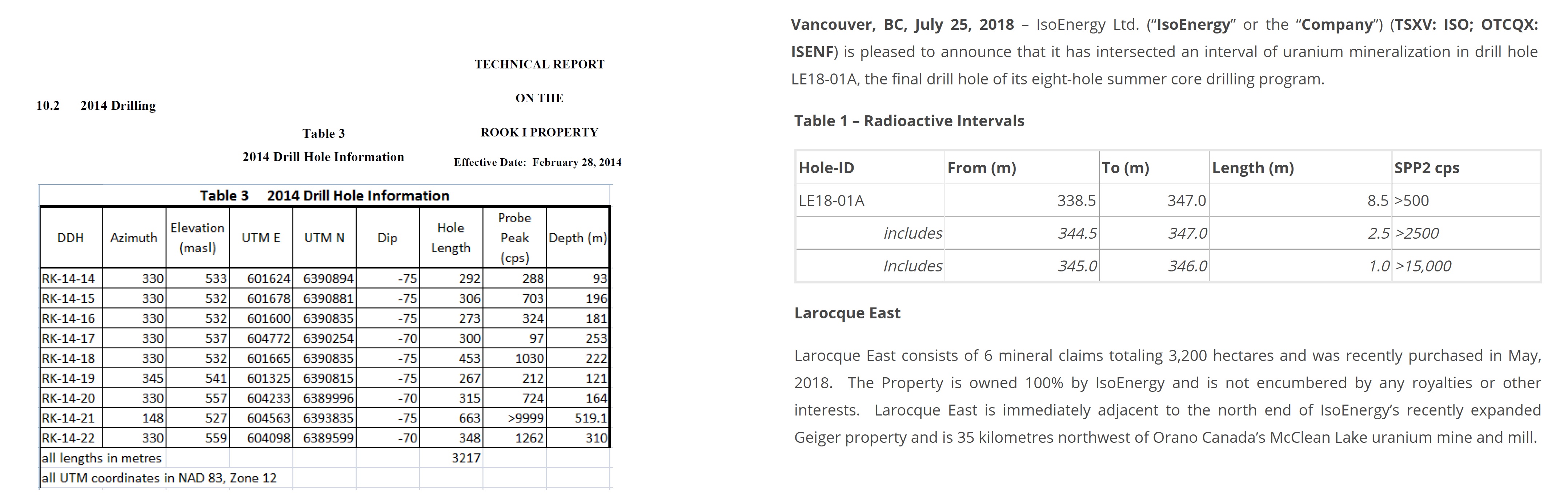

In summer 2013, NexGen drilled 13 holes at the Rook I property following the high-grade uranium discovery at the Patterson Lake South. The NexGen team had targets in mind prior to the PLS discovery, but that discovery helped focus their attention and fuel them to drill, drill, drill through the summer season into September for +3,000 meters drilling. Then, it was time to regroup for the winter program, which is the prime season for uranium exploration in Saskatchewan.

In January 2014, NexGen started a 6,000 meter program at Rook I with a $3M budget. On Friday February 21st, they completed the first hole at Arrow. By Monday February 24th, they issued a news release on that hole describing multiple instances of off-scale radioactivity measurements.

Three follow-up holes around the Arrow discovery hole RK-14-21 encountered no radiometric zones. Of course, hole 21 had suffered a deviation from planned trace and it took a while to correct course. They did and raised $10M in a bought-deal financing on March 4, 2014. Now, Arrow is the largest undeveloped uranium deposit in the Athabasca Basin.

The preliminary results from IsoEnergy at Larocque East have some striking similarities to preliminary results from Arrow. Don’t compare the numbers from the scintillometers (downhole vs. handheld), but please note that both had off-scale readings in the first hole.

One big difference between what happened at Arrow and what has happened so far at Larocque East is market reaction, but that can change quickly with assays from IsoEnergy hole LE18-01A pending and a full winter program ahead.

IsoEnergy is full of prospective exploration ground like Thorburn Lake and the Radio project, which, incidentally, were NexGen’s highest priority projects prior to the discovery of Arrow at Rook I, but the recent staking and acquisitions by IsoEnergy put it into another class entirely.

They have demonstrated that they have superior access to deal flow and know what to do with these assets when they get them. Expect surprises from IsoEnergy as it continues to build the best uranium exploration company in the Basin that I’m aware of.

Find out more in the original news release here: http://www.isoenergy.ca/news/display/index.php?content_id=69

Read my first article on the company here:

https://oilprice.com/Metals/Commodities/This-Year-Everyone-Will-Love-Uranium.html

Disclosure:

No shares. No compensation.