It is my pleasure to share the transcript of an extended conversation I had with Mr. Duane Parnham, President & CEO of Broadway Gold Mining (TSX.V: BRD). Read on for an in-depth introduction to the company.

Peter Bell: Hello, Duane. I saw you briefly at the Sprott Natural Resources Symposium at the end of July this year but didn't get a chance to talk to you. It was great to see you in the building – that's a wonderful event.

Duane Parnham: Thanks, Peter. We've been attending that one periodically for a number of years now. It is one of the better ones. It's always good to get reconnected with folks in the industry and tell our story the best way we can.

Peter Bell: And to the best people you can too, right?

Duane Parnham: Absolutely.

Peter Bell: That's what I love about that event. I first started going to it in 2011 to see John Mauldin. I was doing a master's degree at UBC in financial math and I thought, "John Mauldin? Okay, let's go." And then I met Rick Rule. I've been going every year since because of him.

Duane Parnham: I was first introduced to the conference when we did the UNX Energy presentations. You may not know that one, Peter. That was a very successful project for us. We were exploring for oil and gas offshore in Namibia and we happened to conclude a $730 million transaction with a company from Brazil called HRT. I recall that conference when we were promoting UNX. Marcio Mello of HRT, who is very colorful, was having some absolutely marvelous exchanges at the conference. When you have very smart, witty people on a panel like Rick Rule and Marcio Mello together, it can create great entertainment. To me, that era was very special with all those exchanges and, of course, our successful transaction.

Peter Bell: I had the pleasure to see Marcio Mello speak. He was just roaming the conference floor while giving a speech. It was intense.

Duane Parnham: It was definitely intense, but we live on and those experiences are great ones to carry. We have another very exciting project with Broadway Gold in Montana right now so we're as excited today as we were back then.

Peter Bell: I gather that Broadway is pretty newly listed. I was listening to some interviews with you earlier in the year and that point stuck out for me. I liked how it contrasted with the point that the porphyry you're working on is actually at a fairly advanced stage. Did you guys do some work on it in a private company? I've heard good things about mining in Montana.

Duane Parnham: We listed Broadway in October 2016 and since then we've done a lot of work. We've done two phases of surface drilling, 19 holes. We've done some underground drilling, seven holes. We've done extensive property-wide induced polarization, geophysical surveys, we've done some time-domain EM, electromagnetic geophysical surveys. We've done down the whole gamut of geophysical surveys. We've now expanded the property to 2,514 acres from its original 450 acres. We've done property wide soil sampling, mapping, rock sampling.

We're actually doing a remote sensing alteration mapping study as we speak. We've hired what we think are some of the best minds in Montana. Dr. John Childs has spent his whole career looking at these copper porphyry deposits in Montana and abroad. His team have reviewed all of our technical data, assembled it into a three-dimensional Vulcan database so that we are able to computerize things, and look at the model in three-dimensions. Some really cool things have popped out of that.

The technical data that we retrieved from our drilling and the historical work is really pointing to a pretty powerful, compelling target down below. We have discovered a porphyry system at Madison – a new latite porphyry zone of mineralization. And that's one of the focal points of our Phase Three surface drilling program, which is underway now.

Peter Bell: So much information there, Duane, thank you.

Duane Parnham: It's a lot, plus there's the historical mining. They were mining gold underground at Broadway dating back to the late 1800s. There has been periodic work throughout the years. In particular, at the Madison Project. For a time, the Madison was worked by Coronado, which was a Vancouver-based company, and they drilled some very high-grade gold. Then, they went right to trial mining.

We've got an advantage with all of this data. I call this an advance exploration project. This isn't really a greenfields project. There is a lot of data, both historical and new data that we've produced over the last year. That data has come together to really give us a strong copper porphyry signature.

I have to admit, what got me excited was when we saw so much mineralization up in the skarn zone. These skarns are typically an envelope alteration zone that kind of blankets over these big porphyry intrusions, but the historical work suggested these were actually really broad and wide zones of intense mineralization. When you see that environment, you can begin to speculate that the source is pretty intense. And all of that has been confirmed by Dr. Childs. It has been confirmed by a couple of other geologists that we've had look at the project, as well.

If you latch into one of these copper porphyry deposits, then they're real company makers. They're game changers.

Peter Bell: That's it, right? Still, I've heard people say that it's dangerous for a junior to try to tackle one of them. "Better left to the majors," I think I've heard someone say.

Duane Parnham: Rightfully, so. I agree. Broadway has a very experienced management team and we think we can make a go of it here.

I'm 28 years in the industry with a lot of success playing this game. We know how to use our managerial skills, our technical skills, our market savvy and our network of investors to take on a smart risk. Keeping in mind how and when we proceed with these types of projects, we manage that risk appropriately. With that, we have been able to provide great value for our shareholders. Broadway has a good team behind it and it may be one that's willing to step out a little bit more than others, perhaps, but we've also been able to turn that into big wins for our shareholders.

Peter Bell: If you know what to do with one these porphyries, then it may make sense for you to just start the work! The list of things that Broadway has done already in the first year is just great. I believe you said 19 holes from surface, 7 underground, a full suite of geophysics, geochem, and the digitization of the whole thing. Great!

Duane Parnham: Yes. Again, it's an intense pace and that can be attributed to the solid technical team that we have.

We've also been able to raise capital in a very difficult market. We have about CAD$2.4 million in the treasury currently. We've used our money wisely. For very little expenditure, we've had an excess of $70 million in market cap at one point. It has since pulled back and is around the 50% retracement level right now. These are healthy moves. It has continued to be a very difficult market for junior mining companies, but I feel that there's good opportunity right now. I think the market cycle is coming our way, but that remains to be seen. Regardless, I think this is an ideal time to be looking at projects like this.

Peter Bell: Agreed. And it's a great time to be advancing them, too. To be where you are now, you would have been looking at this for a few years now. Please help me figure out the timeline there. You've been public for just under one year -- what does the work history at Madison look like prior to that? Does this porphyry discovery go back 30, 40 years? And when did you guys come into the picture?

Duane Parnham: Lots there, Peter. Again, the project started in the 1800s. The mine at Butte, Montana is classified as one of the richest hills on earth -- just based on the sheer volume of copper and gold that's come out of that mine. At one time, the Butte mine was providing about 40% of America's copper. It's an incredible mining operation and represents important opportunity in the area.

The geological region in that area has a lot of known porphyry-type deposits, but a lot of them aren't economic today. We know that we're in good hunting ground.

And I believe there is movement back into the US and I believe it is strong. Geopolitical issues in other areas of the globe are increasing. I think majors that are looking to expand operations in safer jurisdictions or even retract into safer jurisdictions, really. I think the US is becoming more attractive. Perhaps we will start to see seniors looking at the US as a place where they want to either buy or find new mines.

Peter Bell: If I can interject there, Duane. I think there's also an urban/rural distinction that's very important. I think you are on the right side of it in a place like Montana, with the long history of mining in the community. That buy-in is really important.

Duane Parnham: Thanks, Peter. You're right. There is often a stigma out there around mining, but I don't think that is the case in Montana, where mining was a major source of jobs and tax revenue for the region.

Mining entails risks of environmental damage, but these can be dealt with in a safe way. Barrick's Golden Sunlight mine is located just 25 road-miles away from where we are located in Montana. It's operating and is licensed to handle cyanide extraction. 45 road-miles away from Broadway's project is the operating Anaconda, which is the Butte mine. They are extracting gold using cyanide there, as well.

We're far enough removed from sensitive, environmentally sensitive areas that our project will remain quite attractive. In fact, we do have a permit for small scale mining extraction. We maintain the licenses and permits from when Coronado did this historical work back in the day.

Another thing that Broadway did this first years was to refurbish the underground workings so that we have access to them. We've been able to take our technical team and equipment down to the 600 level, which is the lowest level that was mined here. We were able to drill those seven holes and hit some extremely high-grade gold values. Like,100 feet of a little better than an ounce of gold per ton.

These are some of the highest-grade holes that this part of the region has seen in some time. It's quite an exceptional setting.

Peter Bell: Wow. The number you said again was over ounce per tonne of gold over 100 feet? That is over 30 meters.

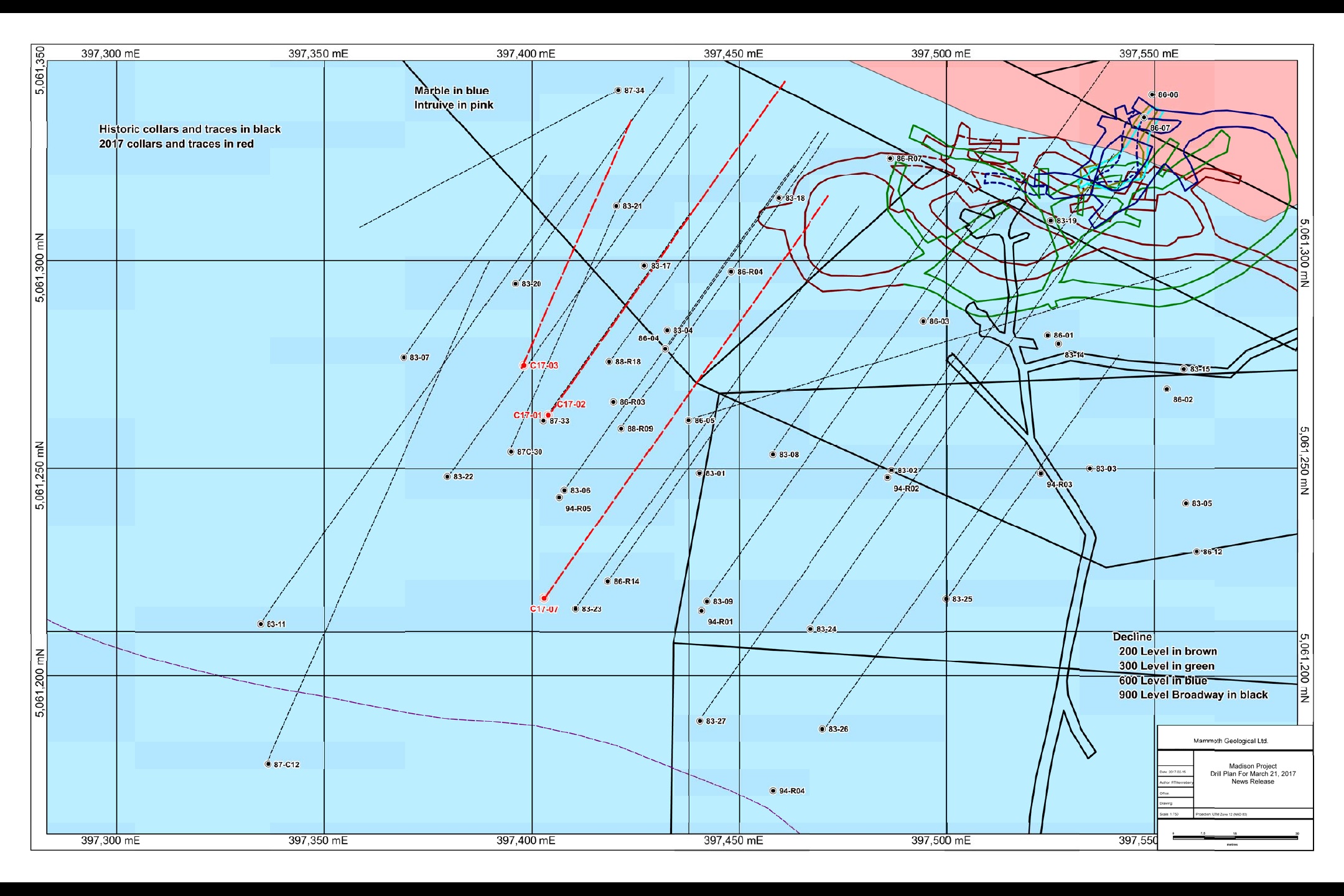

Duane Parnham: I can mention a couple holes here to you. Of the seven holes, Hole number four hit 110 feet or 33.5 meters of 1.6 grams gold and 1% copper. Holes four and five were fanned out. You can think of it as taking your hand and extending out your fingers with drill holes. If you look at our website, then you can see a picture of this.

We were at the bottom station on the 600 level, and we fanned-out holes. Typically, you would do this kind of drilling as you were mining the deposit. Hole #5 was right beside four and it had 99 feet at 24.5 g/t gold and 0.4% copper. The next hole beside that was 36 feet with 41.5 grams gold and 0.4% copper.

Peter Bell: Whoa!

Duane Parnham: These are exceptional intercepts.

Peter Bell: Are those just clips of high grade veins on the gold side, or what's going on there?

Duane Parnham: That's the sulfides. We do not see any visible gold, this is all in veinlets where massive sulfides have been reworked in the skarn. These deposits resemble a pencil, perpendicular to the earth's surface. They were mining this one from surface all the way down to the 600-foot level and we just kept drilling below the footwall there. We hit remarkable intercepts.

From there, we actually did down-hole geophysical surveys. Basically, that enables us to see if this massive sulfide continues on. We've come back with an intense-looking anomaly just to the north of all this. We'll be drilling that in the Phase Three drill program.

Peter Bell: From the bottom of the old workings at your site?

Duane Parnham: That's correct. I'm not a miner, so I forget which way is up down there. I know that the back is the ceiling, but I can't remember what they call what you're standing on.

Yes, we drilled in a degree in a fan formation from the lowest level of previous mining out a little bit lower.

Peter Bell: Good to hear there was enough clearance. I wonder what kind of drill you had down there?

Duane Parnham: From what I can remember, the drill was a bit big. We had issues getting angles, but it worked out. We use an underground drilling rig was contracted by a company called Ground Hog Drilling. They went in and drilled these holes for us.

Peter Bell: And those kind of holes would have been drilled as a routine part of operations when they were in production, right? I guess that is just an ongoing resource definition or infill drilling program.

Duane Parnham: Yes, that's correct. When they get to the end of what your known mineralization, they would bring a drill rig and fan a series of holes to ensure that there's mineralization ahead. Then, they would go and blast. That is how they would advance the face of the mine. They would scoop that stuff out, process it, and keep drilling the face to advance the drift. The driller would be in there to basically tell you where you need to go, as far as the mining was concerned.

Peter Bell: Would you rather be a driller or a mucker? Amazing. They mined down to the 600 level and it looks like you were drilling down to the 900 level, is that correct?

Duane Parnham: I believe it was down to the 700 level, but you may be correct. I'm afraid I can't remember the angle of it. By the way, these are just drill holes into mineralization. These aren't true widths, as in the news release. I’ve described this as being like a pencil and this drilling has gone down into the pencil to give us a sense for what is there. It has told us information about grade, but we don't yet know the width of the pencil, so to say.

Peter Bell: Sorry, if I can interject for anyone who may not quite understand what we're talking about here. They drilled holes out of the bottom of the old mine into where they think the ore is, and they're finding a bunch of good stuff there. Exceptional gold and copper grades, really. These holes start from the same area and spread out, but they haven't been able to do the cross-hatching with additional drill holes that they would require to begin to define the ore body in three dimensions. And it's important to know the three dimensions because you can model the total volume of mineralized material.

Duane Parnham: That's right, thanks Peter. I encourage readers to go to the website and look at the diagrams, they will give you a good idea of what we're discussing here and much more.

Peter Bell: I am on the website now and it looks good. Nice and clean, thank you. I see all the news releases and I've got one map that shows the drill plan and historical underground workings. I believe this shows the holes that are we discussing.

Duane Parnham: We can step back a bit to discuss Broadway more generally, Peter. There are three, maybe four areas of main interest from a geological perspective. We want to expand our resources here significantly.

One area is the zone of massive sulfides underground that we can easily get at. We have just been discussing the drilling that was done at the bottom of the underground mine into this zone. This is a priority for us.

The company could go in and run a trial mine or small-scale mine campaign. That's an opportunity that the company could pursue fairly easily. We've been drilling-out a shallower jasper zone with pretty intense and long intercepts. Some of those assays are running 100 feet of 1% copper or more, with a little bit of gold.

Peter Bell: Some of those holes have much higher-grade gold though, right? I believe you mentioned that Hole four had 24.5 g/t gold. That was one of the holes at the bottom of the old mine.

Duane Parnham: Yes Peter, you're right. That just adds to the excitement that we see in that initial area, which is the massive sulfides underground. We are getting good continuity in that zone, too. It's a great place to start.

We also started hitting and mapping a flanking skarn, an epidote skarn zone where we're getting some pretty good gold grades. That's another opportunity for resource expansion. Then there is Jasper as the third opportunity. And the fourth opportunity would be the deep porphyry that we believe we're seeing in the geophysics. We will be drill-testing that. We really see four ways to build a resource out there.

Peter Bell: It sounds like all of those are fairly similar styles of mineralization, so there may be some benefits from similar processing. Do you guys have any infrastructure at surface?

Duane Parnham: There's a power line in there. There's some mining equipment that we own on site, but when they were trial mining the material was processed at the Golden Sunlight mine. They were extracting the copper-gold from this underground mine, but it was being processed there. We have metallurgical information on that, but we haven't been assessing that so much yet. We haven't moved into a mining stage yet. There is a lot of data on recoveries and all these types of things for that massive sulfide, which we have been discussing. We have not done any metallurgical work on the Jasper and Gold zone, nor has anyone ever done any work on the potential porphyry target at this stage.

Peter Bell: It's a great position after one year as a public company! Doing all this different type of work will help establish many pathways for you to create something that somebody may want to go and throw a whole bunch of money at.

Duane Parnham: In my career, I have never seen a project with such dynamics. You've got a lot of good things going on. Particularly with the optionality here. We're not just drilling one target -- it's not game over if we miss. There is optionality in terms of these pathways, as you said. We're here to create value for our shareholders and we have many ways to attempt to do that.

Let's test the upper skarn zone, where we are getting a lot of copper and a lot of gold. If we keep drilling along this, then we can put together a resource. Then, we can do the metallurgical work to figure out if can we extract this for a profit. Or, we go into that massive sulfide zone where we have the underground infrastructure and can commence small-scale mining. Or, we can swing for the fences and go after that deeper copper porphyry.

This sense of the whole system is what will attract the senior mining companies. The guys who are mining these things really understand how dynamic these deposits are. They know how profitable they are and they know how big they can be. A typical copper porphyry deposit here in Canada or United States generally have multi-billions pounds of copper and multi-million ounces of gold. Then, add silver and malignite as credits and these things can become very profitable operations. So much so that the average grade of copper in a porphyry only needs to be 0.3-0.4% to be economic typically.

When we’re seeing 1-2% copper in the upper skarn, it gives us a lot of excitement. It should give our investors a lot of excitement, as well. "Hey, these guys are onto a really strongly mineralized system there." It's worthwhile for us to keep poking away -- looking for bigger and better things out there.

Peter Bell: Exceptional to have several aspects of this system on your property in Montana. You've described how big these things can become and I would just mention that there are pretty good models of these kinds deposits.

Duane Parnham: That is a real bonus for us. We're not shooting for the stars here or looking for something that nobody's seen before. There are a lot of good examples of historical deposits like this. Many were mined-out. Each deposit has its own variances and specifics, but copper porphyries have alteration halos and zones that we can use for pathfinders to help with exploration. We're following a well-known, and well-established model.

Peter Bell: And it's an elephant.

Duane Parnham: They're big! I've spent much of my career in Africa with exploration, so I'm familiar with getting an elephant by the tail.

Peter Bell: Great. And Montana versus Africa.

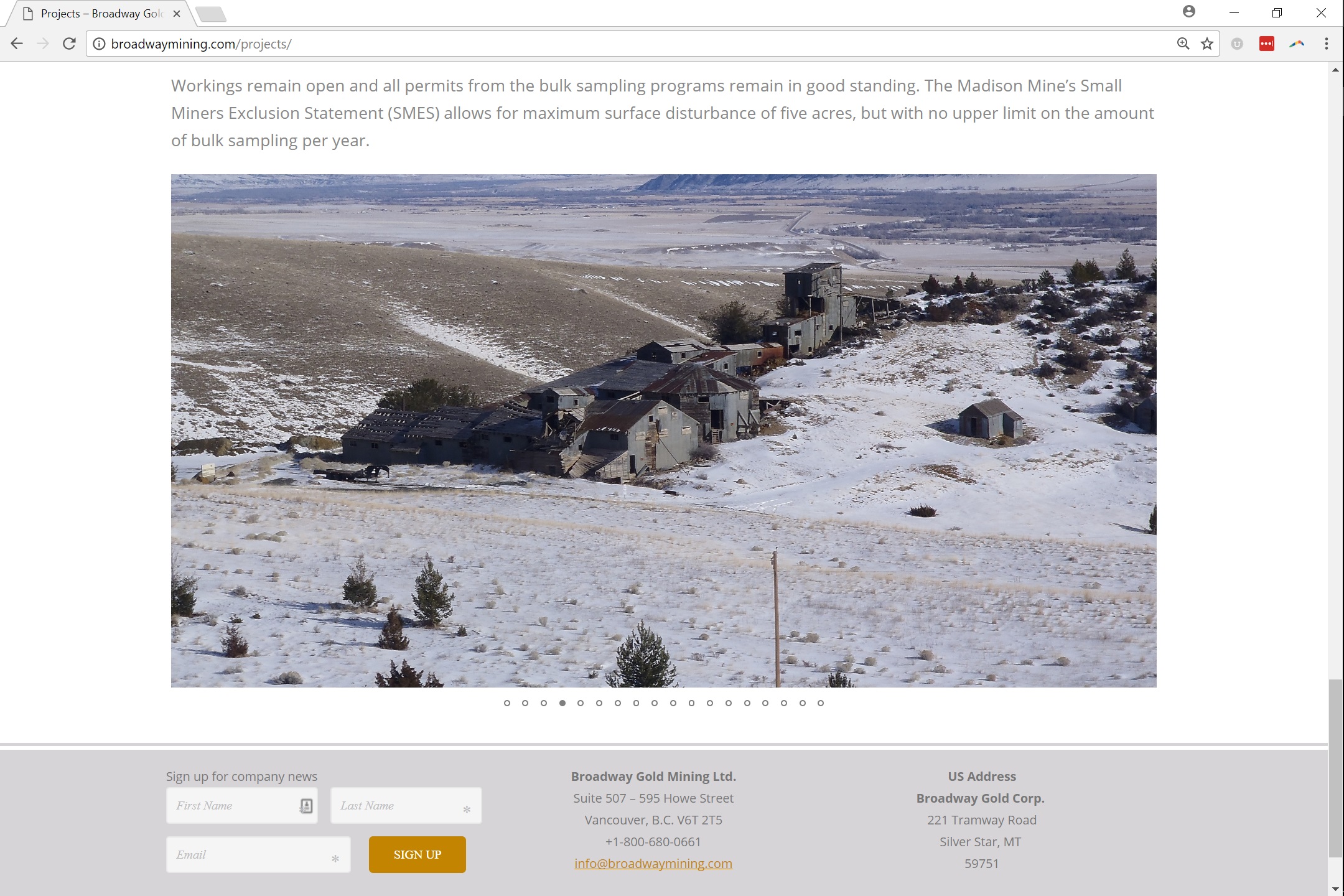

Duane Parnham: Two different places, believe me. Just look at the pictures of the mine itself on our website. Pictures of the drilling, too. It's an absolutely beautiful spot. Anyone who loves spaghetti westerns will really identify with the mountainous regions in the background and these rolling plains. Again, just great spot to be operating.

We have paved road right to our site. I can go to Home Depot and get a hammer. I can drive my pickup truck right from where we are. We've got power, we've got skilled labor right there.

Peter Bell: In the USA.

Duane Parnham: They are very supportive of mines there. The government agency is called the DNA and they are very supportive. They want us to progress and make this a reality.

Peter Bell: Good. Let's see if they can stick to it and not try and take too much along the way.

Duane Parnham: So far, they've accommodated us very well. Everything we've been doing has gone very smoothly. It's been a wonderful relationship.

Peter Bell: This theme of resurgence in the USA is a compelling idea. I love that the technology overlay to it all. Even applied to geological models, right? I wonder what kind of innovations you guys might stumble upon, whether in data visualization or any number of things.

Duane Parnham: I mentioned the Vulcan 3D model, but many people do not know what that is. It's quite a powerful computerized tool that we use to help predict, map, and interpret things. There are different variations of these computerized systems and it really it boils down to which one the consultants are comfortable using. In our case, the Childs Geoscience Group are very familiar with the Vulcan 3D model and it's very useful.

I should also note the quality of our team. We just hired a very seasoned experienced porphyry skarn geologist, Phil Mulholland. He just got on the job and he's a local Montana resident. He's worked for some of the largest seniors, like Barrick, Kinross, and Pegasus Gold. He's developed a number of these skarn opportunities. We're pleased to have him and others of his caliber working for us.

Peter Bell: Thanks, Duane. I look forward to hearing more about all the great people that you hire as this business progresses.

An off-the-wall thought occurs to me here – please humor me for a moment. They did the gold challenge for helping interpret a deposit. I wonder if anyone will ever do something similar to that, but with mine planning.

Duane Parnham: Good question. You're referring to the Goldcorp Challenge and I have to mention David Wall, who was a winner of that. I know him well. They used a similar three-dimensional computerized model as we are discussing now. They had to predict where the trunk of the deposit was located. If the deposit is like a tree, then they were following the branches down to the trunk. Where's the trunk? David used that predictive model to help Goldcorp find where the trunk of the tree is. Now, it's one of the richest gold mines in the world today. These computerized systems are very powerful, and we're pleased to be using this technology.

Peter Bell: I was a youngster when all that was going on, I don't think I knew quite what was happening.

Duane Parnham: Well, you're getting the benefit of it today. We have all learned from stuff like that over the years. These are the types of tools that one should be using to help de-risk location of your next drill hole.

Peter Bell: I'll give Steve de Jong a shout-out here. He was in a leadership position at Integra when they did their own recent challenge. I knew him back in 2008/9 and it is amazing what he has achieved since then.

Duane Parnham: Great. Now, we can use all these tools but I maintain that a geologist has to be lucky. There are a few guys out there. I'm not a geologist, but I consider myself lucky. I've done a couple transactions and have probably yielded my shareholders over a $1 billion in value. I like to put myself in that arena with these lucky geos.

Someone could go their whole career and not drill a hole even close to what we're seeing at Broadway. Then, you've got these guys who find deposit after deposit after deposit. Those are the jockeys that you want to follow in this type of venture.

Peter Bell: And you mentioned a new hire from Montana. Would you say that he is maybe one of the lucky ones?

Duane Parnham: Yes, I would put him in the lucky camp. That's why we hired him.

Peter Bell: Great. And you said that your market cap is around $35 million now, down from $70 million. I wonder about this whole idea of "old highs" in financial markets. Whether it's the price of gold or shares of Broadway Gold Mining BRD, these old highs seem to be important. I've heard Robert McEwen use it as a guide sometimes in speeches and it seems fair.

Duane Parnham: It's an interesting question, Peter. There are many factors to evaluate companies and their share values. I believe we have very strong momentum. When we were very active, we were giving press releases once every two weeks and keeping the market well-informed. We got as high as $1.60 a share and $70-75 million in market cap. We've retraced 50% and I think that's healthy. Stocks can't go up forever. I think that these Fibonacci numbers from technical analysis are somewhat interesting, but let's keep it simple. Prices go up, prices go down. When they go up, you need to consolidate and find new buyers. Where are they? This is how the markets work.

Broadway Gold’s next phase of exploration is underway, and investors can look forward to an awful lot of news from us again. The project is far from dying out. In fact, it's getting more exciting with each piece of data we collect. We have capital. We have about $2.4 million in treasury. We're excited, ready to go again. If we find a copper porphyry deposit down there, then it's game on. That would be a game-changer for the company.

Peter Bell: (Laughs)

Duane Parnham: Great, I love it when somebody can laugh like that in one of these interviews. You're going to have to come down and see the property before the snow, Peter.

Peter Bell: I'm up for it, Duane. I'll bring a GoPro with me and film the whole thing. Can we run around the property and do some prospecting?

Duane Parnham: We will have a drill turning there soon that you can see, Peter. Lots of core to look at. I don't know if you're interested in the science, but there's a lot to see there. A lot of history.

One photo on the web site is the old Broadway, that old decrepit building is actually the old Broadway gold mine, which was constructed in the late 1800s.

Believe it or not, it's designated as a Historical Building. It looks like kind of a fire hazard, but unfortunately, we can't do anything with it. We have to leave it because it's part of history. The guys were going underground and pulling gold out of that place. Many explorers achieved success by looking in areas with historical mining operations. There's generally more to be found there. We see that time and time again, and I think that's another positive attribute Broadway brings to the marketplace.

Peter Bell: And a relatively simple point, too. Looking at the photo of the old buildings on your home page, the ground looks a bit like Africa. Just a sandy plain.

Duane Parnham: Well, they do get snow in Montana. It is cold there.

Peter Bell: I can't imagine what it would have been like for the old-timers. I've heard that they would actually work in the winter in the Yukon because the ground was harder.

Duane Parnham: If you're underground, then you can work 24/7/365.

Peter Bell: I heard you say small scale production, right? That's exciting. What kind of low-hanging fruit can you can grab there?

Duane Parnham: Well, the cheapest way to mine is generally as an open pit but if we can find a high-grade underground deposit then that can work out OK too.

Peter Bell: And it is refreshing to hear you refer to a 50% retracement in shares of Broadway as "healthy." That is telling. I will say that, contrary to conventional wisdom -- it is sometimes a good thing to have a lower share price! Better room for upside. I haven't encountered too many stocks that have pulled back recently and are happy about it. Good for you Duane.

Duane Parnham: I'm a significant, long-term shareholder in Broadway. And I can't trade the stock, anyhow. It's too early in the project development to be worried about valuation, in my opinion. I know others may have different opinion based on their investment criteria and what have you, but I will say it again: we're just getting started.

We think there's something pretty juicy happening down there. We're going to continue drilling and advance this project. I think we're going to surprise the market with some good results.

Peter Bell: Thank you, Duane. Sorry to say "happy about it" -- that may be too strong.

Duane Parnham: Just look at Jeff Bezos -- the volatility in his wealth through Amazon. Sometimes you need to take a longer view to build your company. I believe that that's the way it should be.

It is never an overnight success, unless you win the lottery. I haven't won any lotteries. I'm lucky, but I'm not that lucky. I am a hardworking guy and I'll lean my shoulder into projects like this that show good opportunity to make money.

Peter Bell: Great to see your leadership there, Duane. Anything about else you'd mention about the kind of information out there publicly about other significant shareholders?

Duane Parnham: Investors can visit SEDI, which is a website that displays all the insider holdings and transactions. They will see that I've bought my shares. I didn't receive free shares for being a vendor, or shares for debt, or any of this stuff. Those shares are all bought and paid for. There are some warrants and I believe I have some options that were granted by the Board of Directors. All of that is public information and investors can see that. Steve Hanson is another significant shareholder and he has paid for his shares. The other board members are all shareholders. The company has benefitted from management support in the past.

Peter Bell: Is this a new public entity? Or did it have some existence prior to this?

Duane Parnham: It was an RTO. The company had a small project, but it was a little before my time. It was a property of merit for the purposes of listing the company. It was halt traded at one point and went through an RTO transaction with this project. I'd call it a new start by Canadian junior mining standards. Very clean with a good shareholder base and strong management ownership. We were able to raise capital through non-brokered private placements. We have a good network of shareholders that support management.

We're well funded for this current phase, Phase Three, of drilling that's now underway.

Peter Bell: It makes sense to hear you say "non-brokered" at this point, but I wonder about your relationships with the street. I suppose your past successful exits brought you in touch with some great investment bankers.

Duane Parnham: We do have a good network between myself and Steve. We've done quite a bit of M&A. We've done a lot of financing. People move around, but we have a very strong network of supporters that we're able to draw on. And that is growing.

We've been doing conferences and roadshows in the United States. Getting this company institutional-ready will help investors realize some value, I think. We are seeking more exposure to the marketplace, particularly towards institutional-type investors rather than retail investors. These are natural progressions for companies like us. As we deliver good results to the market, we will attract more eyes and grow. It's a lot of work, these companies are not easy. There's no sitting around. None of us sit around and twiddle our thumbs, waiting for something to happen. We're all out there aggressively advancing the company.

Peter Bell: Great. If anyone is still with us after almost an hour here, Duane, they may be even more gung-ho than you or I! It's easy enough to see a stock price and never know anything about what's going on for the company in reality. It's my pleasure to be able to help provide this in-depth coverage.

Duane Parnham: Thanks, Peter. Every investor should do their due diligence and be comfortable. Usually, looking at the management team is number one. Look at the quality of the mining project, or what have you. Mining is a very cyclical business. We've all been criticized during the bad times, but then everyone loves us when things are going well. A lot of caution is needed for investors with these micro-cap companies. There is so much risk inherent to the business, but there's also huge returns. I advise always investors to do their homework and be comfortable with their investment. If they make that investment, then work with the company and be part of that team to share our success.

Peter Bell: At its best, the junior mining business has a really strong shareholder culture. Something that they should use for business case studies. I've never seen so many activist investors as on Howe Street. Even if they've already sold your stock.

Duane Parnham: For sure, Peter. As a group, junior resource companies raise CAD$7 billion or more a year in venture capital in Canada and use that to apply our skill. The real impact of Canadians in this business is probably much larger -- there are a lot of Canadian mining technical people all around the world. That's inherited in us here, in some ways.

We have a stock market that is very supportive. The TSXV, TSX, and the CSE enable us to have a platform where there's good transparency and decent regulation. These are all things to protect the investors, who really are the company in these small junior mining businesses. It's a good place to be, if that's the type of investment you want.

This Canadian mining culture translates into the shareholder base, whether retail or institutional. There are some good Canadian shareholders, but I have also seen strong support from people in the States with my other projects in the past. They have a bigger cap environment, but people still like the excitement of these micro-caps. It does provide excitement. When there is a big win, it can become a really big win. It's like winning the lottery, to some degree, but much different.

Peter Bell: Montana is due for a win.

Duane Parnham: Winning the lottery is just like an overnight success, but with this stuff you get to be part of it. You get to live it and breathe it. Not just through a stock chart, either. You get to talk to management and some guys are lucky enough to go out to the site. We invited you down and I hope you can benefit from really seeing what it's like here. It's like a lottery ticket, but you can have an awful lot of fun playing with it in the interim.

Peter Bell: And Montana is a place that knows that better than most. This history of mining is unique in the history of the world, in some ways.

Duane Parnham: And Vegas is not too far away.

Peter Bell: That's a big part of the culture of gold mining too, right? The history of all this is very rich. I see potential for Broadway to be a win for the whole Canadian community here. A nice project in the US with good traction -- just nice and simple with lots of blue sky. Could that give a fresh precedent of a Canadian junior having success with mining in the mainland USA? The right kind of success there could even help with the global audience, as well. Whatever the next market cycle looks like, I think all of these issues will be in play.

Duane Parnham: There's a few good points in there, Peter. Our primary listing is here in Canada, of course. The symbol is BRD on the TSX Venture. We're also listed on the OTCQB in the USA with the symbol BDWYF and have a Frankfurt listing, symbol BGH. We approach things with a global eye, as well. We have these listings to help give these other regions an opportunity to participate in our business.

Peter Bell: I've heard good things about the German audience, recently. For any reading closely, I will mention the idea of arbitraging junior mining stocks across multiple listings. I believe you can earn a profit by adding liquidity and improving market conditions for these highly illiquid stocks.

And I'll briefly mention that I saw you on Kitco News’ livestream of the New York Mines and Money show several months ago. I was watching it on YouTube and recall chatting with some people there. I tweeted at the company a bit, too. It was neat to have all those interactions. It was the first time I had participated in a livestream on YouTube like that and it was well done. I just commend you for being part of it.

Duane Parnham: Thank you. As we get older we're supposed to be getting a little bit wiser, but technology is really playing a big part on how companies position themselves to access potential investors. I think the social media platforms are pretty interesting. Live-streaming, as you mentioned, is great. Press releases with graphics and videos -- it's all changing quickly right now. It is opening up access to many people who may be interested in the business, but are busy with work and family obligations. Now, they can start to learn about the company on their own time. And they can really learn a lot, as with interviews like this one that we've done here today Peter. I'm learning about all this and it is exciting.

Peter Bell: Duane Parnham, thank you so much for indulging me here today. It was great to get this introduction to you and Broadway Gold Mining.

Duane Parnham: You're welcome, Peter. Have a great day.

Please note that I was not compensated to prepare and distribute this material.

This document contains statements that are forward looking statements and are subject to various risks and uncertainties concerning the specific factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s periodic filings with Canadian securities regulators. Such information contained herein represents management’s best judgment as of the date hereof based on information currently available. The Company does not assume the obligation to update any forward-looking statement.