A few months ago, Mr. Ray Dalio, founder of Bridgewater, published a hardcopy version of his stunning management book "Principles". He originally published it for free as a simple PDF on the company's website (here) and I was blown away when I found it. I've studied and shared it often since then alongside Mr. Eric Sprott's "Gold Book", which documents his letters and research on gold from 1999-2014 (here).

Mr. Dalio is an interesting character and has many ideas that are relevant to us speculators at CEO.CA. As he says in a footnote in the opening section of the book,

"I have been very lucky because I have had the opportunity to see what it’s like to have little or no money and what it’s like to have a lot of it. … For my tastes, if I had to choose, I’d rather be a backpacker who is exploring the world with little money than a big income earner who is in a job I don’t enjoy. (Though being in a job that provides me with what I want is best of all, for me)."

Read on for my thoughts on some of his "Principles" that are particularly relevant for people who spend time on CEO.CA below.

... 70) Don’t try to be followed; try to be understood and to understand others.

Ray has a clear focus on process over outcomes, saying "We want reasonable thinkers to operate sensibly," but that's easier said than done in the face of strong emotion from risk decisions. Whether you believe in his focus on process or not, a key strength of CEO.CA is that our commentary is preserved in some public record that helps provide context for us understand each other.

An internet community like CEO.CA can be a great place to gather or disperse information and can provide an example of increasing returns to scale or network effects when it's at its best. As Ray says,

"We want people who understand the principles that allow our community to succeed and possess strong ethics that motivate them to work by our rules, rather than to sneak around them. We want people who know that if the community works well, it will be good for them. We don’t want people who need to be ordered and threatened. We don’t want people who just follow orders."

As the network grows, it becomes more important how you conduct yourself. After all, it is the only thing you can control!

To that end, Ray also says that "you always have the right to have and ask questions." That may sound obvious enough, but it can be valuable to remember when talking to someone pitching an investment that is wrapped up into a nice little package.

... 24) Be assertive and open-minded at the same time.

Ray says that "Finding out that you are wrong is even more valuable than being right, because you are learning." That is particularly important when making risk decisions! It's not just about learning but avoiding bad outcomes from bad process, which I think is the real killer for independent-minded speculators.

Ray also says to "Watch out for people who think it’s embarrassing not to know." Oddly enough, I don’t see a lot of condescending attitudes on the site. I'm sure they are out there -- maybe I just don't waste my time. Or maybe there is some self-censorship going on with people who lurk but don't post. I'd encourage those people to go further and read some of the Principles book with the bullboards in mind.

Another line that sounds like a Lululemon throwaway is: "Force yourself and the people who work for you to do difficult things." If you don't get the significance of that one, then it may be a good place to start as your next difficult thing may be wrapping your head around that statement itself!

Now, Ray is focused on managing investment professionals and provides him with a lot of information about people he's working with. We have much more limited info about companies considering or other people posting on CEO.CA and it can be a bit of a stretch to apply all of his ideas here but some, "Avoid the “theoretical should.”", seem to apply well. It's best to keep expectations of other people on the site low or risk constant frustration.

... 98) Don’t assume that people’s answers are correct.

Checking your assumptions is a constant theme for Ray. One of my favourite phrase was something like, "Don't double check -- double do". In other words, trust but verify. Although there are lots of important facts that we cannot verify, it is a good thing to do where possible in the world of junior mining stock promotion.

Ray points out that trust is gained or lost by doing this process of redoing other people's work. You can surely take it too far, but most people don't. Again, the story that Eric Sprott told at Jekyll Island where he arrived at a better estimate of near-term production than the CEO of a gold mining company comes to mind. I think it also helps encourage you to put your best foot forward if you think someone is listening on the bullboards, but maybe that's just me.

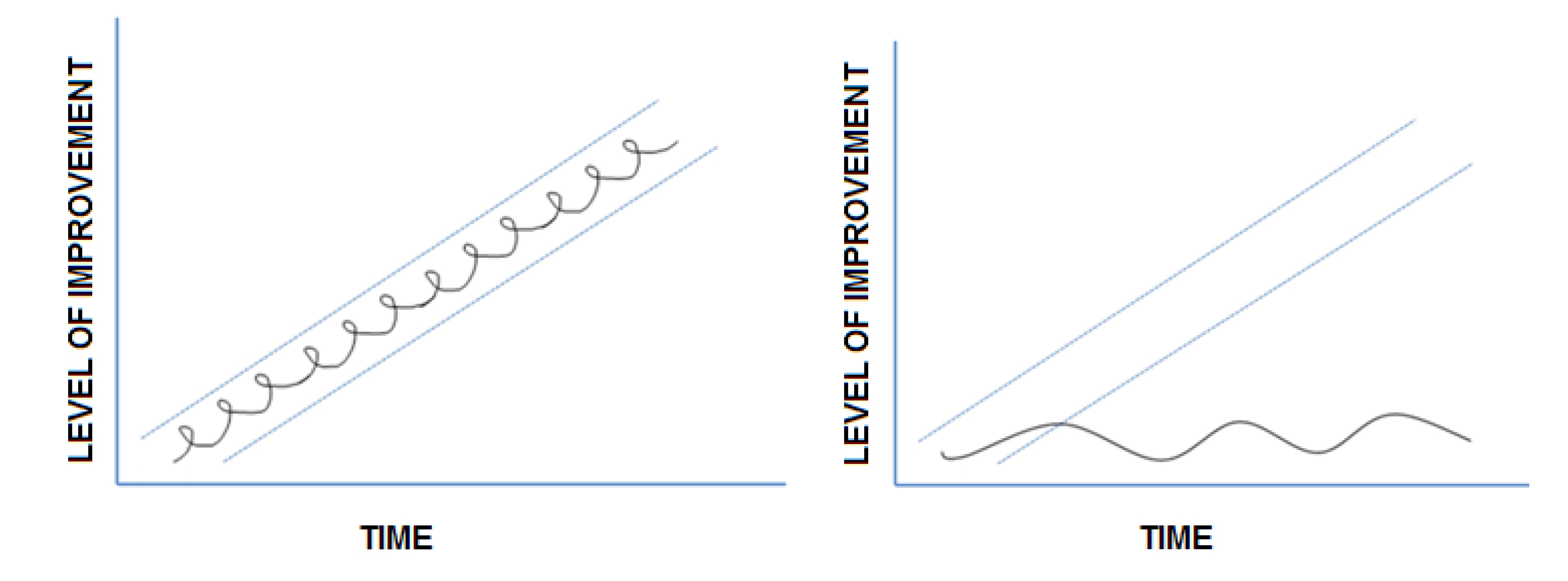

Ray is famous for these little doodles in Principles that look silly, but end up being full of insight. For example, the two diagrams show good and bad performance. The key difference is not just that one increasing and other is not -- the increasing diagram has many more up-down cycles because that person is getting more feedback, which is so important to the Bridgewater culture.

Ray says, "To perceive problems, compare how the movie is unfolding relative to your script." You may find it challenging to chart out exactly what you think is the best path forward for a minerals exploration company given all options available to them, but the crowd can often manage a decent job of it and that's probably the most important thing that a site like CEO.CA can accomplish.

Despite all the neat ideas in Principles, Mr. Dalio has some strong ideas about transparency. He says, "Make the probing transparent rather than private." and that reflects the intense culture at Bridgewater. The daily dressing-down by both superior and inferior staffers is enough to lead most people to retreat from standing up for anything, but that's OK because "Professional Investor" should not be a career choice for most people. It's important that you are able to face being wrong in this business without risk of ruin for your portfolio or character. And it's important to ride your winners as long & hard as possible.

... 194) While everyone has the right to have questions and theories, only believable people have the right to have opinions.

This simple phrase could save the regulars at CEO.CA a lot of frustration, but I think many on the site try to debunk misleading statements out of fear that the general public take those statements as truths. The difference between the site and management offices at Bridgewater is that we are dealing with an ever-changing cast of characters with users changing handles and using anonymous as they wish.

It takes an experienced hand to accurately guess if someone is believable or not without some track record of activity on the site, but that's another thing the crowd can help with. Sometimes the crowd gets sucked into group-think and is not very good at getting to truth, but at least of all that is borne out in full view of the public!

If you read on in Ray's Principles, then you will see more about "not knowing". It is an important part of risk taking, generally. And very relevant to the bullboards, specifically, in terms of who you listen to and what you do about it.

Thanks for a wild year on the site in 2017, best to all for 2018.