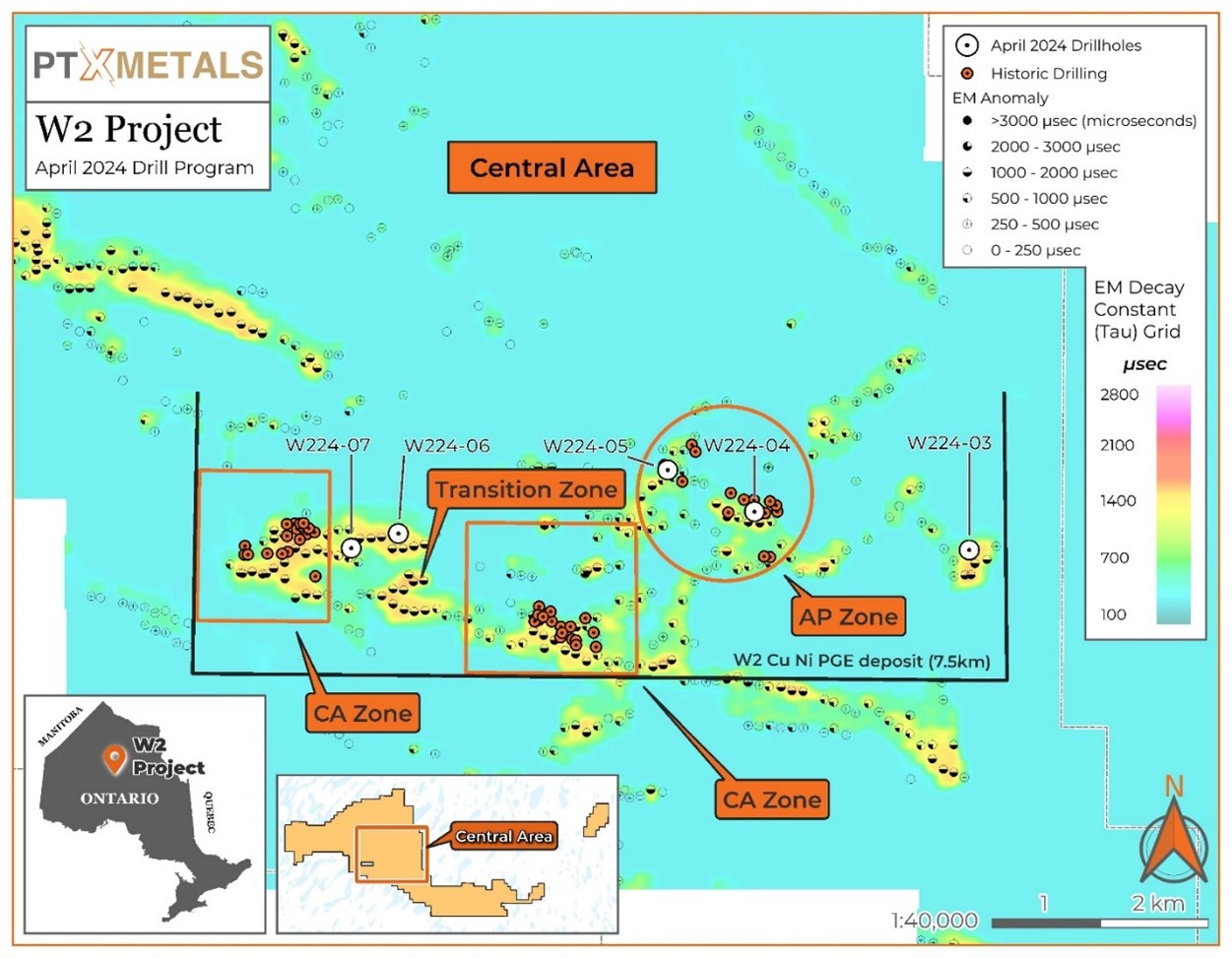

TORONTO, July 30, 2024 (GLOBE NEWSWIRE) -- PTX Metals Inc. (CSE: PTX) (OTCQB: PANXF, Frankfurt: 9PX) (“PTX” or the “Company”) is pleased to announce additional drill results from the 1,544 metre diamond drill program on its 100% owned W2 Cu-Ni-PGE Project (“W2” or “W2 Project”), which covers the whole layered Lansdowne House Igneous Complex (LHIC), located in the “Ring of Fire” region of Northwestern Ontario. This drilling program did not include drilling of the recently acquired claims which include the historical resource area known primarily as the Inco Area (“CA”) Zones nor the previously defined W2 Cu-Ni-PGE Deposit (see image – Figure 1 plan view).

In addition, the Company has completed the 1D exploration program in June and July at the South Timmins Joint Venture projects on Shining Tree and Heenan and Mallard Gold Projects and gold assays will be reported next week (see press release dated June 12, 2024).

The W2 drill holes included both geophysical targets as well as new targets identified from in-house geological and geophysical interpretations. The exploration holes were designed to test the expansion potential of the W2 near surface mineralization trend (identified by 84 historical drill hole results over approximately 7 km), as well as an associated EM (electromagnetic) geophysical trend.

Holes W224-04 to -06 were drilled to infill and confirm the mineralization. Confirmation drilling provides additional data and enhances confidence in the historical reported mineralization zones (Transition and AP zones – see Figure 1). These holes have increased PTX’s geological confidence in the mineralized zones’ continuity. Drill holes W224-01 to W224-03 and drill holes W224-07 were exploration drillholes targeting new areas reaching as far as 28 km from the CA zone (see press release on July 24, 2024).

Highlights:

- Three confirmation drill holes (W224-04, W224-05, and W224-06) successfully confirmed over 7 km near-surface Cu-Ni-PGE mineralization, primarily in the AP zone and transition zone located between the two CA Zones1.

- Drill hole W224-04 - The positive outcomes of these drill holes have substantially increased PTX’s geological confidence in the deposit’s continuity.

- Drillhole W224-04 intercepted a PGE-dominant upper anomalous zone, with 0.41g/t PGE (Pt+Pd) over 3.00 m starting at 64.00 m.

- Below this interval, the drill hole intercepted a thick Cu-Ni-dominated zone similar to those intersected in several nearby historical holes (e.g., 54017-0: 1.22% Cu Eq over 58.3 m, LH01-02: 0.92% Cu Eq over 42.6 m, LH01-20: 0.54% Cu Eq over 45.0 m).

- This lower thicker intercept in W224-04 consists of 0.47% Cu Eq over 46.00 m from 85.00 to 131.00 m, including 0.61% Cu Eq over 13.84 m starting from 117.16 m, with 1.46% Cu Eq over 3.84 m starting from 117.16 m

- Drillhole W224-05 intercepted a near surface cumulative 82.84 m of Cu-Ni-PGE mineralization from three separate mineralization zones starting from 32.87 m; including,

- 67.01 m at 0.44% Cu Eq starting at 32.87 m,

- including 7.50 m at 0.70% Cu Eq starting at 71.50 m.

- Drillhole W224-06 intercepted a cumulative 39.20 m of mineralization from several separate mineralization zones starting from 27.00 m.

- Highlights include 0.62 % Cu Eq over 4.20 m starting at 62.00 m,

- including 1.44 % Cu Eq over 1.60 m.

The Lansdowne House Igneous Complex (“LHIC”), which has been emplaced in the Volcano-sedimentary sequences of the Bartman Lake Greenstone Belt (BLGB), is host to Cu-Ni-PGE and V-Ti oxide mineralization similar to layered complexes (e.g., Bushveld, S. Africa), Big Trout Lake and Ring of Fire Intrusions in northwest Ontario.

Program Summary

Detailed drill hole collar information is summarized in Table 1.

Table 1: Drill hole collar information

| DDH | Easting | Northing | Azimuth | Dip | Length (m) |

| W224-01 | 490690 | 5816990 | 135 | -55 | 115.00 |

| W224-02 | 473250 | 5808960 | 180 | -55 | 240.00 |

| W224-03 | 466444 | 5813303 | 150 | -45 | 258.30 |

| W224-04 | 464454 | 5813658 | 180 | -50 | 191.00 |

| W224-05 | 463651 | 5814044 | 190 | -45 | 214.00 |

| W224-06 | 461155 | 5813456 | 195 | -45 | 294.00 |

| W224-07 | 460718 | 5813320 | 195 | -60 | 232.00 |

Note: Datum provided is NAD83 Z16N

W224-04 to 06 -- Confirmation and In-fill Drill Holes

Drill hole W224-04 was collared to test an airborne geophysical conductive zone within the AP Zone and confirm several historical drill holes intersected mineralization (LH01-20: 0.54% Cu Eq over 45 m; LH01-02: 0.92% Cu Eq over 42.6 m; 54017-0: 1.22% Cu Eq over 58.3 m). Drill hole W224-04 intersected disseminated to locally massive sulphide mineralization. This drill hole intercepted 0.47% Cu Eq over 46.00 m starting at 85.00 m, including 2.26% Cu Eq over 1.00 m starting at 110.38 m and 0.92% Cu Eq over 7.84 m starting at 117.16 m.

Drill hole W224-05 was collared 50 m east of historical drill hole LH01-05 within the AP zone. Drill hole LH01-05 reportedly intersected 0.51% Cu Eq over 141.10 m. Drill hole W224-05 intersected disseminated sulphide mineralization with highlights of 0.44% Cu Eq over 67.01 m starting at 32.87 m, 0.33% Cu Eq over 6.83 m starting at 151.20 m, and 0.26% Cu Eq over 9.00 m starting at 172.00 m. These assay results are consistent with the mineralization reported in historical drill holes. Other historical drillholes around W224-05 include 49182-0 (1.73% Cu Eq over 48.20 m located approximately 300 m northeast of drillhole W224-05).

Drill hole W224-06 was collared to test geophysical targets along with two historical holes, 54013-0 and 54014-0, between the CA Zones. It intersected significant sulphide mineralization and has confirmed the presence of mineralization between the current extent of the CA Zones. It intercepted 0.34% Cu Eq over 3.00 m starting at 27.00 m and 0.62% Cu Eq over 4.20 m starting at 62.00 m, including 1.44 % Cu Eq over 1.60 m.

Significant results are provided in Table 2 below.

Table 2. Detailed Highlight Assay Results for Confirmation Drillholes W224-04 to -06.

| DDH | From (m) | To (m) | Core Length (m) | Cu Eq (%) | Cu_pct | Ni_pct | Co_pct | Au_gpt | Pt_gpt | Pd_gpt |

| W224-04 | 60.00 | 62.18 | 2.18 | 0.30 | 0.15 | 0.03 | 0.01 | 0.03 | 0.01 | 0.15 |

| W224-04 | 64 | 67 | 3 | 0.22 | 0.03 | 0.03 | 0.00 | 0.01 | 0.11 | 0.3 |

| W224-04 | 85.00 | 131.00 | 46.00 | 0.47 | 0.15 | 0.11 | 0.01 | 0.03 | 0.07 | 0.15 |

| incl. | 98.00 | 102.00 | 4.00 | 0.71 | 0.17 | 0.20 | 0.02 | 0.01 | 0.11 | 0.26 |

| incl. | 109.00 | 114.00 | 5.00 | 0.82 | 0.40 | 0.12 | 0.01 | 0.11 | 0.11 | 0.15 |

| incl. | 110.38 | 111.38 | 1.00 | 2.26 | 1.40 | 0.27 | 0.02 | 0.17 | 0.17 | 0.41 |

| incl. | 117.16 | 131.00 | 13.84 | 0.61 | 0.22 | 0.14 | 0.01 | 0.06 | 0.07 | 0.15 |

| incl. | 117.16 | 125.00 | 7.84 | 0.92 | 0.33 | 0.21 | 0.02 | 0.07 | 0.10 | 0.23 |

| incl. | 117.16 | 121.00 | 3.84 | 1.46 | 0.50 | 0.36 | 0.03 | 0.08 | 0.18 | 0.38 |

| W224-05 | 32.87 | 99.88 | 67.01 | 0.44 | 0.12 | 0.10 | 0.01 | 0.03 | 0.07 | 0.21 |

| incl. | 71.50 | 79.00 | 7.50 | 0.70 | 0.24 | 0.15 | 0.02 | 0.04 | 0.07 | 0.28 |

| W224-05 | 151.17 | 158.00 | 6.83 | 0.33 | 0.08 | 0.08 | 0.01 | 0.01 | 0.09 | 0.19 |

| W224-05 | 172.00 | 181.00 | 9.00 | 0.26 | 0.03 | 0.06 | 0.01 | 0.00 | 0.14 | 0.21 |

| W224-06 | 27.00 | 30.00 | 3.00 | 0.34 | 0.09 | 0.10 | 0.01 | 0.01 | 0.03 | 0.08 |

| W224-06 | 62.00 | 66.20 | 4.20 | 0.62 | 0.16 | 0.18 | 0.02 | 0.01 | 0.07 | 0.18 |

| incl. | 64.60 | 66.20 | 1.60 | 1.44 | 0.38 | 0.42 | 0.04 | 0.03 | 0.15 | 0.42 |

| W224-06 | 74.00 | 82.00 | 8.00 | 0.19 | 0.06 | 0.05 | 0.01 | 0.01 | 0.02 | 0.05 |

| W224-06 | 86.00 | 106.00 | 20.00 | 0.21 | 0.05 | 0.05 | 0.01 | 0.01 | 0.06 | 0.09 |

| incl. | 99.75 | 101.00 | 1.25 | 0.53 | 0.15 | 0.11 | 0.01 | 0.06 | 0.23 | 0.13 |

| W224-06 | 151.00 | 155.00 | 4.00 | 0.30 | 0.07 | 0.06 | 0.01 | 0.02 | 0.12 | 0.12 |

Note: Intervals reported in Table 2 represent core lengths and not true widths. *Cu Eq (copper equivalent) has been used to express the combined value of copper, nickel, platinum, palladium, cobalt, and gold as a percentage of copper and is provided for illustrative purposes only and to provide ease of comparison. No allowances have been made for recovery losses that may occur should mining eventually result. Calculations use metal prices as of June 2024 of US$4.42/lb for copper, $7.70/lb for nickel, US$74.65/g for gold, US$31.19/g for palladium, US$32.18/g for platinum, and US$12.32/lb for cobalt, using the formula Cu Eq % = Cu % + Ni %x1.742 + Pd g/t x 0.321 + Pt g/t x 0.331 + Au g/t x 0.768 + Co % x 2.787.

Next Steps

The Company has systematically compiled all historical drill holes in the central area into digital format, and an exploration target model is being prepared to generate 3-D shell geological and mineralization models to better understand the mineralization zones confirmed in this drill campaign. In addition, the exploration target model will report tonnage and grade estimates expressed as ranges. The modeling includes analyzing 84 historical diamond drill holes together with the results from the recently completed Phase 1 drill program, covering the three key areas of the project, including the CA zone, AP zone, and the central mineralized envelope.

The modeling work will follow the guidelines set forth in National Instrument 43-101, Section 14, and will be used to inform further prospecting strategies for exploration at W2. This exploration target model is conceptual, and more work and information, including drilling, are required before fulfilling CIM (Canadian Institute of Mining, Metallurgy, and Petroleum) requirements for the disclosure of a mineral resource.

Completion of Phase 1D Exploration Programs at South Timmins Joint Venture projects:

Work on the South Timmins Joint Venture gold projects during June and early July, at Shining Tree and Heenan Mallard Gold Projects has been completed. The work program follows the successful results reported from the first three programs completed in 2023 and 2024, which confirmed high-grade gold mineralization through stripping and channel sampling at Shining Tree, and notably, included a new gold discovery at Heenan in the Swayze Greenstone belt. The Company will provide a comprehensive update next week of the gold assays.

QA/QC Program

Samples were cut using a diamond blade saw, inserted into labeled bags, and delivered by representatives of PTX Metals to Activation Laboratories Ltd. in Thunder Bay, Ontario. Activation Laboratories Ltd. is an ISO 17025:2005 accredited testing laboratory.

Samples were analyzed for Au, Pt, and Pd using the 1C-OES package, and multi-element analysis was completed by near-total digestion (four-acid) with an ICP-OES finish (IF2 package).

PTX inserted standards and blanks and performs duplicate analysis as part of its QA/QC program. Activation Laboratories also conducts an internal QA/QC program, which includes the insertion of CRMs, blanks, sample repeats, and duplicate samples.

Qualified Person

The technical information presented in this news release has been reviewed and approved by Joerg Kleinboeck, P. Geo, Shuda Zhou P. Geo, and Ike Osmani P. Geo who are qualified persons as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Figure 1: Plan View of 2024 Drill Holes in the W2 Central Area

About PTX Metals Inc.

PTX Metals is a minerals exploration Company with two flagship projects situated in northern Ontario, renowned as a world-class mining jurisdiction for its abundance of mineral resources and investment opportunities. The corporate objective is to advance the exploration programs towards proving the potential of each asset, which includes the W2 Copper Nickel PGE Project and South Timmins Joint Venture Gold Projects.

The portfolio of assets offers investors exposure to some of the world’s most valuable metals including gold, as well as essential metals critical for the clean energy transition: copper, nickel, uranium and rare metals. The projects were acquired for their geologically favorable attributes, and proximity to established mining producers. PTX work programs are designed by a team of expert geologists with extensive career knowledge gained from their tenure working for global mining companies in northern Ontario.

PTX Metals is based in Toronto, Canada, with a primary listing on the Canadian Securities Exchange under the symbol PTX. The company is also listed in Frankfurt under the symbol 9PF and on the OTCQB in the United States as PANXF.

For additional information on PTX Metals, please visit the Company’s website at https://ptxmetals.com/.

For further information, please contact:

Greg Ferron, President and Chief Executive Officer

Phone: 416-270-5042

Email: gferron@ptxmetals.com

Forward-Looking Information

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and includes those risks set out in the Company's management's discussion and analysis as filed under the Company's profile at www.sedar.com. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward- looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

1 in the W2 central mineralized trend defined by over 80 historical drill holes

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/899fe268-ac69-427e-8ad6-edc7da3c05ff