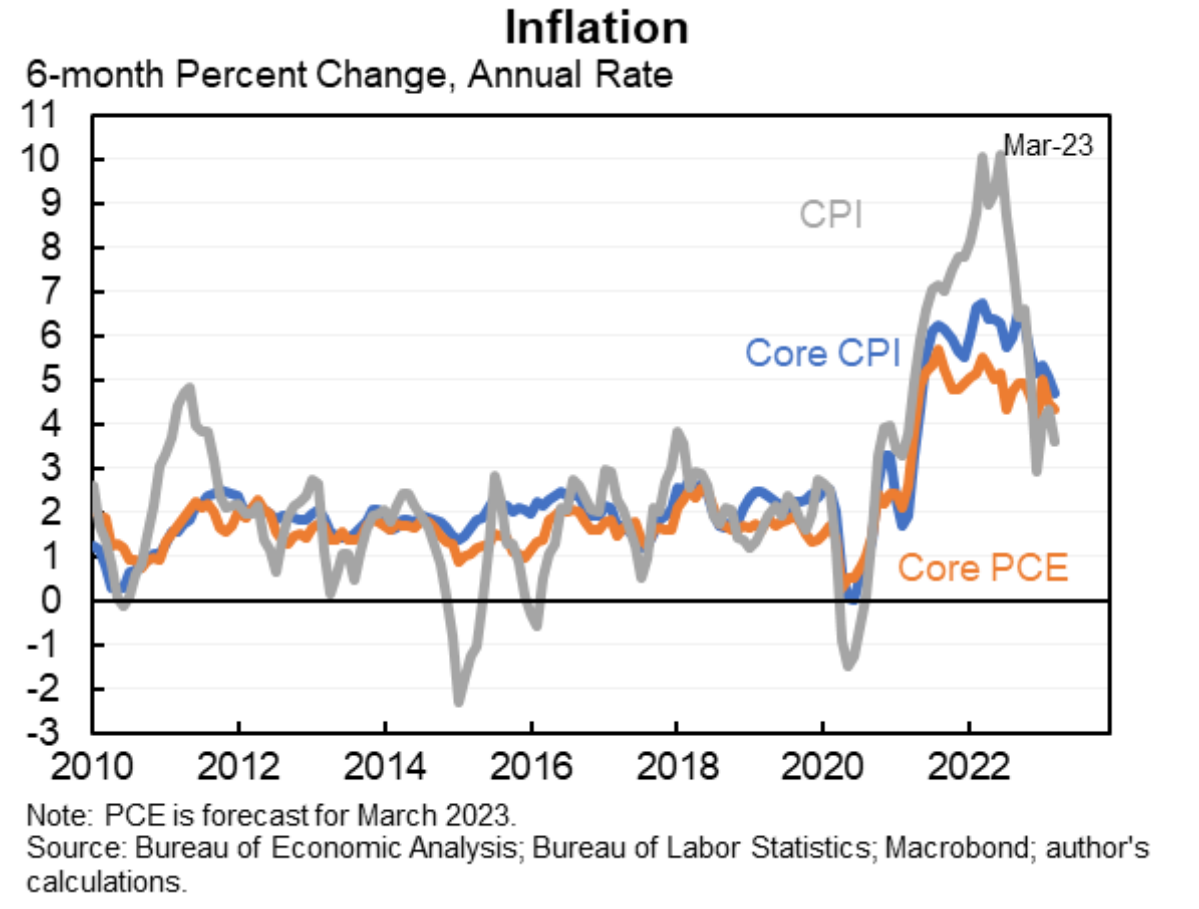

The March CPI report came in pretty much as expected, with the core registering a +5.6% year/year compared to expectations of 5.6%. However, there are some "encouraging" signs that services inflation isn't quite as persistent as feared. Moreover, the shelter component of the core-CPI is likely to continue to moderate over the coming months. (The shelter component accounted for more than 60% of the total increase in core-CPI Y/Y).

It's clear that the economy is softening, consumers are cutting back on spending, and disinflation is beginning to take hold. Given that the market's number one worry at the end of 2022 was inflation, the recent trends in inflation readings and employment data are encouraging. This could give the Fed room to pause next month. However, I am still not expecting the Fed to cut rates until September at the earliest. In addition, if the Fed does begin cutting rates in September, it will likely only be due to an economic calamity that would not be a good thing for the stock market.

Gold has taken encouragement from moderating inflation and falling bond yields, briefly rising above $2,040/oz this morning and heading for its 2nd consecutive weekly close above the $2,000 level (see chart below).

Gold (Weekly)

It's important to remember that markets are forward-looking. Gold, in particular, is looking ahead to the end of 2023 and beginning to price in the beginning of an extended rate-cutting cycle from the Fed. If we use the 2-year US Treasury Yield as a guide for where the Fed Funds Rate is heading, then the Fed is going to cut at least 100 basis points over the next year.

The main risk for precious metals bulls is one of too much optimism being priced in too far ahead of time. So far, I'm not seeing any major contrarian indicators out there. However, I will note that I am seeing a number of $4,000 and $5,000 price targets being thrown around (long-term targets). There has also been a rush to buy physical gold and silver online at bullion dealers like Apmex. In fact, Apmex went so far as to call the recent surge in bullion orders "unprecedented demand".

I will conclude by noting that miners are seeing margins significantly expand in 2023 - falling energy costs and rising metals prices offer a healthy backdrop for gold and silver producers to deliver upside surprises (against favorable year/year comps) as they report quarterly earnings over the next month:

Agnico Eagle Mines - Q1 2023 Earnings Report Expected April 27th (after market close)

Barrick Gold - Q1 2023 Earnings Report Expected May 3rd (before market open)

Kinross Gold - Q1 2023 Earnings Report Expected May 9th (after market close)

Newmont - Q1 2023 Earnings Report Expected April 27th (before market open)

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.