What a difference a few days makes. Last Thursday gold was near $1360 and appeared to be on the brink of breaking out from what could be interpreted as a large ascending triangle. Today gold has fallen to $1324 and appears to be well on its way down to a crucial test of support near $1300:

Gold (Daily)

Surging real rates and a surging US dollar are the proximal causes for the recent dip in gold. However, it must be said that gold is actually holding up relatively well given a nearly 20 basis point spike in the 10-year yield over the last four trading sessions, and what appears to be a highly significant technical breakout in the US Dollar Index.

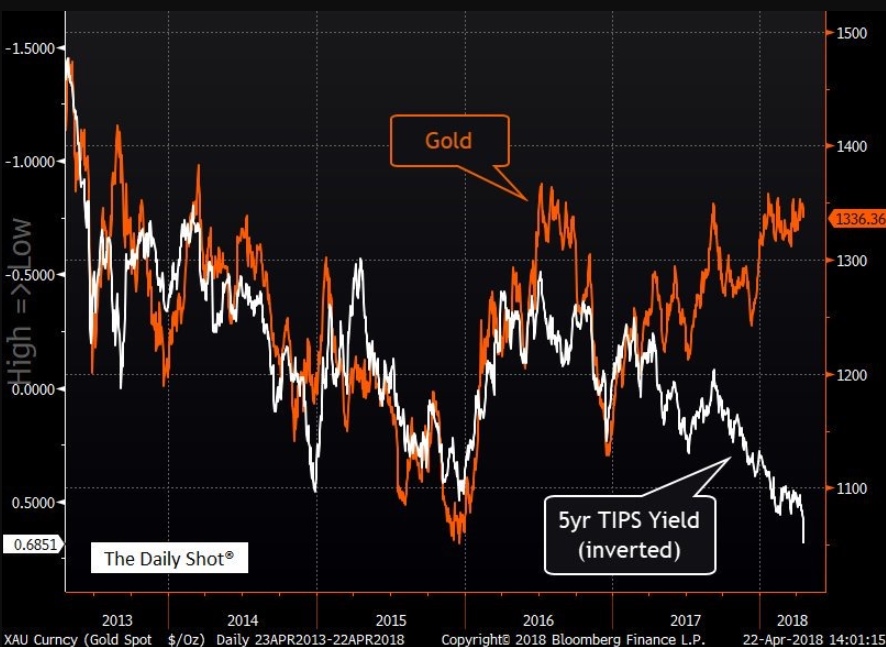

There has been a growing divergence between the US dollar price of gold and real interest rates (as represented by the 5-year TIPS yield in the chart below):

This stunning divergence can be partially explained by weakness in the US dollar currency. Fears of a looming surge in consumer price inflation (due to rising commodity prices) could also help to explain the strength in gold we have seen so far in 2018. However, it must be noted that if the dollar turns around (in a sustained fashion) and inflation becomes a much less potent threat, we could expect a violent reversion to the mean in the above chart.

As it currently stands another 1-2% of downside in gold over the coming days will likely sink sentiment firmly into bearish territory and set the stage for a classic buying opportunity at support. What happens after that will be the key.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.