TORONTO, July 8, 2020 /CNW/ - Battle North Gold Corp. (TSX: RMX) (OTCQX: RBYCF) ("Battle North" or the "Company") (formerly known as Rubicon Minerals Corporation) is pleased to report updated mineral resource estimates (collectively, the "Updated 2020 Mineral Resource Estimate") for the Bateman Gold Project (the "Project")(formerly known as the "Phoenix Gold Project"), prepared in accordance with National Instrument 43-101 of the Canadian Securities Administrators ("NI 43-101"). An updated NI 43-101 technical report for the Project will be filed on www.sedar.com within 45 days. The ongoing Feasibility Study work for the Project remains on schedule for completion in the second half of 2020 ("H2/2020").

Table 1: Updated 2020 Mineral Resource Estimate1 at 3.0 grams per tonne of gold ("g/t Au") Cut-Off Grade

Category | Quantity | Grade | Contained Gold |

Measured (M) | 668 | 6.55 | 141,000 |

Indicated (I) | 3,924 | 6.64 | 838,000 |

M + I | 4,592 | 6.63 | 979,000 |

Inferred | 1,340 | 6.57 | 283,000 |

Notes: |

|

___________________________ | |

1 | There is no certainty that Measured and Indicated mineral resource estimates will be converted to the Proven and Probable mineral reserve categories and there is no certainty that the Updated 2020 Mineral Resource Estimate will be realized. There is no guarantee that Inferred mineral resource estimates can be converted to Indicated or Measured mineral resource categories, or that Indicated or Measured mineral resource estimates will be converted to mineral reserves. Mineral resource estimates that are not mineral reserves do not have demonstrated economic viability. The Updated 2020 Mineral Resource Estimate may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties and other factors, as more particularly described in the Cautionary Statements at the end of this news release. |

2 | Mining cash cost components include in-stope mining costs, underground utilities, material handling, and development costs. |

Table 2: Comparison between Updated 20201,3 and January 20201,4 Estimated Quantities at Reported Cut-Off Grades – 3.0 g/t Au, 3.3 g/t Au, 3.5 g/t Au and 4.0 g/t Au

Cut-off Grade/ | Quantity (000 tonnes) | Grade (g/t Au) | Contained Gold (000 oz) | ||||||

July | Jan | Change | July | Jan | Change | July | Jan | Change | |

3.0 g/t Au | |||||||||

Measured (M) | 668 | 665 | 0% | 6.55 | 6.53 | 0% | 141 | 140 | 1% |

Indicated (I) | 3,924 | 3,243 | 21% | 6.64 | 6.44 | 3% | 838 | 671 | 25% |

Total M+I | 4,592 | 3,908 | 18% | 6.63 | 6.45 | 3% | 979 | 811 | 21% |

Inferred | 1,340 | 2,073 | -35% | 6.57 | 6.97 | -6% | 283 | 464 | -39% |

3.3 g/t Au | |||||||||

Measured (M) | 570 | 569 | 0% | 7.13 | 7.10 | 0% | 131 | 130 | 1% |

Indicated (I) | 3,447 | 2,815 | 22% | 7.13 | 6.94 | 3% | 790 | 628 | 26% |

Total M+I | 4,017 | 3,383 | 19% | 7.13 | 6.97 | 2% | 921 | 758 | 22% |

Inferred | 1,185 | 1,836 | -36% | 7.01 | 7.46 | -6% | 267 | 440 | -39% |

3.5 g/t Au | |||||||||

Measured (M) | 516 | 515 | 0% | 7.53 | 7.48 | 1% | 125 | 124 | 1% |

Indicated (I) | 3,177 | 2,581 | 23% | 7.44 | 7.26 | 2% | 760 | 602 | 26% |

Total M+I | 3,693 | 3,096 | 19% | 7.46 | 7.30 | 2% | 885 | 726 | 22% |

Inferred | 1,098 | 1,713 | -36% | 7.30 | 7.75 | -6% | 258 | 427 | -40% |

4.0 g/t Au | |||||||||

Measured (M) | 412 | 411 | 0% | 8.48 | 8.44 | 0% | 112 | 111 | 1% |

Indicated (I) | 2,646 | 2,128 | 24% | 8.19 | 8.01 | 2% | 697 | 548 | 27% |

Total M+I | 3,058 | 2,539 | 20% | 8.23 | 8.08 | 2% | 809 | 659 | 23% |

Inferred | 897 | 1,417 | -37% | 8.10 | 8.59 | -6% | 233 | 391 | -40% |

Key Points:

Updated 2020 Mineral Resource Estimate1 metrics, based on a 3.0 g/t Au cut-off grade:

- Measured and Indicated mineral resource estimates, in aggregate, increased 21% to 979,000 ounces of gold compared to the January 2020 Estimate4 of 811,000, reflecting an increase in the estimated average grade of 3% to 6.63 g/t Au as compared to 6.45 g/t Au for the January 2020 Estimate;

- As a result of the successful net conversion to Measured and Indicated mineral resources, Inferred mineral resource estimates decreased 39% to 283,000 ounces of gold compared to the January 2020 Estimate of 464,000 ounces of gold, reflecting a decrease in the estimated average grade of 6% to 6.57 g/t Au compared to 6.97 g/t Au for the January 2020 Estimate; and

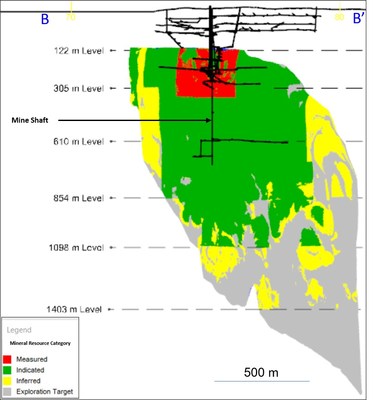

- The increase in the Measured and Indicated mineral resource estimates was mainly between the planned 854 metre ("m") and 1,098 m Levels and was attributable to the Company's successful oriented infill drilling program between those levels this year.

___________________________ | |

3 | Base case scenario for the Updated 2020 Mineral Resource Estimate is at the 3.0 g/t Au cut-off. Other scenarios are shown for comparison purposes. Numbers may not add up due to rounding. |

4 | For further details refer to the mineral resource estimate for the Project effective as of December 6, 2020 (the "January 2020 Estimate") reported in the Company's NI 43-101 technical report for the Project dated January 3, 2020 (the "January 2020 Technical Report"), which is available on SEDAR www.sedar.com and on the Company's website at www.battlenorthgold.com. The January 2020 Estimate is not current and should not be relied upon. |

General observations and commentary on the Updated 2020 Mineral Resource Estimate1

- The Company achieved greater than 90% conversion rate of Inferred mineral resource estimates to the Measured and Indicated categories. The Updated 2020 Inferred mineral resource estimate extends down to the 1,403 m Level presenting an opportunity to further expand the Measured and Indicated mineral resource estimate at depth with additional orientated infill drilling;

- The geological and structural model, as developed in 2018 and updated in early 20205, continues to be observed at depth throughout the F2 Gold Zone;

- The F2 Gold Zone remains open along strike and at depth;

- The mineral resource modelling method and estimation parameters used were consistent to the January 2020 Estimate4;

- The 2020 Updated Inferred mineral resource estimate of 1.3 million tonnes grading 6.56 g/t Au for 282,000 ounces has the potential to be upgrade to the Measured and Indicated categories with future orientated infill drilling. Areas of focus are between the 488 m and 732 m Levels, and between the 915 m and 1,098 m Levels; these areas are within the potential development and production plans being contemplated in the ongoing Feasibility Study work; and

- In addition, the sparsely drilled "Explore Target6" areas containing approximately 1.0 to 1.3 million tonnes grading 5.0 to 7.0 g/t Au (based on 3.0 g/t Au cut-off) have the potential to be upgraded to a mineral resource estimate with further orientated infill drilling.

CEO Comments

Battle North President and Chief Executive Officer George Ogilvie, P.Eng., stated, "The expansion of the Measured and Indicated mineral resource estimate to 979,000 ounces gives us confidence that we can potentially extend the current conceptual mine life to the Bateman Gold Project5 within our impending Feasibility Study. The weighted average drill density within the Updated 2020 Measured and Indicated mineral resource estimate categories is 17 m drill centre spacing, providing us with a great degree of confidence in the data that drives the estimates. We are particularly pleased with two key aspects of the exploration program. The first was the high conversion rate of the January 2020 Inferred mineral resource estimate ounces into the Indicated category, which exceeded 90%. The second was the addition of approximately 132,000 higher-grade ounces in the Updated 2020 Indicated mineral resource estimate grading 8.15 g/t Au between the 976 m and 1,098 m Levels. These results provide strong indications of the further potential exploration upside of the F2 Gold Zone at the Bateman Gold Project."

We have made good progress with the mine planning, engineering work, capital cost request for proposals ("RFP") and believe we are more than 75% complete with the feasibility work programs. We remain on track to deliver the Feasibility Study in the second half of 2020."

___________________________ | |

5 | For further details refer to the January 2020 Technical Report available on SEDAR www.sedar.com and on the Company's website at www.battlenorthgold.com. |

6 | The potential quantity and grade of "Explore Target" areas are conceptual in nature. There has been insufficient exploration of the "Explore Target" areas to define a mineral resource estimate and it is uncertain if further exploration will result in the "Explore Target" being delineated as a mineral resource estimate. |

Updated 2020 Mineral Resource Estimate1 Details

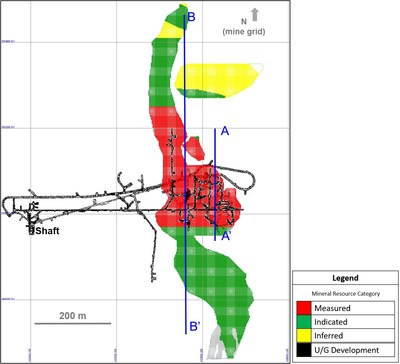

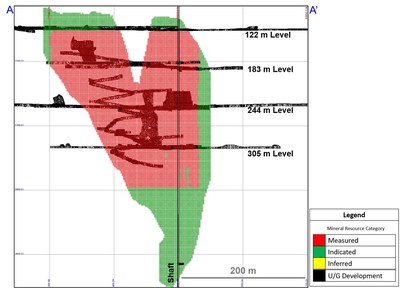

The Updated 2020 Mineral Resource Estimate (see Table 1 above) benefits from 570,861 m of core drilling in 1,683 drill holes. The F2 Gold Zone at the Bateman Gold Project covers a strike length of approximately 1,200 m and depths down to 1,403 m Level and remains open along strike and at depth. The Updated 2020 Mineral Resource Estimate excludes the crown pillar and depletion from prior test trial mining.

The Updated 2020 Mineral Resource Estimate was evaluated using the same geostatistical block modelling approach as with the January 2020 Estimate4. The block model was classified in accordance with Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources and Mineral Reserves (May 2014). Average drill spacing for the Updated 2020 Measured, Indicated and Inferred mineral resource estimates were 8 m, 19 m, and 28 m, respectively.

The sensitivity of the Updated 2020 Mineral Resource Estimate to the selection of cut-off grade is summarized as grade/tonnage data in Table 3 below. Please refer to Table 4 at the end of the news release for further details on the geological modelling and high-grade treatment strategies, including top-cut values and coefficients of variation ("CV") for each sample population. The Updated 2020 Mineral Resource Estimate by underground level is tabulated in Table 5 (at the end of this news release). Please see Diagrams 1, 2, and 3 (at the end of this news release) showing the conceptual plan and longitudinal views of Zones 1 and 2 (the two main mineral domains) of the Updated 2020 Mineral Resource Estimate blocks in the Measured, Indicated, and Inferred mineral resource categories and Explore Target6 areas.

Table 3: Updated 2020 Mineral Resource Estimate1 – Sensitivity Analysis at Potential Mining Cut-off Grades3

Measured and Indicated | Inferred | ||||||

Cut-off Grade | Quantity | Grade | Contained | Quantity | Grade | Contained | |

2.0 | 7,996 | 4.85 | 1,245 | 2,215 | 4.93 | 351 | |

2.5 | 5,980 | 5.72 | 1,101 | 1,678 | 5.79 | 313 | |

*3.0 | 4,592 | 6.63 | 979 | 1,340 | 6.57 | 283 | |

3.3 | 4,017 | 7.13 | 921 | 1,184 | 7.01 | 267 | |

3.5 | 3,693 | 7.45 | 885 | 1,098 | 7.30 | 258 | |

4.0 | 3,349 | 7.85 | 845 | 996 | 7.67 | 246 | |

4.5 | 3,058 | 8.23 | 809 | 897 | 8.10 | 233 | |

5.0 | 2,578 | 8.97 | 744 | 742 | 8.90 | 212 | |

Geological Model and Structural Geology

The geological interpretation of the new drilling utilized in the Updated 2020 Mineral Resource Estimate was reviewed and there were no material changes noted. The geological and structural model, as developed in 2018 and updated in early 20205, continues to be observed at depth throughout the F2 Gold Zone.

Feasibility Study

Based on the Updated 2020 Mineral Resource Estimate of 979,000 ounces of gold in the Measured and Indicated categories at a 3.0 g/t Au cut-off, the Company believes that the Project has a sufficiently well-defined mineral resource base on which to continue mine planning and additional engineering work to determine the Project's commercial viability. The Feasibility Study on the Project remains on track for completion in H2/2020, with the following updates:

- Feasibility work 75% complete: Battle North remains on schedule to deliver the Feasibility Study in H2/2020;

- Potential mining cut-off grade for extractable ounces at 3.3 g/t Au: The Company has designed the stope shapes with a potential mining break-even cut-off grade of 3.3 g/t Au (for three of the four selected mining methods), which is based on costs related to mining, processing, general and administration, sustaining capital, and royalties, and factors in mining recovery, external dilution, a long-term gold price assumption of US$1,375/oz and an exchange rate of 0.74 US$/C$. We are currently evaluating the long-term gold price assumption; however, we anticipate it will be higher in the financial economic model of the Feasibility Study;

- Majority of RFPs received: Battle North is currently evaluating quotes from vendors for various surface and underground work and equipment, including tailings management facility upgrades, underground development and ammonia treatment plant construction; and

- Potential underground ramp development: The Updated 2020 Measured and Indicated mineral resource estimate extends to a depth down to the 1,098 m Level, where the Company anticipates the underground ramp development bottom to be in the Feasibility Study.

Qualified Persons and Quality Assurance and Quality Control (QA/QC)

The content of this news release has been read and approved by Michael Willett, P.Eng., Director of Projects for Battle North, and Isaac Oduro, P.Geo., Manager of Technical Services for Battle North, and Tim Maunula, P.Geo. of T. Maunula & Associates Consulting Inc. ("TMAC"), which is independent of Battle North. All are Qualified Persons as defined by NI 43-101.

Underground drilling was conducted by Boart Longyear Drilling of Haileybury, Ontario and was supervised by the Battle North Gold exploration team. All assays reported are uncut unless otherwise stated. Samples reported herein were assayed by SGS Mineral Services of Red Lake, Ontario and Activation Laboratories Ltd., Dryden, Ontario, both of which are independent of Battle North. All NQ core assays reported were obtained by fire assay with AA-finish or using gravimetric finish for values over 10.0 g/t Au.

Intercepts cited do not necessarily represent true widths, unless otherwise noted, however drilling is generally intersecting interpreted mineralized zones at angles between -30o and +30o. True width determinations are estimated at 65-80% of the core length intervals for the 305 m Level drilling, and estimated at 75-95% of the core length for the 610 m and 685 m Level drilling. Battle North Gold's quality control checks include insertion of blanks, standards and duplicates to ensure laboratory accuracy and precision.7

___________________________ | |

7 | For more information on applicable QA/QC procedures, see the January 2020 Technical Report available on SEDAR www.sedar.com and on the Company's website at www.battlenorthgold.com. |

About Battle North Gold Minerals Corporation

Battle North Gold is a Canadian gold mine developer led by an accomplished management team with successful underground gold mine operations, finance, and capital markets experience. Battle North owns the significantly de-risked and shovel-ready Bateman Gold Project, located in the renowned Red Lake gold district in Ontario, Canada and controls the strategic and second largest exploration ground in the district. Battle North also owns a large gold exploration land package on the Long Canyon gold trend near the Nevada-Utah border in the United States. Battle North's shares are listed on the Toronto Stock Exchange and the OTCQX markets. For more information, please visit our website at www.battlenorthgold.com.

BATTLE NORTH GOLD CORPORATION

George Ogilvie, P.Eng.

President, CEO, and Director

Table 4: Further Details on Geological Modelling and High-Grade Treatment Strategy

Geological Modelling |

Geological domains were modelled based on broad low-grade mineralization envelopes associated with the three main high-titanium basalt lenses defined on the Project property (from mine grid West-to-East including Hanging Wall Basalt, West Limb Basalt, and F2 Basalt). TMAC used block model techniques to estimate gold grade into 2 m x 2 m x 2 m blocks using Geovia GEMS software. All as logged rock types were grouped into three main stratigraphic units consisting of ultramafic units (UM), high-titanium basalt units (HTB) and felsic intrusive units (FI) as determined by grade distribution analysis of the rock types present. These stratigraphic units were then used as mineralization domains to constrain the gold grade estimates. The HTB was treated as a hard boundary with the other lithologies. Grade estimation was completed using inverse distance weighting cubed (ID3) interpolation using 1.0 m composite samples, with additional search controls based on variography and trends of mineralization. A 4-pass search strategy was used where gold estimates required a minimum of 5 and maximum of 11 samples for the first 2 passes, a minimum of 4 and maximum of 8 samples for the 3rd and a minimum of 3 and maximum of 8 samples for the 4th pass. The majority of blocks (>99%) were estimated using two drill holes. Search distances were factored for each successive search. Average density values were assigned to the model based on lithology. |

High-Grade Treatment Strategy |

High-grade composite samples (outliers) were controlled during the estimation process using a combination of distance restriction and capping (composites capped to a defined maximum value). Within the first pass, samples were capped and limited to the first pass search range. For Passes 2 to 4, the outlier samples were removed from the grade estimation. Capping values were assessed based on cumulative probability, disintegration analysis and decile analysis for each lithology within mineral envelopes for Zones 1 to 4 as summarized below. CV of uncapped and capped composite grades for Zones 1 to 4 are summarized below. |

Capping Values for Zones 1, 2, 3, and 4: | ||||

Zones | Lithology | Capping Values | Number Capped | Metal Loss (%) |

Zone 1 | UM | 49 | 10 | 18 |

HTB | 96 | 21 | 15 | |

FI | 16 | 5 | 10 | |

Zone 2 | UM | 50 | 40 | 38 |

HTB | 96 | 21 | 17 | |

FI | 62 | 19 | 9 | |

Zone 3 | UM | 14 | 18 | 29 |

HTB | 4 | none | 0 | |

FI | 18 | 3 | 0 | |

Zone 4 | UM | 5 | 7 | 56 |

HTB | 16 | 7 | 20 | |

FI | 3 | 4 | 10 | |

Descriptive Statistics and CV for Zones 1, 2, 3, and 4 Capped: | |||||||

Zone | Rock | ZR | Count | Maximum | Mean | Standard | CV |

1 | UM | 107 | 5776 | 49.00 | 0.76 | 3.27 | 4.29 |

HTB | 109 | 13201 | 96.00 | 1.91 | 5.78 | 3.02 | |

FI | 117 | 1871 | 16.00 | 0.47 | 1.29 | 2.74 | |

2 | UM | 207 | 57038 | 50.00 | 0.23 | 1.84 | 7.78 |

HTB | 209 | 24445 | 96.00 | 1.10 | 4.23 | 3.87 | |

FI | 217 | 37995 | 62.00 | 0.56 | 2.13 | 3.90 | |

3 | UM | 307 | 20180 | 14.00 | 0.05 | 0.53 | 9.83 |

HTB | 309 | 33 | 3.21 | 0.14 | 0.56 | 3.93 | |

FI | 317 | 4914 | 18.00 | 0.36 | 0.82 | 2.27 | |

4 | UM | 407 | 4121 | 5.00 | 0.05 | 0.29 | 6.30 |

HTB | 409 | 1580 | 16.00 | 0.41 | 1.43 | 3.48 | |

FI | 417 | 456 | 3.00 | 0.22 | 0.46 | 2.08 | |

Table 5: Classified Updated 2020 Mineral Resource Estimate1 by Underground Level at 3.0 g/t Au Cut-off Grade

Measured and Indicated | Inferred | |||||

Below | Tonnes | Grade (g/t Au) | Contained Au oz | Tonnes | Grade | Contained Au oz |

122 | 23 | 8.47 | 6 | 6 | 3.14 | 1 |

183 | 194 | 5.58 | 35 | 8 | 3.82 | 1 |

244 | 234 | 6.19 | 47 | 13 | 5.33 | 2 |

305 | 306 | 7.02 | 69 | 8 | 4.56 | 1 |

366 | 393 | 7.38 | 93 | 27 | 4.40 | 4 |

427 | 378 | 6.78 | 82 | 23 | 4.02 | 3 |

488 | 376 | 6.25 | 76 | 83 | 5.20 | 14 |

549 | 276 | 5.74 | 51 | 69 | 6.62 | 15 |

610 | 277 | 5.59 | 50 | 46 | 8.36 | 12 |

671 | 387 | 6.76 | 84 | 168 | 8.23 | 46 |

732 | 379 | 6.17 | 75 | 99 | 6.50 | 21 |

793 | 319 | 6.32 | 65 | 19 | 4.69 | 3 |

854 | 233 | 5.42 | 41 | 7 | 4.98 | 1 |

915 | 217 | 6.07 | 42 | 89 | 5.06 | 15 |

976 | 310 | 7.61 | 76 | 73 | 6.26 | 15 |

1,037 | 192 | 10.07 | 62 | 85 | 7.62 | 21 |

1,098 | 98 | 7.91 | 25 | 37 | 6.26 | 7 |

1,159 | 147 | 6.59 | 31 | |||

1,220 | 157 | 6.35 | 32 | |||

1,281 | 42 | 4.06 | 6 | |||

1,342 | 80 | 7.77 | 20 | |||

1,403 | 52 | 8.65 | 14 | |||

Notes: |

|

Cautionary Statement regarding Forward-Looking Statements and other Cautionary Notes

All statements, other than statements of historical fact, contained or incorporated by reference in this news release constitute "forward-looking statements" and "forward looking information" (collectively, "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "anticipates", "assumption", "confidence", "believe", "conceptual", "contemplated", "conversion", "demonstrate", "estimate", "expect", "exploration", "factors", "feasibility", "forward", "future", "indication", "may", "mineable", "model", "objective", "on track", "opportunity", "plan", "possibility", "potential", "preliminary", "probability", "progress", "project", "risk", "schedule", "sensitivity", "strategies", "study", "target", "upgrade", "upside", "viability" and "will", or variations of such words, and similar such words, expressions or statements that certain actions, events or results can, could, may, should, will (or not) be achieved or occur in the future. In some cases, forward-looking information may be stated in the present tense, such as in respect of current matters that may be continuing, or that may have a future impact or effect. Forward-looking statements reflect our current expectations and assumptions, and are subject to a number of known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to statements regarding mineral resource estimates, the anticipated timing of the delivery and details of an updated NI 43-101 technical report and/or a Feasibility Study for the Project (including the potential results of such study), potential tonnage of mineralized material and grade thereof from the Project (including, but not limited to, any Explore Target areas), the potential to improve mineral resource estimates (including but not limited to expanding the quantity and converting or upgrading the classification) and any further steps necessary to do so; and mine plans including any potential increases in mine life.

Forward-looking statements are based on the assumptions, estimates, expectations and opinions of management, which management considers reasonable and represent its best judgment based on available facts, as of the date such statements are made. If such assumptions, estimates, expectations and opinions prove to be incorrect, actual and future results may be materially different than expressed or implied in the forward-looking statements. The assumptions, estimates, expectations and opinions referenced, contained or incorporated by reference in this news release which may prove to be incorrect include those set forth herein, and in the Company's Management's Discussion and Analysis for the quarter ended March 31, 2020 (the "Q1, 2020 MD&A") and the accompanying financial statements, and the January 2020 Technical Report, all available under on SEDAR at www.sedar.com and on its website at www.battlenorthgold.com.

Forward-looking statements are inherently subject to known and unknown risks, uncertainties, contingencies and other factors which may cause the actual results, performance or achievements of Battle North to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks, uncertainties, contingencies and factors include, among others: gold price fluctuations; possible variations in mineralization, grade or recovery or throughput rates; uncertainty of mineral resource estimates; inability to realize exploration potential, mineral grades and mineral recovery estimates; actual results of exploration activities including their impact; delays in completion of exploration and other drilling or plans, and any studies, including the ongoing Feasibility Study for the Project, for any reason including insufficient capital and other risks, uncertainties, contingencies and factors identified herein; labour issues at the Company or third parties, such as government and regulatory agencies, suppliers and service providers, including labour shortages and/or work curtailments or stoppages as may result from COVID-19; conclusions of economic, geological or structural evaluations and models including those reflected in mineral resource estimates, or included in the January 2020 Technical Report and the ongoing Feasibility Study, and any other studies for the Project; changes in Project parameters as plans continue to be refined; failure of equipment or processes to operate as anticipated; accidents and other risks of the mining industry; delays and other risks related to operations; the ability to obtain and maintain permits and other regulatory approvals (as well as the timing and terms thereof) and to comply with such permits, approvals and other applicable regulatory requirements; the ability of Battle North to comply with its obligations under material agreements including its current loan facility and other financing agreements; the availability of financing for proposed programs and working capital requirements on reasonable terms and in a timely manner; the ability to meet, repay, or refinance, or replace, or renegotiate current and future debt obligations on reasonable terms and in a timely manner including the current loan facility and closure and reclamation surety bond; the ability of third-party service providers and other suppliers to deliver on reasonable terms and in a timely manner (including those working on the ongoing Feasibility Study for the Project); risks associated with the ability to retain key executives and key operating personnel; cost of environmental expenditures and potential environmental liabilities; relations with local communities including First Nations; failure of plant, equipment or processes to operate as anticipated; cost of supplies; market conditions and general business, economic, competitive, political and social conditions; our ability to generate sufficient cash flow from operations or obtain adequate financing to fund our capital expenditures and working capital needs and meet our other obligations; the volatility of our stock price, and the ability of our common stock to remain listed and traded on the TSX; epidemics, pandemics and other public health crises, including COVID-19 or similar such viruses; and the "Risk Factors" in the Company's annual information form dated March 27, 2020 ("2020 AIF") as well as the risks, uncertainties, contingencies and other factors identified in the January 2020 Technical Report and the Q1, 2020 MD&A and accompanying financial statements, all of which are available on SEDAR at www.sedar.com and on the Company's website at www.battlenorthgold.com. The foregoing list of risks, uncertainties and other factors is not exhaustive; readers should consult the more complete discussion of the Company's business, financial condition and prospects that is provided in the 2020 AIF.

The forward-looking statements referenced or contained herein are expressly qualified by these Cautionary Statements as well as the Cautionary Statements in the Q1, 2020 MD&A, the 2020 AIF and the January 2020 Technical Report. Forward-looking statements contained herein are made as of the date of this news release (or otherwise expressly specified) and Battle North disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable laws.

Cautionary Statement Regarding Mineral Resources

Until mineral deposits are actually mined and processed, mineral resources must be considered as estimates only. Mineral resource estimates that are not Mineral Reserves do not have demonstrated economic viability. The estimation of mineral resources is inherently uncertain, involves subjective judgement about many relevant factors and may be materially affected by, among other things, environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, contingencies and other factors described in the foregoing Cautionary Statements, as well as those described in the Q1, 2020 MD&A and accompanying financial statements, the 2020 AIF and the January 2020 Technical Report. The quantity and grade of reported "Inferred" mineral resource estimates are uncertain in nature and there has been insufficient exploration to define "Inferred" mineral resource estimates as an "Indicated" or "Measured" mineral resource and it is uncertain if further exploration will result in upgrading (or converting) "Inferred" mineral resource estimates to an "Indicated" or "Measured" mineral resource category. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral resource estimates may have to be re-estimated based on, among other things: (i) fluctuations in mineral prices; (ii) results of drilling, and development; (iii) results of test stoping and other testing; (iv) metallurgical testing and other studies; (v) results of geological and structural modeling including stope design; (vi) proposed mining operations, including dilution; (vii) the evaluation of mine plans subsequent to the date of any estimates; and (viii) the possible failure to receive required permits, licenses and other approvals. The mineral resources estimates referenced in this news release were reported using Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves in accordance with National Instrument 43-101 of the Canadian Securities Administrators ("NI 43-101").

Cautionary Statement to U.S. Readers

Information concerning descriptions of mineralization and mineral resources estimates contained in this news release may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the United States Securities and Exchange Commission ("SEC") under applicable United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101. The definitions used in NI 43–101 differ from the definitions under applicable United States securities laws. For example, this news release uses the terms "Measured" and "Indicated" mineral resources and "Inferred" mineral resources which, while defined by NI 43-101 and recognized and required by the Canadian Securities Administrators, are not recognized by the SEC. The estimation of "Measured", "Indicated" and "Inferred" mineral resources involves greater uncertainty as to their existence and economic feasibility than the estimation of a "Reserve". The estimation of "Inferred" mineral resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of mineral resources. It cannot be assumed that all or any part of a "Measured", "Indicated" or "Inferred" mineral resource estimate will ever be upgraded (or converted) to a higher category.

It should not be assumed that any part or all of a "Measured", "Indicated" or "Inferred" mineral resource estimate exists or is economically or legally mineable. Under Canadian securities laws, estimates of "Inferred" mineral resources may not form the basis of feasibility studies, pre-feasibility studies or other economic studies, except in prescribed cases, such as in a preliminary economic assessment under certain circumstances. The SEC normally only permits issuers to report mineralization that does not constitute "Reserves" as in-place tonnage and grade without reference to unit measures. Under U.S. standards, mineralization may not be classified as a "Reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the "Reserve" determination is made.

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/battle-north-gold-achieves-21-growth-in-measured-and-indicated-mineral-resource-estimates-to-979-000-ounces-of-gold-301089881.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/battle-north-gold-achieves-21-growth-in-measured-and-indicated-mineral-resource-estimates-to-979-000-ounces-of-gold-301089881.html

SOURCE Battle North Gold Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2020/08/c0755.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2020/08/c0755.html