CALGARY, AB, May 5, 2021 /CNW/ - Gear Energy Ltd. ("Gear" or the "Company") (TSX: GXE) is providing the following first quarter operating update to shareholders. Gear's Interim Condensed Consolidated Financial Statements and related Management's Discussion and Analysis ("MD&A") for the period ended March 31, 2021 are available for review on Gear's website at www.gearenergy.com and on www.sedar.com.

Three months ended | |||

(Cdn$ thousands, except per share, share and per boe amounts) | Mar 31, 2021 | Mar 31, 2020 | Dec 31, 2020 |

FINANCIAL | |||

Funds from operations (1) | 8,253 | 6,258 | 8,253 |

Per boe | 17.19 | 10.20 | 15.41 |

Per weighted average basic share | 0.04 | 0.03 | 0.04 |

Cash flows from operating activities | 9,892 | 9,788 | 8,016 |

Per boe | 20.60 | 15.95 | 14.97 |

Net (loss) income | (3,497) | (110,215) | 39,349 |

Per weighted average basic share | (0.02) | (0.51) | 0.18 |

Capital expenditures | 7,883 | 11,099 | 386 |

Decommissioning liabilities settled (2) | 1,437 | 671 | 726 |

Net acquisitions (dispositions) (3) | - | 3 | - |

Net debt (1) (4) | 42,929 | 80,261 | 52,864 |

Weighted average shares, basic (thousands) | 221,090 | 216,715 | 216,490 |

Shares outstanding, end of period (thousands) | 247,415 | 216,468 | 216,490 |

OPERATING | |||

Production | |||

Heavy oil (bbl/d) | 3,026 | 3,989 | 3,236 |

Light and medium oil (bbl/d) | 1,513 | 1,775 | 1,657 |

Natural gas liquids (bbl/d) | 121 | 217 | 182 |

Natural gas (mcf/d) | 4,043 | 4,582 | 4,477 |

Total (boe/d) | 5,335 | 6,744 | 5,821 |

Average prices | |||

Heavy oil ($/bbl) | 51.58 | 27.58 | 36.16 |

Light and medium oil ($/bbl) | 63.16 | 50.44 | 48.10 |

Natural gas liquids ($/bbl) | 42.61 | 10.54 | 26.02 |

Natural gas ($/mcf) | 3.05 | 1.93 | 2.69 |

Netback ($/boe) | |||

Commodity and other sales | 50.46 | 31.24 | 36.68 |

Royalties | (4.77) | (3.66) | (4.38) |

Operating costs | (17.51) | (15.93) | (14.83) |

Transportation costs | (2.01) | (2.08) | (1.96) |

Operating netback (1) | 26.17 | 9.57 | 15.51 |

Realized risk management (loss) gain | (4.55) | 4.57 | 4.67 |

General and administrative | (2.37) | (2.77) | (2.41) |

Interest | (1.96) | (1.33) | (2.25) |

Realized gain on foreign exchange | (0.10) | 0.16 | (0.11) |

TRADING STATISTICS ($ based on intra-day trading) | |||

High | 0.64 | 0.50 | 0.31 |

Low | 0.25 | 0.08 | 0.15 |

Close | 0.50 | 0.10 | 0.29 |

Average daily volume (thousands) | 1,307 | 874 | 320 |

(1) | Funds from operations, net debt and operating netback are non-GAAP measures and are reconciled to the nearest GAAP measures under the heading "Non-GAAP Measures" in Gear's MD&A. |

(2) | Decommissioning liabilities settled includes expenditures made by both Gear and the Federal Site Rehabilitation Program. |

(3) | Net acquisitions (dispositions) exclude non-cash items for decommissioning liability and deferred taxes and is net of post-closing adjustments. |

(4) | Net debt as of March 31, 2021, includes $3.3 million of Convertible Debentures that were subsequently converted into common shares. As of the date of this press release, no Convertible Debentures were outstanding. |

MESSAGE TO SHAREHOLDERS

Although we still find ourselves in the midst of a pandemic, the general market sentiment has changed dramatically from a year ago. WTI oil prices have recovered from negative levels last year to now trading above US$65 per barrel. Additionally, investors finally appear to be acknowledging the true value of the tangible resources that are required to fuel the economy now and into the foreseeable future. Despite the strong share price appreciations seen so far this year, most energy companies are still trading close to historical lows when balanced against future revenue generation ability.

With the release of this quarter, Gear has successfully accomplished the goal of providing an exceptionally strong balance sheet. With net debt being reduced by 47 per cent from a year ago, Gear now has material optionality to once again focus on providing shareholder returns in the most efficient and low risk ways possible. The outlook for the remainder of 2021 looks very strong. Gear is predicting material free funds from operations as a result of modest production growth, price stability and an improving cost profile. In aggregate the Company focus will continue to be on significant debt reduction with a slight increase to capital investment for the rest of the year. This modest increase is intended to take advantage of a few very strategic asset opportunities and to invest in decline-reducing water flood projects which will not only provide economic returns this year but will also enhance the ability to generate incremental free funds from operations into the future.

QUARTERLY HIGHLIGHTS

- Funds from operations for the first quarter of 2021 was $8.3 million, an increase of 32 per cent from the first quarter of 2020 as a result of significantly higher commodity prices. First quarter realized prices increased from $31.24 per barrel in 2020 to $50.46 per barrel in 2021. The improved commodity prices were driven by an increase in the West Texas Intermediate ("WTI") benchmark oil price which averaged US$57.84 per barrel in the first quarter along with narrowing Canadian oil differentials on both the heavy and the light oil benchmarks.

- In the first quarter of 2021, Gear recommenced investment in the field through the drilling of eleven successful (10.3 net) wells including ten heavy oil single lateral wells in Paradise Hill and one (0.3 net) light oil multi-stage fractured well in Wilson Creek. A total of $7.9 million was invested during the first quarter. The ten heavy oil wells continue to be optimized, producing a total of over 400 barrels per day over the last 30 days. The light oil well has been on production for 33 days producing an average of 200 barrels per day on an inclining profile with the last few days at approximately 300 barrels per day (on a gross basis).

- Reduced abandonment liabilities by $1.4 million in the first quarter through $0.4 million of expenditures made by Gear and $1.0 million of expenditures through the Federal Site Rehabilitation Program. A total of 61 wells were abandoned and 52 wells were cut and capped. As a result of significant and ongoing cost savings being realized in the field, Gear reduced some estimates for future costs to abandon wells. This assisted Gear in reducing the first quarter corporate decommissioning liability to $80.3 million from the $87.5 million reported in the fourth quarter of 2020.

- Finalized plans to eliminate the flaring of approximately 550 mcf per day of natural gas in Tableland, Saskatchewan. Field work is commencing immediately with the project expected to be operational sometime in the second half of 2021.

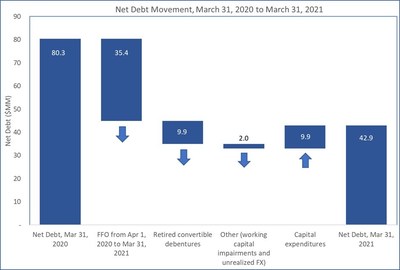

- Reduced net debt by 47 per cent from $80.3 million in the first quarter of 2020 to $42.9 million at the end of the first quarter of 2021. Since the first quarter of 2020, debt has been lowered as a result of funds from operations significantly exceeding capital investment. Additionally, $9.9 million of convertible debentures were retired through the issuance of 30.9 million common shares during the first quarter of 2021. The currently outstanding $42.9 million of net debt includes $3.3 million of convertible debentures which were subsequently retired in April 2021. As of this date, Gear does not have any convertible debentures outstanding.

- As a result of the retirement of convertible debentures, Gear increased its outstanding common shares from 216.5 million at year-end 2020 to 247.4 million at March 31, 2021. Subsequent to the end of the first quarter, Gear issued an additional 10.3 million common shares to retire the remaining convertible debentures and currently has approximately 257.7 million common shares outstanding. The annualized interest savings on the debenture retirement is $0.9 million.

INCREASED 2021 GUIDANCE

- As a result of significantly improved commodity prices, Gear intends to modestly increase its 2021 capital and abandonment expenditure investment from $20 million to $27 million. The incremental expenditures are scheduled for the second half of the year and as such, Gear will remain nimble with respect to any future changes in prices. The additional $7 million in capital will be strategically dedicated to the drilling of one (0.8 net) light oil well, one medium oil exploratory well, and the expansion and acceleration of multiple medium and light oil waterflood projects. Corporate waterflood investment for 2021 now totals approximately $4 million and is anticipated to provide solid economic returns as well as helping to extend the reserves life of the Company. These investments will help reduce the forecasted corporate decline rate into 2022 by two to three per cent, putting Gear on track for the lowest corporate decline in its history thus minimizing future sustaining capital requirements. Guidance for 2021 is now as follows:

2021 Revised | 2021 Original Guidance | |

Annual production (boe/d) | 5,500 – 5,600 | 5,400 – 5,500 |

Heavy oil weighting (%) | 56 | 55 |

Light/Medium oil and NGLs weighting (%) | 32 | 33 |

Royalty rate (%) | 10 | 11 |

Operating and transportation costs ($/boe) | 18.00 | 18.00 |

General and administrative expense ($/boe) | 2.40 | 2.15 |

Interest expense ($/boe) | 1.30 | 1.50 |

Capital and abandonment expenditures ($ millions) | 27 | 20 |

- Gear forecasts production growth through 2021 of approximately eight percent from the first quarter despite a recent production disruption of approximately 200 boe per day in Killam, Alberta as the result of the Government shut-in of a third party gas processing facility. Gear expects to resolve the Killam issue in the coming months.

- Gear is forecasting material future reductions in its bank debt through 2021 as forecasted FFO exceeds planned capital expenditures. Using forward market pricing as of May 4th, 2021 (full year 2021 WTI of US$63 per barrel, WCS diff of US$12.50 per barrel, MSW and LSB diff of US$4.50 per barrel, FX of US$0.81 per C$, and AECO of $2.80 per GJ) and inclusive of 2021 existing hedges, Gear is forecasting the following:

Q2 2021 | Q3 2021 | Q4 2021 | FY 2021 | |

Forecasted FFO ($ million) | 13 | 16 | 15 | 52 |

Forecasted Net debt ($ million) | 32 | 28 | 15 | 15 |

Forecasted Net debt to FFO | 0.6 | 0.4 | 0.3 | 0.3 |

- In the event that markets continue to strengthen through 2021, Gear anticipates further potential expansions in strategic value creation opportunities throughout its diversified portfolio.

Forward-looking Information and Statements

This press release contains certain forward-looking information and statements within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "objective", "ongoing", "may", "will", "project", "should", "believe", "plans", "intends", "strategy" and similar expressions are intended to identify forward-looking information or statements. In particular, but without limiting the foregoing, this press release contains forward-looking information and statements pertaining to the following: the expectation that Gear will have material free funds from operations as a result of modest production growth, price stability and an improving cost profile; the intent of the Company to focus on significant debt reduction with a slight increase to capital investment for the rest of the year; the intent to take advantage of a few very strategic asset opportunities and to invest in decline-reducing water flood projects which are expected to not only provide economic returns this year but will also enhance the ability to generate free funds from operations into the future; Gear's expected abandonment and reclamation liabilities; expectation of plans to eliminate flaring from Gear's Tableland properties and expected timing for the project to be operational; the expected annual interest savings resulting from the conversion of the convertible debentures; 2021 guidance including expected annual average production (including commodity weightings), expected royalty rate, expected operating and transportation costs, expected general and administrative costs, expected interest expense and expected capital and abandonment expenditures; the expectation that waterflood investment in 2021 will provide solid economic returns as well as helping to extend the reserves life of the Company and reduce the forecasted corporate decline rates in 2022 which will reduce sustaining capital requirements; the expectation that Gear will reduce its bank debt through 2021; Gear's forecast 2021 net debt and net debt to FFO; and the expectation that if markets continue to strengthen through 2021 that Gear may undertake further potential expansions in strategic value creation opportunities throughout its diversified portfolio.

The forward-looking information and statements contained in this press release reflect several material factors and expectations and assumptions of Gear including, without limitation: that Gear will continue to conduct its operations in a manner consistent with past operations; the general continuance of current industry conditions; the continuance of existing (and in certain circumstances, the implementation of proposed) tax, royalty and regulatory regimes; the accuracy of the estimates of Gear's reserves and resource volumes; certain commodity price and other cost assumptions; and the continued availability of adequate debt and equity financing and funds from operations to fund its planned expenditures. Gear believes the material factors, expectations and assumptions reflected in the forward-looking information and statements are reasonable but no assurance can be given that these factors, expectations and assumptions will prove to be correct.

To the extent that any forward-looking information contained herein may be considered a financial outlook, such information has been included to provide readers with an understanding of management's assumptions used for budgeting and developing future plans and readers are cautioned that the information may not be appropriate for other purposes. The forward-looking information and statements included in this press release are not guarantees of future performance and should not be unduly relied upon. Such information and statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information or statements including, without limitation: the continuing impact of the COVID-19 pandemic; changes in commodity prices; changes in the demand for or supply of Gear's products; unanticipated operating results or production declines; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in development plans of Gear or by third party operators of Gear's properties, increased debt levels or debt service requirements; any action taken by Gear's lenders to reduce borrowing capacity or demand repayment under its Credit Facilities; inaccurate estimation of Gear's oil and gas reserve and resource volumes; limited, unfavorable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; and certain other risks detailed from time to time in Gear's public documents including in Gear's most current annual information form which is available on SEDAR at www.sedar.com.

The forward-looking information and statements contained in this press release speak only as of the date of this press release, and Gear does not assume any obligation to publicly update or revise them to reflect new events or circumstances, except as may be required pursuant to applicable laws.

NON-GAAP Measures

This press release contains the terms funds from operations, net debt and operating netback, which do not have standardized meanings under Canadian generally accepted accounting principles ("GAAP") and therefore may not be comparable with the calculation of similar measures by other companies. Management believes that these key performance indicators and benchmarks are key measures of financial performance for Gear and provide investors with information that is commonly used by other oil and gas companies. Funds from operations is calculated as cash flow from operating activities before changes in noncash operating working capital and decommissioning liabilities settled. Net debt is calculated as debt less current working capital items, excluding risk management contracts. Operating netbacks are presented both before and after taking into account the effects of hedging and are calculated based on the amount of revenues received on a per unit of production basis after royalties and operating costs. Additional information relating to certain of these non-GAAP measures, including the reconciliation between funds from operations and cash flow from operating activities, can be found in the MD&A.

Barrels of Oil Equivalent

Disclosure provided herein in respect of BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of six Mcf to one Bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent a value equivalency at the wellhead. Additionally, given that the value ratio based on the current price of crude oil, as compared to natural gas, is significantly different from the energy equivalency of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an indication of value.

Initial Production Rates

Any references in this document to initial production (or IP) rates are useful in confirming the presence of hydrocarbons, however, such rates are not determinative of the rates at which such wells will continue production and decline thereafter. Additionally, such rates may also include recovered "load oil" fluids used in well completion stimulation. Readers are cautioned not to place reliance on such rates in calculating the aggregate production for Gear.

SOURCE Gear Energy Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2021/05/c0169.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2021/05/c0169.html