(TheNewswire)

| |||||||||

|  |  |  | ||||||

GRANDE PRAIRIE, ALBERTA – TheNewswire - April 25, 2023 - Angkor Resources Corp. (TSXV:ANK) and (OTC:ANKOF) (“Angkor” or the “Company”) announces the operation of natural gas/carbon capture increased to over 450,000 cubic feet/day in March 2023 at its gas capture project (the “Project”) in Evesham, Saskatchewan.

Initiated in January and amid a cold winter start to the Project, the abundant snow and sub -30o C temperatures complicated tying oil production wells into the gas conservation facilities. However, gradually adding carbon emission natural gas into the pipeline continued and March production delivered consistent numbers processing an average of 477,000 cubic feet/day (477 MCF).

The Project collects certain associated natural gas that is otherwise emitted into the atmosphere from energy production. Mike Weeks, President of EnerCam Exploration Ltd., a subsidiary of Angkor Resources Corp. comments, “As we all strive for cleaner forms of energy, capturing and processing these gases and selling them through a provincial sales distribution only makes sense from both an environmental and economical view. Instead of flaring or venting gas to the atmosphere, we collect natural gas emissions and reduce greenhouse gases.”

Click Image To View Full Size

Click Image To View Full Size

Examples of oil storage tanks venting and flaring.

The Project has current capacity up to three million cubic feet per day, but each wellsite requires a pipeline to connect to the gas capture facility site where dehydration and compression takes place. The Company targets 500 MCF/day as a base and will continue to work with the operating partners of the project, Eyehill Creek Exploration Ltd. to expand the collection and processing of carbon emissions into the provincial natural gas sales pipelines.

The Project receives 40% of the net sales proceeds after payback of the EnerCam investment of $344,000 (with 80% of proceeds until repayment) and is dependent on the spot price of natural gas, which has ranged from $2.65 - $7.10 CAD/GJ over the past 12 months. Payback of the investment is estimated at 12-18 months if gas prices remain as low as today’s gas prices of $3.00 CAD/GJ.

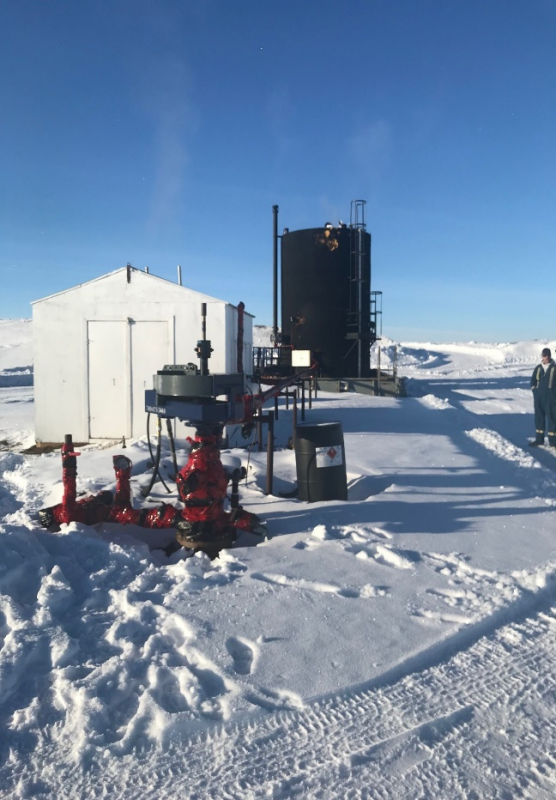

Typical dual compression processing site connected via pipeline to oil production sites.

-------------------------

ABOUT ANGKOR RESOURCES CORPORATION:

Angkor Resources Corp. is a public company, listed on the TSX-Venture Exchange, and is a leading resource optimizer in Cambodia working towards mineral and energy solutions across the country. The company holds multiple mineral exploration licenses in the country and in late 2022, its subsidiary, EnerCam Resources, was granted an onshore oil and gas license of 7300 square kilometers in the southwest quadrant of Cambodia. Angkor expanded to Canada’s energy sector in 2022 with its carbon capture and gas conservation project in Saskatchewan, Canada, proving its long-term commitment to Environmental and Social projects across expanding jurisdictions.

CONTACT: Delayne Weeks - CEO

Email: info@angkorresources.com Website: angkorresources.com Telephone: +1 (780) 831-8722

Please follow @AngkorResources on LinkedIn, Facebook, Twitter, Instagram and YouTube.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to the potential for gold and/or other minerals at any of the Company’s properties, the prospective nature of any claims comprising the Company’s property interests, the impact of general economic conditions, industry conditions, dependence upon regulatory approvals, uncertainty of sample results, timing and results of future exploration, and the availability of financing. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements.

Copyright (c) 2023 TheNewswire - All rights reserved.