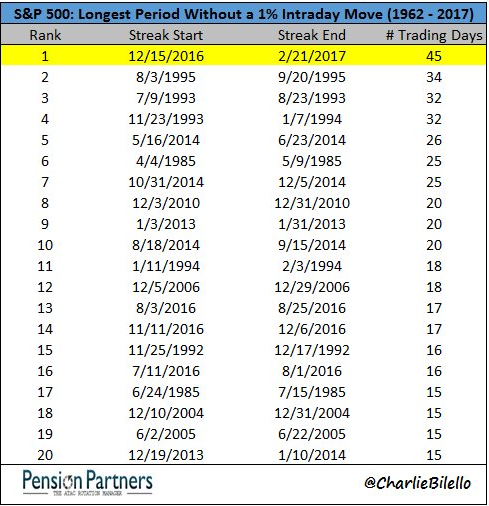

The VIX has been a topic of much greater interest in recent weeks as it flirts with (and even briefly dips into) single digits. Realized volatility is on a record streak with a record 45 consecutive trading sessions without a 1% intraday move:

In addition, we are on a 90 trading session streak in the S&P without a 1% decline. This is the longest streak in more than a decade.

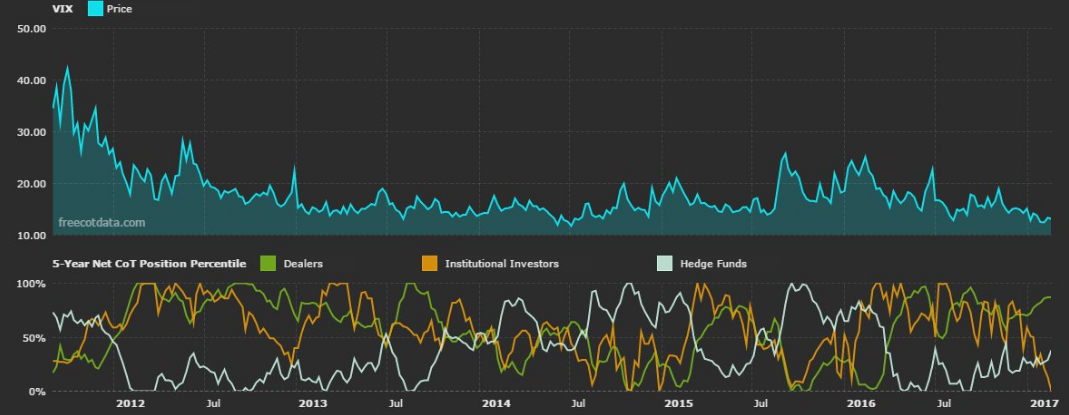

But perhaps most importantly institutional investors (pension funds, mutual funds, etc.) are exhibiting an enormous amount of complacency. Typically long only investors will hold some amount of long exposure in VIX futures in order to hedge against a spike in volatility. No longer! As of the most recent Commitments of Traders Report institutional investors have a 0% net length in VIX futures:

The last time institutional investors had anywhere near this little net long exposure to VIX futures was late-2015, just before we saw a huge spike in volatility in January of 2016. Meanwhile, futures speculators are net short VIX futures against a net long position by hedge funds and dealers (more than 120,000 contracts net short by non-commercial specs vs. a more than 120,000 contract net long by commercials), which equates to a roughly $1.5 billion 'smart money' vs. 'dumb money' trading confrontation. The 'smart money' is long the VIX and complacency is through the roof.

To find out how we are trading the VIX and many other ETFs and individual stocks, including a Junior Resource Model Portfolio, sign up for the Trading Lab today!

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.